Weekend Reading For Financial Planners (January 25–26)

Nerd's Eye View

JANUARY 24, 2025

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. Create a realistic budget 2. Plan for taxes ahead of time 4. Without a steady paycheck or employer benefits, youre responsible for your own budgeting, savings, and future planning. Build an emergency fund 3.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Clever Girl Finance

JULY 3, 2023

Love it or hate it, if you want to be financially successful, you need to budget your money and understand budget categories. Getting your finances in order and building wealth takes planning, and your budget can help you do just that. Determine which budgeting methods will work for you 2. Table of contents 1.

Nerd's Eye View

DECEMBER 23, 2022

From there, we have several articles on advisor marketing: Five tactics advisors can use to make the most of the online referrals they receive. A review of financial planning actions, from tax-loss harvesting to charitable giving, that have a December 31 deadline. How ‘regifting’ can help save money and reduce waste.

Clever Girl Finance

AUGUST 21, 2024

Setting a budget might sound about as fun as doing your taxes, but trust me, it doesn’t have to be a drag! Whether you’re just starting out or need a little refresher, let’s break down the key factors you should consider when setting a budget! Adjust as your budget as needed 7. Table of contents 1.

Clever Girl Finance

JULY 16, 2023

Budgeting as a couple is critical in managing your household finances. Your budget not only allows you to plan and track where the money will be spent, but it enables you to direct the course of your finances together. Table of contents 5 Steps to get started budgeting as a couple Expert tip What is the best way to budget as a couple?

Clever Girl Finance

SEPTEMBER 11, 2023

Like many, you might shudder at the word budget, or perhaps it sounds too boring or challenging to figure out. But the 50-30-20 rule and the 50 30 20 budget template prove it doesn’t have to be difficult. If you’re looking to simplify your budgeting process or are new to budgeting, then this might be the perfect match!

Clever Girl Finance

NOVEMBER 4, 2023

Love it or hate it, if you want to be financially successful, you need to budget your money and success with budgeting means understanding budget categories. So, let’s talk about the various categories that you might need, including a budget categories list! How many categories should I have for a budget?

Clever Girl Finance

DECEMBER 16, 2023

If you don’t feel like you truly have a strong handle on your finances, one possible cause for that is using a budgeting method that doesn’t work. While not everyone needs a to-the-penny balanced budget, some type of budgeting strategy or template is really important if you want to know where your money is going month after month.

Clever Girl Finance

JULY 13, 2024

The 60/30/10 budget turns the traditional rules of budgeting upside down. Instead of focusing on discretionary spending, this budgeting rule emphasizes sprinting toward our financial goals. And although the 60/30/10 rule budget won’t work for everyone, many could use it to take their finances to the next level.

Clever Girl Finance

JANUARY 16, 2024

There are many different ways to come up with your perfect budgeting strategy. Alongside your monthly budget, you should also have a bare bones budget waiting in the wings. Table of contents What is a bare bones budget? Who needs a bare bones budget? It’s a budget that only covers the necessities.

Clever Girl Finance

AUGUST 10, 2023

Budgeting is one of the most important financial habits to develop. There are so many budgeting methods out there to choose from, but it’s not just creating a budget that will set you up for financial success. How do I plan for variable vs fixed expenses in my budget? What are average expenses for a household?

Good Financial Cents

MARCH 17, 2023

This information is critical if you want to create a budget and manage your money correctly. In this article, I’ll show you how to calculate your annual income by converting a $ 25-an-hour wage to a yearly salary. I’ll also share some budgeting and side hustle tips so you can get the most out of the money you earn.

Clever Girl Finance

SEPTEMBER 7, 2023

In personal finance, where income, expenses, dreams, and aspirations converge, the budget emerges as a crucial tool. And when you have a family, creating a family budget becomes even more important. Table of contents What is a family budget? How does a typical family budget look? What is the average family monthly budget?

Clever Girl Finance

JANUARY 16, 2024

A quick Google search of budgeting methods will show you that there’s no shortage of options out there. There is, however, one particular budgeting method that could work well if you are just getting started with budgeting and more so if you don’t like the idea of a monthly budget. What is a paycheck budget?

