More Nonprofits Are Accepting Digital Assets

Wealth Management

MAY 12, 2023

Despite crypto-winter, crypto giving trends may recover.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 12, 2023

Despite crypto-winter, crypto giving trends may recover.

Calculated Risk

MARCH 13, 2025

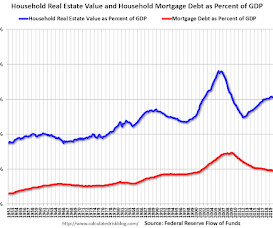

The net worth of households and nonprofits rose to $169.4 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Calculated Risk

SEPTEMBER 12, 2024

The net worth of households and nonprofits rose to $163.8 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Calculated Risk

SEPTEMBER 9, 2022

The net worth of households and nonprofits fell to $143.8 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). trillion during the second quarter of 2022. in Q1, 2022.

Calculated Risk

DECEMBER 9, 2022

The net worth of households and nonprofits fell to $143.3 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). trillion during the third quarter of 2022. in Q2, 2022.

Wealth Management

AUGUST 16, 2023

The call for feedback touches on policies that, if changed, would likely impact the flow of crypto gifts to nonprofits.

Calculated Risk

SEPTEMBER 8, 2023

The net worth of households and nonprofits rose to $154.3 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). trillion during the second quarter of 2023. in Q1, 2023.

Calculated Risk

JANUARY 15, 2025

Financial service providers reported modest growth in lending and little change in asset quality overall, though lenders and community organizations voiced concerns about delinquencies among small businesses and lower-income households. Nonprofit social service agencies faced high demand amidst uncertainty about future funding levels.

Calculated Risk

JUNE 8, 2023

The net worth of households and nonprofits rose to $148.8 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). trillion during the first quarter of 2023. in Q4, 2022.

Calculated Risk

MARCH 9, 2023

The net worth of households and nonprofits rose to $147.7 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). trillion during the fourth quarter of 2022. in Q3, 2022.

Calculated Risk

JUNE 7, 2024

The net worth of households and nonprofits rose to $160.8 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Calculated Risk

MARCH 7, 2024

The net worth of households and nonprofits rose to $156.2 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Calculated Risk

DECEMBER 7, 2023

The net worth of households and nonprofits fell to $151.0 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Carson Wealth

DECEMBER 5, 2024

million nonprofit organizations registered in the U.S. However, either the donor or the donor’s representative retains advisory privileges with respect to the distribution of funds and the investment of assets in the account. Here are some examples of the impact: 1 In 2023, Americans donated $557.16 There are more than 1.8

Calculated Risk

DECEMBER 12, 2024

The net worth of households and nonprofits rose to $168.8 The first graph shows Households and Nonprofit net worth as a percent of GDP. This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Carson Wealth

JANUARY 28, 2025

Determine what kind of assets you want to donate. While cash is the simplest, you can also donate non-cash assets such as stocks, real estate, or private business interests. A recent survey of donors and nonprofits found that one in five projects are negatively affected by risk. [1] Governance risk.

Nerd's Eye View

JANUARY 31, 2024

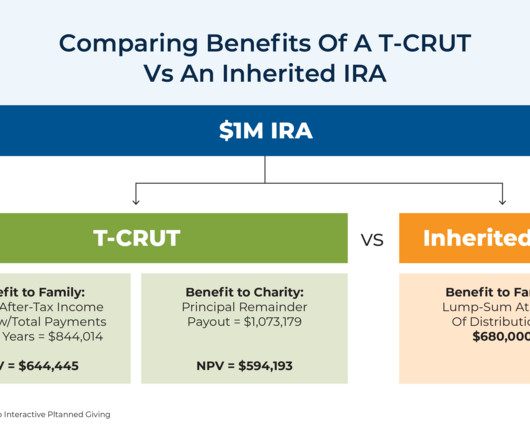

Third, the IRA assets are directed to the T-CRUT as its funding source upon her passing, and fourth, that, at the end of the specified period, a minimum of 10% of the initial fair market value of the assets placed within the trust is transferred to a qualified charity (or charities) as the final remainder beneficiary.

A Wealth of Common Sense

SEPTEMBER 17, 2023

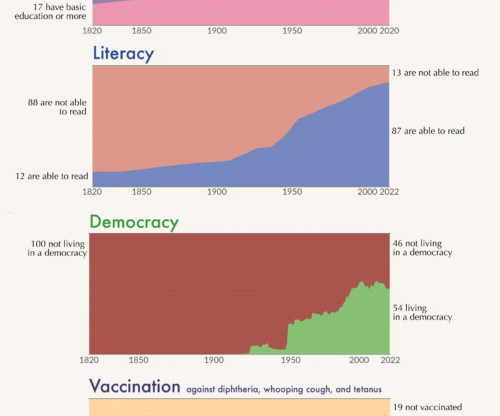

Each quarter they provide details on total financial assets and liabilities for households and nonprofit organizations. The Federal Reserve has tracked household balance sheet data going back to 1952.

