Weekend Reading For Financial Planners (November 4-5)

Nerd's Eye View

NOVEMBER 3, 2023

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Trade Brains

JULY 1, 2023

Moving on we shall analyze the financials of the company, go through the future plans of the company, and finally let’s conclude with a brief summary. billion by 2027, which is a huge growth opportunity in the upcoming years. It has many plans in the future to expand its operations wide and forth. billion in 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Trade Brains

FEBRUARY 14, 2024

Industry Analysis The Indian rail freight industry is experiencing growth and improvements, with ambitious plans and increased investment by the government and schemes such as Gati Shakti, which aim at enhancing capacity, efficiency, and sustainability. The railway sector in India aims to contribute about 1.5% Stock P/E (TTM) 49.73

Trade Brains

AUGUST 16, 2023

Lastly, a highlight of their future plans and a summary conclude the article. Broadly, it is projected to grow at a CAGR of 9-10% per annum to reach $290-310 billion in value by $290-310 billion by 2027 and eventually $850-1,000 billion in value by 2040 commanding a significant 10-12% of the global market. CAGR during 2021-2027.

Trade Brains

NOVEMBER 22, 2023

In 2020, the Murugappa Group via its subsidiary Tube Investments of India (TII) acquired a controlling stake in CG Power and Industrial Solutions Ltd. India is likely to add another 21 GW of onshore wind capacity between 2023 and 2027. The Company plans to improve its market share and build its order book. MW, up by 5.6%

Trade Brains

JUNE 30, 2023

From 2021-2027, the total revenue of the FMCG market is estimated to grow at a CAGR of 27.9%, which will nearly be US$ 615.87 Future Plans So far, we have studied the company’s financial records and have gained an understanding of how each company performs. As of December 2022, the FMCG market has reached a total of US$ 56.8

Trade Brains

JULY 8, 2024

Investments and Government initiatives also play a crucial role in boosting cement demand. Also read… Chemical Stocks – Future Outlook, Market Trends and Insights Future Plans of Ultratech Cement Recent Acquisition The Board of Directors of Ultratech Cement recently approved purchasing 7.06 over the last five years.

MarketWatch

JUNE 27, 2023

BAC said Tuesday it plans to open more than 55 new financial centers in 34 markets including four new states by 2027. “By The financial centers offer banking, investing, retirement, lending and small business services. Bank of America Corp. Bank of America stock is down fractionally in morning trades.

Good Financial Cents

JANUARY 26, 2023

Step 2: Save More than Everyone Else Step 3: Invest and Invest Aggressively Step 4: Maximize Your Retirement Savings Step 5: Set up a Roth IRA Conversion “Ladder” Step 6: Live Beneath Your Means Step 7: Stay Out of Debt Yes, You Can Retire at 50 Retiring at 50 – The Ultimate Guide What Investments Should I Consider If I Want to Retire at 50?

Trade Brains

JULY 8, 2024

Investments and Government initiatives also play a crucial role in boosting cement demand. Also read… Chemical Stocks – Future Outlook, Market Trends and Insights Future Plans of Ultratech Cement Recent Acquisition The Board of Directors of Ultratech Cement recently approved purchasing 7.06 over the last five years.

Trade Brains

JANUARY 4, 2024

In this Fundamental Analysis Of Tanla Platforms, we perform an in-depth analysis of its business, industry, financials, future plans & more Fundamental Analysis Of Tanla Platforms Company Overview Tanla Platforms Limited was established in 1999 as a bulk SMS provider in Hyderabad, India. in FY23 and 6.3% Stock P/E 28.96

Trade Brains

MARCH 8, 2024

million by 2027. million by 2027, registering a CAGR of 12.43% during the forecast period of 2022-2027 Fundamental Analysis Of Praveg – Financials Revenue & Net Profit The company’s financial statement indicates that revenue has increased by 86.7 What do you think about Praveg as an investment opportunity?

Trade Brains

JUNE 5, 2024

billion by 2027, expanding at a CAGR of 15.95% during the period. Also read… Exide Industries: Energizing the Future with Strategic Expansion plans Financials Of Jash Engineering FY 2023 FY 2022 FY 2021 FY 2020 Revenue (in crores) 401.99 In India, the water management market stood at INR 216.03 Net profit (in crores) 51.7

Trade Brains

NOVEMBER 27, 2023

Fundamental Analysis Of Servotech Power Systems: When it comes to investing, many investors tend to focus on well-known companies from the large-cap category. The article concludes with a highlight of future plans and a summary. Let us now explore what plans the company has for the future. 6.64% 2022 8.6% 2023 13% 13.1%

Trade Brains

JANUARY 14, 2024

The article concludes with a highlight of plans and a summary. during 2023-2027, reaching ₹66,955 Billion by 2027. It is supported by a 33% increase in planned capital expenditure by the government. It is also important to note that investment decisions should not be based solely on the information provided above.

