Orion Acquires Summit Wealth Systems To Become Its Next-Generation All-In-One Portal (And More Of The Latest In Financial #AdvisorTech – January 2025)

Nerd's Eye View

JANUARY 6, 2025

FINNY AI, an AI-powered prospecting tool, has raised $4.2

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JANUARY 6, 2025

FINNY AI, an AI-powered prospecting tool, has raised $4.2

Abnormal Returns

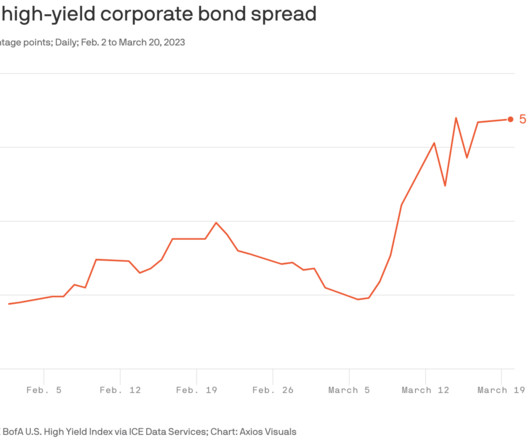

MARCH 21, 2023

mr-stingy.com) Finance Banks may have to re-think deposit velocity going forward. bloomberg.com) Ten reasons why SVB failed including 'The whole banking system is a bizarre confidence trick.' riabiz.com) Josh Brown and Michael Batnick talk with Jesse Eisinger of ProPublica about Credit Suisse, regional banks, and insider trading.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

The Big Picture

MAY 8, 2024

. ~~~ About this week’s guest: Andrew Slimmon is Managing Director at Morgan Stanley Investment Management, and leads the Applied Equity Advisors team; he serves as Senior Portfolio Manager for all long equity strategies. The number is probably a lot lower than you think. What exactly is a concentrated portfolio?

Good Financial Cents

JANUARY 11, 2023

A career in a major bank can be both rewarding and well-paying, with top positions garnering income of hundreds of thousands or even millions of dollars annually. For example, investment bankers are near the top of the list, often working for large investment banks like Goldman Sachs or Morgan Stanley. About the Banking Industry.

The Big Picture

MAY 9, 2023

He is the Chief Investment Officer of Asset and Wealth Management at Goldman Sachs. He’s a member of the management committee. He co-chairs a number of the asset management investment committees. Investment banks were not really a known concept in the area where I grew up. So I got to know banks a little bit.

The Big Picture

AUGUST 16, 2022

And if you’re able to do that in a diverse number of markets and asset classes, while managing risk in the markets that aren’t trending, you know, that’s in general how trend following works. So if you could say that the maximum size of a trend was, say, 100, maybe you might capture 60% or 70% of that trend.

The Big Picture

NOVEMBER 2, 2023

Vice ) • At Fidelity, AI Provides Extra Eyes to Spot Red Flags : The artificial intelligence application Saifr uses natural language processing to help portfolio managers, sales and other staff review public-facing communication. ” The book is a hilarious deep dive into the many characters and scammers that have beset crypto.

The Big Picture

MARCH 25, 2025

And the, you know, obviously just my personal opinion, but I think at that particular point in time, all of the investment banks were bankrupt or insolvent. And, and I kind of raised my hand and said, dad, uncle John, don’t you think it might be a better idea to look at it by the numbers? The numbers are pretty bad.

The Big Picture

JANUARY 21, 2025

I was born in London and when I was three and a half, my father got a job for the World Bank in Washington DC So we all moved to Washington DC Then just before my 10th birthday, my father was posted to Bangladesh for four years. And a, a number of things happened. Where, where did you grow up? Jonathan Clements : Both places.

The Big Picture

SEPTEMBER 3, 2024

They are a publicly traded investment manager, stocks symbol DHIL, that have been public since day one since 2016. They do a number of things at Diamond Hill that many other investment shops don’t. Heather Brilliant : I worked at Bank of America and, and they had a wonderful corporate finance training program.

The Big Picture

JANUARY 16, 2024

She has had a number of different positions within PIM, including managing their flagship core real estate fund. Before she moved into management, she has been on all of the big lists. I worked in sort of a quasi portfolio management role for like a single client account type business. I had two stops before then.

The Big Picture

DECEMBER 19, 2023

There are about 13 different portfolio managers each focused on a different sub-sector. They run long short across each of these, and they’ve put up some pretty impressive numbers over the past couple of years. Most, most of the kids that were going into banking at that time already had their jobs. No, no overlap.

The Big Picture

FEBRUARY 12, 2024

And since that happened, I don’t know, about four or five years ago, the fund has been putting up great numbers, outperforming doing really, really well. They could put me running a grain elevator, gosh knows where I interviewed with consulting companies and banking companies. So we need 15, 20% cash flow type of type of numbers.

