Comfortable Retirement for Clients in Sight? Think Again

Wealth Management

MAY 19, 2023

Education on key asset allocation strategies is necessary to get clients ready for their golden years.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 19, 2023

Education on key asset allocation strategies is necessary to get clients ready for their golden years.

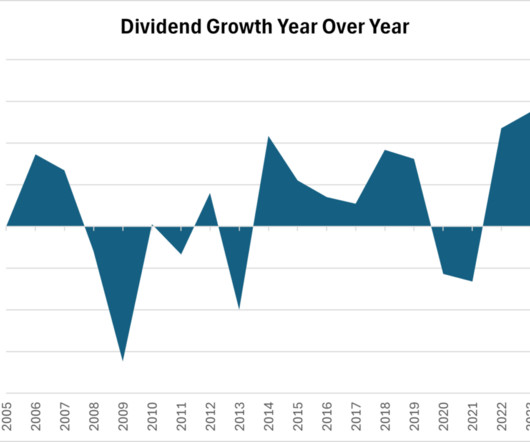

Validea

OCTOBER 28, 2024

We explore several clips from our interviews where Meb shares perspectives that often challenge conventional wisdom, including his thoughts on dividend investing, trend following, and the Federal Reserve.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Brown Advisory

SEPTEMBER 6, 2022

Asset Allocation: Developing a Long-Term Investment Strategy for Mission-Driven Organizations. When putting a plan in place, we believe it is critical for any mission-driven organization to develop an effective, long-term asset allocation strategy to manage its endowment assets. Tue, 09/06/2022 - 10:30.

Abnormal Returns

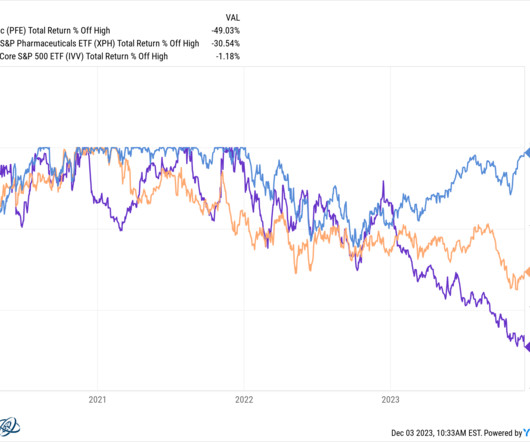

DECEMBER 3, 2023

awealthofcommonsense.com) There are a lot of different asset allocations you can live with. downtownjoshbrown.com) College-educated women with children under 10 are in the workforce at record numbers. (wsj.com) Strategy Remember all that talk about how the 60/40 portfolio was broken? axios.com) Q4 GDP is tracking around 1%.

The Chicago Financial Planner

FEBRUARY 3, 2022

Investors who are well-diversified may be hurt but generally not to the extent of those who are highly allocated to stocks. Review your asset allocation . If you haven’t done so recently, perhaps it is time to review your asset allocation and make some adjustments. Go shopping . FINANCIAL WRITING.

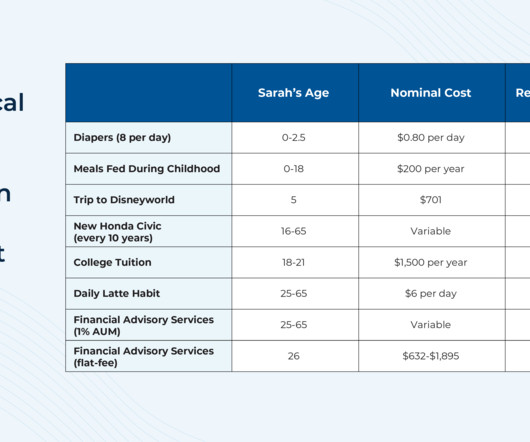

Nerd's Eye View

OCTOBER 23, 2024

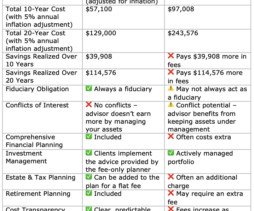

This argument is particularly common in the financial independence and personal finance space, with financial educators like Ramit Sethi being a notable critic. However, over the years, the 1% AUM fee has faced criticism from those who argue that it reduces the value of a portfolio by more than the advisor's guidance adds.

