Weekend Reading For Financial Planners (January 25–26)

Nerd's Eye View

JANUARY 24, 2025

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Clever Girl Finance

DECEMBER 23, 2024

Freelancing is liberating, but without a solid financial plan, it can also be unpredictable. As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. That’s where financial planning for freelancers comes in. Create a realistic budget 2. Plan for taxes ahead of time 4.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

DECEMBER 13, 2024

Also in industry news this week: While the SEC has had the power to restrict mandatory arbitration clauses in RIA client agreements for more than a decade, an advisory committee meeting this week suggests support for such a measure isn't unanimous CFP Board saw a record number of exam-takers during 2024, reflecting recognition of the professional and (..)

Clever Girl Finance

JULY 3, 2023

Love it or hate it, if you want to be financially successful, you need to budget your money and understand budget categories. Getting your finances in order and building wealth takes planning, and your budget can help you do just that. Determine which budgeting methods will work for you 2. Table of contents 1.

Nerd's Eye View

DECEMBER 23, 2022

”, a series of measures that will have significant impacts on the world of retirement planning. From there, we have several articles on advisor marketing: Five tactics advisors can use to make the most of the online referrals they receive. How ‘regifting’ can help save money and reduce waste.

Nerd's Eye View

APRIL 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor released the final version of its Retirement Security Rule (a.k.a.

Dear Mr. Market

AUGUST 23, 2024

Dear Mr. Market: Budgeting apps play a vital role in helping us keep track of our spending, save for future goals, and maintain control over our financial health. Today, we dive into six promising alternatives: YNAB (You Need A Budget), PocketGuard, EveryDollar, Goodbudget, Honeydue, and NerdWallet.

Nerd's Eye View

AUGUST 23, 2024

financial planning, CRM, portfolio management), while taking a more tailored approach to selecting tech in other categories. The survey found that most firms fall into the middle category, utilizing tech in categories that provide an assessed high return on investment (e.g., Read More.

Clever Girl Finance

AUGUST 21, 2024

Setting a budget might sound about as fun as doing your taxes, but trust me, it doesn’t have to be a drag! Think of it as planning your future, making sure you have enough for those big dreams, and yes, even being able to order your favorite dinner in on Friday night. Plan for the unexpected 5. Table of contents 1.

Clever Girl Finance

JULY 16, 2023

Budgeting as a couple is critical in managing your household finances. Your budget not only allows you to plan and track where the money will be spent, but it enables you to direct the course of your finances together. What is the best budget for a married couple? How do you split finances as a couple?

Clever Girl Finance

NOVEMBER 4, 2023

Love it or hate it, if you want to be financially successful, you need to budget your money and success with budgeting means understanding budget categories. So, let’s talk about the various categories that you might need, including a budget categories list! How many categories should I have for a budget?

Nerd's Eye View

JANUARY 27, 2023

By switching to 501(c)(6) nonprofit status, the new CFP Board of Standards will have expanded abilities to advance the planning profession through lobbying and more targeted advertising messages to grow the ranks of CFP professionals.

Nerd's Eye View

APRIL 19, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that CFP Board announced that it has crossed the milestone of 100,000 CFP professionals in the United States, and despite having just celebrated its 50th anniversary last year, just set a record high in the number of advisors sitting (..)

Nerd's Eye View

JANUARY 12, 2024

Also in industry news this week: The Department of Labor (DoL) this week published a final rule delineating what makes an individual an independent contractor versus a company employee, though it did not provide specific guidance for registered representatives of broker-dealers and other financial professionals who have expressed concern that their (..)

Clever Girl Finance

SEPTEMBER 5, 2024

But once I discovered the magic of budget templates, everything changed. Table of contents What is a budget template? The Best budget templates: Spreadsheets The Best budget templates: Apps Expert Tip: Find a budget template that works for you What are some key features to look for in a budget template?

Clever Girl Finance

FEBRUARY 11, 2025

If you’re thinking about using the cash envelope system to budget effectively, having the right cash envelope wallet is key. A well-organized wallet makes it easy to divide, access, and track your cash, helping you stay committed to your budgeting goals. The cash envelope system essentially puts you on a cash budget.