Harness Wealth

MARCH 27, 2025

Pass-Through Entity Tax (PTET) is a state-level tax mechanism designed to sidestep the federal State and Local Tax (SALT) deduction limit. Allowing a pass-through entity to pay state income taxes directly, PTET effectively shifts the tax burden from individual owners to the business itself.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. Create a realistic budget 2. Plan for taxes ahead of time 4. Without a steady paycheck or employer benefits, youre responsible for your own budgeting, savings, and future planning. Build an emergency fund 3.

Carson Wealth

DECEMBER 10, 2024

With careful planning, you may be able to reduce your tax bill or optimize the impact of your estate. Establish a Budget and Schedule for Giving One of your first tasks is to determine how much you are comfortable giving. Or maybe boost their publicity budget to attract more donors? What do you want to do for that organization?

Clever Girl Finance

AUGUST 31, 2022

Whether you get paychecks weekly, biweekly, or monthly, budgeting weekly is a great way to take control of your money and save more. Want to know how to budget weekly paychecks? It may sound tricky, but creating a weekly budget can be straightforward and effective once you know how. How to succeed at budgeting weekly.

James Hendries

SEPTEMBER 25, 2022

Draft a Retirement Budget. Even if you haven’t adhered to a strict budget during your working years, having a budget during the early months of retirement may be crucial—spending more than you’ve planned or failing to anticipate certain large expenses may impact your future retirement income. 1 [link].

Tobias Financial

OCTOBER 13, 2022

Another financial pain point that significantly impacts our budget is taxes. Whether you typically get a refund or owe a tax bill, there are several moves to consider to increase your chances of tax savings. . Watch how investors can turn stock losses into tax savings here: [link] .

Clever Girl Finance

JULY 24, 2023

A cash envelope system is a useful budgeting tool for anyone that needs a visual budget to stay on track. Not only will this method help ensure your spending is controlled, but it has also been shown that cash envelope budgeting may lead to spending less money! What do I do with money left over in my cash envelopes?

MainStreet Financial Planning

AUGUST 2, 2024

It not only helps children learn how to count but also introduces basic concepts of spending, saving, paying taxes, and enjoying their money. BOOKS FOR CHILDREN AGE: 4-7 Anthony C. Delauney created a series of books teaching children practical financial lessons. . – This has been one of Anna’s son Liam’s favorite books.

MainStreet Financial Planning

DECEMBER 20, 2023

Review your budget – Are there any new expenses that you need to add or anything that can be taken out such as any unused subscriptions? One area that often gets overlooked in the midst of planning is reviewing your financial habits and goals, so I’ve put together a short list of 3 areas to review before January.

MainStreet Financial Planning

MARCH 7, 2025

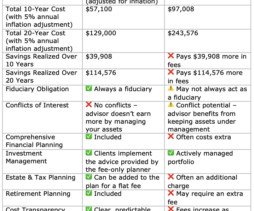

If youre searching for a fiduciary financial planner, flat-fee financial planning, or the best alternative to AUM-based advisors, this article will help you decide which model is right for you. Comprehensive Financial Planning is Included Many AUM advisors charge extra for estate planning, tax strategies, and retirement planning.

Clever Girl Finance

MARCH 19, 2024

Is a financial plan the same as a budget? Articles related to planning your finances Create a solid financial plan and it will help you become financially successful This probably won’t come as a surprise, but everyone’s money plan looks different. Make a budget Budgeting is a key part of how to create a financial plan that works.

Your Richest Life

APRIL 5, 2022

If you’ve already filed your taxes and received your refund, you might already be thinking of ways to use that refund. Here are some tips for putting that money to the best possible use in 2022: Avoid impulse tax refund spending. If you received a tax refund, then you might already be imagining different ways to spend it.

Good Financial Cents

APRIL 17, 2023

In this article, we’ll explore what it means to earn 20 dollars an hour and how much money that would add up to over the course of a year. Important: The amount mentioned does not include deductions for taxes, insurance, 401K, or any other withholdings. Again, this amount is subject to taxes and other withholdings.

Trade Brains

DECEMBER 31, 2023

Tax Loss Harvesting : As an investor, you earn capital gains irrespective of the asset you invest in. While you trade or invest a significant amount of capital and receive good returns, there comes a time when you start worrying about the taxes on those gains. It is called Tax Loss Harvesting. How are Capital Gains Taxed?

Trade Brains

FEBRUARY 7, 2024

HUDCO With the launch of the interim budget for 2024, the Indian government declared a visionary plan to construct 2 crore houses over the next five years. Hope you enjoyed it and found the article insightful. The post HUDCO 333% Surge in One year: Budget Unveils Ambitious Plan for 2 Crore Homes appeared first on Trade Brains.

