Planning for Digital Assets 101

Wealth Management

SEPTEMBER 19, 2023

From Bitcoin to Gmail accounts, the rules governing ownership, storage and transferability of digital assets differ significantly from traditional forms of wealth.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

SEPTEMBER 19, 2023

From Bitcoin to Gmail accounts, the rules governing ownership, storage and transferability of digital assets differ significantly from traditional forms of wealth.

Wealth Management

NOVEMBER 7, 2022

Many DAF donors don’t know that some sponsors allow their financial advisors to select and manage the investments in their accounts.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

The Big Picture

JULY 25, 2023

Pomp points out that: “I am, however, arguing that the total return percentage traditionally quoted is not what people actually achieve in their brokerage account because of taxes. I have addressed Tax Alpha before ( see this and this ); but Pomp indirectly raised a very different issue: Why do people underperform their own assets?

Nerd's Eye View

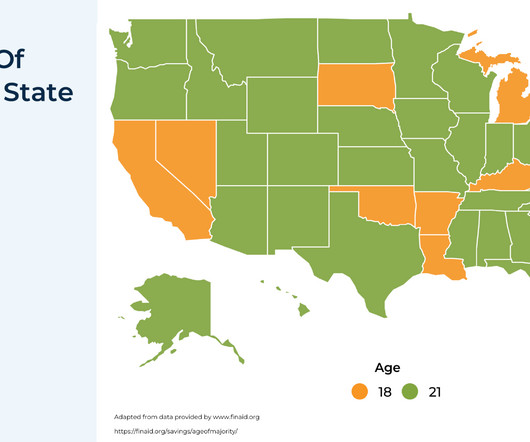

FEBRUARY 26, 2025

However, once a child reaches the age of majority, they may not always be in a position to manage assets responsibly. In these cases, parents may wish to adjust how gifted assets are structured to better align with their family's long-term goals. Read More.

Wealth Management

FEBRUARY 13, 2025

Understanding the options financial advisors have to support your clients largest investment asset, 401(k) retirement accounts.

Nerd's Eye View

DECEMBER 18, 2024

For investment management services, documenting the entire client engagement – such as onboarding, reviewing and recommending portfolio adjustments in line with collected suitability information, opening and funding accounts, conducting periodic reviews, and rebalancing – can help clearly evidence the services provided.

Nerd's Eye View

DECEMBER 9, 2024

Team members who feel a sense of emotional ownership can be a tremendous asset to the firm, driving productivity, innovation, and leadership. Mentoring legal owners to fully embrace their roles can also guide them toward greater accountability and leadership within the firm.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Wealth Management

SEPTEMBER 19, 2024

The SEC’s order pertained to collateralized mortgage obligations held in 20 advisory accounts, including 11 mutual funds.

Wealth Management

JUNE 20, 2024

Account migrations from Morningstar's TAMP to AssetMark will occur over the next six months as the deal is finalized.

Wealth Management

FEBRUARY 20, 2025

The firm is the first asset manager to sign onto the InvestCloud product that launched in December.

Nerd's Eye View

SEPTEMBER 6, 2023

While asset protection is a popular planning topic for High-Net-Worth (HNW) and ultra-high-net-worth clients, those who are not HNW are susceptible to the same threats to wealth. Notably, certain client assets have built-in creditor protection without the use of (often expensive) products or tools.

Financial Symmetry

APRIL 14, 2025

Each of these account types has its pros and cons, which I have outlined below. Once you open this account, it functions the same way as every other bank account does for deposits and withdrawals, and you can order a debit card for your child once they get older for spending purposes.

Calculated Risk

MARCH 4, 2025

The reason, of course, is that the Federal Reserve funded the bulk of these long-term fixed rate assets with increases in interest-bearing very short-term liabilities mainly depository institution deposits (reserves) and repos --with interest rates tied to the federal funds rate. release, and is available in the FRED database.

Nerd's Eye View

JANUARY 9, 2025

On the other hand, the term "financial advice" often refers to much more than asset allocation and wealth management. This principle extends across many aspects of a firm's value proposition, from client newsletters to account log-in frequency to other common metrics of interest.

