Weekend Reading For Financial Planners (January 25–26)

Nerd's Eye View

JANUARY 24, 2025

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

MainStreet Financial Planning

AUGUST 16, 2022

There are many steps in building an investment portfolio, in this article, I’ll discuss how asset allocation and risk tolerance are important considerations when investing. In simple terms, asset allocation is the mix of all the different types of investments you have in your portfolio. Some examples include U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

MainStreet Financial Planning

MARCH 12, 2025

Reevaluate Your Asset Allocation If watching your investment portfolio fluctuate causes anxiety, your current allocation might be too aggressive. Reassess Your Budget Take a close look at your spending. Consider shifting towards a more conservative approach. Are there areas where you can scale back or eliminate expenses?

Carson Wealth

JUNE 27, 2024

Set a Budget (and Stick to It) While seemingly a basic concept in the financial planning toolbox, a budget can uncover bad spending habits unbeknownst to people. Sticking to a budget allows you to monitor your finances and keep you on track. Start creating your budget by determining what your necessities, wants and savings.

MainStreet Financial Planning

MARCH 7, 2025

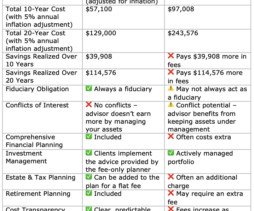

Why a Fee-Only, Flat-Fee Financial Planner is the Better Choice Transparent & Predictable Costs You know exactly what you’re paying, making it easier to budget for financial planning services. Instead, they provide objective, conflict-free financial advice at a predictable cost. Are There Any Benefits to AUM-Based Advisors?

Fortune Financial

OCTOBER 14, 2024

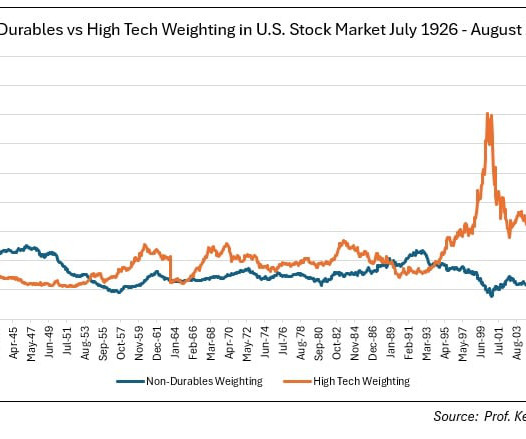

It has been my experience when reviewing portfolios that diversification is typically expressed simply as a number of various stocks owned, or owning a handful of asset classes, usually stocks of various sizes and geographies, and bonds of varying maturities.

MainStreet Financial Planning

DECEMBER 20, 2023

Review your budget – Are there any new expenses that you need to add or anything that can be taken out such as any unused subscriptions? One area that often gets overlooked in the midst of planning is reviewing your financial habits and goals, so I’ve put together a short list of 3 areas to review before January.

Clever Girl Finance

AUGUST 22, 2022

Create a budget. Try using something like the 50/30/20 budget. There are many other budgeting options, as well, like the 70/20/10 or the 30/30/30/10 budget. You can even create your own unique budget, but the really crucial thing is to organize your money. Create a budget that works for you.

Discipline Funds

NOVEMBER 17, 2023

And the only way that disaster happens is if your financial planner is making irrational projections about asset returns and your asset allocation. In fact, the current environment doesn’t look that much different than what we experienced in the 80s and 2010s where the budget deficit was consistently 4-6% of GDP.

Carson Wealth

APRIL 25, 2024

Once you have your goals set, you can build your plan with any combination of the following elements: Budgeting and expense management: Create a detailed budget outlining income, expenses, and savings targets. Investment strategy: Determine asset allocation and investment vehicles aligned with risk tolerance and financial goals.

SEI

AUGUST 2, 2022

Discussions covered a range of topics, including foundation operations, inflation and return expectations, processes for unspent distributions, asset allocation changes, and governance findings. The largest percent (28% on average) of operating budget comes from institutional support/shared service agreement. 47% of $100-500M).

Trade Brains

DECEMBER 7, 2023

From budgeting basics to investments, these courses offer a comprehensive foundation for managing your money in a better way. The course covers an introduction to personal finance, credit cards, life insurance, health insurance, investment instruments, loans, income tax and planning, budgeting and building a strong portfolio.

Carson Wealth

DECEMBER 1, 2022

If you learn to budget in your 20s, that habit will carry with you through your lifetime. Consider online budgeting tools , spreadsheets or even pen and a notebook. . Track income, expenses and build in budgeted items for future financial goals. Build Positive Financial Behaviors.

