F.L.Putnam Adds 3 Firms Totaling $1.25B in Managed Assets

Wealth Management

JULY 25, 2024

The acquisition of the three East Coast-based firms will push F.L.Putnam’s assets under advisement above $10 billion, and its AUM will reach about $7.9

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 25, 2024

The acquisition of the three East Coast-based firms will push F.L.Putnam’s assets under advisement above $10 billion, and its AUM will reach about $7.9

Wealth Management

JUNE 28, 2024

Asset managers continue to launch investment products that resonate with advisors. But what assets work best in the space, and how to deploy them into client portfolios, remains up for debate.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nerd's Eye View

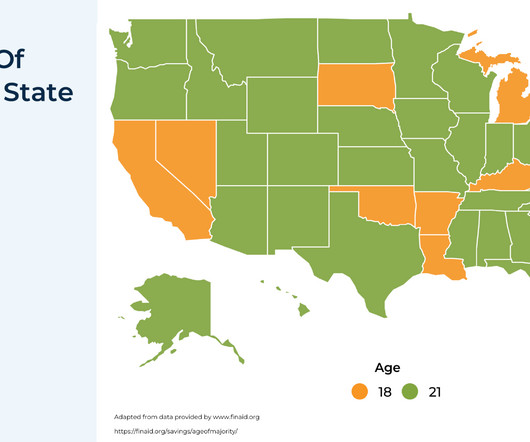

FEBRUARY 26, 2025

However, once a child reaches the age of majority, they may not always be in a position to manage assets responsibly. In these cases, parents may wish to adjust how gifted assets are structured to better align with their family's long-term goals. Read More.

Wealth Management

JANUARY 30, 2025

Private equity and venture capital investments will likely remain the most popular alternative assets among advisors, according to FUSE Research Network.

Wealth Management

JUNE 5, 2024

BlackRock, Fidelity Investments, Franklin Templeton and State Street will collaborate with the technology provider more than ever before to personalize creation of investment portfolios.

Wealth Management

AUGUST 1, 2024

The finding is part of a broader Cerulli report examining the opportunities and challenges surrounding the use of alternative investments in the retail channel.

Wealth Management

NOVEMBER 7, 2024

Burney, Rayliant and Clough Capital Partners formed a joint venture to create Powered by ETFs, which incorporates U.S. and international equities and alternative investments.

Wealth Management

SEPTEMBER 30, 2024

Fidelity's Mike Scarsciotti discusses the growing popularity of ETFs, the resurgence of active management and the evolving approaches to asset allocation.

Wealth Management

OCTOBER 7, 2024

Santander will combine its alternative investments and investment platforms units, which will be integrated into asset management.

Wealth Management

OCTOBER 10, 2024

Gen X, millennials and Gen Z are set to inherit $84 trillion in assets—they have different priorities that aren’t reflected in wealth management brands today.

Wealth Management

SEPTEMBER 30, 2024

Fidelity's Mike Scarsciotti discusses the growing popularity of ETFs, the resurgence of active management and the evolving approaches to asset allocation.

Wealth Management

SEPTEMBER 30, 2024

Fidelity's Mike Scarsciotti discusses the growing popularity of ETFs, the resurgence of active management and the evolving approaches to asset allocation.

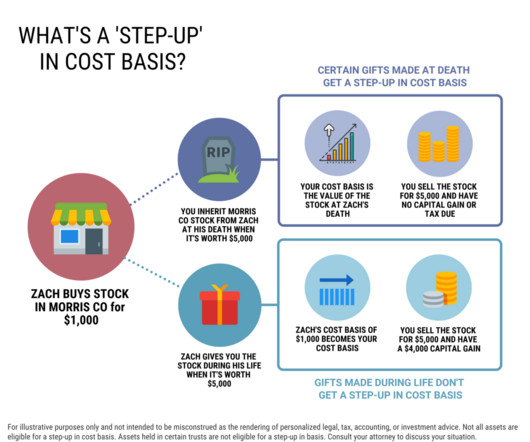

Darrow Wealth Management

JANUARY 16, 2025

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Heres how stepped up cost basis works on stock and other assets at death. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets.

Wealth Management

SEPTEMBER 26, 2024

The ETFs in this gallery are top funds for key asset classes, such as large-cap equities, small-cap equities, emerging markets, bond strategies and bitcoin.

