A Timeline Of Financial Markets

The Big Picture

MAY 1, 2023

I’ve included some samples below , but you should go check out the Timeline in its entirety… ~~~ Joseph de la Vega wrote the first ever behavioral finance book in 17th century Holland.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Big Picture

MAY 1, 2023

I’ve included some samples below , but you should go check out the Timeline in its entirety… ~~~ Joseph de la Vega wrote the first ever behavioral finance book in 17th century Holland.

Abnormal Returns

MARCH 7, 2025

podcasts.apple.com) Finance Dave Nadig talks with Barry Ritholtz about his new book "How Not to Invest." youtube.com) Joe Weisenthal and Tracy Alloway talk efficient markets with Eugene Fama and David Booth. AI Shane Parrish talks AI with Josh Wolfe, co-founder and managing partner of Lux Capital.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Abnormal Returns

MARCH 31, 2024

wsj.com) Gary Stevenson’s book “The Trading Game” helps explain the past twenty years in the financial markets. (capitalspectator.com) What will it take for small caps to outperform? ft.com) What it takes to add an EV charger in your garage. klementoninvesting.substack.com) There are no guarantees in life. Risk is everywhere.

The Big Picture

OCTOBER 29, 2022

A list of his favorite books is here; A transcript of our conversation is available here this week. Chancellor is the author of “ Devil Take the Hindmost: A History of Financial Speculation.” His new book “ The Price of Time: The Real Story of Interest ” is a nominee for FT’s 2022 Business Book of the Year.

Wealth Management

APRIL 4, 2023

It was quite the decade for financial markets and one that will go down in the history books.

Abnormal Returns

MARCH 26, 2024

wsj.com) Books Gary Stevenson’s book “The Trading Game” helps explain the past twenty years in the financial markets. klementoninvesting.substack.com) What you can learn from Carrie Sun's new book “Private Equity: A Memoir.” (capitalspectator.com) Higher for longer is helping to push Treasury yields higher.

The Big Picture

SEPTEMBER 9, 2023

McAuliffe has a unique track record of successful innovation applying statistical methods to real-life prediction problems, particularly in the financial markets. A list of his favorite books is here ; A transcript of our conversation is available here Tuesday.

Abnormal Returns

JANUARY 1, 2023

crossingwallstreet.com) The best books Ben read in 2022 including "Die With Zero" by Bill Perkins. topdowncharts.substack.com) Six things that don't change in financial markets including the attraction of 'shiny objects.' (abnormalreturns.com) Top clicks this week Here is Eddy's 2023 Buy List.

The Big Picture

APRIL 22, 2023

A list of his favorite books is here ; A transcript of our conversation is available here Tuesday. There are substantial restrictions and non-competes created by the largest Broker Dealers many of which have been overturned by “right-to-work” states.

Abnormal Returns

JANUARY 30, 2023

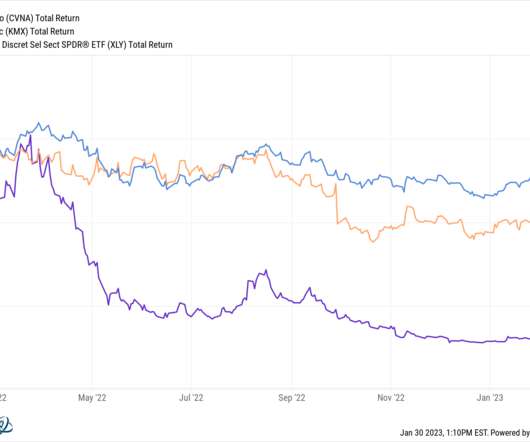

nytimes.com) Funds How the launch of the SPDR S&P 500 ETF Trust ($SPY) changed financial markets. axios.com) Five insights from Max Fisher's new book, "The Chaos Machine: The Inside Story of How Social Media Rewired Our Minds and Our World." (nytimes.com) How layoffs.fyi became the go-to site for data on tech layoffs.

The Big Picture

DECEMBER 23, 2023

A list of his favorite books is here ; A transcript of our conversation is available here this week. Pring Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications by John J.

