Biden’s 2024 Green Book Tax Proposals

Wealth Management

MARCH 15, 2023

What “fair share” taxation means for estate planning.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 15, 2023

What “fair share” taxation means for estate planning.

Nerd's Eye View

OCTOBER 9, 2024

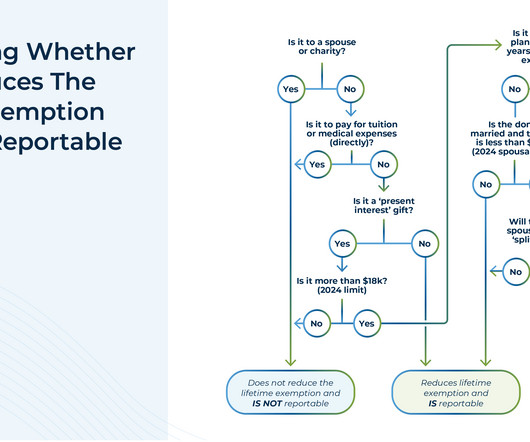

While all gifts could technically be considered taxable to the donor, the annual gift tax exclusion (currently at $18,000) provides for a practical allowance that makes it unnecessary to track and report every small gift (because no one wants to spend time accounting for the value of birthday gifts like bikes, books, or cash!).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

The Big Picture

MARCH 18, 2025

That insight greatly simplified my task of making the book both fun to read and helpful for anyone interested in investing. Here is a broad overview of each of the 10 main sections, which can help you quickly grasp the key ideas in the book. Be tax-aware. Bad Ideas : 1. Poor Advice : Why is there so much bad advice?

Abnormal Returns

DECEMBER 1, 2024

wsj.com) The Microstrategy ($MSTR) story will make for a great book one day. reason.com) Taxing unrealized capital gains is a bad idea. paragraph.xyz) Can adjusting the tax code help increase fertility? abnormalreturns.com) We are doing a Bluesky-themed book giveaway just in time for the holidays. Just ask Norway.

Abnormal Returns

DECEMBER 11, 2024

(podcasts.apple.com) Christine Benz and Jeff Ptak talk with Tom Idzorek and Paul Kaplan about their new book "Lifetime Financial Advice: A Personalized Optimal Multilevel Approach." sites.libsyn.com) Peter Lazaroff on some year-end tax strategies. wsj.com) Why some wealthy Americans simply fail to file their taxes.

Abnormal Returns

DECEMBER 25, 2024

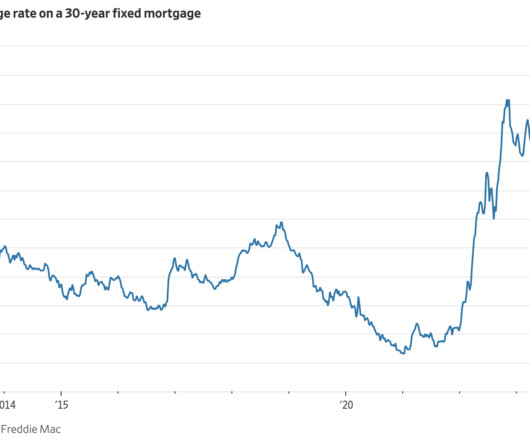

Podcasts Christine Benz talks with Daniel Crosby about his new book "The Soul of Wealth: 50 Reflections on Money and Meaning." podcast.moneywithkatie.com) Peter Lazaroff on how tax projections work. peterlazaroff.com) Housing Taxes and insurance are creeping up as a percentage of total home ownership costs.

Nerd's Eye View

JANUARY 20, 2025

There is no shortage of written content available for financial advisors to enhance their technical skills, grow in their careers, and run more successful planning practices, from books to research studies to long-form written content.

Abnormal Returns

MARCH 14, 2025

(fasterplease.substack.com) Policy Stephen Dubner talks tax myths with Jessica Riedl, a senior fellow in budget, tax, and economic policy at the Manhattan Institute. freakonomics.com) Laurence Kotlikoff talks with Prof. Richard Berner about the evisceration of financial oversight.

Nerd's Eye View

JULY 17, 2024

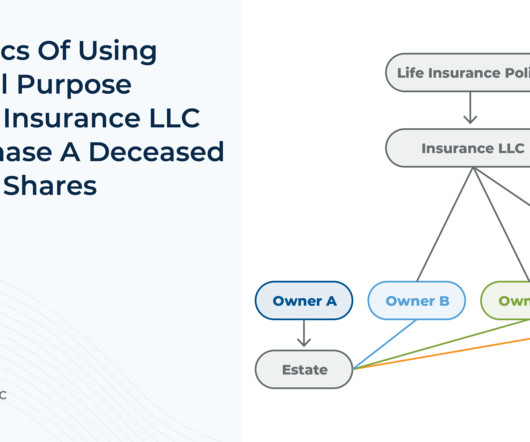

million estate tax threshold or for whom inclusion of the insurance proceeds would bump them over the threshold. And with the threshold scheduled to be reduced by 50% when the Tax Cuts & Jobs Act expires after 2025, many more business owners stand to be impacted by the Connelly decision in the near future. Read More.

