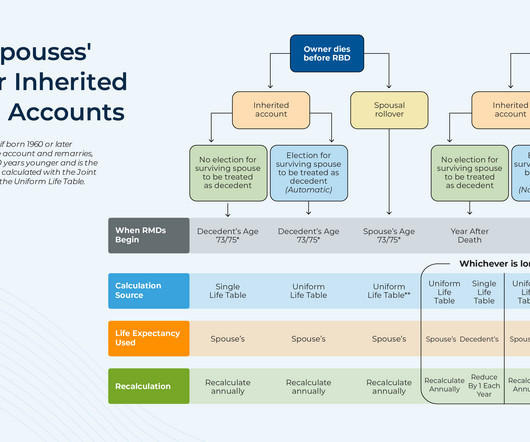

New RMD Rules For Spousal Beneficiaries Of Retirement Accounts With SECURE 2.0’s “Spousal Election” Option

Nerd's Eye View

SEPTEMBER 11, 2024

Among all the different types of retirement account beneficiaries, those who are the surviving spouse of the original account owner receive the most preferential tax treatment when it comes to distributing the account's assets after the owner's death. But the SECURE 2.0

Let's personalize your content