Abnormal Returns

NOVEMBER 3, 2022

(morningstar.com) How signaling happens in the options market. theatlantic.com) The big book publishers don't really launch new, important authors any more. abnormalreturns.com) Why rough edges remain in financial markets: people. abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking?

Trade Brains

FEBRUARY 21, 2024

The company’s total outstanding order book as of 31st January 2024 stands at a whopping amount of Rs 76,000 crores. This article takes a closer look at BEL’s journey, exploring the company’s business, the turnover breakup of the company, order book status, the recent big orders the company received, and future outlook.

The Big Picture

MARCH 7, 2023

Barron’s ) • Loose Monetary Policy and Financial Instability. Fed working paper finds that long periods of easy money leads to financial instability. This may not be surprising to financial market participants, but this is the first time I have seen a Fed working paper coming to this conclusion.

The Big Picture

FEBRUARY 16, 2024

He guided the NYFed in providing support to financial markets and administering “stress tests” to banks — at a time when banks like Citi and Morgan Stanley were under enormous pressure — a very large job in the Spring of 2009. He describes that as a turning point in the banking crisis.

A Wealth of Common Sense

SEPTEMBER 3, 2023

I love studying financial market history. If you look back at enough charts and read enough books about market history, you’re invariably drawn to the booms and busts. And looking into the booms and busts makes you look at certain dates and outlier events.

The Big Picture

MARCH 20, 2023

This is why rescuing them is so infuriating: “This inequity is especially galling to those of us who work in the financial markets. But those people and companies who are bailed out do not. Wall Street has long been a brutal meritocracy. billion dollar rescue of Chrysler in 1980, followed by Continental Illinois Bank in 1984 ($1.8

Abnormal Returns

NOVEMBER 4, 2022

amycastor.com) Books Five insights from Edward Chancellor's new book "The Price of Time: The Real Story of Interest." nextbigideaclub.com) Tyler Cowen recommends Jon Hilsenrath's new book "The Trailblazing Economist Who Navigated an Era of Upheaval." abnormalreturns.com) Why rough edges remain in financial markets: people.

The Big Picture

FEBRUARY 7, 2024

He co-hosts the Behind the Markets podcast with Wharton finance Professor Jeremy Siegel and has helped update and revise Siegel’s Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies. So his own portfolio started selling the S&P 500 and buying value.

Investment Writing

JUNE 17, 2024

The anti-clutter commenter mentioned The Associated Press Style Book , which says: Use of the hyphen is far from standardized. The post “High net worth” in your financial marketing appeared first on Susan Weiner Investment Writing. “Using two hyphens in a three-word modifier feels like overdoing it.” “I

Indigo Marketing Agency

MARCH 20, 2025

Recession Concerns & Market Volatility: How Financial Advisors Should Communicate With Clients As financial advisors , youre well aware that so far the 2025 financial market has been more unpredictable than a toddler. How can financial advisors get custom content for their clients?

The Big Picture

NOVEMBER 20, 2023

His book What Investors Really Want delves deeply into that topic. As it turns out, investors are motivated not just by financial returns, but also by the “expressive and emotional benefits” their capital can have. 3 Meir Statman has spent his career researching how investor psychology impacts their behavior.

Truemind Capital

AUGUST 12, 2023

Other Asset Classes : After a strong rally, Gold cooled off in Q1FY24 on the back of profit booking and shifting focus towards equity. CONNECT WITH TRUEMIND ADVISOR The post Financial Market Round-Up – Jul’23 appeared first on Investment Blog. You can write to us at connect@truemindcapital.com or call us at 9999505324.

Abnormal Returns

OCTOBER 23, 2022

(nytimes.com) Pyramid of Lies - Duncan Mavin's book on the Greensill Capital debacle "Pyramid of Lies" is 'great.' statnews.com) BlackRock’s ($BLK) financial markets advisory group has become a go-to resource for governments. abnormalreturns.com) Celebrating our 17th blogiversary and a book giveaway.