Abnormal Returns

JANUARY 15, 2025

podcasts.apple.com) Retirement Retirement is a great time to do some creative tax planning. readthejointaccount.com) Taxes What you need to know about paying taxes on your crypto trading. awealthofcommonsense.com) The best retirement withdrawal strategy is one you can live with. sherwood.news) Direct File is expanding.

The Big Picture

MARCH 10, 2025

Question : “ Barry, your book How Not to Invest dissects numerous financial misconceptions. His brilliant insights colored lots of themes in my book, and Denominator Blindness is a perfect example. Q :“ Your book discusses emotional decision-making extensively. Here is the full-length Q&A discussion.

The Big Picture

JUNE 17, 2023

We discuss the Carried Interest tax loophole, a tax dodge that benefits a few 1000 people in the country but cost U.S. Senators Baldwin, Manchin, Brown have repeatedly introduced legislation to close the Carried Interest Tax Loophole but it remains stubbornly in place. taxpayers 180 billion dollars per decade.

Abnormal Returns

MARCH 24, 2025

crr.bc.edu) The widow tax is real. kitces.com) A Q&A with Barry Ritholtz author of the new book "How Not to Invest." (crr.bc.edu) What do (different) surveys tell us about well-being in retirement? thinkadvisor.com) Advisers The RIA model continues to take share. citywire.com) Flourish is buying Sora.

XY Planning Network

MARCH 3, 2025

Tax season is here, and it's crucial to be aware of the latest updates for 2024 to ensure you're compliant and maximize your returns. Tax law is an everchanging beast, with new rules and regulations being introduced every year. Professions are built around them, and the consequences of misreporting them can be hefty taxes from the IRS.

Abnormal Returns

FEBRUARY 12, 2025

youtube.com) Sahil Bloom Barry Ritholtz talks with Sahil Bloom author of the new book "The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life." ritholtz.com) Derek Thompson talks with Sahil Bloom author of the new book "The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life." Does it work?

Abnormal Returns

SEPTEMBER 18, 2024

talkingbillions.co) How to Retire A review of Christine Benz's new book “How to Retire: 20 Lessons for a Happy, Successful and Wealthy Retirement.” thefinancialbodyguard.com) There is a danger in jumping the gun on estate tax law changes. morningstar.com) George Kinder has a new book, “The Three Domains of Freedom.” cnbc.com)

Abnormal Returns

SEPTEMBER 8, 2024

awealthofcommonsense.com) Early in retirement is the time to do some tax planning. whitecoatinvestor.com) Three reasons to buy Josh Brown's new book "You Weren’t Supposed To See That." Don't let anyone tell you otherwise. wsj.com) Three reasons why the stock market declines. ritholtz.com) How pour-over coffee got so good.

Abnormal Returns

SEPTEMBER 25, 2024

(podcasts.apple.com) How to Retire Amy Arnott and Dan Lefkovitz talk with Christine Benz, about her new her book, "How to Retire: 20 Lessons for a Happy, Successful, and Wealthy Retirement." cameronhuddleston.com) Taxes Understanding the differences between marginal and effective tax rates.

Abnormal Returns

DECEMBER 9, 2024

kitces.com) Taxes Nvidia ($NVDA) CEO Jensen Wang and his wife have good estate attorneys. nytimes.com) Why some wealthy Americans deliberately fail to file their taxes. thinkadvisor.com) Ten books financial advisers should check out including "You Werent Supposed To See That: Secrets Every Investor Should Know" by Joshua Brown.

Abnormal Returns

FEBRUARY 7, 2025

fs.blog) Finance Hunter talks with Dan Rasmussen author of the new book "The Humble Investor: How to Find a Winning Edge in a Surprising World." lewisenterprises.blog) Eric Golden talks taxes and ETFs with Meb Faber, co-founder and CEO of Cambria Investments. podcasts.apple.com) Kim Mills talks with Prof.

Harness Wealth

JANUARY 10, 2025

Tax advice is a common topic on social media platforms like TikTok. Influencers promise easy ways to secure tax deductions, simplifying complex ideas into bite-sized claims that gloss over important details in the process. Can Hiring Your Children Help You Save on Taxes? Can You Claim Your Pet as a Tax Write-Off?

