Morningstar: Assets in Tax-Managed SMAs Now Total Over $500B

Wealth Management

OCTOBER 17, 2024

The amount of assets in tax-managed SMAs has jumped 67% from year-end 2022.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 17, 2024

The amount of assets in tax-managed SMAs has jumped 67% from year-end 2022.

Nerd's Eye View

AUGUST 7, 2024

Traditionally, people tend to think of their estate as comprising one big 'pot' of assets, focusing on the sum of all the assets rather than on each individual asset itself.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 7, 2024

Nisha Patel, CFA, managing director at Parametric, explores tax law changes, strategies, and tax-loss harvesting to maximize savings.

Wealth Management

AUGUST 29, 2023

The proposals aim to align tax reporting on digital assets with that of other financial assets.

Wealth Management

OCTOBER 7, 2024

The Cambria Tax Aware ETF and the Stance Sustainable Beta ETF will each be seeded with the appreciated securities of wealthy investors, who will swap their assets for shares in the funds rather than buy into them with cash.

Wealth Management

OCTOBER 21, 2024

Practitioners can use a variety of strategies to shift value.

Nerd's Eye View

SEPTEMBER 25, 2024

Over the last 60 years, the top Federal marginal tax bracket has steadily decreased from over 90% in the 1950s and 60s to 'just' 37% today. While it's true that the top marginal tax rate has decreased dramatically since the mid-20th century, the difference in the actual tax paid by most Americans has been far more modest.

The Big Picture

JULY 25, 2023

Pomp points out that: “I am, however, arguing that the total return percentage traditionally quoted is not what people actually achieve in their brokerage account because of taxes. I have addressed Tax Alpha before ( see this and this ); but Pomp indirectly raised a very different issue: Why do people underperform their own assets?

Nerd's Eye View

AUGUST 21, 2024

Irrevocable trusts lie at the heart of a variety of estate planning strategies, as gifts to irrevocable trusts can allow for the transfer of assets outside of an owner’s estate for estate tax purposes with more structure than an outright gift. the assets' original owner).

Wealth Management

MAY 21, 2024

The best of both worlds.

Wealth Management

APRIL 9, 2024

The new role will partly support 55ip, whose CEO, Paul Gamble, revealed last week that he would step down from that post in September.

Wealth Management

FEBRUARY 28, 2025

large caps, where it sees opportunities in private markets and how it approaches tax considerations. Brian Spinelli, co-CIO, talks about why the firm is staying away from U.S.

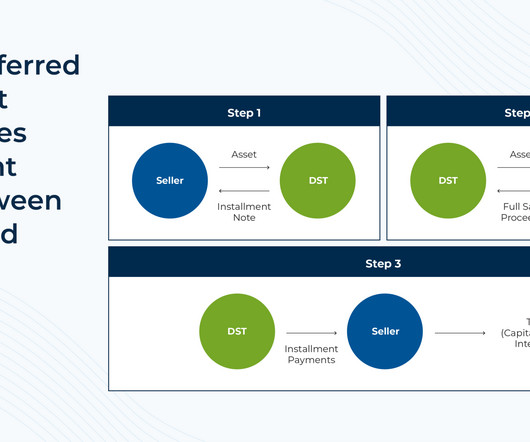

Nerd's Eye View

MAY 29, 2024

Small business owners often treat their businesses not only as their source of income during their working years, but also as an asset that can be sold to fund their retirement. One way to reduce the tax impact of selling a small business is by using an installment sale. Under IRC Sec. Under IRC Sec.

Nerd's Eye View

OCTOBER 26, 2022

Roth conversions are, in essence, a way to pay income taxes on pre-tax retirement funds in exchange for future tax-free growth and withdrawals. Conversely, if the opposite is true and the converted funds would be taxed at a lower rate upon withdrawal in the future, then it makes more sense not to convert.

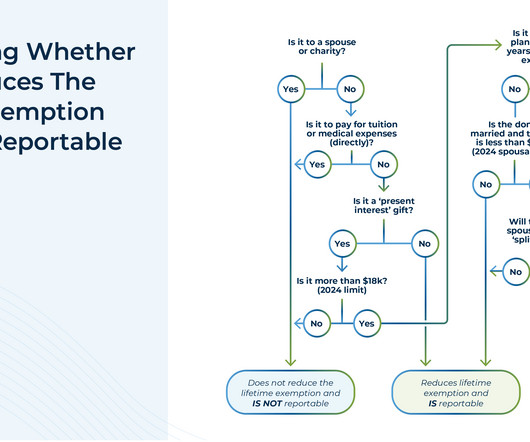

Nerd's Eye View

OCTOBER 9, 2024

While all gifts could technically be considered taxable to the donor, the annual gift tax exclusion (currently at $18,000) provides for a practical allowance that makes it unnecessary to track and report every small gift (because no one wants to spend time accounting for the value of birthday gifts like bikes, books, or cash!).