Brown Advisory

SEPTEMBER 11, 2016

By Taylor Graff, Head of Asset Allocation Research and Ed Chadwyck-Healey, Head of International Private Clients ⚑ Investment Outlook Falling Interest Rates Trigger Investor Hunger For Yield Investors snapping up U.S. securities are seeking yield as much as safety as interest rates plunge toward record lows.

Brown Advisory

SEPTEMBER 11, 2016

By Taylor Graff, Head of Asset Allocation Research and Ed Chadwyck-Healey, Head of International Private Clients ? Geopolitical instability and the end to nearly a decade of budget austerity have improved the prospect for defense industry stocks. Investment Outlook Falling Interest Rates Trigger Investor Hunger For Yield.

Good Financial Cents

JUNE 11, 2023

What’s more, these wealth advisors aren’t really there to teach you how to put together a budget, they strictly manage your money. You can also get information on your performance and asset allocation. This will help you to create an asset allocation that will get you where you need to go with your investments.

Yardley Wealth Management

JULY 20, 2022

They both dream of traveling half—or even most—of the year after retirement, but they’re not sure if they can afford to, or how to budget so that their retirement savings will last. We’d look at the asset allocations of their portfolios and whether they’re tax-deferred, tax-exempt, or taxable. So—problem solved, right?

WiserAdvisor

OCTOBER 5, 2022

When applied to investing, many folks may come to the same conclusion that 80% of their returns are generated from only 20% of their asset allocations. In finance, you can use the 80/20 rule for important activities such as budgeting, asset allocation, and planning.

Zoe Financial

MAY 18, 2023

They can help you analyze your current investments, optimize your asset allocation, and make necessary adjustments to ensure your retirement nest egg grows steadily. They can help you budget effectively, set up college savings accounts, and explore investment options to support your family’s future financial needs.

Brown Advisory

MARCH 28, 2019

The first approach is to determine an acceptable level of risk—often termed a “risk budget”—and then seek to maximize potential return within that risk constraint. The “shoestring curve” below depicts these risks for a hypothetical portfolio, assuming various asset allocation targets. expected dispersion from mean returns).

Brown Advisory

MARCH 28, 2019

The first approach is to determine an acceptable level of risk—often termed a “risk budget”—and then seek to maximize potential return within that risk constraint. We use shoestring charts to help clients understand key short-term and long-term risks associated with their asset allocation and spend-rate decisions.

Brown Advisory

NOVEMBER 29, 2016

The budget gap for nonprofits has widened because of a slump in their three sources of funds—donations, grants and portfolio returns. Stop-gap measures, such as increasing portfolio withdrawals, may erode the total amount of a portfolio, thereby impairing annual returns and eventually prompting deep budget cuts. Making More From Less.

Clever Girl Finance

DECEMBER 13, 2023

For example, you might have to prioritize saving for retirement over a luxury vacation budget. A honest look at your budget can help you determine where you can potentially cut back to contribute more to your retirement savings. Keep an eye on asset allocation Not all investments are created equally.

WiserAdvisor

FEBRUARY 29, 2024

They help with asset allocation Asset allocation is an important component of successful retirement planning, and working with the best financial advisors for retirement can provide invaluable guidance in navigating this complex terrain. The value of rebalancing extends beyond just maintaining asset allocation.

Fortune Financial

OCTOBER 31, 2022

Now is a good time to give your finances a checkup to ensure your budget is back on track ahead of the holidays. Plug budget leaks : Spending leaks are impulsive and non-necessity purchases. Retirement savers and retirees can adjust to market turmoil by looking at spending and asset allocation plans to build a cash reserve.

Yardley Wealth Management

JUNE 12, 2023

Keeping our asset allocation and increasing our wealth. I have been doing this for 25 years now and I can tell you that every single person who has made me sell out because of anticipating some event or a market downturn has regretted it in the long run.

James Hendries

OCTOBER 7, 2022

Elevated food and gas prices continue to stretch budgets, and higher interest rates have increased borrowing costs. Asset allocation does not ensure a profit or protect against a loss. Our thoughts are with those impacted by this devastating storm. This has clearly been a challenging year for households. Gas prices are falling.

WiserAdvisor

DECEMBER 13, 2023

Eases contribution pressure Starting early means you can spread your contributions over a longer period, making it easier to integrate them into your budget without feeling overwhelmed. Adapt your approach Late starters should consider a strategic shift in their asset allocation. What are the best ways to save for retirement?