Nerd's Eye View

SEPTEMBER 20, 2024

Also in industry news this week: A coalition of organizations representing financial advisors is pressing Congress to include tax breaks for financial advisory fees amidst expected negotiations to address the pending expiration of several provisions of the Tax Cuts and Jobs Act A recent survey indicates that client referrals remain the chief source (..)

Abnormal Returns

DECEMBER 4, 2024

Podcasts Christine Benz talks 2025 taxes with Ed Slott author of "The Retirement Savings Time Bomb Ticks Louder." nextavenue.org) The best books and podcasts on aging in 2024 including "Learning to Love Midlife: 12 Reasons Why Life Gets Better with Age" by Chip Conley. apolloacademy.com) Taxes Some things to know about doing a QCD.

Abnormal Returns

SEPTEMBER 4, 2024

ritholtz.com) Rick Ferri talks with Christine Benz about her new book "How to Retire, 20 Lessons for a Happy, Successful, and Wealthy Retirement." morningstar.com) Early in retirement is the time to do some tax planning. Podcasts Barry Ritholtz talks with Eric Balchunas about the importance of falling fund fees.

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

Abnormal Returns

APRIL 21, 2024

philbak.substack.com) Taxes How much do higher taxes prompt millionaires to relocate? theatlantic.com) Is there a better way to maximize charitable giving instead of a tax deduction? vox.com) Trying to tax all families equitably is a dilemma. nber.org) How book bans have spread across America. leaves out.

The Big Picture

FEBRUARY 5, 2025

His latest book is Private Equity Deals: Lessons in investing, dealmaking, and operations. Today, he’s founder and CIO of Capital Allocators and hosts a podcast by the same name, his book, So You Want to Start a Hedge Fund, Lessons for Managers and Allocators is the seminal work in the space. Why hedge funds?

Abnormal Returns

FEBRUARY 24, 2025

Podcasts Christine Benz and Amy Arnott talk with Preston Cherry, author of a new book "Wealth in the Key of Life: Finding Your Financial Harmony." thinkadvisor.com) Cutting IRS workers is going to make life more difficult for tax preparers (and payers). citywire.com) Government Social Security is not rife with fraud.

Abnormal Returns

AUGUST 1, 2024

Books Five insights from "Smart, Not Loud: How to Get Noticed at Work for All the Right Reasons" by Jessica Chen. washingtonpost.com) The amount of tax breaks an organization like Harvard University gets is stunning. wsj.com) Policy How U.S. administrations became addicted to economic sanctions. Sometimes things go wrong.

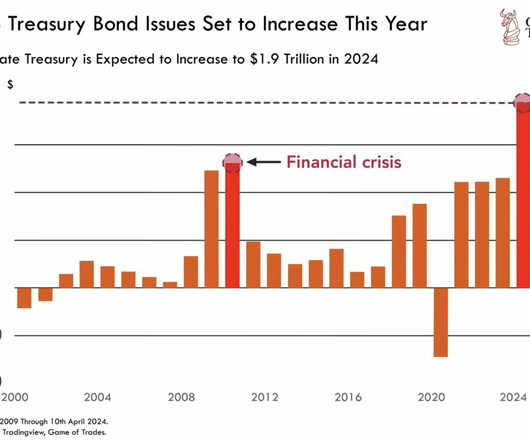

The Big Picture

AUGUST 12, 2024

I’m deep in my book writing work discussing federal debt when I see a tweet that simply epitomizes the entire genre. October 2, 2017) Deficit Chicken Hawks vs Ronald Reagan (July 13, 2010) Politics & Investing The post Catastrophizing Debt appeared first on The Big Picture.

Abnormal Returns

FEBRUARY 1, 2024

etf.com) Vanguard has launched two new ETFs, the Vanguard Intermediate-Term Tax-Exempt Bond ETF ($VTEI) and Vanguard California Tax-Exempt Bond ETF ($VTEC). wapo.st) What you need to know about booking travel on your credit card booking site. (vanityfair.com) A round up of Vision Pro reviews. nytimes.com)

Abnormal Returns

FEBRUARY 7, 2024

(sites.libsyn.com) Daniel Crosby reads a chapter from his new book "The Soul of Wealth." open.spotify.com) Taxes What happens if you don't file and/or pay your taxes. financialducksinarow.com) Who pays taxes on Social Security benefits? peterlazaroff.com) Morgan Housel on the art of spending money.

Abnormal Returns

OCTOBER 11, 2023

humbledollar.com) Taxes How to compare the yields on taxable and muni bonds. marketwatch.com) Some basic things not to get wrong in your tax filings. financialducksinarow.com) Investment taxes, 101. humbledollar.com) 32 insights from JL Collins' book "The Simple Path to Wealth."

