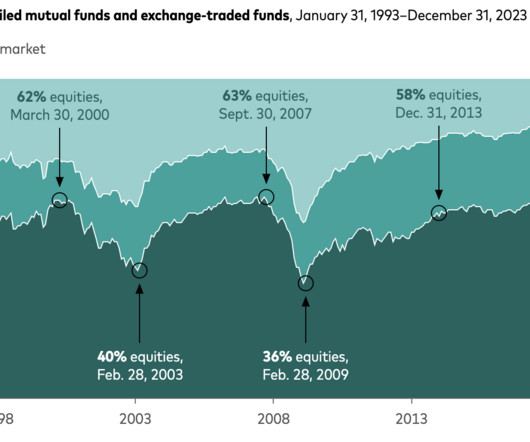

The Bond Bear Market & Asset Allocation

A Wealth of Common Sense

SEPTEMBER 5, 2023

I’m generally not a fan of completely rethinking your asset allocation just because you wish you would have invested in something else with the benefit of hindsight. Fighting the last war can be a damaging strategy if you’re constantly investing in the rearview mirror based strictly on performance.

Let's personalize your content