Sunday links: a satellite asset

Abnormal Returns

FEBRUARY 11, 2024

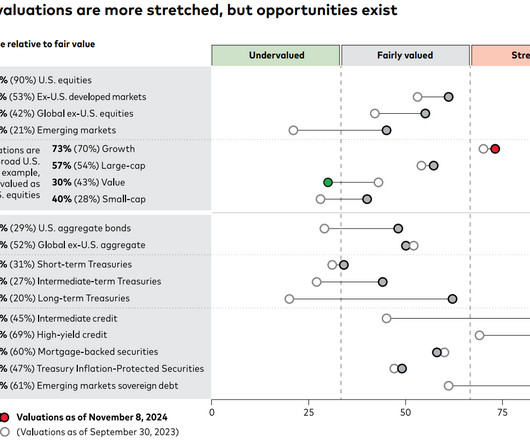

wsj.com) Companies Just how important AI is for valuations today. npr.org) Using Russian sovereign assets to rebuild Ukraine would be unprecedented. tker.co) The economic schedule for the coming week. (axios.com) A look at Gary Sernovitz's new novel "Counting House." barrons.com) Boeing's ($BA) downfall is a wakeup call.

Let's personalize your content