Transcript: Heather Brilliant, Diamond Hill

The Big Picture

SEPTEMBER 3, 2024

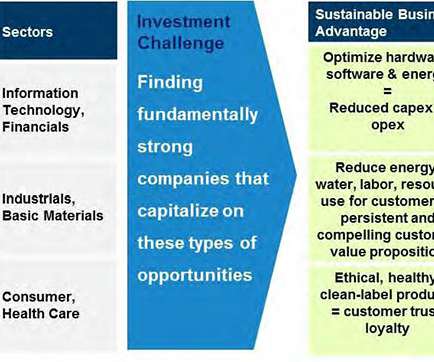

So, so you’ve held analyst roles and a number of asset managers. And so I had a lot of contacts in Australia at that point, and one of them was the CEO of what was at the time called Colonial First State Global Asset Management. But there’s always gotta be some element of the valuation really being compelling.

Let's personalize your content