Prime Capital Investment Advisors Buys Cornerstone Comprehensive Wealth Management

Wealth Management

MARCH 9, 2023

With $400 million in assets, Cornerstone is the 15th acquisition in PCIA history and builds on roughly 500% growth in just five years.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 9, 2023

With $400 million in assets, Cornerstone is the 15th acquisition in PCIA history and builds on roughly 500% growth in just five years.

Wealth Management

MAY 17, 2023

After growing nearly 800% in five years, PCIA plans to move about $1 billion in client assets to Goldman Sachs to improve custodial services and access.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

JULY 30, 2024

The milestone validates Captrust’s business model and growth of the registered investment advisor space.

Wealth Management

JULY 12, 2023

Executives say the funding will fuel the next stage of growth for PCIA, which has already expanded assets by some 700% since early 2018.

Wealth Management

MARCH 29, 2023

The Department of Justice also charged Surage Roshan Perera of wire fraud, investment advisor fraud and money laundering, for allegedly defrauding an unnamed investor.

Wealth Management

JULY 31, 2024

based registered investment advisor with over $1.35 billion in client assets and 25 employees. Rodgers & Associates Wealth Advisers, a Lancaster, Pa.-based

Wealth Management

MARCH 7, 2024

Cornerstone Advisors, a Baxter, Minn.-based based team with about $360 million in client assets, joins from Cetera Investment Advisors.

Wealth Management

AUGUST 2, 2022

Heber Fuger Wendin Investment Advisors, with $8.6 billion in assets, brings to Mariner its client roster of community banks and credit unions.

The Big Picture

AUGUST 26, 2022

Our previous discussions (debates really) were over the traditional model of brokerage I push back against versus the fee-based fiduciary asset management I embrace. This made me chuckle, as we had discussed this level of unsuitable and inappropriate asset management for years, with me offering an endless parade of examples.

Nerd's Eye View

SEPTEMBER 20, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) released the latest edition its annual survey outlining the state of state-registered RIAs, showing that the number of state-registered firms and their assets (..)

Tobias Financial

MARCH 16, 2025

As you work toward your financial goals, regularly reviewing your investment portfolio is essential. Whether youre new to investing or have years of experience, taking a step back to evaluate your strategy can help ensure that your portfolio remains aligned with your objectives, especially in times of market uncertainty and volatility.

Abnormal Returns

JANUARY 26, 2023

etf.com) Investment grade bonds are having a good start to the year. bloomberg.com) NEA is becoming a registered investment advisor. investmentnews.com) Why ETFs continue to gobble up new asset classes. Markets A look at Vanguard's 10-year equity return forecasts. axios.com) Why luxury watch prices are coming down.

Brown Advisory

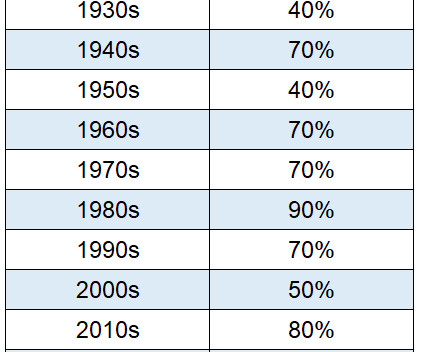

SEPTEMBER 6, 2022

Asset Allocation: Developing a Long-Term Investment Strategy for Mission-Driven Organizations. When putting a plan in place, we believe it is critical for any mission-driven organization to develop an effective, long-term asset allocation strategy to manage its endowment assets. Tue, 09/06/2022 - 10:30. 70–90% vs. 80%).

Darrow Wealth Management

NOVEMBER 4, 2024

For non-fiduciary financial advisors, recommendations may only need to be suitable , not necessarily in the client’s best interest. Hybrid firms can switch between their status as a registered investment advisor and brokerage, which can be problematic for individuals seeking unbiased financial advice.

Trade Brains

OCTOBER 31, 2024

per equity share Also read… Pharma stock down by more than 3% after promoter sells stake worth ₹3000 Cr SPS Finquest Limited SPS Finquest Limited was incorporated in 1996 and is a non-deposit-taking, non-systemically important NBFC, primarily offering loans and investment services. Investing in equities poses a risk of financial losses.

