What Is In Your Control?

The Big Picture

SEPTEMBER 28, 2022

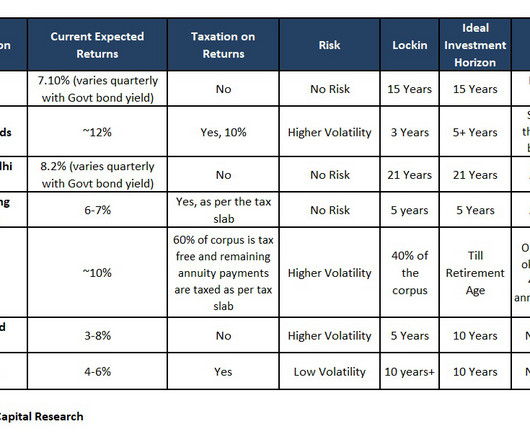

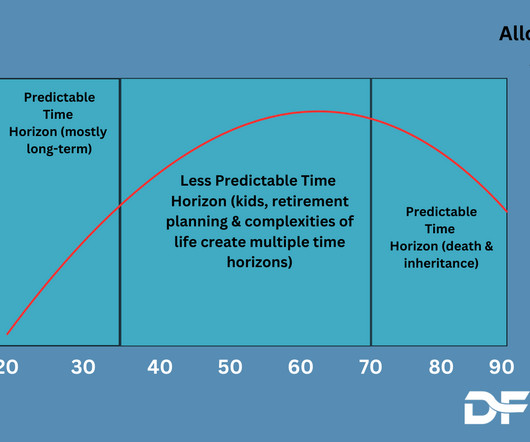

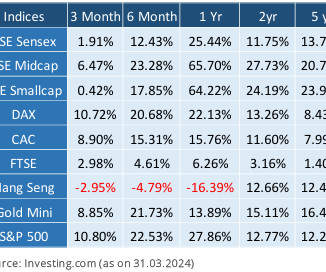

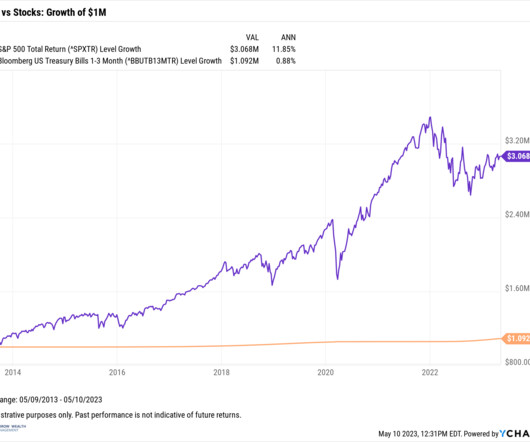

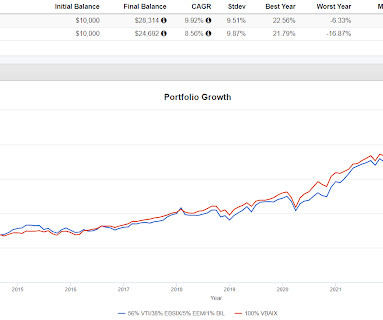

Consider this tweet I bookmarked back in August; This updated version , via Mindfulenough , gave me the idea to turn it into something investment-related. This includes a broad Asset Allocation including full Diversification of asset classes, geographies, etc. Asset Allocation. Federal Reserve. Volatility.

Let's personalize your content