Abnormal Returns

AUGUST 28, 2024

wsj.com) Roth IRAs If higher tax rates are inevitable, Roth IRAs look like the preferred solution. crr.bc.edu) A review of Larry Swedroe's new book "Enrich Your Future: The Keys to Successful Investing." (awealthofcommonsense.com) Aging How gifting becomes more complicated near the end of life. How to get out. ofdollarsanddata.com)

The Big Picture

OCTOBER 15, 2022

Instead of paying dividends to shareholders, it is more tax efficient to lower fees of the funds held by their investors aka owners. A list of his favorite books is here ; A transcript of our conversation is available here later this week. Tom Rampulla’s favorite books. Books Barry mentioned. in client funds.

Abnormal Returns

MAY 8, 2024

podcasts.apple.com) Books Why Meir Statman wrote “A Wealth of Well-Being: A Holistic Approach to Behavioral Finance.” advisorperspectives.com) The 7 best retirement books including "More Than Enough: A Brief Guide to the Questions That Arise After Realizing You Have More Than You Need" by Mike Piper.

A Wealth of Common Sense

MARCH 24, 2025

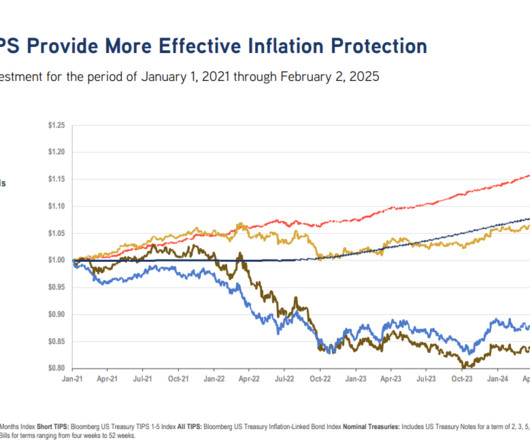

Today’s Talk Your Book is brought to you by F/m Investments: See here for more information on their ultra-short TIPS ETF On today’s show, we discuss: Why TIPS did not work in 2022 What are TIPS Why inflation hedges worked poorly in 2022 Introducing RBIL What a TIPS product gets you in terms of income and appreciation Paying tax on phantom (..)

Abnormal Returns

DECEMBER 24, 2023

(wsj.com) The employee-retention tax credit, or ERC, is a hot mess. time.com) Books The 16 best books of 2023 including "Fire Weather: A True Story from a Hotter World" by John Vaillant. time.com) Books The 16 best books of 2023 including "Fire Weather: A True Story from a Hotter World" by John Vaillant.

Abnormal Returns

OCTOBER 18, 2023

talkingbillions.co) Frazer Rice talks with Jared Dillian about his forthcoming book "No Worries: How to Live a Stress-Free Life." wsj.com) Taxes 14 common tax myths including 'You can write off lifestyle expenses if you are an influencer.' thomaskopelman.com) The IRS is going to launch free tax filing next year in 13 state.

Abnormal Returns

DECEMBER 13, 2023

Podcasts Jordan Harbinger talks with Morgan Housel about his book "Same As Ever." thomaskopelman.com) The pros and cons of tax-loss harvesting. humbledollar.com) Some books Morningstar types recommend including "Number Go Up" by Zeke Faux. awealthofcommonsense.com) Is America's housing stock ready for an aging population?

Abnormal Returns

JANUARY 3, 2024

morningstar.com) Ted Seides talks with Morgan Housel about his new book "Same As Ever." washingtonpost.com) How property taxes vary by state. Podcasts Christine Benz and Jeff Ptak talk with Jonathan Clements about his financial journey. ritholtz.com) More adult children are living with their parents.

The Big Picture

MARCH 25, 2025

Extra special guest, Jim O’Shaughnessy, his book that I came to know him with first was, what Works on Wall Street, which has been just a perennial seller. If you have to take a 10 or 20% haircut, I want all this off the books. We’re gonna talk more about quotes and books in a moment. What a delight. Right, right.

Abnormal Returns

MARCH 20, 2024

ritholtz.com) Dan Haylett talks with Christine Benz about her new book "How to Retire: 20 Lessons For A Happy, Successful & Wealthy Retirement." theconversation.com) Taxes Earned income? flowfp.com) Billionaires pay their taxes differently. humbledollar.com) The bigger donor advised funds get, the more scrutiny they receive.

Abnormal Returns

JANUARY 10, 2024

ritholtz.com) Claer Barrett talks with Morgan Housel about his book "Same As Ever." ft.com) Jim O'Shaughnessy talks with Jared Dillian about his new book "No Worries: How To Live a Stress-free Financial Life." thomaskopelman.com) If you get paid by 1099 you need to do more work to manage your tax liabilities.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content