Clever Girl Finance

MARCH 29, 2024

When you are paid on a biweekly basis, it may make sense to create a biweekly budget. A biweekly budget is perfect for those who get paid every other week. You can structure your budget around your paychecks so you don’t miss anything with your money, and you can find out how here! How does a biweekly budget work?

Nerd's Eye View

FEBRUARY 23, 2024

Which suggests that instead of trying to go head-to-head with these larger firms (and their heftier marketing budgets) in attracting clients, smaller firms might instead demonstrate how they are 'different' by offering a unique service offering tailored to their ideal target clients.

Clever Girl Finance

JANUARY 16, 2024

There are many different ways to come up with your perfect budgeting strategy. Alongside your monthly budget, you should also have a bare bones budget waiting in the wings. Table of contents What is a bare bones budget? Who needs a bare bones budget? It’s a budget that only covers the necessities.

Clever Girl Finance

JULY 13, 2024

The 60/30/10 budget turns the traditional rules of budgeting upside down. Instead of focusing on discretionary spending, this budgeting rule emphasizes sprinting toward our financial goals. And although the 60/30/10 rule budget won’t work for everyone, many could use it to take their finances to the next level.

MainStreet Financial Planning

NOVEMBER 9, 2023

Many of our clients have used Mint and it has been a favorite of MainStreet Financial Planning for many years. With the recent news of Mint shutting down, we wanted to share a few helpful alternatives for budgeting tools to help you stay on track with accomplishing your goals! month or if you pay all at one time it is $99.99/year

Clever Girl Finance

OCTOBER 9, 2023

Whether you’re working for yourself or have an irregular job schedule, budgeting on an irregular income can be tough. But creating a budget for this type of income is easy to learn! Table of contents Budgeting when you have an irregular income 1. Create your baseline budget 2. Can you budget with an irregular income?

Clever Girl Finance

AUGUST 10, 2023

Budgeting is one of the most important financial habits to develop. There are so many budgeting methods out there to choose from, but it’s not just creating a budget that will set you up for financial success. How do I plan for variable vs fixed expenses in my budget? What are average expenses for a household?

Clever Girl Finance

DECEMBER 16, 2023

If you don’t feel like you truly have a strong handle on your finances, one possible cause for that is using a budgeting method that doesn’t work. While not everyone needs a to-the-penny balanced budget, some type of budgeting strategy or template is really important if you want to know where your money is going month after month.

Clever Girl Finance

MARCH 9, 2024

How can you ensure you don’t go over your budget? However, with the right strategies, learning how to stay on budget can be done! Table of contents Fundamentals for budgeting success 6 Tips for staying on budget Expert tip: Try loud budgeting How can you ensure you don’t go over your budget? Let’s dive in!

Clever Girl Finance

SEPTEMBER 11, 2023

Like many, you might shudder at the word budget, or perhaps it sounds too boring or challenging to figure out. But the 50-30-20 rule and the 50 30 20 budget template prove it doesn’t have to be difficult. If you’re looking to simplify your budgeting process or are new to budgeting, then this might be the perfect match!

Clever Girl Finance

DECEMBER 13, 2023

Budgeting isn’t just about making sure you have enough to pay the bills each month. It’s also about planning ahead for future expenses. Articles related to saving money for specific things Sinking fund categories can help you prepare for the future! These can help you build out your budget and live debt-free.

Clever Girl Finance

JANUARY 16, 2024

A quick Google search of budgeting methods will show you that there’s no shortage of options out there. There is, however, one particular budgeting method that could work well if you are just getting started with budgeting and more so if you don’t like the idea of a monthly budget. What is a paycheck budget?

Clever Girl Finance

SEPTEMBER 7, 2023

In personal finance, where income, expenses, dreams, and aspirations converge, the budget emerges as a crucial tool. It’s not just a set of numbers, rather, it’s a strategic plan that empowers you to navigate the complexities of financial decisions. Table of contents What is a family budget? What is a family budget?

Clever Girl Finance

JANUARY 22, 2024

If you’re really struggling financially and aren’t sure which problem to tackle or how, budget counseling can help. Table of contents What is budget counseling? Does budget counseling affect your credit score? Articles related to counseling and budgeting Consider budget counseling to get your finances in order!

