Why Advertising “Conflict-Free” Advice Could Violate The SEC’s Marketing Rule

Nerd's Eye View

OCTOBER 30, 2024

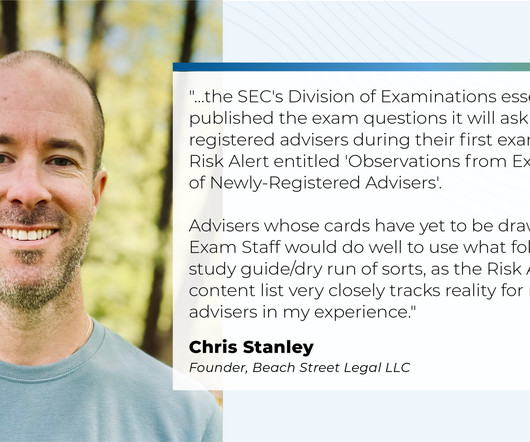

As fiduciaries, financial advisors are required to disclose any conflicts of interest that exist between themselves and their current and potential clients. But no matter the size or directness of the conflict, it still needs to be disclosed to clients, at a minimum on the advisor's Form ADV Part 2A brochure.

Let's personalize your content