Nerd's Eye View

AUGUST 23, 2023

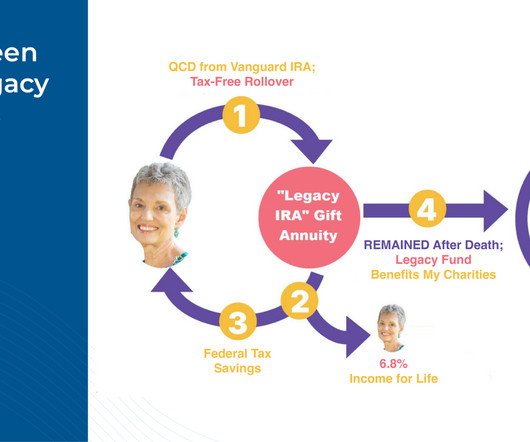

Testamentary CGAs, on the other hand, can be established after a donor’s death, funded with IRA or other assets to provide income for another person. in an IRA or 401(k) plan) to contribute to the Charitable Gift Annuity, they would need to withdraw – and be taxed on – those funds first. But the SECURE 2.0

Wealth Management

SEPTEMBER 20, 2022

The firm is joining Tent, a nonprofit network of major corporations committed to supporting refugees, New York-based Blackstone said Tuesday in a statement. The alternative-asset manager said it has already hired 500 displaced people.

Abnormal Returns

AUGUST 3, 2024

thequietlife.net) Hospitals Nonprofit hospitals are often quite profitable, and CEO pay reflects this. wapo.st) When PE buys a hospital, asset sales commence. (msn.com) What therapy is for, and what it isn't for. freddiedeboer.substack.com) Some famous introverts, illustrated.

Brown Advisory

SEPTEMBER 6, 2022

Asset Allocation: Developing a Long-Term Investment Strategy for Mission-Driven Organizations. When putting a plan in place, we believe it is critical for any mission-driven organization to develop an effective, long-term asset allocation strategy to manage its endowment assets. Tue, 09/06/2022 - 10:30. 70–90% vs. 80%).

Brown Advisory

MAY 4, 2020

Beyond Investing: Strategic Advice for Nonprofits ajackson Mon, 05/04/2020 - 14:54 Running a nonprofit is a tall order. And in parallel with their program work, nonprofit leaders must also build the financial and organizational infrastructure to sustain those programs.

Brown Advisory

SEPTEMBER 4, 2019

Beyond Investing: Strategic Advice for Nonprofits. Running a nonprofit is a tall order. And in parallel with their program work, nonprofit leaders must also build the financial and organizational infrastructure to sustain those programs. Wed, 09/04/2019 - 14:54. client: SMALL PRIVATE REGIONAL COLLEGE.

SEI

SEPTEMBER 12, 2022

INS CTA: Nonprofit Committee Connection Blog subscribe. Nonprofit-committee-connection-subscribe_CTA.jpg. Blog: Nonprofit Committee Connection. Mon, 09/12/2022 - 12:22. Include Image (left or right). Your tie to the topics that matter most. From industry conference recaps to insights on market and regulatory events, MJ digs in.

SEI

SEPTEMBER 12, 2022

INS CTA - Nonprofit Committee Connection Blog subscribe. Nonprofit-committee-connection-subscribe_CTA.jpg. Blog: Nonprofit Committee Connection. Mon, 09/12/2022 - 12:22. Include Image (left or right). Your tie to the topics that matter most.

Cordant Wealth Partners

NOVEMBER 18, 2024

You can donate appreciated assets to your DAF, avoiding capital gains taxes and further lowering your tax bill. The donor receives a tax deduction in the year the contribution is made, and the donated assets continue to grow tax-free in the account until the donor gifts them to the qualified charities of their choice.

The Big Picture

OCTOBER 5, 2024

But amid ongoing turmoil in the nonprofit world, some people are trying to build a new creative economy. Cutter has put-up impressive numbers since its 2022 launch, and now manages more than $500 million in institutional assets. Find a connection to the longer view and a wiser perspective on what matters. In the U.S.,

Walkner Condon Financial Advisors

FEBRUARY 15, 2024

The nonprofit sector has a path forward, but it needs the help of individuals, institutions, and government to get there. Whichever way you look at it, 2024 will bring uncertainty for a vast swath of the nonprofit sector, making planning and charitable spending more conservative and less dependable. A Look at 2024’s Hunt for Revenue.

