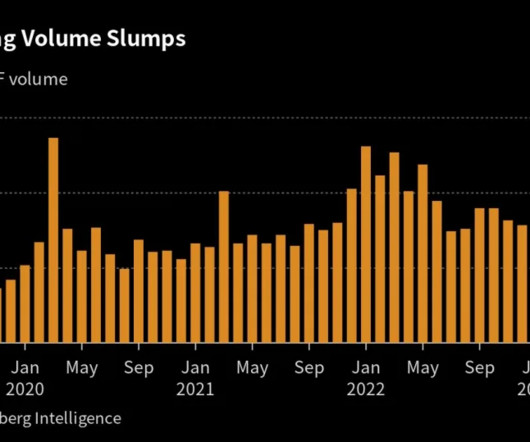

U.S. Bank Failures, 2001 – Present

The Big Picture

MARCH 22, 2023

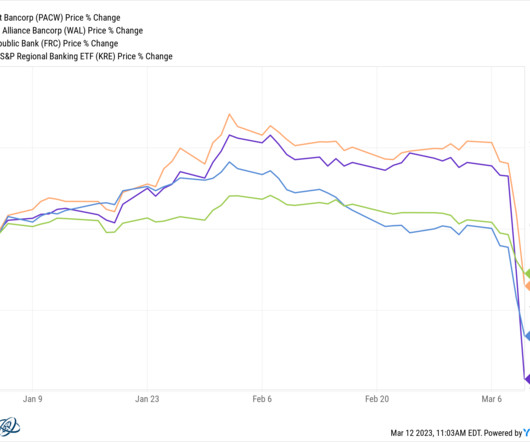

Bank failures since 2001, scaled by amount of assets in 2023 dollars. The graphic above, via Flowing Data , puts recent events into perspective: At $209 billion in assets, the Silicon Valley Bank failure since Washington Mutual crashed in 2008 (JPM Chase took them over from the FDIC). The post U.S.

Let's personalize your content