Nerd's Eye View

MARCH 21, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a report from Cerulli Associates found that, amidst an industry-wide trend towards comprehensive financial planning and away from pure transaction-based investment management, asset-based fees currently represent 72.4%

Wealth Management

JANUARY 16, 2025

Now, some are running into trouble amid a sluggish dealmaking environment and declining asset values. More than 100 continuation funds were raised between 2019 and 2021.

Wealth Management

NOVEMBER 5, 2024

Apollo, like its peers, continues to target high earners for higher-fee-paying assets and has set a goal of raising at least $150 billion for its global wealth business by 2029.

Nerd's Eye View

DECEMBER 18, 2024

For investment management services, documenting the entire client engagement – such as onboarding, reviewing and recommending portfolio adjustments in line with collected suitability information, opening and funding accounts, conducting periodic reviews, and rebalancing – can help clearly evidence the services provided.

Nerd's Eye View

JANUARY 24, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that while overall financial advisor headcount remains relatively flat, the RIA channel continues to gain share in terms of both headcount (as brokers break away to start their own independent firms and aspiring advisors seek (..)

Abnormal Returns

MARCH 10, 2025

(citywire.com) The latest in advisor fintech news including saturation in the portfolio management tech space. kindnessfp.com) Why clients need to organize their digital assets for estate planning purposes. riabiz.com) This money manager's ETF business was built on entertaining clients. abnormalreturns.com)

Wealth Management

FEBRUARY 7, 2025

Empower Personal Wealth, which staffs about 1,000 advisors, reported 29% asset growth in 2024.

Abnormal Returns

OCTOBER 28, 2024

on.ft.com) Fund management Franklin Templeton's ($BEN) Western Asset Management unit has missed out on the bond market rally. (cnbc.com) But don't expect a ton of liquidity. sherwood.news) Robinhood ($HOOD) is jumping into the prediction markets. theblock.co) HFT firms want speed, at any cost.

Wealth Management

NOVEMBER 5, 2024

Apollo, like its peers, continues to target high earners for higher-fee-paying assets and has set a goal of raising at least $150 billion for its global wealth business by 2029.

Wealth Management

NOVEMBER 26, 2024

No single asset can promise complete security, but gold has a proven track record of maintaining its value in times of economic turbulence.

Nerd's Eye View

MARCH 12, 2025

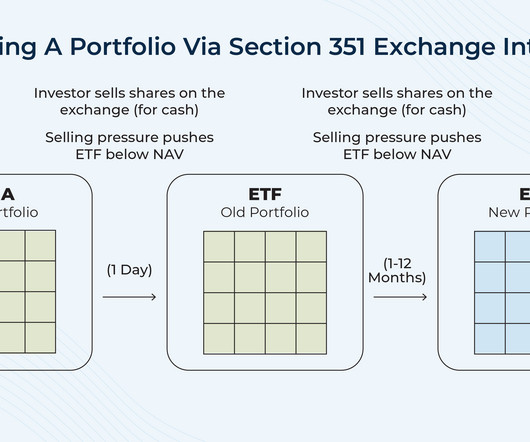

While the gains signal portfolio growth, they also create challenges for ongoing management. Once a portfolio becomes 'locked up', i.e., unable to be managed without triggering capital gains, investors' options become limited. Charitably inclined investors can donate appreciated securities and avoid gains on the sale.

The Big Picture

NOVEMBER 15, 2024

He is the portfolio manager of the Return Stacked ETF Suite, manging 800 million in ETF assets. All of our earlier podcasts on your favorite pod hosts can be found here. Be sure to check out our Masters in Business next week with Corey Hoffstein , CEO/CIO Newfound Research.

Wealth Management

DECEMBER 26, 2024

Carlo di Florio, president of the industry compliance consulting firm ACA Group, said SEC Chair Nominee Paul Atkins approach to digital assets would be one of the most important legacies hell leave should he be confirmed.

Wealth Management

NOVEMBER 6, 2024

As $80 trillion transitions over the next two decades through the Great Wealth Transfer, the value of complex assets and bequests will only grow for charities aiming to maximize their impact.