Nerd's Eye View

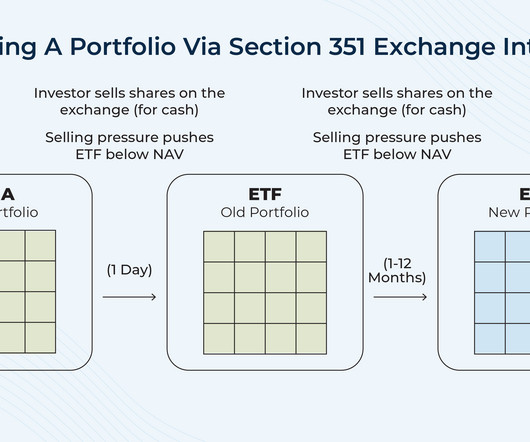

MARCH 12, 2025

Following the long run-up in the US equity markets since the bottom of the 2008–2009 financial crisis, many investors with taxable investment accounts have likely found themselves with high embedded gains in their portfolios. While the gains signal portfolio growth, they also create challenges for ongoing management.

Nerd's Eye View

DECEMBER 17, 2024

Fran is the CEO of Toler Financial Group, an RIA based in Silver Spring, Maryland, that oversees nearly $200 million in assets under management for 280 client households. Welcome to the 416th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Fran Toler.

Wealth Management

JANUARY 22, 2024

Advisor use of separately-managed accounts as standalone programs and part of unified managed accounts will soon exceed $2 trillion in assets, the research firm found.

The Big Picture

AUGUST 26, 2022

Our previous discussions (debates really) were over the traditional model of brokerage I push back against versus the fee-based fiduciary asset management I embrace. My examples of overpriced, low-performing, abusive account management have been derided as outliers. He was aghast over this. But I digress.

Wealth Management

JANUARY 8, 2025

The investigation, which spanned four years and involved 14 state regulators, revolved around how the firm supervised the transferring of brokerage account assets into advisory accounts.

Abnormal Returns

FEBRUARY 26, 2025

tonyisola.com) Age is just one factor when it comes to your asset allocation. mrmoneymustache.com) Why you need to account for your Treasury income on your state taxes. fastcompany.com) What to consider when rolling over a 401(k) account to an IRA. (podcasts.apple.com) Investing Targeted apathy as an investment philosophy.

Calculated Risk

MARCH 13, 2025

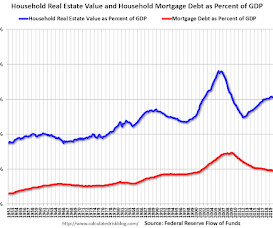

The Federal Reserve released the Q4 2024 Flow of Funds report today: Financial Accounts of the United States. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household debt increased 3.1

Wealth Management

MAY 9, 2024

Just 2% of assets are offered via a Unified Managed Account framework.

Wealth Management

SEPTEMBER 5, 2023

million client accounts and $1.3 trillion in assets were moved overall. More than 7,000 advisor firms, 3.6

Wealth Management

APRIL 4, 2024

After accounting for additional risks and fees, the asset class delivers virtually no extra return to investors, according to a study released by the National Bureau of Economic Research.

Wealth Management

APRIL 24, 2023

Despite some high-profile departures, the bank says the exiting teams accounted for less than 20% of total wealth management assets.

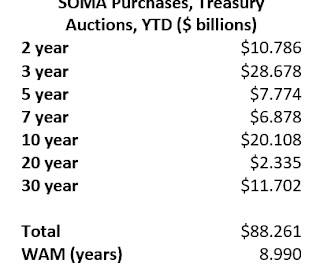

Calculated Risk

MARCH 11, 2025

Most of these gains in Treasury and Agency MBS assets were funded with increases in very short duration interest-bearing Federal Reserve liabilities, mainly deposits of depository institutions (reserves) and Reverse Repos. of marketable Treasury bills outstanding at the end of February, and Treasury bills accounted for a measly 4.7%

Abnormal Returns

FEBRUARY 10, 2025

mailchi.mp) Fund management Endowment funds are not simply savings accounts. bloomberg.com) You need a strategy to survive the commoditization of the asset management industry. (ft.com) AI is only now entering its 'true product-building era.' institutionalinvestor.com) Interest in forex trading has been in decline for awhile now.

