Weekend Reading For Financial Planners (January 25–26)

Nerd's Eye View

JANUARY 24, 2025

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Big Picture

MARCH 24, 2025

The text accompanying that chart reads: “ Consumption: in 2024, one third of GDP came from government spending, a record high excluding periods of war or crisis; this was financed by 6-7% budget deficits, another unwelcome peacetime record.” Total expenditures exclude consumption of fixed capital (CFC), which is a noncash charge.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Clever Girl Finance

DECEMBER 23, 2024

Create a realistic budget 2. Without a steady paycheck or employer benefits, youre responsible for your own budgeting, savings, and future planning. Create a realistic budget Budgeting isnt just for nine-to-fiversits the lifeline of freelancers. Table of contents Why financial planning for freelancers is crucial 1.

Abnormal Returns

JANUARY 15, 2025

(financialducksinarow.com) Home ownership Alina Fisch, "A home is a bittersweet tangle of realities: your private sanctuary, a way to belong to a community, a place to make memories and express your personality, a financial asset you can leave to your heirs.but also a potential albatross of costs, hassle, and risk."

Abnormal Returns

JULY 9, 2024

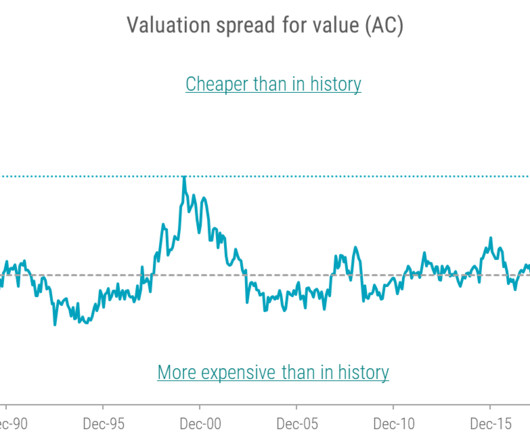

Asset pricing The CAPM doesn't work. kitces.com) How budget deficits affect Treasury yields. Maybe this measure does. klementoninvesting.substack.com) Brown stocks outperform green stocks. alphaarchitect.com) Hedge funds Replicating multi-strategy hedge fund returns is kind of a waste. alphaarchitect.com)

Clever Girl Finance

DECEMBER 16, 2023

If you don’t feel like you truly have a strong handle on your finances, one possible cause for that is using a budgeting method that doesn’t work. While not everyone needs a to-the-penny balanced budget, some type of budgeting strategy or template is really important if you want to know where your money is going month after month.

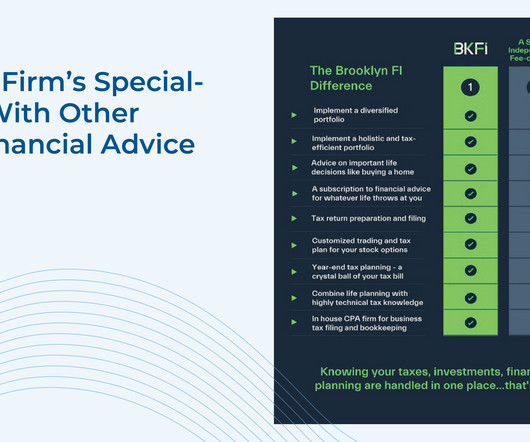

Nerd's Eye View

FEBRUARY 23, 2024

Which suggests that instead of trying to go head-to-head with these larger firms (and their heftier marketing budgets) in attracting clients, smaller firms might instead demonstrate how they are 'different' by offering a unique service offering tailored to their ideal target clients.

eMoney Advisor

DECEMBER 13, 2022

Generally, a mass affluent client has investable assets between $100,000 and $1 million. These individuals are often underserved by traditional investment firms because they lack the assets to meet minimum requirements. Start with the goal and work backward to create a budget. Mass Affluent Clients and the Advice They Crave.

