Weekend Reading For Financial Planners (January 25–26)

Nerd's Eye View

JANUARY 24, 2025

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

APRIL 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor released the final version of its Retirement Security Rule (a.k.a.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

JANUARY 12, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Securities and Exchange Commission this week authorized 11 Spot Bitcoin Exchange-Traded Funds (ETFs), which could provide financial advisors and their clients with a convenient way to invest in the cryptocurrency without (..)

Nerd's Eye View

JULY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent U.S.

Nerd's Eye View

DECEMBER 23, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”, A review of financial planning actions, from tax-loss harvesting to charitable giving, that have a December 31 deadline.

MainStreet Financial Planning

MARCH 7, 2025

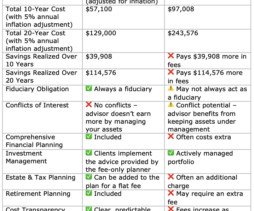

When choosing a financial advisor, how they charge for their services can significantly impact your long-term wealth. The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management).

Midstream Marketing

NOVEMBER 7, 2024

Key Highlights Learn how to improve your financial planner’s online visibility by using SEO and SEM wisely. Introduction In financial planning, it is key to know about search engine optimization (SEO) and search engine marketing (SEM). Digital marketing strategies are crucial for the success of financial planners.

Clever Girl Finance

DECEMBER 23, 2024

That’s where financial planning for freelancers comes in. As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Table of contents Why financial planning for freelancers is crucial 1. Create a realistic budget 2. Its exhilaratingand, lets be honest, a little overwhelming.

Midstream Marketing

NOVEMBER 8, 2024

Key Highlights Find good ways to get new clients as a financial advisor. Explore several ways to get financial advisor leads. Get advice from experts about good tools and methods for lead generation in financial services. It will help you connect with potential clients looking for financial help.

Midstream Marketing

OCTOBER 29, 2024

Key Highlights A strong marketing plan is key for financial advisors. This guide offers helpful tips to create a good advertising plan in the financial services area. Introduction In today’s world, having a strong online presence is really important for financial advisors. It is key for the growth of your business.

WiserAdvisor

SEPTEMBER 1, 2022

If you are thinking about why you should continue meeting with your financial advisor, you have already taken a big step toward securing your financial future – you have engaged the services of a professional. Now, how often you need to meet with your advisor depends on the degree of help needed by you.

The Chicago Financial Planner

FEBRUARY 6, 2022

Look at your budget, determine how much you can afford to defer each pay period and get started. If you work with a financial advisor make sure that they consider your 401(k) and all investments when helping you plan for your retirement. FINANCIAL WRITING. They may also offer advice in some format.

Indigo Marketing Agency

DECEMBER 19, 2022

As a financial advisor, your job requires you to stay on top of leading industry information, the evolving ways to connect with clients, and new strategies for managing money. That’s why we’ve identified the top 41 financial influencers we believe will greatly impact the industry in 2023. Check out his Twitter feed here.

BlueMind

JULY 15, 2022

Although the purpose is simple: to protect investors, customers, the economy, and society from financial crimes but on the other hand it increased compliance challenges for financial advisors. It is a constant expense that digs steadily into the budget and can be further exacerbated by cyber attacks.

International College of Financial Planning

APRIL 20, 2022

If you are a student looking to make a career in finance, becoming a financial planner is a great place to start. Financial planning is a rewarding, stable career that can give you the opportunity to help people make the most of their money. It includes budgeting, saving, and investing.

Walkner Condon Financial Advisors

MAY 26, 2023

During this time, Alicia took an elective personal finance class and mastered Excel to meticulously budget her student loans and wages so she wouldn’t run out of money before the end of the semester, eventually earning a degree in Marketing from the University of Wisconsin-La Crosse.

Your Richest Life

JULY 17, 2024

This is why everyone needs a budget, because no matter how much money you have coming in, you should still have a plan for it. Financial advice from the internet, podcasts, books or even your family members has to be taken with a grain of salt, because those sources don’t know your full financial picture.

