FDIC Changes Insurance Coverage of Trust Bank Accounts

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

Abnormal Returns

MARCH 12, 2025

financialducksinarow.com) Americans are not shy about withdrawing early from their 401(k) accounts. mr-stingy.com) Should you get your insurance coverage re-quoted? (theretirementmanifesto.com) 401(k) Five things to understand about your retirement savings plan. wsj.com) Investing Why you need to be diversified by time horizon.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nerd's Eye View

MARCH 15, 2023

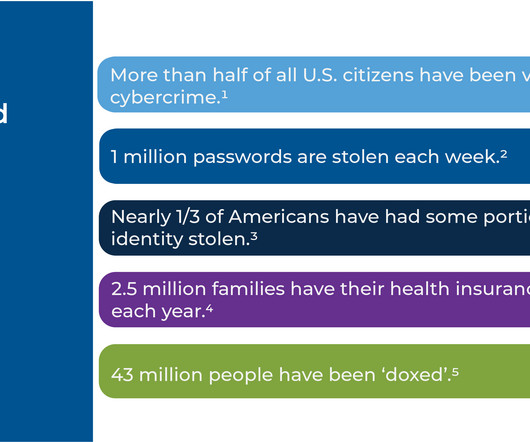

For instance, ensuring clients maintain the proper insurance coverage based on their needs is an important part of the financial planning process. Risk management is a key part of many financial advisors’ value propositions. At the same time, clients face another class of risks that advisors often do not consider: cyber.

Good Financial Cents

FEBRUARY 1, 2023

Investing in a guaranteed interest account is a great way to secure your money, as there is very little risk. Guaranteed interest accounts provide reliable, consistent returns and can be used for short-term savings or to supplement other investments in your portfolio. How Does A Guaranteed Interest Account Work?

MainStreet Financial Planning

MARCH 15, 2023

Even though the federal government has rescued SVB and guaranteed all deposits over the FDIC insurance limit of $250,000 per account, that doesn’t mean they will be doing it again for other banks. Let’s review and recap how Federal Deposit Insurance Corporation (FDIC) insurance works and what other alternatives are available.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Be sure two open separate bank accounts e.g. your personal bank accounts should be separate from your business bank accounts. Keep funds separate Maintain separate accounts for your personal emergency fund and business savings.

AdvicePay

JUNE 13, 2024

Here are some examples of one-time and ongoing services you can offer clients under the fee-for-service model: One-Time Services Ongoing Services Comprehensive Financial Plan Ongoing Financial Planning Second Opinion Engagement Advising on Held-Away Accounts Student Loan Analysis Tax Planning Portfolio Tax Efficiency Review Estate Planning Housing (..)

Walkner Condon Financial Advisors

NOVEMBER 11, 2022

CONTRIBUTIONS ACCOUNTS. Employer-Sponsored Accounts such as 401(k) and 403(b). The maximum contribution amount for these respective accounts is $20,500 , with an additional catch-up contribution limit of $6,500 for individuals aged 50 or older. IRA Accounts. Here is our list of things to consider as we come to the end .

Integrity Financial Planning

MARCH 19, 2023

As a result, and due to the fact that, like many large bank accounts, most of SVB’s funds were not covered by the FDIC (Federal Deposit Insurance Corporation), other venture capital firms and tech companies panicked, yanking their funds due to the stock loss.

MarketWatch

MARCH 22, 2023

SOFI said Wednesday that those with its checking or savings accounts will be able to access up to $2 million of Federal Deposit Insurance Corporation (FDIC) insurance, versus the standard $250,000 amount. SoFi Technologies Inc.

Clever Girl Finance

AUGUST 19, 2024

Review your maternity leave and insurance coverage 6. Update your life insurance policy 8. Explore Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) 12. Consider opening a 529 college savings plan or another type of account specifically for your child’s education.

Carson Wealth

SEPTEMBER 7, 2023

Some key points that consumers should know are: Premiums are generally lower compared to other types of life insurance. Coverage expires at the end of the term, and there is no cash value accumulation. This type of insurance policy is generally used to secure a high death benefit at a relatively low cost over a finite period of time.

Truemind Capital

SEPTEMBER 8, 2024

Consider investing in safe, ultra-short-term liquid funds, currently yielding ~7.5%, offering a better alternative to bank savings accounts. #2 2 Adequate Life and Health Insurance Coverage Ensure you have sufficient health insurance—at least Rs 20 lakhs for a family of four in a metro city.

MainStreet Financial Planning

JUNE 13, 2023

Update your life and disability insurance. Now more than ever you want to have appropriate life and disability insurance coverage, so if something unexpected happens your family will be OK. Start saving and investing in a brokerage account so you have funds saved up to meet these future expenses.