Abnormal Returns

AUGUST 3, 2022

obliviousinvestor.com) Why you don't likely need a budget in retirement. gofrombroke.com) Time is your most valuable asset. (getrichslowly.org) An excerpt from "Taking Stock: A Hospice Doctor's Advice on Financial Independence, Building Wealth, and Living a Regret-Free Life" by Jordan Grumet. awealthofcommonsense.com).

Nerd's Eye View

JULY 5, 2024

Also in industry news this week: A separate Supreme Court decision struck down the SEC's use of in-house judges to adjudicate cases involving civil penalties (unless both parties in the matter agree to it), likely setting up more settlement offers from the regulator to avoid a drawn-out legal process in the Federal court system At a time when it has (..)

Truemind Capital

AUGUST 2, 2024

Here is what we are doing to efficiently manage investments after accounting for the budget changes. Gold is an important asset class in a globally uncertain environment and should have a 10-15% portfolio allocation. CONNECT WITH TRUEMIND ADVISOR The post Budget impact on Investments appeared first on Investment Blog.

Nerd's Eye View

OCTOBER 16, 2023

Consumers have a wide range of options when it comes to choosing a provider of financial advice, from larger wirehouses and asset managers to smaller Registered Investment Advisers (RIAs).

MainStreet Financial Planning

MARCH 12, 2025

Reevaluate Your Asset Allocation If watching your investment portfolio fluctuate causes anxiety, your current allocation might be too aggressive. Reassess Your Budget Take a close look at your spending. Consider shifting towards a more conservative approach. Are there areas where you can scale back or eliminate expenses?

The Big Picture

SEPTEMBER 19, 2023

The transcript from this week’s, MiB: Elizabeth Burton, Goldman Sachs Asset Management , is below. Elizabeth Burton is Goldman Sachs asset management’s client investment strategist. We actually have a budget for risk management and technology and tools. It depends on your asset allocation. Thank you for having me.

The Big Picture

JANUARY 15, 2025

At the Money: Lessons in Allocating to Alternative Asset Classes. Investors have lots of questions when allocating to these asset classes: How much capital do you need? How should investors approach these asset classes? What sort of return expectations should investors have for these different asset classes?

Nerd's Eye View

OCTOBER 4, 2023

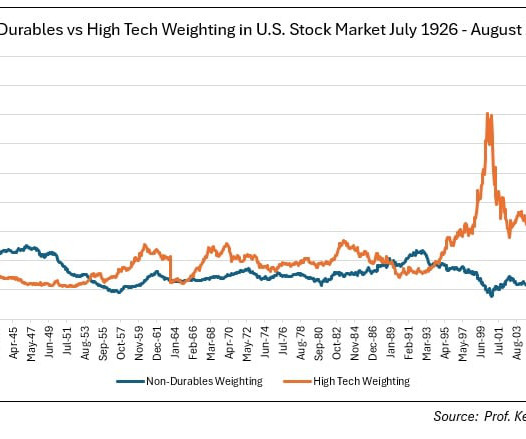

And even though U.S. There's also the question of whether long-term equity returns could be significantly lower than we've experienced during the post-WWII era without the boost of lower interest and tax rates.

Clever Girl Finance

DECEMBER 15, 2022

Set a budget for self-care expenses. If it’s important to you, budget for it. This way you’re not buying on impulse or spending more than you allocated on your budget. Work and budgeting hacks for women. Your health is your biggest asset. Yes, put the bi-weekly nails or lashes down. Take advantage of 401k matching.

Nerd's Eye View

SEPTEMBER 25, 2024

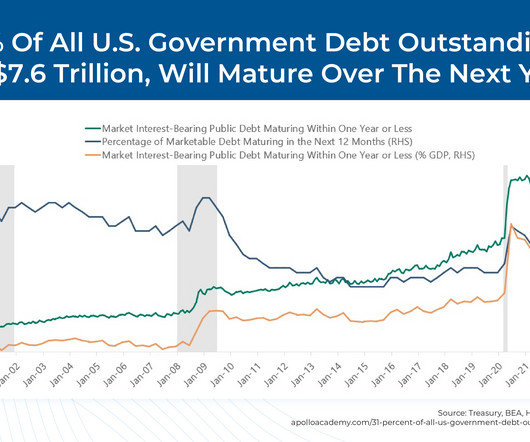

tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon. However, with the national debt expanding rapidly, observers of U.S.

