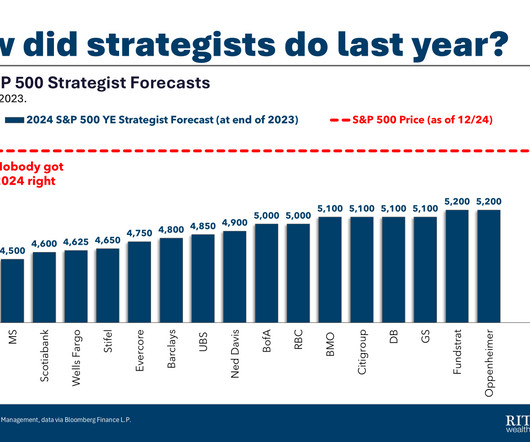

“Nobody Knows Anything,” Wall Street Strategist Edition

The Big Picture

JANUARY 2, 2025

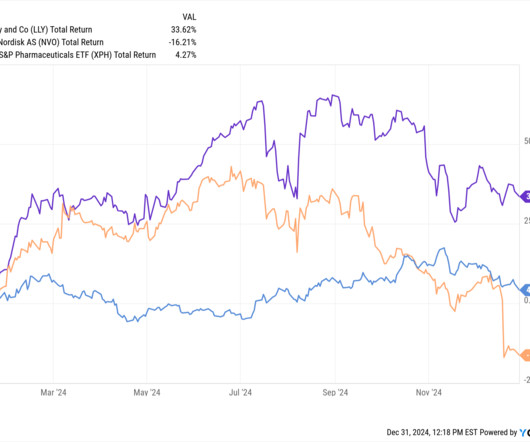

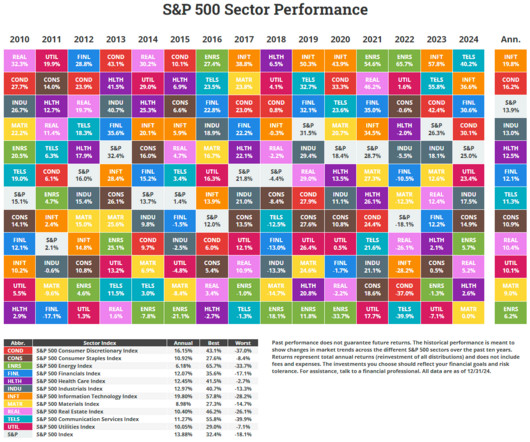

A regular theme around these parts is “ Nobody Knows Anything. ” Specifically, nobody knows what will happen in the future. This is true about equity and bond markets, specific company stocks, and economic data series. We do not know which geopolitical hot spot will erupt in turmoil; we have no idea where or when the next natural disaster will hit.

Let's personalize your content