Credit Suisse Said to Begin Sale of US Asset Management Arm

Wealth Management

OCTOBER 18, 2022

The unit is likely to draw interest from other asset managers and private equity firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 18, 2022

The unit is likely to draw interest from other asset managers and private equity firms.

Wealth Management

JANUARY 26, 2023

Appraisal business is down, as investment sales activity and refinancing deals have declined. Now, appraisers must rely on supplemental data to make value assessments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

MAY 29, 2024

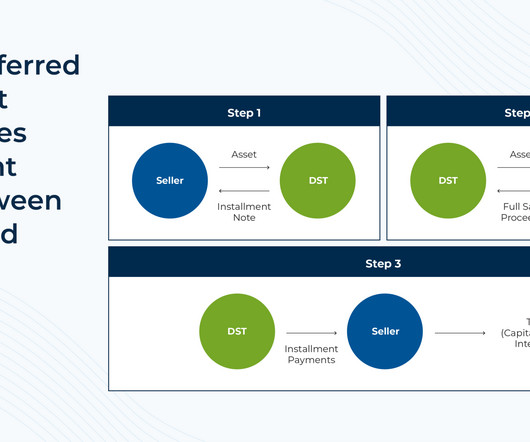

Small business owners often treat their businesses not only as their source of income during their working years, but also as an asset that can be sold to fund their retirement. One way to reduce the tax impact of selling a small business is by using an installment sale. Under IRC Sec. Under IRC Sec.

Wealth Management

MAY 25, 2023

Investment sales in the sector have been impacted by the same volatile forces as other commercial real estate assets, but potential long-term returns remain attractive.

Wealth Management

AUGUST 1, 2022

Sales of individual assets were up in the first half of the year, according to MSCI Real Assets. But portfolio transactions are becoming less common.

Wealth Management

NOVEMBER 6, 2023

Avantax said the decline was due to attrition of lower producing advisors as it moves closer to finalizing a sale to Cetera later this month.

Nerd's Eye View

NOVEMBER 14, 2024

As the financial advice industry began shifting from a sales-based model to a more sustainable asset management approach, advisors found their roles shifting along with it.

Abnormal Returns

OCTOBER 31, 2023

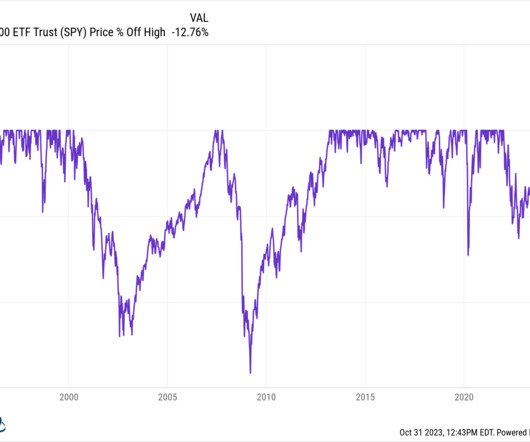

humbledollar.com) Why it's easy to say you will buy when stocks 'go on sale.' Strategy Money market returns look good.almost too good. wsj.com) Six lessons from William Bernstein's "The Four Pillars of Investing." behaviouralinvestment.com) Crypto Vanguard is opting out of the Bitcoin ETF race.

Wealth Management

DECEMBER 18, 2023

is working with advisors as it evaluates possibilities for the US asset-management platform including a full or partial sale. Huatai Securities Co.

The Big Picture

JANUARY 24, 2025

The firm is owned by Mass Mutual, and half of its $431 billion in invested assets are from the insurance giant, with the rest coming from institutional investors. He also spent 5 years as the company’s President, overseeing a majority of Barings business sectors, including investments, sales, operations and tech.