Trade Brains

DECEMBER 18, 2023

In this article, we will perform a Fundamental Analysis of Gravita India and take a look at thier business, financials, future plans and more. Future Plans Of Gravita India Gravita aims to establish new recycling verticals of rubber, lithium, steel & paper by 2027. 600+ crores. Market Cap(Cr) 7,250.02 Stock P/E 51.5

Trade Brains

SEPTEMBER 9, 2024

The company is planning to expand its operations to increase the capacity of more than 5,00,000 MT in FY27. In capital expenditure, Gravita India Limited has invested in FY23 by 110 crore and FY24 by 98 crore. The company has outlined a capex plan of over INR 600 crores up to FY27, mostly self-funded without significant new debt.

Trade Brains

OCTOBER 6, 2023

Cipla Vs Dr. Reddy’s Laboratories In this article on Cipla Vs Dr. Reddy’s Laboratories, we compare their scale of operations, segments, financials, future plans and more… Today, we will fundamentally analyze two such Companies that form part of the Top 5 largest Pharmaceutical Companies in India. Reddy's - Debt to Equity 0.28

Trade Brains

MAY 30, 2024

Due to the upcoming projects and innovations in technologies such as AI, the semiconductor industry is also expected to grow exponentially, around 9% by 2024–2027. On top of that, they are also planning to expand their Balco smelter, essentially going from 5,50,000 metric tons to a million metric tons. 1,32,732 (Cr) in FY2022 to Rs.

Trade Brains

DECEMBER 29, 2023

In this Fundamental Analysis of Man InfraConstruction , we will analyze the 50+ years old company, its financials, future plans and more. Industry Overview The Indian economy has grown from the 10th to the 5th largest in the world in the last nine years and is set to be the third largest by 2027–28. 5-year average 0.57 Stock P/E 17.62

Trade Brains

SEPTEMBER 28, 2024

Get ready to discover how you can turn your love for jewellery into an attractive investment opportunity. billion in 2023 to USD 100 billion in 2027. In India, strategic measures have been implemented to promote exports and attract investments in the sector. The Indian jewellery market size was estimated to grow at a CAGR of 5.7%

Trade Brains

APRIL 10, 2023

Herein this article we will be performing a fundamental analysis of Mold-Tek Packaging Limited , performing the ratio analysis, and having a look at the future plans of the company. The Indian packaging market is expected to witness growth at a CAGR of around 12.50% during the forecast period (2022 – 2027). Happy investing!

Trade Brains

SEPTEMBER 18, 2023

It soon plans to launch Bogie Bracket, ATS Bracket, Hanger Shackles, Spring Pin & U-Bolt. Net Profit Margin 7.24% Operating Profit Margin 11.27% Future Plans Of Jamna Auto Industries A new plant has been established in Jharkhand, which is anticipated to be fully operational by the second quarter of FY 24. Market Cap (Cr.)

Trade Brains

SEPTEMBER 6, 2024

As a leading force in India’s business sector, RIL highlighted its plans for growth across retail, digital services, and energy. The company’s innovative approaches and strategic investments underscore its commitment to driving substantial value. The conglomerate aims to double its value by 2027.

Trade Brains

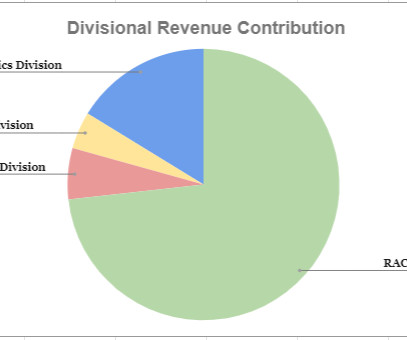

APRIL 5, 2024

As per several reports, the HVAC industry is expected to register a 10–12% CAGR from FY 2022–23 to FY 2027–28. Revenue and profits increased significantly due to timely investments in required capex, which helped increase profitability and improve share in RAC manufacturing and other segments. 6927 crore in FY23 against Rs.

MarketWatch

JANUARY 24, 2023

LLY said Tuesday it’s planning to invest an additional $450 million in a manufacturing site at Research Triangle Park in North Carolina and will create at least 100 jobs. The expansion is expected to be up and running in 2027. Eli Lilly & Co. The news comes at a time when many companies are laying off staff.

Trade Brains

MARCH 20, 2024

The development of the infrastructure sector has been a priority area for the Government and has witnessed enhanced public investment over the years. As India aims to grow to a USD 5 trillion economy by 2027, the Construction sector will be critical for boosting economic growth as it is the key growth enabler for several other sectors.

Trade Brains

NOVEMBER 18, 2023

billion by 2027. billion by 2027, registering a CAGR of 4.7%. billion by 2027, growing at a CAGR of 9.8%. billion by 2027, growing at a CAGR of 9.8%. The volume of this segment is expected to reach 1,128 KT by 2027 from 718 KT in 2022, registering a CAGR of 9.5%. and reach $148.7 billion in 2022 to $8.85

Trade Brains

AUGUST 6, 2023

Later, we shall proceed with the future plans of the company. India was the second-largest cement producer in the world as of FY22 and is expected to grow at a CAGR of 4-5% by the end of 2027 as per CRISIL reports. Future Plans Of Triveni Turbine Up to this point, we have understood the financial performance of the company.

