Charitable Planning with Retirement Assets

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Nerd's Eye View

JANUARY 22, 2024

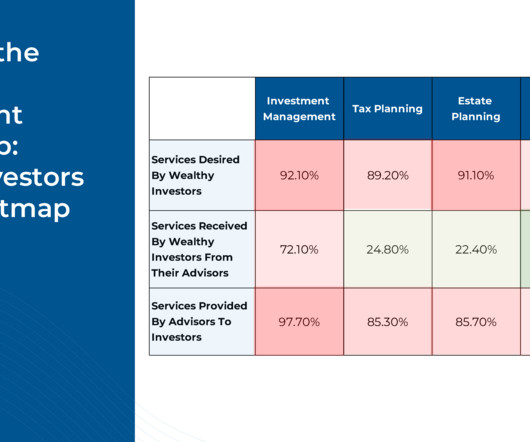

For example, an advisor may think of "risk management" in terms of life and property insurance coverage, whereas HNW clients may instead think of tax and estate-planning strategies as asset protection measures – particularly for the future wealth of their heirs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

MainStreet Financial Planning

DECEMBER 19, 2022

But what if you could do good for the charity and your taxes at the same time? Charitable donations can lock in tax deductions that will save you money. Having a simple plan and willingness to use alternatives to cash donations can help you lower your tax liability. Donate appreciated assets instead of cash.

Ballast Advisors

SEPTEMBER 5, 2024

Financial and Tax Benefits of Charitable Giving From a financial perspective, charitable giving offers significant tax benefits. Donations to qualified organizations are tax-deductible, reducing your taxable income and potentially lowering your tax bill. Broadridge Investor Communication Solutions, Inc.

eMoney Advisor

JANUARY 31, 2023

We also follow a cadence that helps us plan our schedule. We start the year with a session focused on budgeting and typically end the year with a webinar related to tax and charitable planning. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice.

James Hendries

NOVEMBER 26, 2022

So, here is a list of things for you to think about as you consider your year-end charitable donations. Make a Plan. Ideally, at the beginning of every year – with your financial professional – you would map out a plan to maximize the tax benefits of your giving. to support. Is it an organization that supports literacy?

Brown Advisory

APRIL 1, 2020

We believe that the current environment offers a number of strategic planning opportunities to improve your financial plan, enhance wealth transfers to heirs or charities, minimize the impact of income taxes and broadly help you advance your progress toward long-term goals. tax code that are not permanent.

Let's personalize your content