Current Market Risks and Your Retirement

Integrity Financial Planning

MARCH 28, 2023

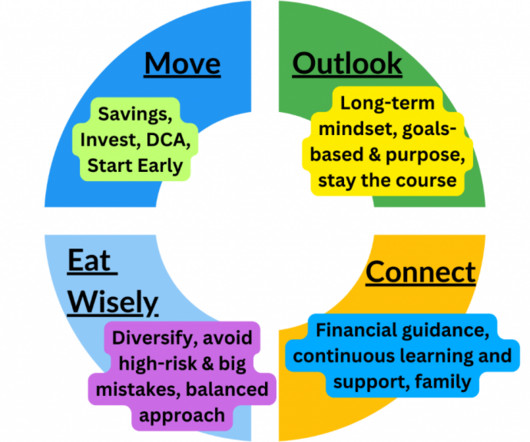

Because of the pandemic, we have seen massive changes in how the market behaves, and we are having to readjust how we approach retirement planning. If you are looking for financial guidance in these uncertain times, reach out to us for a complimentary review of your finances. [1-4]

Let's personalize your content