Trade Brains

OCTOBER 30, 2023

The Indian BPC market is expected to grow from around $20 billion in 2022 to around $33 billion in 2027, registering a CAGR of about 11%, which is among the highest in the retail sector. The online BPC market, which accounted for 16% of the total market in 2022, is projected to grow at a CAGR of 29% to reach 34% by 2027.

Trade Brains

SEPTEMBER 22, 2024

In this article, we will look at LIC Housing Finance vs Bajaj Housing Finance, two behemoths in the housing industry about their financials, key metrics, and plans. Looking ahead, Crisil MI&A expects the overall housing segment to grow at a CAGR of 13-15% from Fiscal 2024 to Fiscal 2027. for Fiscal 2023 and credit costs of 0.5%

Trade Brains

FEBRUARY 18, 2024

Gravita India : Investors often seek out the potential for significant returns, sometimes investing in speculative “story stocks” that lack revenue, let alone profitability. However, the truth is that consistently losing money can eventually prompt investors to withdraw their investments. 83.32 % Aluminium 338.81

Trade Brains

JUNE 6, 2024

billion by 2027. With comprehensive strategies and investments, Amara Raja Energy & Mobility is well-positioned to capitalize on these emerging opportunities in the automotive and new energy markets. They also plan to increase their renewable energy usage from the current 19.6% The data center market was valued at US$4.35

Trade Brains

JANUARY 29, 2023

Many companies have scaled their business and this brings an opportunity for investors, especially those who want to remain invested in stocks for a period of more than five to ten years. This investment was increased to a whopping ₹ 10,000 crores in FAME-II. It plans to establish TARMAC buses in airports.

Trade Brains

MAY 1, 2023

A highlight of the future plans and a summary to conclude the article at the end. Future Plans of IRCTC So far we looked at the previous fiscals data for our fundamental analysis of IRCTC. In this section, we’ll try to get a sense of the future plans of the company. and a high-interest coverage ratio of 27.8. Source: IRCTC Ltd.

Trade Brains

JANUARY 21, 2024

The freight infrastructure capacity augmentation by DFC is crucial in achieving the Indian Railways’ target of 3000 MT freight loading by 2027. The Company also has plans to enter the Electric Vehicle segment, enabled by its Partnership with American Green Power. of the country’s GDP to 8% by 2030. 1182 Cr in FY22. .)

Trade Brains

OCTOBER 27, 2023

The Indian stationery market has shown consistent growth over the years, reaching an estimated size of INR 385 Bn by value and expected to grow at a ~14% CAGR during FY 2023-27 period to reach a market value of INR 657 Bn by FY 2027. By FY 2027, the market is expected to reach ₹75 billion.

Trade Brains

FEBRUARY 16, 2024

In India, increased economic activity and a favorable demand environment suggest that the country’s expanding momentum will certainly attract substantial investments and continue growing. Future Outlook To become a billion-dollar revenue company by 2027 Achieve ₹ 20,000+ cr expected order book in FY27. 5-year average 0.3

Trade Brains

OCTOBER 25, 2023

trillion by Fiscal 2027. The Government aims to make India a global healthcare hub and plans to increase public health spending to 2.5% The medical devices industry also offers immense opportunities for investors and service providers, as India is a leading destination for high-end diagnostic services and capital investment.

Trade Brains

JANUARY 16, 2024

Despite its age, the sector continues to grow and evolve, presenting significant investment opportunities. The article concludes with a highlight of plans and a summary. The freight infrastructure capacity augmentation by DFC is crucial in achieving the Indian Railways’ target of 3000 MT freight loading by 2027.

Validea

JULY 26, 2023

Of course, all these things matter and play an important role, but for most of us who invest I would argue it’s the power of compounding over long periods of time that is the most powerful force in building wealth. Getting Invested to Begin With The first and most crucial step in leveraging compounding is simply getting started.

Validea

JULY 26, 2023

Of course, all these things matter and play an important role, but for most of us who invest I would argue it’s the power of compounding over long periods of time that is the most powerful force in building wealth. Getting Invested to Begin With The first and most crucial step in leveraging compounding is simply getting started.

Trade Brains

OCTOBER 6, 2024

Future Plans Of Tata Motors vs Mahindra & Mahindra Tata Motors Tata Motors is working to expand its electric vehicle (EV) portfolio, with plans to launch new EV models like the Curvv EV and increase the penetration of EVs across various price points. MEAL is valued at $9 billion and plans to launch products by 2027.

Trade Brains

SEPTEMBER 11, 2024

CAGR calculates an investment’s average annual growth rate over a given time frame. It helps investors and analysts compare investments of different sizes and durations. Future Outlooks: Angel One Limited plans to diversify its product offerings, including lending, fixed income, and asset management. Market Cap (Cr.)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content