Clever Girl Finance

DECEMBER 1, 2022

In this article, I’ll take you through everything you need to know in order to plan for your financial future. A monthly budget to help you keep your expenses below your income. A debt pay-off and spending plan (using your budget). Discuss your budget and money goals and make financial decisions together. Plan for taxes.

Clever Girl Finance

AUGUST 19, 2024

Adjust your budget to include baby expenses 2. Articles related to expanding your family Leverage these tips to save for a baby! Adjust your budget to include baby expenses As soon as you know you have a baby is on the way, it’s a good idea to take a close look at your current budget. Practice living on one income 4.

Random Roger's Retirement Planning

APRIL 2, 2024

In the last couple of years we cut several expenses which in the context of a post retirement budget could add up. That same article said that cardiovascular disease will cost $263,000-$315,000 out of pocket for retirees. The article didn't put cancer in that same context but I can't imaging it would be cheaper than CVD.

Trade Brains

FEBRUARY 21, 2024

Bharat Electronics: In the budget plan for the year 2023-24, the government increased the money allocated for defense to ₹5.94 Further, in the interim Union Budget 2024-25 the allocation mentioned was over Rs 6.21 The Profit after Tax grew by 28% to Rs 3,007 Crore in FY 2022-23 as against Rs 2,349 Crore in FY 2021-22.

Good Financial Cents

FEBRUARY 22, 2023

In this article, I’ll let you know how much money you can expect to take home (after taxes) if you earn $50,000 annually, depending on where you live in the US. The Impact of Vacation Time on Your Annual Salary How to Make More While Working Less $50,000 a Year is How Much After Taxes? an hour and $48.08

Clever Girl Finance

JANUARY 22, 2024

10 steps to manage a financial windfall Expert tip: Keep living your life normally Factoring in taxes How do you deal with sudden financial windfall? Articles related to being wise with money Manage your large sum of money smartly! Tax refunds that are more than you expected. What should you do with a $1,000 windfall?

Clever Girl Finance

DECEMBER 13, 2023

Articles related to saving for retirement Start saving for your retirement today! Make funding tax-advantaged accounts a priority Tax-advantaged accounts are specifically designed to help savers build their retirement nest egg. Once in the account, your contributions will grow tax-free.

Clever Girl Finance

APRIL 29, 2024

Articles related to making good money choices You can recover from bad financial decisions! What to do if you have not been saving: One way to easily save is to establish the habit of trying out different budgeting methods and working with a monthly budget. What is the best financial decision?

Integrity Financial Planning

JUNE 27, 2023

That’s why this article will provide valuable tips and insights to help retirees build a legacy for their families and future generations. This process should include setting realistic and achievable objectives, creating a budget, and establishing an emergency fund. [2]

Clever Girl Finance

AUGUST 14, 2022

In this article, we will discuss everything you need to know about sinking funds - the why, the what, and the how. Do you cut down on the rest of your budget? Without a doubt, in the coming months, an expense will likely come up that is outside of your usual budget. Self-employment tax. How will you pay for it?

Good Financial Cents

JULY 3, 2023

Keep in mind that this calculation represents the gross annual salary, not accounting for taxes, insurance, 401K, or deductions. This equates to approximately $1,200 per week before taxes and deductions are applied. With an hourly rate of $30, you would receive a bi-weekly paycheck of approximately $2,400 before taxes and deductions.

Harness Wealth

FEBRUARY 27, 2023

Founders, board members, and employees of startups that get acquired can experience tax consequences as a result of a liquidity event. It’s imperative to plan for the tax implications so you can be prepared to pay what you owe the IRS. For example: How much do you need to budget for taxes?

Good Financial Cents

APRIL 19, 2023

In this article, we’ll explore what exactly goes into making a six-figure income and the types of jobs that can provide an annual salary in this range. This amount is based on gross income, which is before taxes and other deductions are taken out. How Much Is 6 Figures After Taxes? Is it as lucrative as everyone thinks?

Clever Girl Finance

JANUARY 29, 2023

If you are curious about how much savings you should have by what age , you'll find references to this throughout the article. Any medical debt, personal loans, or back taxes are also considered liabilities. Make a budget consistently The first thing to do to increase your wealth is to make a budget.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content