Alpha Architect

JULY 19, 2024

The amortization of volatility should be of concern for private capital asset classes. In order to properly budget for beta risks, it is critical that investors in private assets understand the amount of systemic (beta) risk that will “wash” into their private portfolios.

Nerd's Eye View

DECEMBER 6, 2023

Notably, while many financial coaches satisfy the majority of these requirements – they are in the business of offering advice to clients and are compensated as such – they often steer clear of making specific securities recommendations, focusing instead on areas like budgeting, debt management, savings, and retirement planning.

Nerd's Eye View

DECEMBER 5, 2023

billion in assets under management for just over 350 client households. billion of AUM (and is now increasing the firm's marketing budget and hiring a dedicated marketing professional to help further expand his firm's reach). Welcome back to the 362nd episode of the Financial Advisor Success Podcast !

Truemind Capital

JULY 26, 2024

When so much money is printed without any underlying asset to back it, it starts losing its value, especially when the interest rates are close to zero. Therefore, to hedge against such global uncertainties, investment in a universally accepted asset class i.e. Gold becomes a good hedge. appeared first on Investment Blog.

Good Financial Cents

JANUARY 16, 2023

Access to wide array of alternative asset classes Access to ultra-wealthy investments Can invest for income or growth Learn More Now. Because the platform holds various assets – real estate , cryptocurrencies , artwork , and more – the average user holds about seven investments. Unique Asset Classes. Yieldstreet IRA.

Abnormal Returns

SEPTEMBER 3, 2024

Markets How major asset classes performed in August 2024. frontofficesports.com) Global Ireland is running a budget surplus. entrylevel.topdowncharts.com) REITs have stopped going down. entrylevel.topdowncharts.com) Strategy Analysts focus on these market numbers, you don't have to. axios.com) Year 2 for ESPN Bet is here. than Europe.

Nerd's Eye View

AUGUST 22, 2023

Cary is the Senior Vice President & Director of Women and Wealth Services for Advisor Capital Management, an independent RIA with offices around the country and headquartered in Charlotte, North Carolina, that oversees more than $6 billion in assets under management for 1,700 client families.

Clever Girl Finance

JANUARY 29, 2023

What's included with net worth Net worth includes your assets and your liabilities. Subtract your liabilities from your assets to get your net worth. Your assets include everything from the cash in your bank accounts to the value of your stock portfolios and the market value of anything tangible that you own such as a house or a car.

MainStreet Financial Planning

AUGUST 16, 2022

There are many steps in building an investment portfolio, in this article, I’ll discuss how asset allocation and risk tolerance are important considerations when investing. In simple terms, asset allocation is the mix of all the different types of investments you have in your portfolio. Some examples include U.S.

Clever Girl Finance

DECEMBER 23, 2024

Create a realistic budget 2. Without a steady paycheck or employer benefits, youre responsible for your own budgeting, savings, and future planning. Create a realistic budget Budgeting isnt just for nine-to-fiversits the lifeline of freelancers. Table of contents Why financial planning for freelancers is crucial 1.

Random Roger's Retirement Planning

OCTOBER 30, 2022

We might spend $100/mo on supplements but that is in our grocery budget. As was the case for 2022 we're saving about $1000/mo because we can get away with catastrophic coverage and by Blue Cross' estimate, another $500/mo on other medical expenses. Vitamin D and zinc are cheap, turmeric and magnesium glycinate are expensive.

MainStreet Financial Planning

MARCH 7, 2025

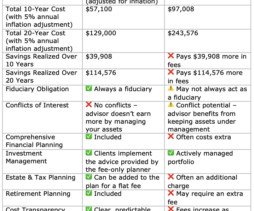

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). Unlike AUM advisors, they dont have an incentive to keep assets under management, so their recommendations are truly objective.