The Big Picture

APRIL 6, 2023

Here is why: These posts seem to be a bizarre combination of public records scraping and AI; they look like they were designed to generate clicks rather than reflect honest investment recommendations. RWM runs over $3 billion in client assets. But as the Chief Investment Officer of RWM, I can assure you that it is utter nonsense.

Nerd's Eye View

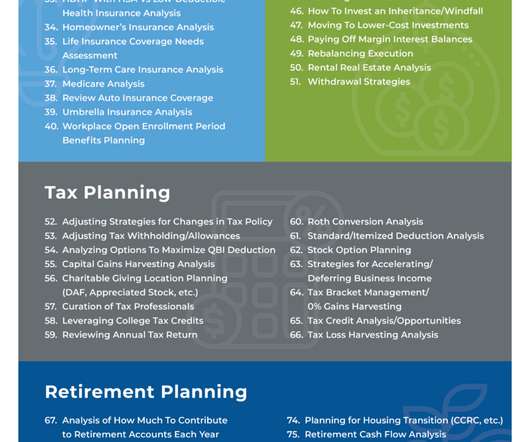

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

Nerd's Eye View

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

Advisor Perspectives

OCTOBER 6, 2024

For registered investment advisors and others who provide financial advice, autumn is the start of a season loaded with opportunity.

The Big Picture

JANUARY 19, 2024

Dutta discusses why Climate Investing is a for-profit opportunity, and not as it is so often portrayed as “Woke Investing.” ” The 2023 COP results suggest that climate investing will be an enormous global opportunity. The digital investment advisor manages over $40 billion in assets for 800,000 clients.

The Big Picture

AUGUST 9, 2024

Named one of the 25 most influential people by Investment Advisor, his breakthrough book, “ What Investors Really Want , ” changed how we view investor motivations. All of our earlier podcasts on your favorite pod hosts can be found here.

International College of Financial Planning

JULY 31, 2023

Investing is essential to achieving our financial goals, whether saving for retirement, funding our children’s education, or building wealth for the future. However, eliminating the complex world of investments can be challenging, and many individuals fall prey to common investment mistakes that can hinder their financial success.

Darrow Wealth Management

FEBRUARY 13, 2025

Although some firms use these compensation methods, the majority base fees on a percentage of assets under management (AUM) for their services. Fee-only firms are unique as they do not receive commissions from selling financial products, such as insurance policies or investment products. Independent firm.

A Wealth of Common Sense

SEPTEMBER 1, 2023

Rob Isbitts at ETF.com says Jerome Powell’s speech at Jackson Hole is bad news for 60/40 investors: For nearly two decades, investment advisors and self-directed investors came to understand and appreciate “asset allocation” as a complementary combination of stocks and bonds.

International College of Financial Planning

JUNE 14, 2023

Are you passionate about investments? If so, you can turn your passion into a profession by becoming a SEBI-registered investment advisor. SEBI has introduced guidelines for individuals aspiring to become investment advisors in India. Investment advice can be delivered online or offline channels.

Brown Advisory

SEPTEMBER 6, 2022

Investing for Purpose: A Governance Perspective on Mission-Aligned Investment Strategy. Increasingly, investment committee members are exploring mission-aligned investing for the organizations they serve. DEFINING MISSION-ALIGNED INVESTING. Tue, 09/06/2022 - 10:17.

Mullooly Asset Management

OCTOBER 20, 2022

In this week’s video, Tom references a survey done by AARP that shows 45% of people would rather go to the dentist than meet with an investment advisor. People deserve complete transparency when working with an investment advisor.

Random Roger's Retirement Planning

JULY 19, 2022

Do a search for asymmetric investing and you'll find a mishmash of results including research exploring option strategies, dampening portfolio volatility, an ETF that unlike SPD that we looked at yesterday does appear to capture upside while muting the downside. We should probably mention alternatives assets as a source of asymmetric returns.

Trade Brains

NOVEMBER 3, 2024

The Indian non-banking financial sector demonstrates remarkable resilience through strong net interest margins and effective asset quality management. Moreover, Bajaj Finance maintains exceptional asset quality with GNPA and NNPA at 1.06% and 0.46% respectively. Investing in equities poses a risk of financial losses.

International College of Financial Planning

NOVEMBER 10, 2021

There is great demand for Investment Advisor professionals in India and here we look at the various Investment Advisor Courses and Training Programs that you can take. The demand for Investment Advisors has been constantly rising over the last two decades.