Abnormal Returns

NOVEMBER 6, 2022

ben-evans.com) Unreasonable Hospitality Will Guidara talks about his book "Unreasonable Hospitality: The Remarkable Power of Giving People More Than They Expect." abnormalreturns.com) Why rough edges remain in financial markets: people. abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking?

Trade Brains

SEPTEMBER 28, 2023

Over the years, the company’s order book has been increasing its proportion of public orders. As of now, the order book stands at 70% Public orders worth Rs. Market Cap (Cr.) Cr Price to Book Value 1.33 Market Cap (Cr.) Cr Price to Book Value 1.33 Particulars Amount Particulars Amount CMP 781 Market Cap (Cr.)

Discipline Funds

JANUARY 21, 2025

As companies stay private longer and the private equity markets grow the public markets are increasingly becoming a place where people gamble and engage in negative sum games that they may not understand as inherently negative sum.

Discipline Funds

FEBRUARY 28, 2025

Buffett said: Having loads of liquidity lets us sleep well … during episodes of financial chaos that occasionally erupt in our economy, we will be equipped both financially and emotionally to play offense while others scramble for survival. But why is Buffett able to remain so persistently aggressive?

The Big Picture

AUGUST 8, 2022

ADMATI: So, in the book, we go through a lot of the history of banking, including the basic banking model, which is sort of it’s a wonderful life kind of 363 boring banking model and that too had a crisis in savings and loan and in many other banking crisis. Just hundreds of billions of dollars and misrepresenting their books ….

Trade Brains

JULY 28, 2023

Best Low PE Penny Stocks #1 – BN Rathi Securities BN Rathi Securities Ltd is a stock broking firm that provides integrated services including the entire spectrum of activities relating to financial market transactions. Particulars Data Particulars Data CMP (In Rs) 42 Market Cap (in Rs Crs) 35 Stock P/E 4.4 ROE (in %) 19.3

Midstream Marketing

AUGUST 13, 2024

Providing useful content, like market updates or guides for financial planning, is a good idea too. This encourages people to visit your website, book a consultation, or learn more about your services. When you send real marketing materials straight to their mailboxes, it makes a strong impression.

Trade Brains

NOVEMBER 30, 2023

Best NBFC Stocks in India : Non-Banking Financial Institutions or NBFCs for short are Companies that almost function like a bank. They are free to lend to the public as well as borrow from the financial markets. Bajaj Finance increased its loan book by over 2.96 Market Cap (Cr.) Market Cap (Cr.) Raja, and T.

Trade Brains

SEPTEMBER 17, 2023

Here are the 5 Indian stocks in which Goldman Sachs has highest holdings: Top Indian Stocks Held By Goldman Sachs Top Indian Stocks Held By Goldman Sachs #1 – Gokaldas Exports Particulars Amount Particulars Amount CMP 780 Market Cap (Cr.) Cr Price to Book Value 5.35 Market Cap (Cr.) Cr Price to Book Value 4.49

Trade Brains

OCTOBER 1, 2023

Market Cap (Cr.) ₹ 99,449 Cr EPS 4.32 RoE 22.49 % RoCE 30.15 % Promoter Holding 51.14% FII Holding 17.35% Debt to Equity - Price to Book Value 6.91 As of April 01, 2023, the company’s order book position stood at ₹60,690 Crores. Market Cap (Cr.) ₹ 51,536 Cr EPS 12.61 Price to Book Value 7.43 Stock P/E 31.5

Trade Brains

OCTOBER 2, 2023

Market Cap (Cr.) ₹ 1,239.74 Price to Book Value 2.83 Net Profit Margin 13.30% Operating Margin 20.77% The company financials show that the company increased its revenue from ₹ 339.15 Currently, the company has a price-to-book value of 2.83 Market Cap (Cr.) Promoter Holding 74% Price to Book Value 2.51