Carson Wealth

MARCH 21, 2025

An endowment is a portfolio of assets that is invested to provide support for a cause. Theyre established to benefit charitable organizations, including educational or cultural institutions, community organizations, service organizations such as hospitals, and other nonprofits. What Is an Endowment?

MainStreet Financial Planning

MAY 10, 2023

A few weeks ago, I had the pleasure of attending a gala fundraiser for one of my favorite nonprofit organizations, Junior Achievement. You may not be aware, but I worked for this same nonprofit for about 5 years before joining MainStreet. Junior Achievement’s mission is to inspire and prepare young people to succeed.

Million Dollar Round Table (MDRT)

JULY 23, 2023

By Bryce Sanders As a financial advisor or agent, you may do research to discover who in your area has assets and money in motion to fill your prospecting pipeline. Nonprofits issue them too. You might seek referrals or find out who just moved into the neighborhood. It’s a lot of work. Philanthropists have money to give away.

International College of Financial Planning

JULY 30, 2022

Certified Financial Planner (CFP) is globally the most respected financial designation for personal assets management. One can do CFP online course for the most comprehensive financial planning services, which often include asset management. As an individual investor, CFPs are experts in the field of personal asset management.

Harness Wealth

FEBRUARY 4, 2025

In this article, well explore all the details of alternative investments, the reasons behind their growth as an investment choice, and how their tax treatment differs from traditional assets. Eligibility: Retail investors can purchase digital assets without accreditation, though some advanced products may have restrictions.

Brown Advisory

SEPTEMBER 29, 2020

Endowment and Foundation Challenges: Managing Charitable Gift Annuities ajackson Tue, 09/29/2020 - 14:00 The charitable gift annuity is one of a number of donor-friendly solutions that nonprofit institutions can offer to donors. However, the management of underlying assets in a gift annuity pool is a different matter.

Brown Advisory

SEPTEMBER 29, 2020

The charitable gift annuity is one of a number of donor-friendly solutions that nonprofit institutions can offer to donors. A charitable gift annuity (CGA) is a contract between donor and institution—the nonprofit receives a gift from the donor, and in return the donor receives an income stream from the nonprofit.

SEI

AUGUST 2, 2022

Nonprofits and healthcare organizations. That’s why, when facing market volatility, stewards of long-term assets held at all types of nonprofit institutions recognize the importance of a well-thought-out investment process. . Equities: equity asset classes were down double digits, regardless of size and geography. .

Brown Advisory

NOVEMBER 29, 2016

The directors at many nonprofits today are finding that, by some measures, working for the common good has never been so tough. The budget gap for nonprofits has widened because of a slump in their three sources of funds—donations, grants and portfolio returns. Making More From Less. Tue, 11/29/2016 - 14:44.

SEI

SEPTEMBER 1, 2022

Nonprofits and healthcare organizations. Varieties of crypto : This creates a new pathway for donations through different methods that give you options like stock, real estate, or any type of asset donation. Nonprofit institutions have a lot to think about when it comes to the success of their organization. phernandez1.

Brown Advisory

APRIL 16, 2018

The Other 95% achen Mon, 04/16/2018 - 13:23 The traditional goal for a nonprofit’s investment portfolio was to earn a 5% return or so that could be used to fund the nonprofit’s programs. Today, we help nonprofits make an impact with the other 95% of their portfolio.

Brown Advisory

APRIL 16, 2018

The traditional goal for a nonprofit’s investment portfolio was to earn a 5% return or so that could be used to fund the nonprofit’s programs. Today, we help nonprofits make an impact with the other 95% of their portfolio. When a nonprofit wants a mission-aligned investment strategy, we use the same process.

Brown Advisory

APRIL 28, 2020

The CARES Act Supplement: New Relief Funds Authorized eberkwits Tue, 04/28/2020 - 08:44 On April 23rd, Congress approved a second emergency package to expand funding for small businesses, nonprofits, hospitals and money for COVID-19 testing. Business and nonprofits with up to 10,000 employees or up to $2.5

Brown Advisory

APRIL 28, 2020

On April 23rd, Congress approved a second emergency package to expand funding for small businesses, nonprofits, hospitals and money for COVID-19 testing. The measure replenishes the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) program for nonprofits and small businesses. Documentation Preparedness.

Carson Wealth

NOVEMBER 3, 2022

With a DAF, you contribute assets — cash, real estate, stock, even cryptocurrency — to a fund you establish through a custodial account, which then becomes a charitable account you personally control. Donate valuable assets that aren’t cash. Create a donor-advised fund (DAF).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content