Nerd's Eye View

NOVEMBER 22, 2023

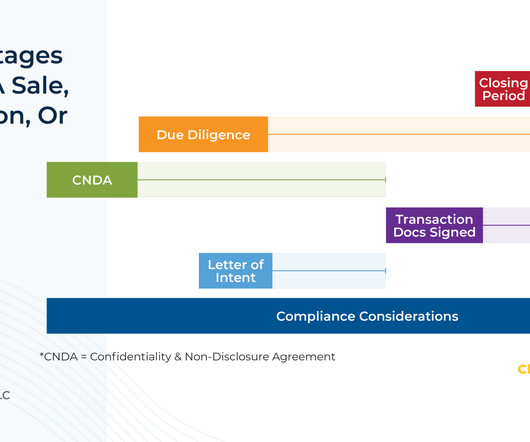

The initial step towards the eventual sale of an advisory firm requires the seller to identify a well-suited counterparty, which can be challenging given the population of well-funded serial acquirers who have a material advantage over firm owners, many of whom have likely never bought or sold a business. Read More.

Wealth Management

APRIL 23, 2024

The bank has struck an agreement to transfer clients and their assets from the unit known as Marcus Invest to Betterment, a $45 billion digital investment-advisory firm.

Nerd's Eye View

MARCH 12, 2025

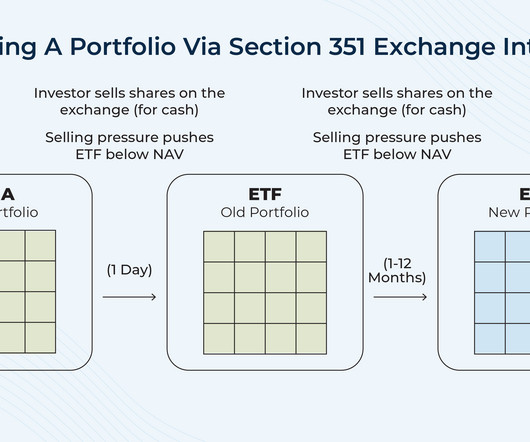

Because when it comes time to rebalance the portfolio to its asset allocation targets – or to reallocate the portfolio to a new strategy – any trades made to implement those changes can generate capital gains, resulting in tax consequences for the investor.

Calculated Risk

JANUARY 15, 2025

Consumer spending moved up moderately, with most Districts reporting strong holiday sales that exceeded expectations. Vehicle sales grew modestly. Commercial real estate sales edged up. Fed's Beige Book Economic activity increased slightly to moderately across the twelve Federal Reserve Districts in late November and December.

Wealth Management

OCTOBER 1, 2024

Wealth advisors and asset managers expect a boost in flows to actively managed fixed income strategies in the wake of lower interest rates, reports FundFire. Schwab Asset Management is splitting shares on two-thirds of its ETFs in an attempt to boost sales.

Nerd's Eye View

OCTOBER 1, 2024

Gaetano is a partner and senior financial advisor at Fountainhead Advisors, an RIA based in Warren, New Jersey, that oversees approximately $900 million in assets under management for 1,000 client households.

Wealth Management

SEPTEMBER 30, 2024

Listen as Peter Nolan, Head of Sales at Pontera, shares how his firm empowers advisors to offer holistic, integrated advice on all client assets, including 401(k) plans

Abnormal Returns

APRIL 22, 2025

morningstar.com) Private assets Tariffs are only going to make things harder for startups. wired.com) Secondary sales are now a part of every VC's playbook. sherwood.news) Real estate Burned lots are up for sale in Pacific Palisades. (morningstar.com) Bonds Treasury bonds have never been risk free.

Wealth Management

MAY 14, 2023

A decade-long market of ever-rising asset prices has led many to overlook the need to formalize business development. In a more challenging growth environment, as much as 5% of revenue should be spent on marketing and sales, according to speakers at DeVoe & Co.'s 's annual conference.

Wealth Management

NOVEMBER 9, 2022

While Seritage assets are sure to create investor interest, a cloudy economic outlook and tighter financing availability are bound to be major factors in negotiations, market observers say.

Wealth Management

JUNE 26, 2024

Open, honest and candid discussion about the DOL rule in Texas court, DC asset growth due to passive investing, Fisher's minority sale, Wealthies finalists and more.