Wealth Management

NOVEMBER 6, 2024

As $80 trillion transitions over the next two decades through the Great Wealth Transfer, the value of complex assets and bequests will only grow for charities aiming to maximize their impact.

Wealth Management

NOVEMBER 5, 2024

Apollo, like its peers, continues to target high earners for higher-fee-paying assets and has set a goal of raising at least $150 billion for its global wealth business by 2029.

Wealth Management

SEPTEMBER 30, 2024

Listen as Peter Nolan, Head of Sales at Pontera, shares how his firm empowers advisors to offer holistic, integrated advice on all client assets, including 401(k) plans

Wealth Management

APRIL 26, 2024

As clients become increasingly aware of the complexities of wealth transfer, asset protection and legacy planning, they expect comprehensive guidance from their advisors.

The Big Picture

JANUARY 24, 2025

The firm is owned by Mass Mutual, and half of its $431 billion in invested assets are from the insurance giant, with the rest coming from institutional investors. Over 20 years with the firm, Freno has held various positions including Managing Director, Head of Global High Yield, and Head of Global Markets.

The Big Picture

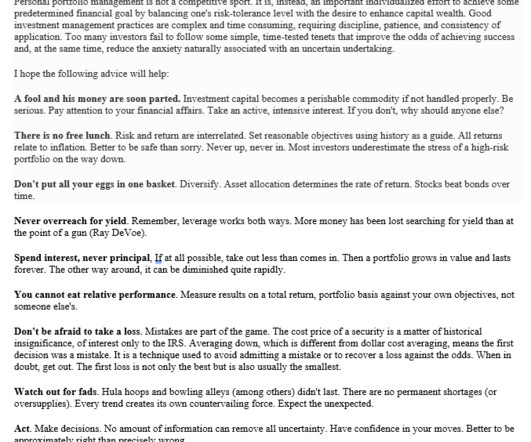

DECEMBER 30, 2024

He eventually became president of Merrill Lynch Asset Management, leading the division with a value-oriented approach and a focus on long-term fundamentals. He co-authored Investment Analysis and Portfolio Management , now in its fifth edition. Asset allocation determines the rate of return. Better to be safe than sorry.

Wealth Management

OCTOBER 7, 2024

Listen as Peter Nolan EVP, Strategic Sales & Partnerships, Pontera, shares how his firm empowers advisors to offer holistic, integrated advice on all client assets, including 401(k) plans

Darrow Wealth Management

MARCH 13, 2025

If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. So if you have a large portion of your wealth tied to a single stock, here are six options to manage it. Options Contracts: Utilizing options like cashless collars, covered calls, and protective puts to manage risk or generate income.

Wealth Management

FEBRUARY 11, 2025

Ric Edelman, founder of the Digital Assets Council of Financial Professionals, talks all things Bitcoin.

Wealth Management

MAY 21, 2024

The acquisitions of Wealth Management Solutions and Autumn Wind Asset Management represent Modern Wealth’s seventh and eighth transactions and bring its assets to over $3.7

The Big Picture

FEBRUARY 14, 2025

This week, I speak with Christine Phillpotts , Portfolio Manager for Ariel Investment s emerging markets value strategies. Previously, she spent 10 years at AllianceBernstein as Portfolio Manager and Senior Research analyst in emerging markets. She also worked as JPMorgan Asset Management equity research associate for US Tech.

Nerd's Eye View

JANUARY 21, 2025

Daniel is the CEO of WMGNA, a hybrid advisory firm based in Farmington, Connecticut, that oversees approximately $270 million in assets under management for 200 client households. My guest on today's podcast is Daniel Friedman.

The Big Picture

MARCH 3, 2025

Over that decade plus of doing CNBC, I had become friendly with Big Joe Besecker of Emerald Asset Management. . “Jordan Rules” were real, and I was absolutely convinced convinced! that something foul was afoot.1 1 Fast-forward to the 2000s.

Wealth Management

OCTOBER 1, 2024

Wealth advisors and asset managers expect a boost in flows to actively managed fixed income strategies in the wake of lower interest rates, reports FundFire. Schwab Asset Management is splitting shares on two-thirds of its ETFs in an attempt to boost sales.

Wealth Management

OCTOBER 21, 2024

trillion in assets under advisement and $258 billion in assets under management. With NEPC, Hightower and its affiliates will represent over $1.8

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content