WiserAdvisor

DECEMBER 2, 2022

However, what is equally critical when it comes to creating a portfolio is asset allocation and selection. Asset allocation aims to balance risk and reward through a portfolio composition of different kinds of assets. If not allocated efficiently, you may become subject to a slew of taxes and other charges.

Darrow Wealth Management

FEBRUARY 9, 2025

In another words, if your asset allocation is 60% stocks and 40% bonds, the current weighted average yield is 2.19%. Asset allocation Generally, dividend stocks tend to be older, more mature companies. However, it’s essential not to let dividends drive your entire asset allocation strategy.

The Chicago Financial Planner

JUNE 13, 2022

Ideally you’ve been rebalancing your portfolio along the way and your asset allocation is largely in line with your plan and your risk tolerance. Financial coaching focuses on providing education and mentoring on the financial transition to retirement. NEW SERVICE – Financial Coaching. FINANCIAL WRITING.

Darrow Wealth Management

MARCH 3, 2025

Because of these differences, stocks and bonds accomplish different things in an asset allocation. Why stocks and bonds belong in a diversified portfolio Investors have different needs, risk tolerances, time horizons, and financial situations which should be considered in an asset allocation.

The Chicago Financial Planner

FEBRUARY 5, 2022

Perhaps it’s time to rebalance and to rethink your ongoing asset allocation. Financial coaching focuses on providing education and mentoring on the financial transition to retirement. Take stock of where you are. What impact have the solid stock market gains of the past three years had on your portfolio? Costs matter.

Darrow Wealth Management

MARCH 13, 2025

If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. This includes the stock itself, its sector, industry, and other highly correlated assets. What is a concentrated stock position? A diversified portfolio is the cornerstone of a risk-adjusted investment strategy.

Zoe Financial

MARCH 21, 2025

Provide insights on asset allocation and risk management. Help allocate funds based on long-term financial goals. Planning for Family & Legacy From education planning to multigenerational wealth transfer, an advisor can: Help structure estate plans to reflect your legacy goals.

The Chicago Financial Planner

NOVEMBER 8, 2021

If so, this is a good time to revisit your asset allocation and perhaps reduce your overall risk. Financial coaching focuses on providing education and mentoring on the financial transition to retirement. Learn from the past . It is said that fear and greed are the two main drivers of the stock market. FINANCIAL WRITING.

Advisor Perspectives

APRIL 29, 2024

But advisors need education on the role alternatives can play in asset allocation and how creating portfolios that complement traditional assets drive business growth. Most platforms for alternative investments are just concerned with getting advisors access to those investments.

Carson Wealth

JANUARY 22, 2025

The process of diversifying among asset classes is known as asset allocation, and the exact composition should be based on your financial goals and risk profile. You can also further diversify within an asset class. Knowing this and setting long-term goals for your money retirement, education, etc.

MainStreet Financial Planning

MARCH 7, 2025

Hands-Off Investment Management If you prefer a professional to handle asset allocation, rebalancing, and investment selection, an AUM-based advisor can actively manage your portfolio. Are There Any Benefits to AUM-Based Advisors?

SEI

AUGUST 2, 2022

Higher education. Fueled by our joint study with AGB, our recent three roundtable events were well attended and yielded practical insights for financial professionals within higher education. Use of an OCIO was 40%, as this size segment of higher education has been moving more recently into this investment partner model.

The Richer Geek

OCTOBER 12, 2022

Jeff also leads a private inner circle mastermind that helps educate over 1000 investors on how to navigate the crypto markets. Jeff is a key component to the fund as it pertains to asset allocation. Jeff serves as the CIO for Boron Capital’s Digital Large Cap Cryptocurrency investment fund.

