How Biden’s Budget Proposals Impact Pre-2026 Planning

Wealth Management

APRIL 16, 2024

Shenkman and Joy Matak discuss proposals in the 2025 Green Book.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 16, 2024

Shenkman and Joy Matak discuss proposals in the 2025 Green Book.

Wealth Management

JUNE 25, 2024

A new report from Cerulli & Associates finds the retail financial advisor channel has been the biggest growth driver behind ETFs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

OCTOBER 21, 2024

Craft plans to avoid application of the step transaction doctrine before the exemption potentially gets reduced.

Wealth Management

AUGUST 9, 2024

The rollout of the 2025-2026 FAFSA college student admissions form already has been delayed until Dec.

Abnormal Returns

JULY 3, 2023

Fintech Why fintech startups need advisers onboard to help them sell to wealth management firms. kitces.com) Estate planning Four things to consider in anticipation of 2026. matts-newsletter-7a3f46.beehiiv.com) beehiiv.com) A round-up of the past month's advisor-tech news including Vanilla's new "estate advisory" platform.

Abnormal Returns

MAY 29, 2023

(ritholtz.com) Are you a Texas-based adviser interested working with Ritholtz Wealth Management? 1, 2026 and becomes a big problem for reactive RIAs who fail to help clients take action now." (thinkadvisor.com) Steve Lockshin, "The dream becomes a nightmare for millions of high-net-worth investors on Jan.

Abnormal Returns

MAY 8, 2023

citywire.com) Dynasty Financial Partners has formed Dynasty Investment Bank to provide services related to mergers and acquisitions in wealth management. kitces.com) Practice management Why succession planning is important to firm owners whether they plan to sell or not. investmentnews.com)

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

Wealth Management

OCTOBER 21, 2024

Timing considerations for late allocations of GST tax exemption before 2026.

Wealth Management

OCTOBER 4, 2024

The estate and gift tax exemption (set at $13.61 million per individual in 2024) is due to expire on Jan. If Congress doesn’t act, that tax exemption will be cut in half to about $6 million. To help your clients prepare for the real possibil

Wealth Management

FEBRUARY 6, 2025

Keller will step down on April 30, 2026, with the Board planning a search for his successor in the coming year. In a LinkedIn post, Keller wrote that leading well means leaving well.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

Wealth Management

FEBRUARY 6, 2025

Keller will step down on April 30, 2026, with the Board planning a search for his successor in the coming year. In a LinkedIn post, Keller wrote that leading well means leaving well.

Wealth Management

SEPTEMBER 7, 2022

Backers for the 5 Times Square loan, which runs through May 2026, include Morgan Stanley, Apollo Global Management Inc. and American International Group Inc. RXR and its partners have invested another $300 million to help renovate the site.

Abnormal Returns

SEPTEMBER 30, 2024

kitces.com) Tax strategies if the TCJA expires in 2026. (riabiz.com) Charles Schwab ($SCHW) is mothballing the Institutional Intelligent Portfolios platform. riabiz.com) Taxes How pre-tax retirement contributions provide flexibility down the road. wealthmanagement.com) Advisers 7 more lessons from building an fee-only RIA from scratch.

Darrow Wealth Management

JANUARY 30, 2023

Another reason to consider: tax rates are set to increase in 2026 when the provisions of the Tax Cuts and Jobs Act expire. Article was written by Darrow Wealth Management President Kristin McKenna and originally appeared on Forbes. Remaining funds can be invested in a brokerage account.

NAIFA Advisor Today

AUGUST 1, 2024

NAIFA’s Committee on Governance has nominated John Wheeler , CFP, CLU, ChFC, CRPC, LACP, CLTC, LUTCF, Executive Senior Partner at Totus Wealth Management LLC in Houston, Texas, to be the 2025 NAIFA Secretary. As incoming Secretary, Wheeler will be in line to serve as President-Elect in 2026 and President in 2027.

Darrow Wealth Management

JULY 30, 2024

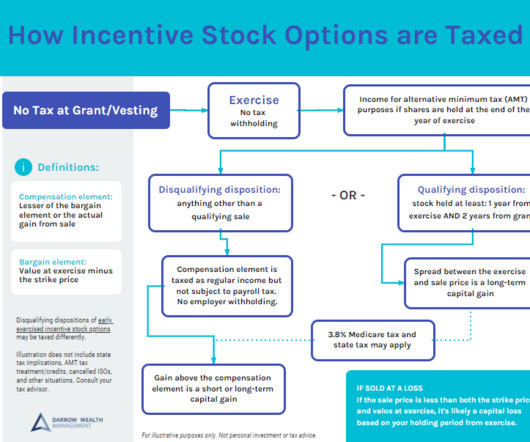

Tax laws change periodically, and they’re scheduled to change again in 2026. Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. A large spread makes it very difficult financially to exercise shares before the options expire after leaving the company.

Darrow Wealth Management

AUGUST 30, 2022

Consider changes to state residency, scheduled tax rate increases in 2026, income changes, and other factors like college financial aid and Medicare premiums which use tax returns from two years ago. If you need help managing sudden wealth from an inheritance, please contact us today to schedule a consultation.

