GMO Launches Nebo Wealth At T3

Wealth Management

JANUARY 22, 2024

The new platform is meant to help advisors achieve portfolio personalization at scale, and bridge an industry gap between financial planning and asset allocation.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 22, 2024

The new platform is meant to help advisors achieve portfolio personalization at scale, and bridge an industry gap between financial planning and asset allocation.

Abnormal Returns

FEBRUARY 26, 2025

tonyisola.com) Age is just one factor when it comes to your asset allocation. humbledollar.com) Personal finance Two questions to ask if you need to re-prioritize your financial plan. timmaurer.com) Financial influencers are not looking out for your best interests. meaningfulmoney.life) Why we keep striving.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

International College of Financial Planning

MARCH 12, 2025

Many influencers dont have professional financial expertise; theyre just good at marketing. What to Do Instead: Stick to fundamentals: Learn about asset allocation, risk management, and diversification before investing. Investing Without a Game Plan The Mistake: Gen Z loves DIY investing, thanks to easy-to-use apps.

The Big Picture

SEPTEMBER 28, 2022

What is in your control : Your Portfolio : You want to create something robust enough to withstand drawdowns and recessions; not necessarily the best possible set of assets but the ones you can live with day in and day out. This includes a broad Asset Allocation including full Diversification of asset classes, geographies, etc.

Abnormal Returns

APRIL 15, 2024

standarddeviationspod.com) Christine Benz and Amy Arnott talk asset allocation and more with Matt Krantz. morningstar.com) The biz Why Dynasty Financial stands since putting plans for an IPO on ice. citywire.com) Adjustments are a natural part of life planning.

Nerd's Eye View

OCTOBER 23, 2024

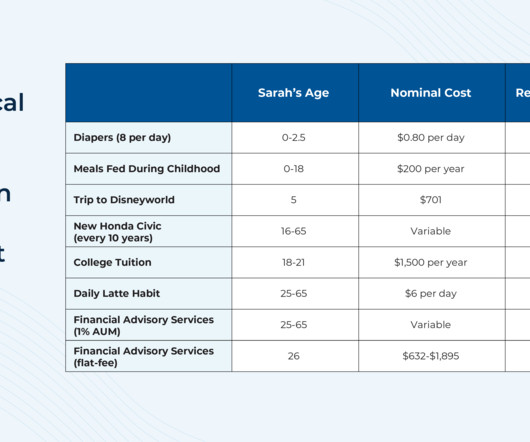

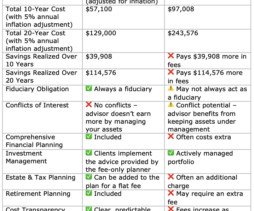

Though in practice, while a 1% AUM fee is a common 'starting point' in the industry, the actual fee structure can vary based on the firm's approach; for example, some firms may reduce the fee for high-net-worth clients, or charge an additional fee for separate and additional services (from deeper financial planning to add-ons like tax preparation).

Carson Wealth

APRIL 25, 2024

There are some things in life you just can’t plan for: an unexpected illness, job loss, death of spouse, disability. And while experiencing one of these major events can drastically impact your life, having an effective financial plan can help ensure that it doesn’t ruin your financial well-being.

The Chicago Financial Planner

FEBRUARY 3, 2022

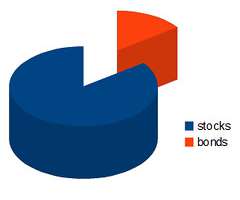

Investors who are well-diversified may be hurt but generally not to the extent of those who are highly allocated to stocks. Review your asset allocation . If you haven’t done so recently, perhaps it is time to review your asset allocation and make some adjustments. Go shopping . The Bottom Line .

MainStreet Financial Planning

AUGUST 16, 2022

There are many steps in building an investment portfolio, in this article, I’ll discuss how asset allocation and risk tolerance are important considerations when investing. In simple terms, asset allocation is the mix of all the different types of investments you have in your portfolio. Some examples include U.S.

The Chicago Financial Planner

JUNE 13, 2022

Assuming that you have a financial plan with an investment strategy in place there is really nothing to do at this point. Ideally you’ve been rebalancing your portfolio along the way and your asset allocation is largely in line with your plan and your risk tolerance. Do nothing. Focus on risk. Look for bargains.

MainStreet Financial Planning

MARCH 12, 2025

This ensures you wont need to sell investments when markets are down, protecting your long-term financial plan and providing peace of mind during turbulent times. Reevaluate Your Asset Allocation If watching your investment portfolio fluctuate causes anxiety, your current allocation might be too aggressive.

Nerd's Eye View

JANUARY 4, 2023

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. This strategy is valuable because it generally allows for higher initial withdrawal rates than more static approaches that don’t accommodate clients willing to adjust their spending in retirement.

MainStreet Financial Planning

MARCH 7, 2025

If youre searching for a fiduciary financial planner, flat-fee financial planning, or the best alternative to AUM-based advisors, this article will help you decide which model is right for you. Unlike AUM advisors, they dont have an incentive to keep assets under management, so their recommendations are truly objective.