Abnormal Returns

JUNE 18, 2024

caia.org) How much in taxes have private equity fund managers avoided through carried interest? (papers.ssrn.com) Comparing the (real) volatility of private equity and private credit. alphaarchitect.com) Secondary PE investments are a necessary part of the system. ft.com) Research Does it matter what time zone your stocks trade in?

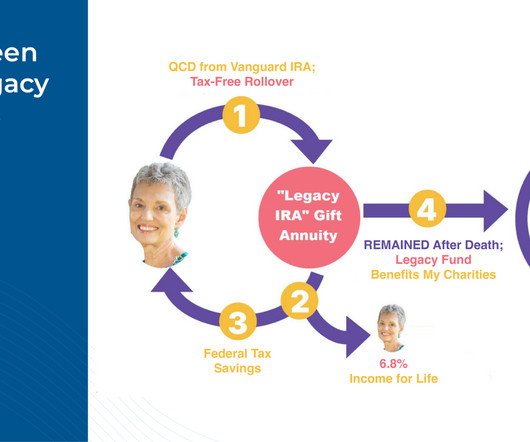

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Wealth Management

OCTOBER 20, 2022

Municipal bonds are a relatively safe investment with tax-free interest that gives them an advantage over other fixed-income assets.

Abnormal Returns

AUGUST 26, 2024

kitces.com) Matt Zeigler talks with Eben Burr of Toews Asset Management about his unique path through the industry. riaintel.com) Why Ryan Eisenman co-founded alternative asset data provider Arch. youtube.com) Family offices A Q&A with Heather Flanagan, head of family office services at Wealthspire Advisors. citywire.com)

Wealth Management

OCTOBER 19, 2023

The RIA firm acquires an Indiana-based team of 10, including three CPAs, and around $100 million in managed assets.

Wealth Management

JULY 27, 2023

Private letter ruling examines how to effectively consolidate through a Section 507(b)(2) transfer.

Wealth Management

AUGUST 16, 2023

The call for feedback touches on policies that, if changed, would likely impact the flow of crypto gifts to nonprofits.

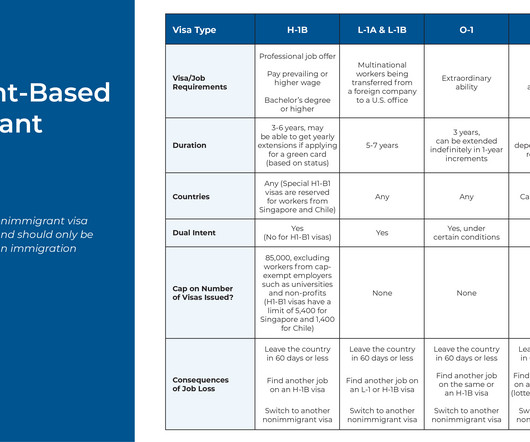

Nerd's Eye View

MAY 17, 2023

that incentivizes saving for these goals for American citizens – namely with tax-advantaged accounts such as 401(k) plans, IRAs, 529 college savings plans, and Health Savings Accounts (HSAs) – can impose hurdles on foreign nationals who rely on them for their own savings needs. However, the system in the U.S.

The Big Picture

JANUARY 24, 2024

At the Money: How to Pay Less Capital Gains Taxes (January 24, 2024) We’re coming up on tax season, after a banner year for stocks. Successful investors could be looking at a big tax bill from the US government. On this episode of At the Money, we look at direct indexing as a way to manage capital gains taxes.

Nerd's Eye View

JANUARY 21, 2025

Daniel is the CEO of WMGNA, a hybrid advisory firm based in Farmington, Connecticut, that oversees approximately $270 million in assets under management for 200 client households.

Abnormal Returns

AUGUST 5, 2022

rajivsethi.substack.com) What would a tax on stock buybacks mean? (techcrunch.com) Finance KKR ($KKR) wants to win more IPO business. wsj.com) The CFTC is looking to close down prediction market PredictIt. marginalrevolution.com) Stuff The value of NFL franchises just keeps going up. sportico.com) Boatsetter is Airbnb ($ABNB) for boats.