Trade Brains

DECEMBER 7, 2023

Personal Finance for Beginners by FinGrad FinGrad Academy is an educational platform that offers various courses on financial products for better investment opportunities. Personal Finance – Mutual Funds course by Zerodha Varsity Zerodha Varsity is an educational platform that offers all financial content in different modules.

Talon Wealth

OCTOBER 26, 2023

Educate yourself about finances. If you don’t know the basics of investing – like asset allocation, diversification, and compounding – then a quick web search can help. It should consider inflation, current savings, and investments’ expected compound annual growth rate.

Carson Wealth

MARCH 21, 2025

Theyre established to benefit charitable organizations, including educational or cultural institutions, community organizations, service organizations such as hospitals, and other nonprofits. Endowments can be funded by cash, stocks, bonds, or real property and are typically organized as trusts or private foundations.

International College of Financial Planning

JULY 30, 2022

For e.g. saving for a home, retirement, or Higher education. One can do CFP online course for the most comprehensive financial planning services, which often include asset management. The key to building wealth is diversification and asset allocation. It includes the importance of having a well-diversified portfolio.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. Understanding the Value of Financial Planning Education Financial markets are becoming increasingly intricate, requiring professionals to stay ahead through continuous learning and development.

Clever Girl Finance

AUGUST 22, 2022

If you don't mind a study period for a few years, you may also consider pursuing higher education if you can afford it. And a college education can give you more options for jobs. The investing world can be complex, so do your research about everything from bonds and mutual funds to asset allocation.

Validea

APRIL 17, 2023

Most investors pay close attention to their asset allocation. And that makes sense since research has shown that the asset classes a portfolio is allocated to drive the majority of its return over time. But asset allocation isn’t the whole story.

Truemind Capital

SEPTEMBER 30, 2024

But money is required after 5 years, so exposure to equity asset class was recommended to achieve optimum asset allocation mix. #2 3: Client(s) have goals like retirement & children’s education and the time horizon is more than 8-10 years. 2 : FDs were done at very low rates. E.g. 6-6.5%.

International College of Financial Planning

JULY 31, 2023

Investing is essential to achieving our financial goals, whether saving for retirement, funding our children’s education, or building wealth for the future. They are financial experts with extensive education and training in finance and investments. By diversifying investments advisors can help with asset allocation.

The Big Picture

JANUARY 21, 2025

He also worked as director of financial Education at, at Citigroup. And even before I went to Cambridge, I actually spent eight months working for a little suburban newspaper outside of Washington DC and in many ways it was the most fun and the most educational experience I had in journalism. He wrote over a thousand columns.

Harness Wealth

NOVEMBER 12, 2024

Consider 529 Plans A 529 Plan is a tax-advantaged investment account specifically designed to fund education costs. This can be a particularly useful method for estate planning and maximizing tax benefits, as the funds grow tax-free when used for qualified education expenses.

Discipline Funds

FEBRUARY 21, 2023

Traditional portfolio management applies allocation models that account for risk per unit of return, but fail to account for the problem of time within this process. This means the portfolio manager plugs in a certain risk profile and then spits out an “efficient” asset allocation such as a 60/40 stock/bond portfolio.

eMoney Advisor

MARCH 21, 2023

By using your expertise to communicate, educate, and provide perspective, you’ll likely magnify the loyalty of your clients. Prepare your clients by educating them about market dynamics and how the work you do for them will help position their investments for the long term.

eMoney Advisor

DECEMBER 27, 2022

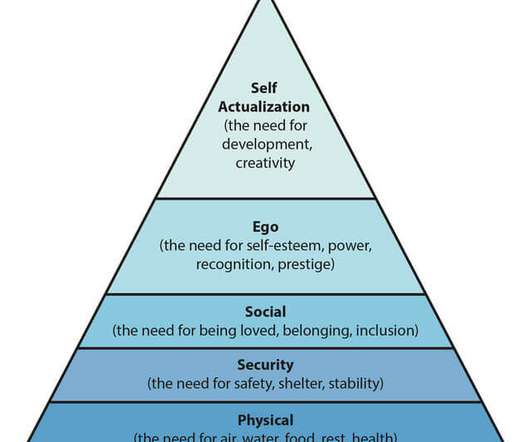

At this level, the focus shifts to growing assets for long-term success and longevity. Financial freedom advances to long-term care and children’s education, as well as retirement savings and vacations. Accumulating wealth refers to growing investments, paying down debt, and saving for retirement.