David Nelson

JULY 18, 2022

As an analyst and on the line portfolio manager I can tell you that estimate revision is one of the more successful factors in stock selection. Coming into the year the glass was half full as banks were expected to be a direct beneficiary of FOMC rate hikes to bring down inflation expectations. Data by Bloomberg.

Good Financial Cents

FEBRUARY 15, 2023

Investment management companies – firms that provide individual portfolio management and may work with other investment companies. Robo-advisors, in particular, have democratized investment management. Outstanding customer service, including a large number of local branch offices. Highly regarded trading platform.

Good Financial Cents

JUNE 11, 2023

One thing that I have craved for investors is a tool that allows you to sync all your financial accounts – your investment portfolio, checking and savings accounts, credit cards and other loan accounts – in one place, and then provides an investment-related analysis of your entire portfolio.

The Big Picture

JULY 11, 2023

JOHNSON: And then I moved into, we had a bank at the time, and I moved into running part of the bank. RITHOLTZ: So Franklin obviously divests out of the banking business, the credit card business, the auto financing business. Did you guys just say, we really want to be pure investment management? RITHOLTZ: Right.

The Big Picture

DECEMBER 6, 2022

So, yeah, I had a career in investment banking with Jefferies, and it was a really good professional experience because I do have the opportunity to work in M&A, equity and debt financing. I had the chance to be part of some very interesting transactions in the banking space. I was employee number 10. billion deal.

The Big Picture

OCTOBER 31, 2023

And now we have a number of different hedge funds, some we have in the macro, we have multi-Strat, we have point hedge funds with in technology in the healthcare field. Where, 00:06:25 [Speaker Changed] Where were you managing those for in 96? Do do we care about round numbers like a hundred million or 500 million in sales?

Clever Girl Finance

SEPTEMBER 11, 2023

For instance, its robo-advisory service simplifies portfolio management, and the educational content helps beginners grasp trading basics. Merrill Edge Merrill Edge is the online brokerage of Bank of America. Preferred rewards program BofA members who enroll in preferred rewards get banking benefits (e.g.

The Big Picture

AUGUST 29, 2023

And it worked out and had multiple job offers coming out of school from a number of different insurance companies. I had a number of relationships that I built up and had another job lined up in New York City. DAVIS: So when we think about how those teams are evaluated, it’s a three-year number. So how did you perform?

The Big Picture

OCTOBER 8, 2024

And actually, interestingly, Joe was director of research there for a number of years before I moved on to start Perceptive. I was an analyst there for two years and then when a opportunity opened up for an internal promotion to portfolio manager in the beginning of 2017, they, they promoted me to that seat.

The Big Picture

DECEMBER 28, 2022

But a money market fund was sure to be a winner compared to the bank CDs that were limited by regulation to 5% interest. All you had to do as a money market fund manager is buying the standard stuff, Treasury bills, commercial paper and the like. This is plain vanilla on some money market fund. RITHOLTZ: Wow.

Aleph

JANUARY 21, 2023

Jan 19, 2023 Looming Twitter interest payment leaves Elon Musk with unpalatable options [link] If Twitter is worth no more than $15B at best, then basically the banks will own it, unless Musk tries to fold it into $TSLA, or some recapitalization that spreads the pain Jan 17, 2023 Odds and Ends California Has a Gas-Price Mystery: Too High, But Why?

Good Financial Cents

AUGUST 11, 2022

Robo-advisors offer easy account setup, robust goal planning, account services, and portfolio management all at a reasonable price - start investing today by clicking on your state. You can get some fiercely competitive interest rates by opening your savings account or CD with an online bank like Capital One 360 and CIT Bank.

The Big Picture

MARCH 7, 2023

And all these questions that I was trying to answer had direct applications to hedge fund strategies and portfolio management. How do you crunch the numbers on that, and where do you come out on small cap and value? Another the great lesson, and I was still a global macro portfolio manager with my own silo at SAC Capital.

Bell Investment Advisors

JUNE 29, 2023

I’m joined here today by Ryan Kelley, Lead Portfolio Manager and Research Analyst for Bell. All these numbers are as of June 16. It was almost the same number when I checked this on the 16th. But before we go there, maybe a couple of comments about the banking crisis that occurred earlier this year in March.

Brown Advisory

JUNE 3, 2015

Visa has embarked on a project of “financial inclusion’’ by providing savings, credit and payment services via mobile phones to people in emerging markets with little or no access to banks. Visa is working with the government of Rwanda to link banks in a global system accessible with mobile phones. An Expanding Toolkit.

Brown Advisory

MAY 12, 2020

Mick Dillon and Bertie Thomson, portfolio managers of the strategy, are keenly aware of the events that have disrupted markets over the last five years, yet equally aware of the risk to the portfolio if they let those events distract them from their research and investment decisions. “We We call this the win-win.”

Brown Advisory

MAY 12, 2020

Mick Dillon and Bertie Thomson, portfolio managers of the strategy, are keenly aware of the events that have disrupted markets over the last five years, yet equally aware of the risk to the portfolio if they let those events distract them from their research and investment decisions. “We We call this the win-win.”.

