Steps Advisors Can Take Before Tax laws Change

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. For some, this may lead to more taxes paid on capital gains.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

APRIL 5, 2023

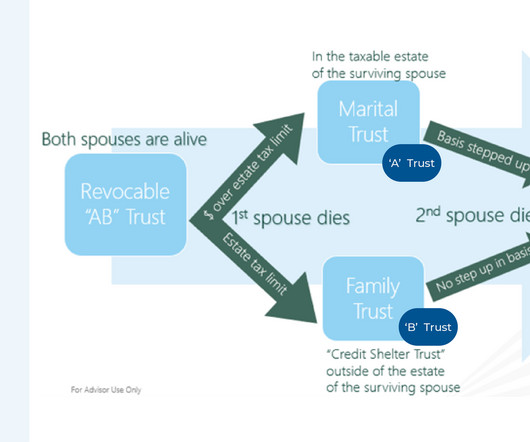

Given how frequently the tax code changes, advisors can add value for clients by ensuring their estate plans are aligned with current law to meet the clients’ objectives, and not with past rules that may no longer apply to them. However, the passage of TCJA resulted in the estate gift tax exemption nearly doubling (from $5.6M

Harness Wealth

JANUARY 29, 2025

April 15 marks the IRS tax return filing deadline for 2025. Although this is the traditional tax filing deadline, given the spate of recent natural disasters (such as the California wildfires and Hurricane Milton), the IRS is granting certain filing and payment extensions beyond this date.

Nationwide Financial

MARCH 6, 2023

Even if a client believes they would not be subject to estate or gift tax under current law, you may want to re-examine the value of their assets to determine whether they exceed a lower exemption amount. Tax season has begun, and it’s not too early to think about planning for the 2023 tax year.

Let's personalize your content