Midstream Marketing

NOVEMBER 26, 2024

Introduction In the busy world of financial services, asset managers and Registered Investment Advisors (RIAs) require solid marketing strategies to succeed. They need to recognize the special needs and challenges investment advisors face. With targeted marketing efforts, investment advisors can stand out.

The Big Picture

MAY 11, 2023

SAVE THE DATE: Future Proof 2023, September 10-13 Future Proof will feature over 100 industry-leading speakers, innovators, and disruptors building the future of wealth management, including: Morgan Housel , Partner, The Collaborative Fund Adam Nash , Co-Founder & CEO, Daffy David Goodman , Producer & Writer, Family Guy, Futurama, The Orville (..)

Advisor Perspectives

MAY 23, 2024

The promise of independence is luring more and more advisors to the Registered Investment Advisor (RIA) channel. RIA headcount has grown rapidly over the past decade and by 2027, Cerulli estimates that RIAs will control nearly one-third of intermediary asset market share.

Tobias Financial

MARCH 11, 2025

He highlighted the importance of long-term investing, cautioning against making hasty decisions in reaction to short-term market fluctuations. Franklin reinforced the investment principle: Its not the timing of the market. He also emphasized the value of diversification when managing investments. Its time in the market.

Abnormal Returns

MARCH 27, 2023

allaboutyourbenjamins.com) Jack Forehand and Justin Carbonneau talk with Ehren Stanhope of O'Shaughnessy Asset Management about the ins and outs of direct indexing. investmentnews.com) How Harold Evensky explains a bucket approach to retirement investing. kitces.com) Retirees Even retirees need to have a rainy day fund.

Brown Advisory

APRIL 20, 2022

Good Preparation Leads to a Good Audit Experience: What to Expect from Your Investment Advisor mhannan Wed, 04/20/2022 - 06:03 After an extended period of strong returns that began in 2009, many not-for-profit (NFP) organizations find themselves increasingly challenged to earn the traditional target of an inflation-adjusted 5% annual spending rate.

Truemind Capital

SEPTEMBER 13, 2024

He had no idea of where the investments were made by his father. The investments were all over the place and he was not even sure if all the assets were accounted for. A family member who worked hard to save the assets in the hope of a better future for others. appeared first on Investment Blog. Keep it simple.

The Big Picture

MARCH 31, 2023

Embattled First Republic Bank is no longer searching for a buyer as investment advisors and company executives seek to repair the company’s balance sheet before any sale might take place, FOX Business has learned. ( trillion asset manager of TIAA. Wall Street Journal ) • First Republic Bank is not currently looking for a buyer.

Cordant Wealth Partners

NOVEMBER 18, 2024

You can donate appreciated assets to your DAF, avoiding capital gains taxes and further lowering your tax bill. A donor-advised fund is a charitable investment account that allows you to support your preferred charities over time while receiving a tax deduction upfront. How much control do I have over my DAF investment allocation?

The Big Picture

MARCH 25, 2025

O’Shaughnessy Asset Management, became a leader in direct indexing, eventually was bought by Franklin Templeton, leading him to launch O’Shaughnessy Ventures, O’Shaughnessy Fellowships, infinite Loops podcast, just so many different things. You know, like one of the best growth factors in investing is momentum.

Nerd's Eye View

APRIL 11, 2023

Thomas is a Senior Partner for Signature Estate & Investment Advisors, an independent RIA based in Los Angeles, California, that oversees nearly $16 billion in assets under management, with $570 million of those assets being managed by Thomas' practice that serves more than 250 client households.

Good Financial Cents

JUNE 11, 2023

One thing that I have craved for investors is a tool that allows you to sync all your financial accounts – your investment portfolio, checking and savings accounts, credit cards and other loan accounts – in one place, and then provides an investment-related analysis of your entire portfolio. Personal Capital to the rescue.

BlueMind

NOVEMBER 24, 2022

They will expect personalized services in investment management as well as from you and justifiably so. Registered Investment Advisors versus Broker-Dealers The bigger the wealth, the more complicated it is to manage it. The RIA industry is expected to only grow further in the coming years.

Advisor Perspectives

JULY 16, 2024

Since carriers are still digesting and figuring out how they want to cover DA, investment advisors should focus on working with a broker who understands this space. What was true six months ago, can easily be different now and in further down the road.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content