Trade Brains

APRIL 12, 2023

Best Small Cap Stocks Under Rs 100 #1 – Rail Vikas Nigam CMP ₹74 Market Cap (Cr.) Book Value ₹33.7 Price to Book Value 2.2 and presently trades at a price-to-book value (P/B) ratio of 2.2. Best Small Cap Stocks Under Rs 100 #2 – HFCL CMP ₹63 Market Cap (Cr.) Book Value ₹21.1 Book Value ₹33.9

Trade Brains

JANUARY 12, 2024

Market Cap (Cr.) ₹ 37,618 EPS (TTM) ₹ 83.32 RoE (%) 27.07% RoCE (%) 29.71% Book Value per Share ₹ 523.53 Price to Book Value 5.52 Market Cap (Cr.) ₹ 33,226 EPS (TTM) ₹ 58.50 Price to Book Value 6.89 Particulars Amount Particulars Amount CMP ₹ 1,105 Market Cap (Cr.) Price to Book Value 1.15

Trade Brains

AUGUST 13, 2023

Market Cap (Cr.) Promoter Holding 31% Book Value ₹22 Debt to Equity 0.01 Price to Book Value 3.30 Best Debt Free Penny Stocks in India #2 – Rajoo Engineers Particulars Amount Particulars Amount CMP ₹53 Market Cap (Cr.) Promoter Holding 66% Book Value ₹17 Debt to Equity 0.01 Price to Book Value 2.89

Trade Brains

SEPTEMBER 7, 2022

177 Market Cap (Rs. Book Value (Rs.) Price to Book 1.2 167 Market Cap (Rs. Book Value (Rs.) Price to Book 2.9 149 Market Cap (Rs. Book Value (Rs.) Stock P/E 574 Price to Book 6.0 160 Market Cap (Rs. Book Value (Rs.) Price to Book 20.8 192 Market Cap (Rs.

Trade Brains

JUNE 11, 2023

Market Cap (Cr) Rs 13,887.9 Book Value 35.2 Price to Book Value 1.2 Market Cap (Cr) Rs 41,714.67 Book Value 31.3 Price to Book Value 1 Dividend Yield 4.34 Market Cap (Cr) Rs 43,153.17 Book Value 37.61 Price to Book Value 1.13 Market Cap (Cr) Rs 1,024.28 Book Value 32.12

Trade Brains

JULY 31, 2023

Best Debt Free Large Cap Stocks #1 – Tata Consultancy Services (TCS) Particulars Amount Particulars Amount CMP ₹3,411 Market Cap (Cr.) 12,27,739 EPS ₹115 Stock P/E 28 RoE 47% RoCE 59% Promoter Holding 72% Book Value ₹247 Debt to Equity 0.09 Price to Book Value 13.40 Price to Book Value 8.58 Price to Book Value 4.94

Trade Brains

AUGUST 11, 2023

Best Penny Stocks with High Net Profit Margin #1 – Swadeshi Polytex Particulars Amount Particulars Amount CMP ₹47 Market Cap (Cr.) EPS ₹9 Stock P/E 5 RoE 389% RoCE 482% Promoter Holding 66% Book Value ₹7 Debt to Equity 0.00 Price to Book Value 6.00 Market Cap (Cr.) Book Value ₹118 Debt to Equity 0.10

Trade Brains

JUNE 23, 2023

Financials Of SAIL: CMP ₹ 84.0 Market Cap (Cr.) ₹ 35,241 EPS ₹ 5.27 Book Value ₹ 133 Promoter Holding 65.0 % Price to Book Value 0.65 Besides refining, they also market and distribute their oil products through over 58,000 customer touch-points and 34000 fuel stations in India. Financials Of IOCL CMP ₹ 91.9

Trade Brains

JULY 14, 2023

CMP (In Rs) 470 Market Cap (in Rs Crs) 5,87,698 Dividend Yield (%) 4.04 % Face Value (in Rs) 1 EPS (In Rs) 15.44 Promoter Holding 0 Book Value 49.51 Debt Equity Ratio 0 Price to Book Value 8.89 CMP (In Rs) 487 Market Cap (in Rs Crs) 33,022 Dividend Yield (%) 2.7 Promoter Holding (%) 45 Book Value (In Rs) 113.3

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content