Discipline Funds

MARCH 10, 2025

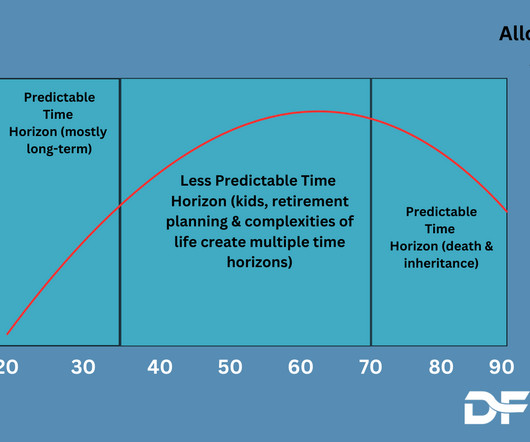

This is also what makes retirement planning so difficult – you effectively lose an asset in your portfolio when your income stops or declines. And this is why I’ve become such a big advocate of defining our durations within our financial plans.

AdvicePay

JULY 14, 2022

The adoption of the fee-for-service financial planning model is changing the dynamics of business operations inside wealth management firms. But without a well-defined service model to deliver financial planning services, advisors soon discover that unstructured, ad-hoc service offerings don’t scale very well.

Darrow Wealth Management

MARCH 3, 2025

Because of these differences, stocks and bonds accomplish different things in an asset allocation. Why stocks and bonds belong in a diversified portfolio Investors have different needs, risk tolerances, time horizons, and financial situations which should be considered in an asset allocation.

Discipline Funds

DECEMBER 20, 2023

The end of the year is an ideal time to start planning for the year ahead and make sure you’re on target to achieve those goals. Asset and Liability Matching. Good financial planning is all about asset and liability matching across time. Asset Allocation and Goals. Kill high interest rate debts.

eMoney Advisor

DECEMBER 27, 2022

As client expectations continue to evolve, there is an opportunity for financial planners to broaden and deepen their service offerings by providing holistic financial planning. Holistic financial planning goes beyond traditional financial planning to help clients achieve the best outcomes as defined by their individual needs.

Darrow Wealth Management

FEBRUARY 9, 2025

Allocation choices also shouldn’t be based on the notion that dipping into principal derails a financial plan. In another words, if your asset allocation is 60% stocks and 40% bonds, the current weighted average yield is 2.19%. Examples include real estate, financials, and utilities.

Abnormal Returns

NOVEMBER 21, 2022

(riabiz.com) CI Financial ($CIXX) is planning to spin-off its U.S. riabiz.com) Retirement Why retirees should include Social Security into their asset allocation. riabiz.com) What mid-life women need from a financial adviser. unit debt-free in 2023. thinkadvisor.com) How Notice 2022-53 has affected the tax code.

Discipline Funds

AUGUST 16, 2024

As you may or may not know – I have an obsession about time within financial planning processes. And one thing I’ve become convinced of is that this is the absolute most challenging period in someone’s financial life because that’s the period where your time horizon becomes most uncertain.

Tobias Financial

MARCH 16, 2025

Whether youre new to investing or have years of experience, taking a step back to evaluate your strategy can help ensure that your portfolio remains aligned with your objectives, especially in times of market uncertainty and volatility.

eMoney Advisor

MARCH 21, 2023

Historically, staying the course and following a financial plan has outperformed rash investment decisions when there are times of uncertainty in the financial market. But it takes a strong plan—and no small amount of willpower—to do this. You can also look at cash management and debt reduction solutions.

Gen Y Planning

MARCH 10, 2025

As we move through the first quarter of 2025, weve had several clients, colleagues, and friends reach out with questions about recent market movements and the impact of tariff discussions on their personal financial plan. Diversifying portfolios across asset classes, sectors, and geographies to reduce concentrated risks.

Advisor Perspectives

DECEMBER 26, 2023

Featuring an open architecture model marketplace and an integrated proposal-generation tool targeting clients and prospects, Rendezvous empowers advisors with the technological resources to streamline goals-based financial planning and proposal generation, offer investment solutions and asset allocation tools that achieve clients’ goals and reclaim (..)

The Chicago Financial Planner

FEBRUARY 5, 2022

Rather I suggest an investment strategy that incorporates some basic blocking and tackling: A financial plan should be the basis of your strategy. Perhaps it’s time to rebalance and to rethink your ongoing asset allocation. Take stock of where you are. Take stock of where you are. Costs matter.

The Chicago Financial Planner

NOVEMBER 8, 2021

Financial Planning is vital. If you don’t have a financial plan in place, or if the last one you’ve done is old and outdated, this is a great time to review your situation and to get an up-to-date plan in place. Do it yourself if you’re comfortable or hire a fee-only financial advisor to help you.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

Discipline Funds

NOVEMBER 11, 2024

This included: 2:44 Defined Duration Investing – my new asset allocation process by which I focus on quantifying the time horizons over which to use certain instruments and help match them to a financial plan. In this episode they discuss the 8 big lessons they’ve learned from me over the years.