Carson Wealth

AUGUST 4, 2022

Of course, there are always the everyday household expenses to account for in your post-retirement budget. Oh, and it doesn’t account for things like over-the-counter medications, dental care or long-term care costs. . Another option is adding insurance coverage that can help pay for some of the more significant health events.

Carson Wealth

APRIL 25, 2024

Retirement planning: Calculate retirement needs and contribute regularly to retirement accounts. Insurance coverage: Evaluate insurance needs for health, life, disability, long-term care and property, ensuring adequate coverage.

Clever Girl Finance

DECEMBER 1, 2022

A fully-funded emergency account. The right type of insurance coverage (Life, health, disability, home, etc.). Should you have joint accounts or separate accounts? Having joint accounts is great, but I also believe in having your own personal savings accounts. What does your savings account look like?

Clever Girl Finance

OCTOBER 13, 2022

Luckily, I have a well-funded Health Savings Account (HSA) to cover the costs. Your emergency cash fund should be kept in a liquid account. Invested funds take longer to access—it could take a couple of business days to sell your investments and cash out of your account. Most banks let you move money between accounts instantly.

Good Financial Cents

NOVEMBER 2, 2022

But the most unique feature of Ladder Life is the ability to either increase or decrease your coverage, as needed. If you need more life insurance coverage, once you have a policy in place, you can increase the death benefit. But if your need for coverage declines, you can reduce the death benefit.

Good Financial Cents

DECEMBER 12, 2022

There are no fees for opening an account, transferring money, or managing your portfolio. They also make money through interest earned on cash balances in customer accounts, as well as from select securities transactions. FDIC coverage protects depositors up to $250,000 per account in the event of a bank failure.

Clever Girl Finance

JANUARY 9, 2024

Our goal is to help you understand it so you can make the best life insurance decision for yourself! What is cash value life insurance? It’s more than basic life insurance coverage. It’s a type of life insurance policy with a savings account attached to it, called the cash value component.

Carson Wealth

JULY 19, 2022

Some traditional qualified retirement plans, such as 401(k) Plans and SIMPLE IRAs, allow employees to defer wages into tax favored accounts. These accounts work well for most employees, but all have limitations that might make them fall short for highly paid executives. However these plans do carry some additional risks. .

WiserAdvisor

MARCH 13, 2024

Strategically selecting tax-efficient investment vehicles, such as retirement accounts, tax-deferred annuities, and municipal bonds, helps reduce the effect of taxes on your investment returns. Securing comprehensive health insurance coverage allows you to mitigate the financial risks associated with an illness, injury, or medical emergency.

Carson Wealth

DECEMBER 27, 2023

While premiums can cost more than you are willing to pay, no one in an accident has ever said, “I wish I had less insurance.” And in more dire situations, your loved ones named as beneficiaries will be covered. · Home & auto insurance – Review the cost of your current insurance coverage.

eMoney Advisor

FEBRUARY 9, 2023

Financial Planning Needs: Retirement planning Education and family planning Obtaining appropriate insurance coverage Business and tax planning Significant asset purchases Strategies for Serving Clients in This Stage: Clients at this stage are experiencing life events — both large and small — that will impact their financial planning needs.

Clever Girl Finance

MARCH 19, 2024

your short, mid-term, and long-term goals) The right types of insurance coverage (Life, health, disability, home, etc.) What does my savings account look like? Track your spending A master plan for your money should be an accurate representation of your finances, which means accounting for exactly where your money is going.

eMoney Advisor

DECEMBER 6, 2022

They can check their homeowner’s insurance coverage before making a claim once the storm has passed. A majority of insured homeowners (63 percent) haven’t added annual inflation adjustment coverage to prevent being underinsured. Don’t forget about the contents of those properties.

Truemind Capital

APRIL 4, 2024

I have encountered a few cases where a significant amount of money was kept in a savings account that was yielding 2.5-3.5% In case the debt is more than the investments, a term insurance plan over the tenure of the debt is absolutely necessary. returns while an outstanding loan costing 8-9%.

Clever Girl Finance

APRIL 29, 2024

Not saving any of your monthly income When it comes to saving money, I’ve heard so many people complain that after they’ve paid their bills, they don’t have any money to contribute to their retirement accounts or to add to their emergency fund. Next assess your current life to determine what insurance gaps you have.

Carson Wealth

JANUARY 4, 2024

While from a behavioral standpoint some suggest you should tackle low balance accounts first, a financial planning approach suggests you tackle high interest rate debt first. Proper insurance coverage: One of the biggest risks for many people in their 30s is they’re still acting as if they’re invincible.