Clever Girl Finance

JANUARY 10, 2025

7 Steps to discovering your money values Expert tip: Set reminders to revisit your money values FAQs about money values Articles related to money values Start living in line with your money values today! Your money values influence the decisions you make about budgeting, saving, investing, and even giving. What are money values?

Clever Girl Finance

NOVEMBER 8, 2022

Not to worry if your budget is tight, our staycation ideas are here to save the day! In this article, we'll discuss some fun staycation ideas that will leave you refreshed and ready to get back to work in no time! You also need an emergency fund just in case things don't go as planned. Plan a day trip.

Good Financial Cents

MARCH 17, 2023

This information is critical if you want to create a budget and manage your money correctly. In this article, I’ll show you how to calculate your annual income by converting a $ 25-an-hour wage to a yearly salary. I’ll also share some budgeting and side hustle tips so you can get the most out of the money you earn.

Clever Girl Finance

FEBRUARY 11, 2025

The benefits of a no spend month Expert tip: A no spend month can make you more intentional Mistakes to avoid during your no spend month Commonly asked questions about doing a no spend month Articles related to spending less Try a no spend month! Follow your existing budget : Stick to your pre-planned necessities and nothing extra.

Clever Girl Finance

DECEMBER 1, 2022

No one cares about your financial well-being more than you, so it's important to have a financial plan for yourself. Knowing how to make a financial plan will allow you to save money, afford the things you really want, and achieve long-term goals like saving for college and retirement. What is a financial plan?

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Clever Girl Finance

DECEMBER 23, 2024

Freelancing is liberating, but without a solid financial plan, it can also be unpredictable. As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. That’s where financial planning for freelancers comes in. Create a realistic budget 2. Plan for taxes ahead of time 4.

Clever Girl Finance

FEBRUARY 11, 2025

Creating your low-buy year rules How to stay successful during your low-buy year Expert tip: Use a low buy to get clear on your values Alternatives to a low-buy year Questions commonly asked about doing a low-buy year Articles related to spending less Are you ready to give a low-buy year (or week, month, or quarter) a try?

Clever Girl Finance

JANUARY 17, 2023

Many of us associate budgets with being an annoying part of managing our financial lives. At worst, some of us think of budgets as a major constraint on how we would like to live our life. But a deeper understanding of the purpose of budgets might make sticking to it a bit more palatable. What is the purpose of budgets?

Trade Brains

FEBRUARY 7, 2024

HUDCO With the launch of the interim budget for 2024, the Indian government declared a visionary plan to construct 2 crore houses over the next five years. With that, let’s go ahead and see what are the future plans of HUDCO. Hope you enjoyed it and found the article insightful.

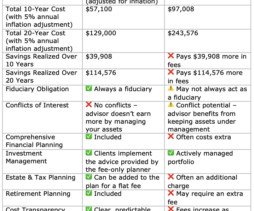

MainStreet Financial Planning

MARCH 7, 2025

If youre searching for a fiduciary financial planner, flat-fee financial planning, or the best alternative to AUM-based advisors, this article will help you decide which model is right for you. Comprehensive Financial Planning is Included Many AUM advisors charge extra for estate planning, tax strategies, and retirement planning.

Clever Girl Finance

JULY 16, 2022

Whether you need to find inexpensive activities for the summer break, are saving for a family vacation , or need to make a Christmas budget , these money saving blogs for moms contain all the tips and tricks you need. And that's not all because her articles also focus on family budgeting and motherhood tips. Life and a Budget.

MainStreet Financial Planning

DECEMBER 20, 2023

One area that often gets overlooked in the midst of planning is reviewing your financial habits and goals, so I’ve put together a short list of 3 areas to review before January. Review your budget – Are there any new expenses that you need to add or anything that can be taken out such as any unused subscriptions?

eMoney Advisor

JANUARY 31, 2023

But my thinking changed when I realized that as a planning-led firm, we should be providing more to our clients than market updates—we were missing a big opportunity. Developing topics, engaging speakers, and creating presentation content are all time-consuming and require careful advanced planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content