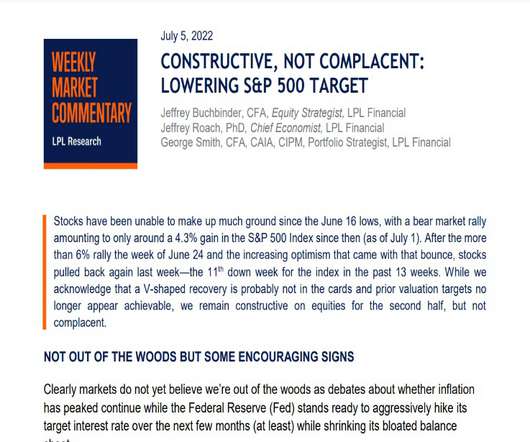

Resilient Consumers Have Not Saved Retail Stocks | Weekly Market Commentary | December 5, 2022

James Hendries

DECEMBER 4, 2022

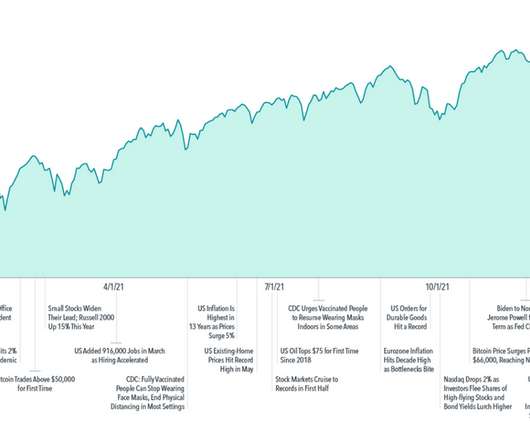

Economic and corporate data support the initial strong reads on holiday retail sales despite the macro headwinds, reinforcing the idea that today’s consumer is in a better position than usual at this point in the business cycle. Retail Sales Data Supports Initial Holiday Shopping Trends. over the last 20 years, pre-2020.

Let's personalize your content