Weekend Reading For Financial Planners (February 15–16)

Nerd's Eye View

FEBRUARY 14, 2025

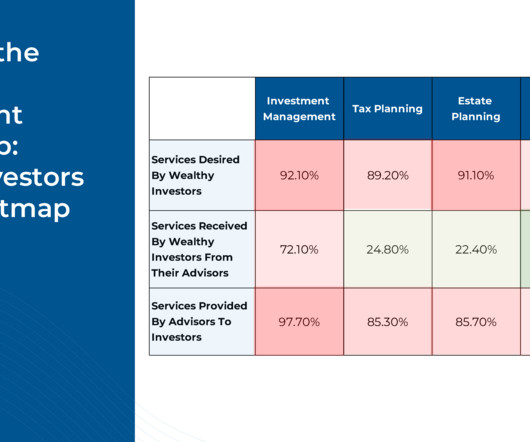

Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g.,

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

FEBRUARY 14, 2025

Which suggests firms that can meet clients' evolving needs as they advance up the wealth spectrum (e.g.,

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

MARCH 28, 2025

Which suggests that, amidst ongoing debate over fiduciary-related regulations, an advisor's status as a fiduciary could both lead to greater client trust (both in their individual advisor relationship and perhaps in the financial advice industry as a whole) and, ultimately, higher client retention rates.

Nerd's Eye View

FEBRUARY 7, 2025

During his nearly two-decade tenure, Keller oversaw a near-doubling of the number of CFP professionals, the establishment of a new 501(c)(6) professional organization to promote the benefits of financial advice and planning careers, and updates to the CFP Board's investigation and disciplinary processes, among many other changes.

Nerd's Eye View

JANUARY 10, 2025

Also in industry news this week: A survey indicates that nearly 71% of new financial advisors drop out in the first 5 years, with firms offering better training and mentorship opportunities (as well as entry-level positions that don't come with business development targets) seeing higher employee retention rates How broker-dealer self-regulatory organization (..)

Alpha Architect

JANUARY 2, 2024

This article seeks to examine what research says about the interplay between risk tolerance, financial literacy, and trust and their collective impact on the pursuit of financial advice by Black and Hispanic households. Do racial barriers prevent Black and Hispanic households from pursuing financial advice?

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Nerd's Eye View

JANUARY 13, 2025

Which is surprising to some, given that a decade ago, the emergence of so-called "robo-advisors" was supposed to displace human financial advisors and compress advisory fees. In reality, though, the robos struggled to gain traction, and the human financial advice business just continues to grow.

Nerd's Eye View

JANUARY 20, 2023

Also in industry news this week: While the number of RIA M&A deals increased in 2022, the size of these deals declined, perhaps reflecting challenging market and economic headwinds A recent survey suggests that nearly half of financial advisory clients have changed advisors or have considered doing so since the start of the pandemic and that portfolio (..)

Nerd's Eye View

DECEMBER 26, 2022

that this blog – its articles and podcasts – is a regular habit for tens of thousands of advisors, but that not everyone has the time or opportunity to read every blog post or listen to every podcast that is released from Nerd’s Eye View throughout the year. Read More.

Nerd's Eye View

JULY 14, 2023

Also in industry news this week: The SEC this week finalized a series of rules designed to discourage future runs on money-market funds, potentially reducing their liquidity risk A recent study suggests that advisor marketing messages that address prospective clients' emotional concerns, in addition to their technical questions, could be particularly (..)

Nerd's Eye View

AUGUST 2, 2024

market during the past decade, historical data suggest that they could serve as a helpful ballast against sharp inflation-adjusted drawdowns in U.S. market during the past decade, historical data suggest that they could serve as a helpful ballast against sharp inflation-adjusted drawdowns in U.S.

Nerd's Eye View

AUGUST 2, 2024

market during the past decade, historical data suggest that they could serve as a helpful ballast against sharp inflation-adjusted drawdowns in U.S. market during the past decade, historical data suggest that they could serve as a helpful ballast against sharp inflation-adjusted drawdowns in U.S.

Nerd's Eye View

JULY 28, 2023

Also in industry news this week: The SEC released a proposal that would require firms to take steps to eliminate or neutralize conflicts of interest when using predictive data analytics tools with clients A recent study found that financial advisors remain the top source of financial advice for consumers, with social media coming in well behind From (..)

Nerd's Eye View

SEPTEMBER 1, 2023

Also in industry news this week: A legal challenge to FINRA's operations as a self-regulatory organization has the potential to upend the current regulatory system for broker-dealers and their registered representatives A recent study indicates that while many consumers appear confident handling their finances on a 'DIY' basis during their careers, (..)