Wealth Management

OCTOBER 7, 2024

Listen as Peter Nolan EVP, Strategic Sales & Partnerships, Pontera, shares how his firm empowers advisors to offer holistic, integrated advice on all client assets, including 401(k) plans

Wealth Management

MARCH 14, 2024

After presiding over infrastructure expansion, a shift in strategy and more than $80 billion in asset growth, Hightower’s CEO shares his thoughts on the job, the industry and recent rumors of a sale.

Wealth Management

JANUARY 4, 2024

After two years of rising interest costs hindering asset sales, owners are seizing on recent rate stability to push for portability to get deals done.

Wealth Management

MARCH 22, 2023

Last year marked a record for global sales of real estate secondary transactions. Asset managers expect 2023 to beat that figure.

Abnormal Returns

DECEMBER 5, 2024

axios.com) Fund management BlackRock ($BLK) will soon oversee almost $600 billion of alternative assets. wired.com) Economy Heavy truck sales increased in November. (jaywoods.substack.com) Companies Dollar stores have had a rough 2024. sherwood.news) Palantir ($PLTR) did not. nbcnews.com) A tool that can scan your phone for spyware.

Nerd's Eye View

JANUARY 28, 2025

Kay Lynn is the President of Merit Financial Advisors, a hybrid advisory firm based in Alpharetta, Georgia, that oversees approximately $13 billion in assets under management for 26,000 client households. My guest on today's podcast is Kay Lynn Mayhue.

Wealth Management

MARCH 2, 2023

The private equity firm had sought an extension from holders of the securitized notes to allow time to dispose of assets and repay the debt, according to people with knowledge of the plan.

The Big Picture

JANUARY 16, 2023

For some companies, a brand is something that helps slightly boost customer engagement and sales. But for others, including some of the largest companies in the world, a strong brand is one of their most valuable assets. Visual Capitalist : How much money is a brand truly worth?

Abnormal Returns

NOVEMBER 5, 2023

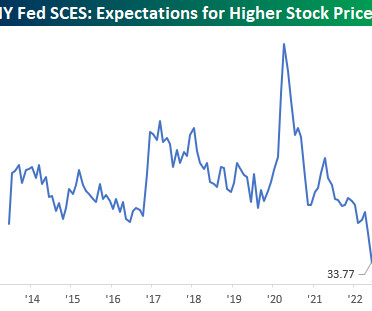

humbledollar.com) There's nothing magic about asset allocation. alchemy.substack.com) Why it's easy to say you will buy when stocks 'go on sale.' Top clicks this week Six lessons from William Bernstein's "The Four Pillars of Investing." humbledollar.com) Be wary shifting too much of your money into bonds. awealthofcommonsense.com)

Wealth Management

OCTOBER 15, 2023

The volume of distressed asset sales remains muted and Bisnow looked at why that is the case. Bloomberg reported that Netflix is planning to open physical retail stores. These are among the must reads from the real estate investment world to kick off the new week.

Abnormal Returns

OCTOBER 17, 2024

wsj.com) Asset management Asset managers are rushing to launch CLO ETFs. wsj.com) India's asset management market is fiercely competitive. fastcompany.com) Why secondary sales of PE stakes are picking up. (morningstar.com) Investors are already noticing the drop in cash yields.

Wealth Management

NOVEMBER 20, 2023

The sale of Signature Bank’s apartment loans could be announced as early as today, reports The Wall Street Journal. Private credit is rising in popularity, but established asset managers are winning more than half of new deals, according to Bloomberg.

Wealth Management

DECEMBER 13, 2022

Sales of multifamily assets and development sites have been the most active of any property types in New York City recently, reports The Real Deal. The Street forecasts that equity REITs might see a better year in 2023. These are among today’s must reads from around the commercial real estate industry.

The Big Picture

AUGUST 26, 2022

Our previous discussions (debates really) were over the traditional model of brokerage I push back against versus the fee-based fiduciary asset management I embrace. This made me chuckle, as we had discussed this level of unsuitable and inappropriate asset management for years, with me offering an endless parade of examples.