Nationwide Financial

MARCH 24, 2023

Key Takeaways: As the cost of college continues to rise, your clients might be faced with the often-daunting challenge of saving for their children’s future education expenses. Coverdell Education Savings Accounts and UGMA accounts are options for college savings accounts as well.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Clarifying these distinctions will help you prioritize and allocate resources accordingly.

The Irrelevant Investor

JANUARY 3, 2018

Stating the obvious, education matters, a lot. investors who allocate to emerging markets. Asset allocation- never the best, never the worst, usually good enough. Also pretty nuts to think that stocks have been up 12 of the last 14 years (13 of 14 including dividends). Prettay, prettay, prettay good.

SEI

AUGUST 2, 2022

That’s why, when facing market volatility, stewards of long-term assets held at all types of nonprofit institutions recognize the importance of a well-thought-out investment process. . Investment education is critical. Stress testing various market cycles. Navigating through downturns.

Zoe Financial

MAY 18, 2023

They can help you analyze your current investments, optimize your asset allocation, and make necessary adjustments to ensure your retirement nest egg grows steadily. It pays to have a good wealth planner in your corner. An advisor can answer questions like: When can I fully retire?

Brown Advisory

JULY 17, 2018

The cost of college is growing at an astronomical rate, and Section 529 plans have long helped individuals and families grow assets earmarked for education in a tax-efficient manner. As of this year, Federal law lets you distribute up to $10,000 each year from your 529 plan to fund primary (K-12) education tuition.

Brown Advisory

JULY 17, 2018

The cost of college is growing at an astronomical rate, and Section 529 plans have long helped individuals and families grow assets earmarked for education in a tax-efficient manner. As of this year, Federal law lets you distribute up to $10,000 each year from your 529 plan to fund primary (K-12) education tuition. 1 [link]. .

Workable Wealth

SEPTEMBER 16, 2020

Asset Allocation. Building on diversification, asset allocation is an investment strategy that builds your portfolio by weighing an adequate amount of risk for your goals. Asset allocation evaluates how your portfolio is created and the specific securities you are investing in. Dollar-Cost Averaging.

James Hendries

SEPTEMBER 27, 2022

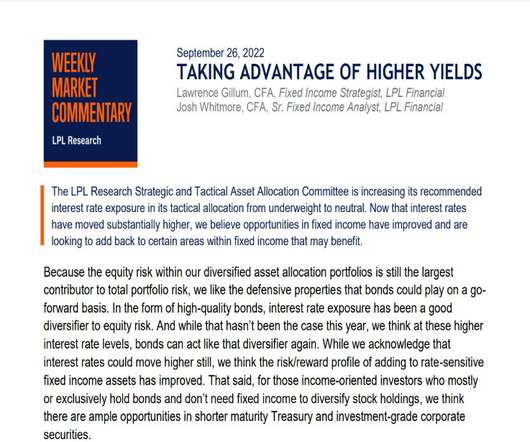

The LPL Research Strategic and Tactical Asset Allocation Committee is increasing its recommended interest rate exposure in its tactical allocation from underweight to neutral. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Clarifying these distinctions will help you prioritize and allocate resources accordingly.

Carson Wealth

DECEMBER 1, 2022

Talking with a qualified investment advisor can help you develop an asset allocation appropriate for meeting your financial goals. — 1 Social Security Administration, “Education and Lifetime Earnings,” [link]. Determine an Appropriate Risk Tolerance for a Longer Time Horizon .

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content