Nerd's Eye View

MARCH 24, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week’s edition kicks off with the news that the CFP Board of Standards launched its 1st ad campaign, dubbed "It’s Gotta Be A CFP", following its transition to a 501(c)(6) organization.

MainStreet Financial Planning

FEBRUARY 1, 2024

Planning for college Taking a gap year Relocating to another state or country Retirement income planning And so much more In embracing the Garrett Planning Network model, clients gain not just financial advice, but a partnership built on trust, transparency, and a commitment to their financial well-being.

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Nerd's Eye View

SEPTEMBER 6, 2024

Notably, while the rule will create an additional compliance burden, the due diligence advisers offering comprehensive planning services (as well as their investment custodians) are likely already conducting on their clients to create an effective financial plan could be a 'defense mechanism' for these firms against criminals looking to take advantage (..)

Nerd's Eye View

SEPTEMBER 15, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent survey indicates financial advisors are the most trusted source of financial advice for consumers across generations, and are particularly trusted among wealthier individuals.

Nerd's Eye View

JULY 17, 2023

has increasingly made financial services products available directly to consumers, financial advisors have focused more and more on the business of financial advice itself. But as technology (in particular, the internet!)

Nerd's Eye View

JULY 5, 2024

Supreme Court decision shifting authority to interpret laws passed by Congress from Federal agencies to the judicial system could have significant impacts on regulation of the financial advice industry, including the potential for additional legal challenges to regulations from the Securities and Exchange Commission (SEC), the Department of Labor (DoL), (..)

Nerd's Eye View

FEBRUARY 23, 2024

Also in industry news this week: A recent study has found that advisors who gain additional credentials tend to see a boost both in their confidence and in their business metrics, with the CFP certification standing out in terms of value The implications for RIAs of a proposed Treasury Department rule that would subject many firms to certain anti-money-laundering (..)

Nerd's Eye View

OCTOBER 21, 2022

Also in industry news this week: The wealth of those in the Millennial and Generation Z cohorts increased by 25% in 2021 and members of these generations are willing to pay for financial advice, according to a new study. Social Security COLA for 2023.

Nerd's Eye View

DECEMBER 8, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a new study from research firm Cerulli has found that investors' willingness to pay for financial advice has risen over the last 15 years, with more investors reporting using a financial advisor (and a decreasing share considering (..)

Nerd's Eye View

JULY 8, 2024

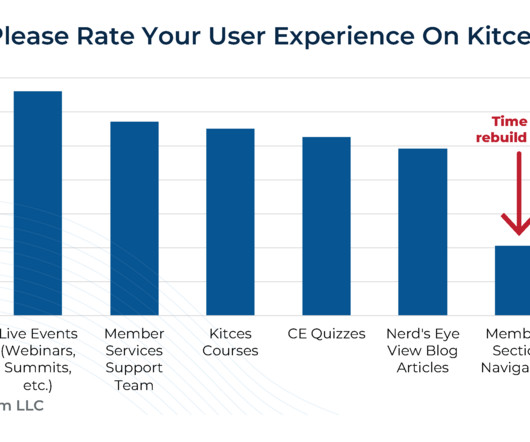

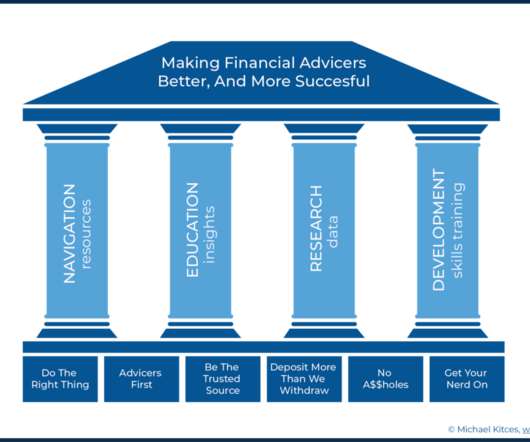

Given the continuing growth of advicers who fall under these new IAR CE Requirements, the Kitces platform is not only continuing to offer IAR CE (along with all of its other CE types) through its Nerd's Eye View blog articles, but, starting this year, has also expanded IAR CE eligibility to our webinars as well.

Nerd's Eye View

JANUARY 22, 2024

In this 'hybrid' video-based article, Michael Kitces and John Bowen, CEO and founder of CEG Worldwide and CEG Insights (formerly Spectrem Group), dive into CEG's extensive data on the "gap" between the services that financial advisors actually offer to their clients and what HNW clients truly want from their advisors.

