Investing Behavioral Hacks

The Big Picture

NOVEMBER 15, 2023

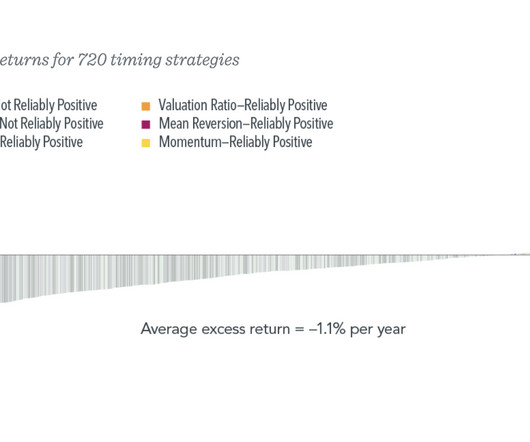

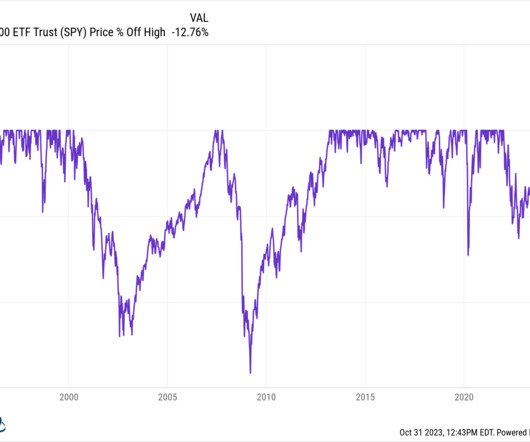

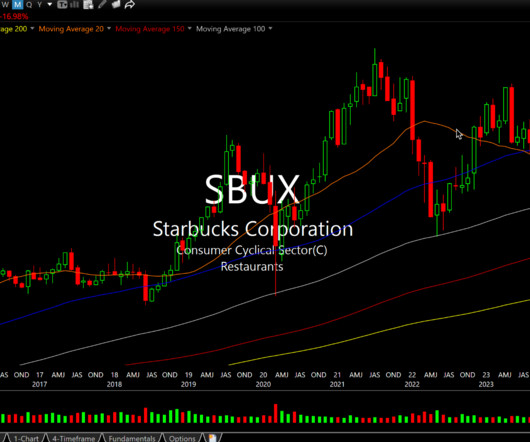

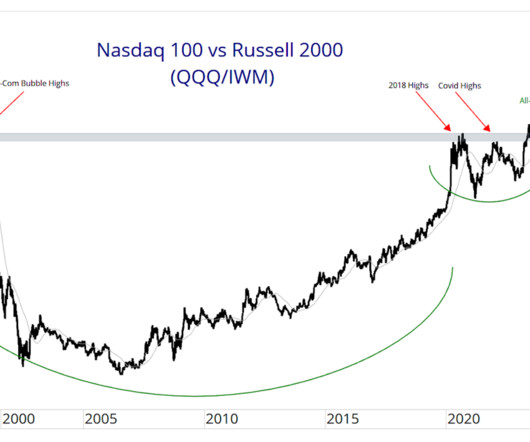

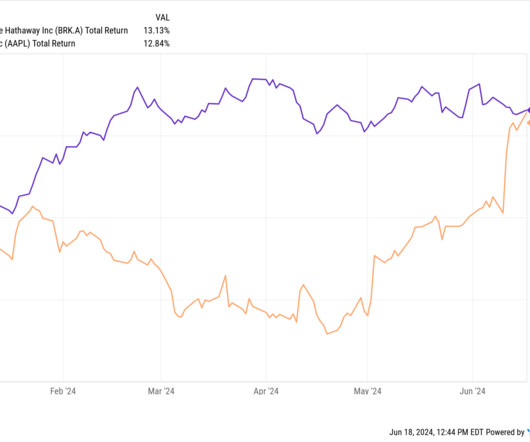

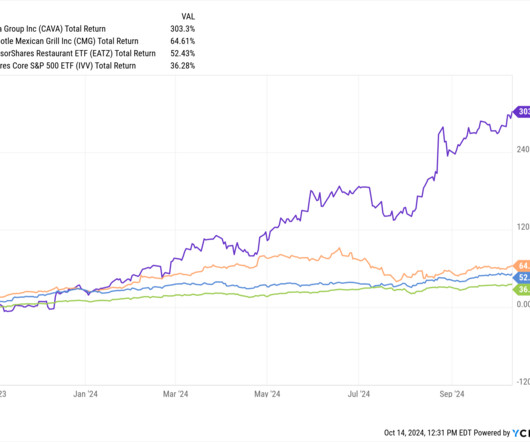

Markets screamed higher yesterday after a benign CPI report showed a 0.0% It was a classic fear-driven error, a combination of bad market timing and poor impulse control. It was a classic fear-driven error, a combination of bad market timing and poor impulse control. Last, recognize that markets go up and down.

Let's personalize your content