Tobias Financial

APRIL 11, 2024

We are thrilled to announce that our Wealth Advisors, Edzai Chimedza, CFP® and Franklin Gay , CFP®, EA will be leading two Financial Planning Seminars at Nova Southeastern University. Contact us today, and let’s discuss how we can assist with your specific financial situation. appeared first on www.tobiasfinancial.com.

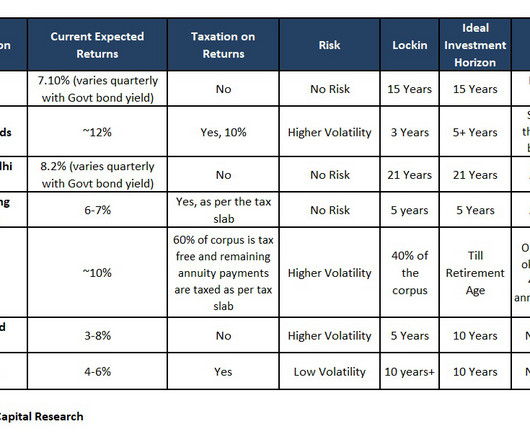

Truemind Capital

FEBRUARY 23, 2024

A few days ago, I had a very unusual request from the HR of a multi-billion dollar company with whom I was in discussion regarding sessions on financial well-being for their employees. Since we have expertise in long-term investment strategies and financial planning, I told her that we could not help her with this requirement.

Zoe Financial

MARCH 21, 2025

When to Work with a Financial Advisor Many high earners and affluent individuals seek financial guidance at pivotal moments, such as: 1. Preparing for Retirement Transitioning from a career to retirement requires careful financial planning. A financial advisor can: Help you maintain a disciplined investment strategy.

The Irrelevant Investor

MAY 23, 2019

I have never had a financial plan built for me, which is somewhat embarrassing, even hypocritical. I guess the way I rationalized not having a plan was that I wanted to wait until I settled into my house, literally and figuratively. Each of these decisions are critical and at least as important as your asset allocation.

Nationwide Financial

JANUARY 25, 2023

Here are some key points to use with clients as you help them assess their retirement plans. Review risk tolerance and current asset allocation strategy It’s important to ensure your clients’ portfolios align with their risk tolerance because taking too much risk can negatively impact their ability to navigate market fluctuations.

Discipline Funds

AUGUST 2, 2024

As you might know, I am a big fan of asset/liability matching strategies and what I call Defined Duration investing. Asset allocation is really just a temporal problem and if you don’t have temporal clarity in your portfolio then you’ll find out that you have behavioral ambiguity in your portfolio.

Discipline Funds

OCTOBER 18, 2024

The simple answer is that the short-term movements of the stock market should be irrelevant to your financial plan assuming you have a well constructed temporally diversified portfolio. Insurance is largely optional and plan dependent, but I think of the other 4 time horizons as essential. 2) Stock market gambling.

MainStreet Financial Planning

DECEMBER 20, 2023

Over the course of the year the market moves up and down and that can throw off your portfolio allocation and the end of the year is a great time to do a rebalance where you evaluate whether you need to make any changes to get your portfolio aligned with the target asset allocation.

Random Roger's Retirement Planning

MAY 10, 2024

An investor needing something close to equity market returns for their financial plan to work needs something of a "normal" allocation to equities. Not that 20% is universally wrong, not everyone needs close to equity market returns for their financial plan to work. Maybe that's 50% or maybe 60% but it's not 20%.

Carson Wealth

MARCH 7, 2024

Develop Your Personal Asset Allocation Now that have your 401(k) and IRA open and funded, how can you determine the correct asset allocation for each? This model may be more beneficial for somebody making more money and consequently in a higher tax bracket. Again, I wish I had that crystal ball!

Discipline Funds

FEBRUARY 21, 2023

This innovative approach to asset allocation helps improve the probability of meeting your financial goals by helping you better understand your liabilities and the way specific assets align with those liabilities. We then apply the proper assets based on liability needs, not based on asset performance wants.

Truemind Capital

JULY 8, 2024

Originally posted on LinkedIn : www.linkedin.com/shivanichopra Email us at connect@truemindcapital.com or call us at 9999505324. Truemind Capital is a SEBI Registered Investment Management & Personal Finance Advisory platform.

International College of Financial Planning

JULY 30, 2022

Earning the CFP designation requires a rigorous course of study covering investment planning, income taxation, retirement planning and risk management. The Certified Financial Planner course is the perfect course to achieve all topics related to finance. By paying for CFP services, you strengthen your overall financial plan.

Discipline Funds

JULY 19, 2023

That’s great if you have a longer time horizon but it becomes a big financial planning problem if you need liquidity in a year like 2022 and the entire set of assets is deeply negative. The problem of time within an asset allocation is arguably the most important aspect of any sustainable financial plan.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content