Nerd's Eye View

SEPTEMBER 6, 2023

While asset protection is a popular planning topic for High-Net-Worth (HNW) and ultra-high-net-worth clients, those who are not HNW are susceptible to the same threats to wealth. Notably, certain client assets have built-in creditor protection without the use of (often expensive) products or tools.

Wealth Management

FEBRUARY 22, 2023

During the fourth quarter of 2022, 66 independent financial professionals affiliated with the tax-centric broker/dealer.

Nerd's Eye View

AUGUST 23, 2023

However, the caveat with current CGAs has been that they could only be funded with after-tax dollars before the donor’s death, meaning that if an individual only had tax-deferred funds (e.g., Second, they reduce the donor's tax bill in the year the CGA is created by excluding the amount contributed to the CGA from taxable income.

Wealth Management

JANUARY 30, 2023

Taxpayers would have to pay annual taxes on asset values rather than income.

Wealth Management

JANUARY 21, 2025

Hill Investment Group is planning a February debut for the Longview Advantage ETF (ticker EBI), which will start trading with an estimated $500 million of assets.

Wealth Management

FEBRUARY 29, 2024

There isn’t a way to make K-1s shorter or less complex. But advisors and clients can cut down on their workload by “bringing organization to the chaos of chasing down K-1s”, says Arch co-founder Ryan Eisenman.

The Big Picture

APRIL 3, 2023

The asset value peak was $33.6 Given the rough year markets had in 2022, including all of the held asset classes, it is an impressive, albeit curious showing. The group also names 2022’s Best of, including Fund, Asset Class, Region, and Industry of the Year (all found here ). Its an amazing collection of charts and data.

The Big Picture

AUGUST 20, 2024

The transcript from this week’s, MiB: Mike Greene, Simplify Asset Management , is below. We have to pay attention to this, and we have to understand why this is potentially a risky asset. Precisely because we look at it and we’re like, wait a second, if this risk goes wrong, not only do I lose my assets, but I lose my job.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

The Big Picture

SEPTEMBER 28, 2022

What is in your control : Your Portfolio : You want to create something robust enough to withstand drawdowns and recessions; not necessarily the best possible set of assets but the ones you can live with day in and day out. This includes a broad Asset Allocation including full Diversification of asset classes, geographies, etc.

Abnormal Returns

APRIL 15, 2024

standarddeviationspod.com) Christine Benz and Amy Arnott talk asset allocation and more with Matt Krantz. riabiz.com) Retirement accounts On the downside of holding non-traditional assets in an IRA. investmentnews.com) Why funds in pre-tax retirement accounts need to be adjusted for taxes.

The Big Picture

DECEMBER 4, 2024

Would you like to diversify but also defer paying big capital gains taxes? I’m Barry Ritholtz and on today’s edition of at the money we’re going to discuss how to manage concentrated equity positions with an eye towards diversification and managing big capital gains taxes. None of these solutions are optimal.

Wealth Management

FEBRUARY 15, 2023

For people with crypto assets trapped on bankrupt platforms, the possibility they’ll have to pay the IRS is another blow.

Abnormal Returns

APRIL 23, 2023

abnormalreturns.com) Just in time for tax day, a custom indexing linkfest! wealthmanagement.com) Short duration assets, like CDs, look good right now, but they do have risks. tonyisola.com) Ten years of live numbers on a tax-loss harvesting program. Also on the site Ramit Sethi teaches you how to spend money.

Abnormal Returns

DECEMBER 19, 2023

alphaarchitect.com) The high quality anomaly shows up across asset classes. indexologyblog.com) Inflation makes tax efficiency all the more important. aqr.com) Reinsurance returns are not surprisingly uncorrelated with traditional asset classes. Factors Timing returns factors is tempting, but difficult in practice.

Abnormal Returns

DECEMBER 5, 2023

Active management Active investing has a tax problem. hamiltonlane.com) Portfolio managers love to shift blame for underperforming assets. papers.ssrn.com) Convenience yield, or why collectibles should have a lower return than traditional financial assets. insights.finominal.com) Factors What happened to the momentum effect?

The Big Picture

APRIL 11, 2024

And even still, fund fees and taxes remained a major cost element. They slowly accumulated some assets, but hardly moved the needle on Wall Street. In 1978, Congress enacted Internal Revenue Code Section 401(k), which allowed tax-deferred savings through a company-administered plan. Lots of other active managers did well.

Wealth Management

SEPTEMBER 7, 2022

The 990-T form involved in the incident is used by both tax-exempt groups and individuals with some retirement accounts invested in certain assets, including master limited partnerships and real-estate investment trusts.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content