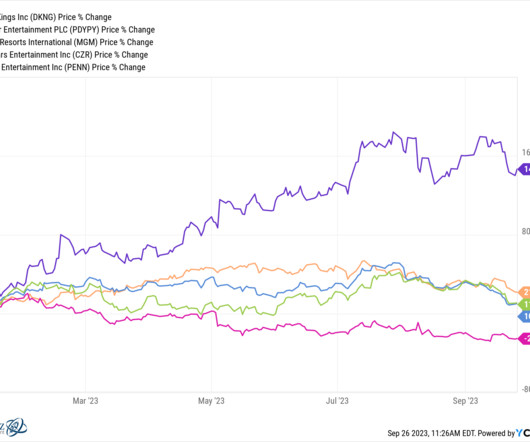

Abnormal Returns

SEPTEMBER 26, 2023

morningstar.com) Alternative assets are not all that alternative. wired.com) Asset allocation How various asset classes performed during a recession. calculatedriskblog.com) The bifurcation between new and existing home sales continues. Alternatives Private market access funds are all the rage.

Nerd's Eye View

FEBRUARY 25, 2025

Jennifer is the CEO of The Mather Group, an RIA based in Chicago, Illinois, that oversees $15 billion in combined assets under management and advisement for approximately 4,400 client households. Welcome to the 426th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jennifer des Groseilliers.

The Big Picture

MAY 6, 2023

An exclusive excerpt from When the Heavens Went on Sale, by the bestselling author of Elon Musk. The Ringer ) Be sure to check out our Masters in Business interview this weekend with Julian Salisbury , Chief Investment Officer of Goldman Sachs Asset & Wealth Management , with $737 billion in assets under management.

Abnormal Returns

NOVEMBER 13, 2023

on.ft.com) Michael Batnick and Ben Carlson talk with Chris Kuiper, Director of Research at Fidelity Digital Assets. newsletter.abnormalreturns.com) Mixed media There is no shortage of new, trophy apartments for sale in Manhattan. Crypto The crypto industry is at a crossroads, post-FTX. Then check out our weekly e-mail newsletter.

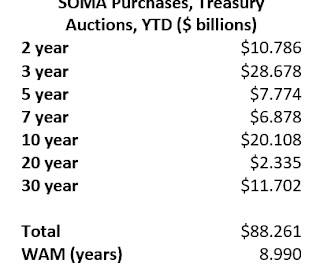

Calculated Risk

MARCH 11, 2025

Most of these gains in Treasury and Agency MBS assets were funded with increases in very short duration interest-bearing Federal Reserve liabilities, mainly deposits of depository institutions (reserves) and Reverse Repos. After all, Treasury notes close to maturity are by their nature short maturity assets!)

Abnormal Returns

SEPTEMBER 27, 2024

youngmoney.co) Finance ETF assets in the U.S. vox.com) Restaurants Restaurant sales are tailing off. Markets Most stocks are working right now. theirrelevantinvestor.com) Some investments are an IQ test. downtownjoshbrown.com) It's easy to get distracted these days as an investor. just hit $10 trillion. Diners are bored.

Nerd's Eye View

JULY 5, 2024

Also in industry news this week: A separate Supreme Court decision struck down the SEC's use of in-house judges to adjudicate cases involving civil penalties (unless both parties in the matter agree to it), likely setting up more settlement offers from the regulator to avoid a drawn-out legal process in the Federal court system At a time when it has (..)

Abnormal Returns

MARCH 5, 2024

investmenttalk.co) Crypto Spot Bitcoin ETFs are raking in the assets. biopharmadive.com) Economy Heavy truck sales increased in February. (seeitmarket.com) Strategy Being right is more important than being first. microcapclub.com) Being fearful is no way to invest. dariusforoux.com) Why you should write more.

Calculated Risk

OCTOBER 11, 2022

Look at that huge increase in mortgage credit availability back in the 2004 - 2006 period (remember “fog a mirror, get a loan”, NINJA loans: No Income, No Job or Assets?). The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content