Wealth Management

APRIL 2, 2024

Fidelity has imposed a new $100 fee on ETFs issued by nine firms in order to account for the cost of listing the funds on its platform. Some asset managers are raising the alarm on the booming private credit market, reports FundFire. These are among the investment must reads we found this week for wealth advisors.

Abnormal Returns

APRIL 7, 2024

abnormalreturns.com) Top clicks this week Two stocks accounted for a third of the Russell 2000's 5.2% wsj.com) How major asset classes performed in March 2024. awealthofcommonsense.com) When an asset has no intrinsic value, i.e. gold, you have more decisions to make. Also on the site Better investors make fewer decisions.

Calculated Risk

SEPTEMBER 12, 2024

The Federal Reserve released the Q2 2024 Flow of Funds report today: Financial Accounts of the United States. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household debt increased 3.2

A Wealth of Common Sense

DECEMBER 5, 2024

We also touched on questions about managing your brokerage account, the best way to optimize asset location, RSUs vs. HELOCs when paying for a home renovation and jewelry as an asset class. Further Reading: 10 Money Revelations in my 40s 1And these peer rankings are net worth figures.

Calculated Risk

SEPTEMBER 9, 2022

The Federal Reserve released the Q2 2022 Flow of Funds report today: Financial Accounts of the United States. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Abnormal Returns

MARCH 26, 2025

(sherwood.news) Private equity Private equity will not rest until they have access to your 401(k) account. riabiz.com) Private assets in an exchange traded fund is an oxymoron. bloomberg.com) McKinsey & Co. with their 2025 report on private equity performance. mckinsey.com) ETFs Buffer ETFs are no great innovation.

Calculated Risk

DECEMBER 9, 2022

The Federal Reserve released the Q3 2022 Flow of Funds report today: Financial Accounts of the United States. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Alpha Architect

DECEMBER 20, 2024

That has led many to question whether intangible assets, such as patents and proprietary software, are properly treated. Current accounting standards, which require companies to expenserather than capitalizetheir outlays on activities that create intangible capital, lead [.]

Wealth Management

DECEMBER 14, 2022

listed ETF assets but account for 12% of the industry’s net inflows, proving the shift toward more active strategies has room to continue to grow in 2023. Active ETFs make up less than 5% of the overall U.S.-listed

Abnormal Returns

DECEMBER 4, 2024

humansvsretirement.com) Barry Ritholtz talks with Matt Hougan, CIO at Bitwise Asset Management, about how to get crypto exposure. wsj.com) College Why income matters more than assets when it comes to college financial aid. tonyisola.com) How to get more money into a 529 account.

Wealth Management

SEPTEMBER 7, 2022

The 990-T form involved in the incident is used by both tax-exempt groups and individuals with some retirement accounts invested in certain assets, including master limited partnerships and real-estate investment trusts.

Abnormal Returns

FEBRUARY 4, 2024

wsj.com) How major asset classes performed in January 2024. allstarcharts.com) Four steps to build a no-fuss portfolio including eliminating redundant accounts. (ft.com) What happens when you stop focusing on the stock market. capitalspectator.com) It's not just tech stocks that are working. collabfund.com)

Abnormal Returns

DECEMBER 12, 2023

institutionalinvestor.com) Alternative assets The institutionalization of alternative assets has backfired for most investors. papers.ssrn.com) Does cross-sectional asset pricing matter for the macroeconomy? papers.ssrn.com) When do you need to take into account 'key person' risk? aswathdamodaran.blogspot.com)

Abnormal Returns

JUNE 12, 2024

podcasts.apple.com) Asset allocation Small asset allocation shifts don't matter much in the long run. awealthofcommonsense.com) Why asset allocation matters. barrons.com) Why couples could benefit from separate and joint accounts. podcasts.apple.com) Sam Parr talks with the owner of a 24,000 square foot house.

Abnormal Returns

FEBRUARY 13, 2024

alphaarchitect.com) A round-up of research on cross-asset correlations. capitalspectator.com) How 'auto-accounts' could help people start saving. (aqr.com) How many factors do you really need? klementoninvesting.substack.com) Why noise traders are a threat to short sellers. wsj.com)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content