Harness Wealth

MAY 25, 2023

Here’s a deep dive into the average fees of financial advisors, in 2023. The primary fee structures are: Fee-only : Advisors only receive payment from their clients for the services they provide, not receiving any commissions or other incentives from product providers. Between 0.5%

Clever Girl Finance

JULY 16, 2023

And that’s probably why you’re asking the question: do I need a financial advisor? Table of contents Is it really necessary to have a financial advisor? How to know When don’t you need a financial advisor? How much does a financial advisor cost? Leverage these tips to decide!

Clever Girl Finance

JULY 16, 2023

And that’s probably why you’re asking the question: do I need a financial advisor? Table of contents Is it really necessary to have a financial advisor? How to know When don’t you need a financial advisor? How much does a financial advisor cost? Leverage these tips to decide!

WiserAdvisor

AUGUST 3, 2023

While many individuals choose to navigate their financial journey independently, seeking the guidance of a professional financial advisor can offer unique advantages that may prove invaluable in the long run. One common aspect that most individuals consider is the cost associated with engaging a financial advisor.

WiserAdvisor

DECEMBER 1, 2023

The need for sound financial guidance is universal. Whether you are self-employed or salaried, everyone can benefit from the expertise of a financial advisor. However, some professionals, like doctors, may need the guidance of a financial advisor more than others.

WiserAdvisor

AUGUST 18, 2023

When it comes to personal finance, the guidance of a financial advisor can help you in more ways than one. These experts have the necessary financial knowledge and expertise to help you make informed decisions about your money, investments, and future financial security. Financial advisors charge a fee for their services.

MainStreet Financial Planning

NOVEMBER 14, 2023

With the exit of the Mint online budgeting app at the end of 2023, we have been asked by clients what other options are available. I was attracted to this tool because it worked with spreadsheets, and once created, a Tiller sheet can be shared with other family members, or even one’s financial planner, to be viewed or edited.

WiserAdvisor

JUNE 2, 2023

While there are various types of finance professionals who offer financial advice and services falling under the general financial advisor category, it should be noted that they differ significantly. Below are the different kinds of financial advisors you may choose from: 1. Need a financial advisor?

Clever Girl Finance

DECEMBER 23, 2024

That’s where financial planning for freelancers comes in. As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Table of contents Why financial planning for freelancers is crucial 1. Create a realistic budget 2. Its exhilaratingand, lets be honest, a little overwhelming.

Midstream Marketing

AUGUST 14, 2024

Key Highlights Search for ways to get new clients and grow your financial advisor business. Introduction For a financial advisor, getting new clients is very important for business growth. Advisors must also take care of current clients to keep them happy and loyal. They might need financial guidance.

International College of Financial Planning

MARCH 8, 2023

The Union Budget is one of the year’s most anticipated events for both companies and individuals. The financial budget for this year (2023) is important as it sets the tone for the economy in the following year. Health and Education : The budget has allocated INR 3.06 Infrastructure : The budget has earmarked INR 5.54

Ballast Advisors

MAY 8, 2023

They started working with the team of financial advisors at Ballast Advisors over a decade ago. Jean and her husband worked hard to realize their financial goals, being a snowbird in Florida, golfing, traveling, and loving on eight great-grandchildren. We followed the advice of our financial planner.

Indigo Marketing Agency

JANUARY 17, 2022

It’s no secret that the financial landscape is changing rapidly. To stay ahead of the curve, financial advisors must identify and align themselves with the top influencers in the field. Here are 36 financial advisor influencers who will likely have a big impact on the industry in 2022.

Sara Grillo

DECEMBER 12, 2022

Watch as all h&#@ breaks loose discussing the question of broker vs. financial advisor, commissions, fees, value, and more! I am a CFA® charterholder and financial advisor marketing consultant. I am an irreverent and fun marketing consultant for financial advisors. This debate went psycho at times.

Harness Wealth

JUNE 1, 2023

When it comes to managing wealth and planning for a secure financial future, the services of financial professionals, such as financial advisors or wealth managers, are invaluable. Table of Contents What Services Does a Financial Advisor Provide? Here, we focus on two such studies. .’