Nerd's Eye View

AUGUST 24, 2022

In his latest article for the Nerd’s Eye View blog, Chris Stanley, investment management attorney and Founding Principal of Beach Street Legal, laid out the statutory requirements for RIA advisory agreements and what to include in the agreement when describing the RIA’s services and fees.

Nerd's Eye View

AUGUST 24, 2022

In his latest article for the Nerd’s Eye View blog, Chris Stanley, investment management attorney and Founding Principal of Beach Street Legal, laid out the statutory requirements for RIA advisory agreements and what to include in the agreement when describing the RIA’s services and fees.

Nerd's Eye View

SEPTEMBER 25, 2023

Gradually, CFP Board also raised the ethical standards for CFP professionals, introducing a fiduciary standard on financial planning in 2008 and, in 2020, an expanded fiduciary standard that applies whenever the certificant is giving financial advice.

Nerd's Eye View

JULY 25, 2022

Yet despite this – and perhaps even because of it – advisory firms are putting an ever-greater focus on financial planning in 2022, as a way to both show value to clients in the midst of difficult market returns, and, more broadly, to help clients navigate the current environment.

Midstream Marketing

OCTOBER 30, 2024

Key Highlights The financial advice world is changing. They need to put in more effort to attract prospective clients looking for financial advice. Understanding the Marketing Landscape for RIAs The world of financial advice is changing fast. This helps them draw in new clients who need financial advice.

MainStreet Financial Planning

MARCH 7, 2025

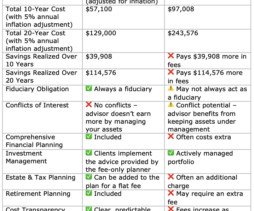

In contrast, a fee-only, flat-fee financial planner provides transparent pricing, unbiased advice, and comprehensive financial planningwithout taking a percentage of your investments. Instead, they provide objective, conflict-free financial advice at a predictable cost.

Carson Wealth

FEBRUARY 27, 2024

I may be biased, but I think almost everyone would benefit from some kind of advice for their money. Not that many years ago, if you wanted financial advice, your choices were limited. There are so many different ways to get affordable financial advice now. Read the full article on HerMoney. Not anymore.

Sara Grillo

APRIL 19, 2024

But before we get into it… Look, there are alot of schmucks out there hawking crap products disguised as financial advice. I’m not a lawyer – so please don’t interpret anything I say here as legal advice. Do your own diligence when you are seeking financial advice. Don’t be fooled!

Indigo Marketing Agency

MARCH 19, 2025

Book a free call and get a custom financial strategy.) Example: Instead of: We provide expert financial advice to help you plan for retirement. For example, run straightforward lead-generation ads but also post insightful blog articles or videos to establish credibility.

Integrity Financial Planning

JUNE 7, 2023

In this article, we will explore some strategies to help you choose the best investments for your IRA. Fees are sometimes essential to recieving high-quality financial advice, but high fees can also eat away at your returns over time. Investing in an Individual Retirement Account (IRA) is an excellent way to save for retirement.

The Irrelevant Investor

NOVEMBER 28, 2021

Articles A DAO is a company that has no leadership structure. (By

Indigo Marketing Agency

SEPTEMBER 6, 2022

The same is true for financial advice. Interested in reading Bob Veres’s full article? Testimonials provide credibility and social proof. If you look up a restaurant or a car wash online, you want to see five-star reviews before you take the time to drive there. Testimonials give you that credibility factor. Click here.

eMoney Advisor

NOVEMBER 22, 2022

As a financial professional, how comfortable are you with being on the receiving end of financial advice? How comfortable would you be taking financial advice from another financial planner? Consumers face a lot of anxiety when it comes to meeting with a financial professional to talk about their money.

Darrow Wealth Management

NOVEMBER 17, 2022

Article is a general communication only and should not be used as the basis for making any type of tax, financial, legal, or investment decision. Darrow Wealth Management doesn’t provide tax advice; consult your tax advisor to discuss your personal situation. .

Midstream Marketing

DECEMBER 10, 2024

This article will show you ten important marketing campaigns. These campaigns help build a strong marketing plan for financial advisors. Create quality blogs, articles, and videos addressing their needs. Share important articles, industry news, and useful tips on financial planning. Engage with your followers.

Midstream Marketing

NOVEMBER 6, 2024

It shows you are a reliable partner who cares about your clients’ financial health. The Importance of Content Marketing for Financial Advisors Content marketing can help your brand stand out. By making helpful and interesting content often, you show that you are a reliable choice for financial advice.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content