The Big Picture

JULY 18, 2023

BARRY RITHOLTZ, HOST, MASTERS IN BUSINESS: This week on the podcast, I have an extra special guest, Tom Wagner, co-founder and portfolio manager at Knighthead Capital. If you jump into a First Republic Bank a little early, well your early is the same as wrong. WAGNER: You know there are a number of things that occurred.

The Big Picture

OCTOBER 17, 2023

Graham Foster] : 00:02:54 That was a number, that was number theory, pure number theory. And whether it’s all numbers or even numbers. Some people look at a casino as entertainment and hey, we’re gonna spend X dollars, pick a number, 500, 2000, whatever it is. Number one, longevity.

The Big Picture

MAY 23, 2023

GREW: So, I got a call and this one was ultimately from a recruiter who’s working for Lehman Brothers, an investment bank, a bond house. In part because I again benefited from being in the mix when we were the second bank that was raided by the Japanese regulators after they’d gone into Credit Suisse. RITHOLTZ: Right.

The Big Picture

JULY 24, 2023

I started my career as a bank teller, but fell in love with markets. MIAN: So Stray Reflections is a macro advisory and community that works with portfolio managers, CIOs around the world. RITHOLTZ: You had 1987, you had 1997, you had 1998 there were a number of really substantial. Tell us a little bit about that.

Trade Brains

SEPTEMBER 14, 2024

Fund Management includes managing debt funds and providing portfolio management services. It uses data-driven risk management and credit underwriting processes. Despite competition from banks, NBFC profitability is improving. Placements involve structuring and syndicating financing for originator partners.

Trade Brains

MARCH 8, 2024

Angel One Vs Motilal Oswal The number of retail investors in India has boomed in recent years with the onset of the pandemic. With a commitment to providing end-to-end digital financial solutions, the company has also ventured into portfolio management services. million clients.

The Big Picture

NOVEMBER 14, 2023

She has run a number of firms and a number of divisions at large firms and traced a career arc that’s just very unusual compared to the typical person in finance. Eventually leading her to a point where she’s managing quants, running about a hundred billion dollars in assets. Have you thought about it?

Trade Brains

SEPTEMBER 16, 2023

Mutual Funds: A mutual fund is a pool of investment collected from a large number of investors to invest their money in different types of financial assets such as stocks, bonds, etc. Gold: Investment in Gold is a typical age-old asset class used in India for long-term investment and capital appreciation.

ClearMoney

JANUARY 4, 2022

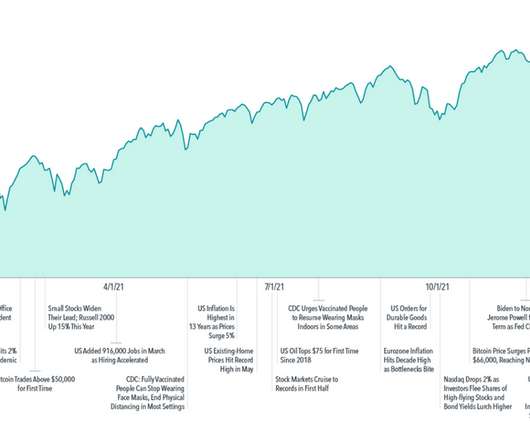

In addition to the effective vaccines, markets were buoyed by a number of other positive developments, including strong corporate earnings and increased consumer demand. Concentrating your portfolio in a few hot stocks or cryptocurrencies—like focusing on any small number of holdings—can expose investors to substantial risk.

Brown Advisory

SEPTEMBER 3, 2015

Central bank stimulus. The European Central Bank in March, aiming to push down borrowing costs, began monthly purchases of bonds totaling 60 billion euros ($68 billion). Regional banks have had time to insulate themselves from a departure by Greece. By Stephen Shutz, CFA, Tax-Exempt Portfolio Manager.

Investment Writing

NOVEMBER 20, 2024

For example, “A number of good things happened last year, but let’s first get the bad news out of the way,” he says on page 3 of his 2012 shareholder letter (PDF). Yet the report is widely discussed by sophisticated financial professionals. I’ve never heard anyone call Warren Buffet dumb because of the way he writes.

Brown Advisory

OCTOBER 1, 2015

Similar trends are evident in other parts of the world, and of course central banks everywhere are attempting to stimulate demand in order to revive inflation, in part because today’s high debt loads are easier to pay down when currencies become cheaper. banks, according to the World Bank. Worries in Shanghai.

The Big Picture

JULY 19, 2022

So, first, I found the book to be quite fascinating, very in depth and you managed to take some of the more technical arcana and make it very understandable. You began as a central bank portfolio manager in Finland. So, that relationship actually already started when I was a portfolio manager, right?

WiserAdvisor

AUGUST 18, 2022

Compare different mutual funds based on their returns, exit loads, asset allocation, standard deviation, expense ratios, portfolios, management style, Sharpe ratios, and more. To do so, first, you should conduct an investment analysis of your short-listed mutual funds. There is no right or wrong approach here.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content