Trade Brains

FEBRUARY 7, 2024

HUDCO With the launch of the interim budget for 2024, the Indian government declared a visionary plan to construct 2 crore houses over the next five years. GNPA (Gross Non-Performing Assets): GNPA represents the total amount of loans that borrowers haven’t repaid on schedule. Net NPA ratio has remained below 0.6%

Carson Wealth

DECEMBER 10, 2024

Establish a Budget and Schedule for Giving One of your first tasks is to determine how much you are comfortable giving. Youll want to consider your income, net worth, types and liquidity of assets, your future needs and familys needs, and any other plans you want to fund like a business venture or advanced degree.

Clever Girl Finance

FEBRUARY 6, 2023

Then, create or refer to your spending journal or a budgeting tool to see how much you’re spending every month. You might be cutting out some of your “fun” budgets for this one. Put simply, liquid assets refer to (A) cash or (B) other financial assets you can quickly convert into cash. Is it an asset or a liability ?

Clever Girl Finance

MARCH 19, 2024

Is a financial plan the same as a budget? Make a budget Budgeting is a key part of how to create a financial plan that works. A budget must work for you, which means finding a method that suits your circumstances. A budget must work for you, which means finding a method that suits your circumstances.

Fortune Financial

OCTOBER 14, 2024

It has been my experience when reviewing portfolios that diversification is typically expressed simply as a number of various stocks owned, or owning a handful of asset classes, usually stocks of various sizes and geographies, and bonds of varying maturities.

Carson Wealth

DECEMBER 8, 2022

Create a Budget. A budget is an excellent way to help you stay on track in real time with your expenses. Two budgeting apps I like: Mint , which is free and great for tracking and categorizing expenses; and YNAB (You Need a Budget), which costs $100 a year but is ad-free. And where will you deposit the savings?

Clever Girl Finance

DECEMBER 7, 2022

Net worth is the value of all of your assets minus the liabilities that you owe. So by knowing your starting point and how much or how little you have, you can figure out how much money and assets you will need to acquire to achieve your goal. You can even save money on a tight budget. Get on a budget. Get on a budget.

Integrity Financial Planning

JUNE 27, 2023

This process should include setting realistic and achievable objectives, creating a budget, and establishing an emergency fund. [2] This can include investing in stocks, bonds, real estate, and other assets. [3] 3] However, it’s not about picking the right assets and hoping to get rich quickly.

MainStreet Financial Planning

DECEMBER 20, 2023

Review your budget – Are there any new expenses that you need to add or anything that can be taken out such as any unused subscriptions? One area that often gets overlooked in the midst of planning is reviewing your financial habits and goals, so I’ve put together a short list of 3 areas to review before January.

Clever Girl Finance

AUGUST 19, 2024

Adjust your budget to include baby expenses 2. Adjust your budget to include baby expenses As soon as you know you have a baby is on the way, it’s a good idea to take a close look at your current budget. Create a “ baby budget ” to handle the unexpected costs that might pop up. Start saving for immediate baby costs 3.

Walkner Condon Financial Advisors

APRIL 26, 2024

This post does not cover budgeting; it is assumed that the couple is comfortable with their day-to-day spending and is intended to encourage a broader discussion on financial strategy and goals. Do you have savings accounts, retirement accounts, individual brokerage accounts, or any other assets that your partner should be aware of?

WiserAdvisor

SEPTEMBER 1, 2022

If your financial affairs are complex in nature that require a higher frequency of supervision such as overseeing an estate, sale of a real estate property, having multiple investments across different asset classes and sectors, etc., You need help creating a budget. Budgeting is one of the most important aspects of financial planning.

Clever Girl Finance

DECEMBER 1, 2022

A monthly budget to help you keep your expenses below your income. A debt pay-off and spending plan (using your budget). Discuss your budget and money goals and make financial decisions together. It allows you to determine exactly what happens to your assets after you are gone. A fully-funded emergency account.

Clever Girl Finance

FEBRUARY 2, 2023

It’s about amassing assets and making your money work for you. What they do have, is a lot of assets , such as real estate, investments, cash, and financial stability. Instead, a wealthy person saves as much money as possible and invests it in assets. Long-term goals and assets. Growing wealth is a long-term commitment.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content