Performance Advertising Guidelines For Investment Advisers Under the SEC’s New Marketing Rule

Nerd's Eye View

DECEMBER 7, 2022

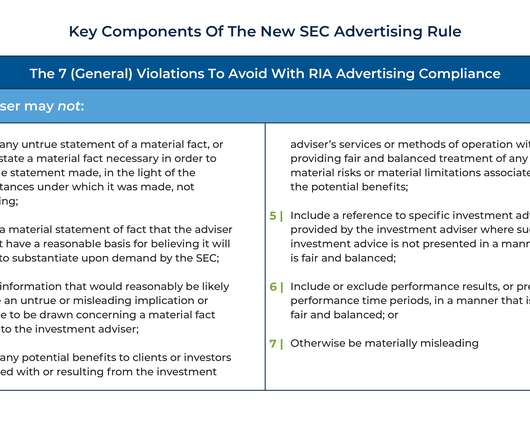

For investment advisers looking to attract prospective clients, advertising the performance of their investment strategies would be a logical way to market their services (at least if they had strong historical returns!). Two final prohibitions under the Marketing Rule include restrictions on the use of predecessor performance (e.g.,

Let's personalize your content