Clever Girl Finance

JANUARY 22, 2024

Consult with professionals for your windfall finance planning During the waiting period, consult with a certified financial planner , a financial advisor, and/or a CPA to determine what to do concerning taxes. Be sure to discuss this with your financial planner or financial advisor for specific guidance.

Sara Grillo

JANUARY 8, 2024

I am a CFA® charterholder and financial advisor marketing consultant. I have a newsletter in which I talk about financial advisor lead generation topics which is best described as “fun and irreverent.” I am an irreverent and fun marketing consultant for financial advisors. How do they pull it off?

Clever Girl Finance

MARCH 19, 2024

Create a list of things to plan for How to make a financial plan Expert tip: Consider your needs for each life stage Determine the type of financial plan you need Tips on how to frequently review your financial plan What is a financial plan using an example? Is a financial plan the same as a budget?

Zoe Financial

FEBRUARY 21, 2023

Depending on your situation, you may need the help of a financial advisor or an accountant. Dear Zoe Experts, I’ve been looking for tax planning guidance and am deciding whether to hire a financial advisor or an accountant. Depending on your situation, you may need the help of a financial advisor or an accountant.

Carson Wealth

DECEMBER 1, 2022

Build Positive Financial Behaviors. If you learn to budget in your 20s, that habit will carry with you through your lifetime. Consider online budgeting tools , spreadsheets or even pen and a notebook. . Track income, expenses and build in budgeted items for future financial goals. Work With a Financial Advisor

Good Financial Cents

DECEMBER 14, 2022

As a financial executive, the chief financial officer (CFO) is responsible for the financial health of an organization. The CFO role is multi-faceted and includes everything from financial planning and analysis to business budgeting, financial decision-making, and risk management. Personal Financial Advisor.

eMoney Advisor

DECEMBER 21, 2022

Goal-based planning is a good option when you don’t have all the client’s financial details, but they’re asking for help reaching specific individual goals, such as setting a budget, saving for an emergency fund, or paying off a student loan. It’s also a good choice for clients who are new to financial planning.

Your Richest Life

JANUARY 16, 2024

You Need a Budget and Monarch Money are a couple that I recommend. Come up with a budget Many people avoid budgets because they feel restrictive, but honestly, keeping a consistent budget offers a lot of freedom. When you keep up with your budget, you can build in opportunities for spending without guilt.

Yardley Wealth Management

OCTOBER 12, 2022

I would also recommend that Margaret enlist the help of a financial planner, who can help her set a budget and undertake the next step: detection. She will also need to make a separate list of any assets or liabilities (such as a mortgage) she is sure the family has.

Yardley Wealth Management

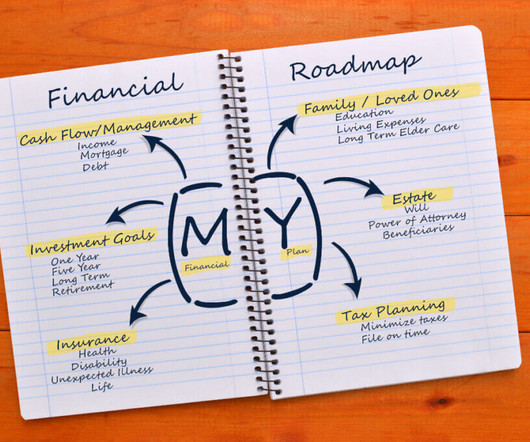

JUNE 29, 2022

The post Roadmap For Financial Planning appeared first on Yardley Wealth Management, LLC. Roadmap for financial planning When I say that being a financial advisor is a lot like being a therapist, you probably think I’m joking. Ask yourself Kinder’s Three Questions, either by yourself or with your financial planner.

Tucker Advisors

APRIL 4, 2023

Far too many people have overlooked it as an alternative because they either felt they did not have enough money to invest or could not seem to consistently budget money for the purpose of investing. This could allow people to get used to budget adjustments from the very start of their new job and wages.

International College of Financial Planning

NOVEMBER 10, 2021

MBA (Finance) – This is the minimum qualification that you’d need to work as an investment or financial advisor in India. Certified Financial Planner (CFP) – Much like the CFA, CFP or Certified Financial Planner also remains one of the most sought out qualifications in this industry.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content