The Big Picture

JUNE 6, 2023

Once you have your asset allocation dialed in, your automatic contributions dialed in, all the basics, then you can move on. You know, a rich life, most people expect a money book to start with a chapter on budgets. We’re going to get a budget. Everybody hates the word budget. I hate budgets myself.

Brown Advisory

OCTOBER 4, 2021

As we will discuss in this article, we conduct climate-related research and analysis (as part of our overall research efforts) along several separate but integrated tracks to guide our asset allocation, manager research and portfolio construction efforts.

Brown Advisory

OCTOBER 4, 2021

As we will discuss in this article, we conduct climate-related research and analysis (as part of our overall research efforts) along several separate but integrated tracks to guide our asset allocation, manager research and portfolio construction efforts. A 360-Degree Climate Evaluation. CARBON ATTRIBUTION” of SUSTAINABLE PORTFOLIOS .

Brown Advisory

OCTOBER 11, 2021

We believe that the investment return needed to achieve that objective should be the most important guidepost for a portfolio’s asset allocation. With traditional assets like stocks and bonds at high valuations, the implications for future returns of those assets may be underwhelming. Source: BLOOMBERG.

Brown Advisory

OCTOBER 11, 2021

We believe that the investment return needed to achieve that objective should be the most important guidepost for a portfolio’s asset allocation. With traditional assets like stocks and bonds at high valuations, the implications for future returns of those assets may be underwhelming. Source: BLOOMBERG.

Fortune Financial

SEPTEMBER 25, 2023

Your risk tolerance will influence your investment strategy and asset allocation. It may encompass budgeting, debt management and developing strategies for saving and investing. Incomes and Expenses Evaluate your current financial situation. Investment Management Investment management is a critical aspect of wealth management.

Brown Advisory

SEPTEMBER 3, 2015

While the budget outlook for U.S. By Taylor Graff, CFA, Asset Allocation Analyst. Many hedge funds and municipal bond mutual funds persisted with purchases even as credit-rating firms downgraded the bonds far below investment grade. The investors’ losses spotlight a pitfall in the $3.6 Dream or Opportunity?

WiserAdvisor

DECEMBER 29, 2022

The reluctance to create a budget, use formulas and data, and arrive at decisions can impact your present and future finances. A budget is the foundation of a financial plan. Managing your finances can sometimes be overwhelming, as most people lack the proper understanding of how the market functions. Cash flow. Rule of 72.

Truemind Capital

OCTOBER 22, 2021

Poor suffer the most from the impact of inflation since they have very low exposure to assets whereas food & fuel accounts for a major part of their household budget. For debt allocation one can consider short maturity portfolios like ultra-short-term, low duration, or floating rate funds.

Fortune Financial

SEPTEMBER 25, 2023

Your risk tolerance will influence your investment strategy and asset allocation. It may encompass budgeting, debt management and developing strategies for saving and investing. Incomes and Expenses Evaluate your current financial situation. Investment Management Investment management is a critical aspect of wealth management.

WiserAdvisor

AUGUST 18, 2022

Compare different mutual funds based on their returns, exit loads, asset allocation, standard deviation, expense ratios, portfolios, management style, Sharpe ratios, and more. Further, the advisor can offer assistance in matters related to creating a budget, reducing your taxes, boosting your savings rate, and more. To conclude.

James Hendries

JULY 3, 2023

The early and successful budget airlines, or online digitized and aggregated commercial real estate data, all emanated from strong conviction. LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommends a neutral tactical allocation to equities, with a modest overweight to fixed income funded from cash.

Brown Advisory

MAY 4, 2020

As is often the case, its strategic and investment choices are intertwined, because the college needs to allocate its precious capital across several competing options. It is seeking to expand, specifically with regard to housing and athletic facilities, to keep up with a desired growth in enrollment.

Brown Advisory

SEPTEMBER 4, 2019

As is often the case, its strategic and investment choices are intertwined, because the college needs to allocate its precious capital across several competing options. It is seeking to expand, specifically with regard to housing and athletic facilities, to keep up with a desired growth in enrollment.

The Big Picture

SEPTEMBER 19, 2023

We actually have a budget for risk management and technology and tools. It depends on your asset allocation. I also don’t think you should ever really beat yourself up for sticking to your asset allocation and your beliefs. And they took it out of their asset allocation in favor of other strategies.

WiserAdvisor

JANUARY 8, 2023

A lot of investors use the New Year to review their portfolios, change asset allocations, and prepare for the coming months. As per the Congressional Budget Office (CBO), the act can reduce budget deficits by $237 billion over the next ten years. 2023 may see high demand for electric vehicles, solar panels, and others.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content