Walkner Condon Financial Advisors

JUNE 27, 2023

People may have to continue their health insurance coverage through COBRA , enroll in a spouse’s health plan, or shop for insurance through the marketplace. Related to health care costs, you will likely lose any unused Flexible Spending Account (FSA) funds that you have. Unemployment insurance. This is uncommon.

Walkner Condon Financial Advisors

JUNE 27, 2023

People may have to continue their health insurance coverage through COBRA , enroll in a spouse’s health plan, or shop for insurance through the marketplace. Related to health care costs, you will likely lose any unused Flexible Spending Account (FSA) funds that you have. Unemployment insurance. This is uncommon.

Fortune Financial

FEBRUARY 28, 2023

Unknown global markets and volatility could erode retirement accounts. It could cost more than the projected amount if all retirement funds are in a pre-tax account. What Is A Health Savings Account? The balance in HSAs varies based on the age of account holders. Centers for Medicare and Medicaid Services.

Clever Girl Finance

FEBRUARY 2, 2023

Open a checking account A checking account is one of the basic tools you should have in your personal finance arsenal. Unfortunately, some low-income families are denied access to traditional checking accounts. If you do not have access to a traditional checking account, consider an online checking account.

MainStreet Financial Planning

JUNE 2, 2022

Without sufficient insurance coverage, a homeowner is at risk of having to pay out of pocket to rebuild their home after a disaster. Here are the 8 types of insurance coverage that you will want to review to see if you have sufficient coverage for your home. Replacement cost coverage (aka “Dwelling”).

WiserAdvisor

JULY 27, 2023

Calculate potential income from investments, such as retirement accounts (401(k), IRA), and other assets. Take advantage of catch-up contributions to retirement accounts, as you’re 50 years old. Review Insurance Coverage: Ensure you have adequate health, life, and long-term care insurance coverage.

Gen Y Planning

JULY 1, 2023

Essentially, an emergency fund is a separate savings account you rarely touch unless (you guessed it) you experience a financial emergency. Automate Savings : Most banks and financial institutions will allow account holders to create automatic transfers between accounts.

Gen Y Planning

JANUARY 5, 2022

Start by automating drafts from your checking account to an emergency fund. Set up recurring payments for your mortgage/rent, insurance, utilities, etc., Depending on the bill, you might decide to set up automatic drafts from your bank account or a credit card. Review Your Insurance Coverage .

Workable Wealth

OCTOBER 14, 2020

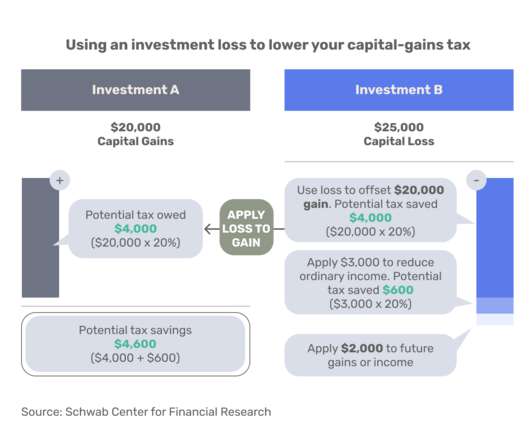

Improper risk management and insurance coverage. You can accomplish this task in several ways like strategic charitable giving, maxing out your retirement accounts, tax-loss harvesting, and more. You will have an investment strategy that already accounts for your risk tolerance, capacity, time horizon, and goals.

Truemind Capital

FEBRUARY 2, 2021

Insurance is needed when you have dependents and do not have sufficient assets to take care of them in case of any mishap. One should always opt for a pure term plan (pure cost for insurance coverage) when insurance is required. NPS offers you two approaches to invest in your account: Auto choice or Active choice.

Gen Y Planning

OCTOBER 13, 2023

This likely means maxing out retirement savings accounts like a 401k or Roth IRA, and opening a brokerage account to continue saving beyond the “traditional” routes. You might even look to create a “bucket strategy” where you invest in different buckets or accounts based on different time horizons. Take your time.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Be sure two open separate bank accounts e.g. your personal bank accounts should be separate from your business bank accounts. Keep funds separate Maintain separate accounts for your personal emergency fund and business savings.

Harness Wealth

OCTOBER 24, 2024

Bank Routing and Account Numbers: Required for direct deposit of any refunds or for payments due. 1099-INT (Interest Income): Reports interest income earned from bank accounts, bonds, or other investments over $10 during the tax year. or details of foreign accounts or investments may need to be reported.

Zoe Financial

DECEMBER 23, 2022

To implement this strategy, first look at all your investments in your non-retirement accounts. With the ups and downs in the property markets these days, the coverage on primary and vacation homes and rental properties may have changed significantly since the last time you updated your insurance coverage.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content