Darrow Wealth Management

DECEMBER 23, 2022

Starting in 2026, the catch-up will be indexed by inflation. to Bring Sweeping Changes to Retirement Rules appeared first on Darrow Wealth Management. The Secure Act 2.0 IRAs: the $1,000 catch-up limit will be indexed by inflation for tax years starting in 2024. The post Secure Act 2.0

Darrow Wealth Management

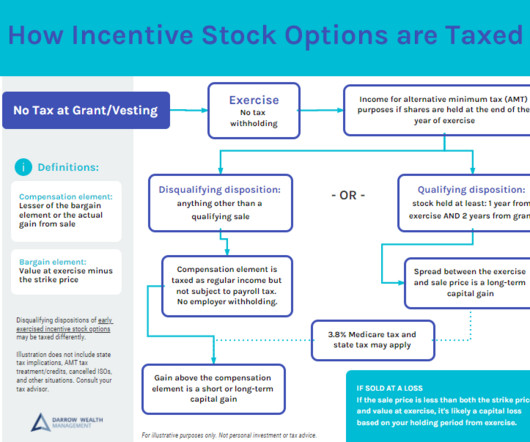

MARCH 29, 2024

These higher limits are scheduled to sunset in 2026. Last reviewed March 2024 The post Incentive Stock Options: Navigating AMT and AMT Credits appeared first on Darrow Wealth Management. There are two AMT tax rates: 26% and 28%. AMT exemptions and phase out were increased significantly in the 2017 Tax Cuts and Jobs Act.

Darrow Wealth Management

JULY 30, 2024

Tax laws change periodically, and they’re scheduled to change again in 2026. Article written by Darrow Wealth Management President Kristin McKenna, CFP® and originally appeared on Forbes. A large spread makes it very difficult financially to exercise shares before the options expire after leaving the company.

Darrow Wealth Management

APRIL 20, 2022

Pend-up demand, reopening, healthy corporate and consumer balance sheets, and relatively low tax rates , have economists forecasting real GDP slightly under the long-term average of 2% through 2026. The post 2 Reasons Taming Inflation Won’t Be Easy appeared first on Darrow Wealth Management. US real GDP and forecast.

Harness Wealth

JULY 29, 2024

If the sunset occurs, this inflation-adjusted amount, which is currently $13,610,000 as of July 2024 , could be reduced by one-half (after inflation adjustments for 2025 and 2026) starting on January 1, 2026. The war for talent will continue to constrain many professional practices that assist with wealth transfer planning.

Darrow Wealth Management

MARCH 24, 2024

2026 tax law changes impacting alternative minimum tax The 2017 Tax Cuts and Jobs Act drastically reduced the number of taxpayers who were subject to the AMT. These favorable changes are set to sunset in 2026. Again, you’ll pay the higher tax under either calculation. Run the numbers to find out.

BlueMind

APRIL 25, 2022

Unfortunately, the same gender bias exists in the wealth management industry as well and this needs to change. According to Boston Consulting Group (BCG) as of now, women now control over 32% of global wealth and that number is only expected to rise. For Canada alone, the expected is 50% of accumulated wealth by 2026.

Steve Sanduski

SEPTEMBER 17, 2024

Advisors who want to swim in the deep end of the pool have to scale the quality of their teams, their tech stacks, and the services they provide beyond basic wealth management. And so right now, like a lot of advisors, we’re dealing with the fact that the unified credit is scheduled to go down in 2026.

Darrow Wealth Management

MARCH 24, 2024

2026 tax law changes impacting alternative minimum tax The 2017 Tax Cuts and Jobs Act drastically reduced the number of taxpayers who were subject to the AMT. These favorable changes are set to sunset in 2026. Again, you’ll pay the higher tax under either calculation. Run the numbers to find out.

Darrow Wealth Management

MARCH 29, 2024

These higher limits are scheduled to sunset in 2026. Last reviewed March 2024 The post Incentive Stock Options: Navigating AMT and AMT Credits appeared first on Darrow Wealth Management. There are two AMT tax rates: 26% and 28%. AMT exemptions and phase out were increased significantly in the 2017 Tax Cuts and Jobs Act.

Harness Wealth

MARCH 10, 2023

The manager’s carried interest is 20%, or $200,000. If the manager chooses to use the Three-Year Carried Interest Loophole, they would not be required to pay taxes on that $200,000 until 2026. Tax services provided through Harness Tax LLC.

Wealth Management

NOVEMBER 21, 2024

Gensler’s term was set to expire in 2026, but he announced today that he will leave on Jan. He called working with the commission’s staff “an honor of a lifetime.”

Wealth Management

MARCH 11, 2025

Envestnet is aiming to have the capability to support semi-liquid funds by 2026. These are among the investment must reads we found this week for wealth advisors. President Trumps whipsaw moves on tariffs have disrupted markets and rattled investors.

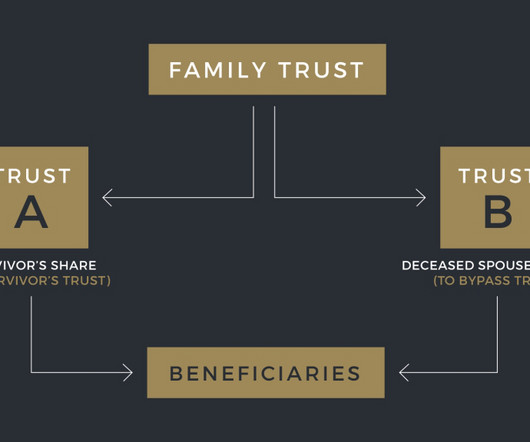

Dear Mr. Market

NOVEMBER 22, 2024

If Bill dies in 2026 without using any of his ~$7.5 Portability is now a permanent feature of federal estate tax law, but if your estate plan still includes AB Trust planning, it might now be doing more harm than good. million estate tax exemption, Alice can file a portability election with the IRS—without needing a separate trust.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content