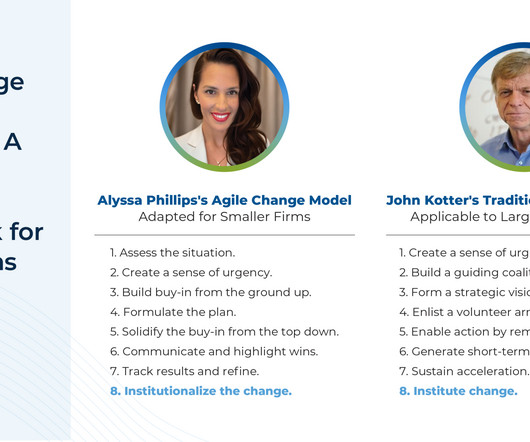

8-Step “Agile Change” Framework For Smaller Firms To Communicate And Implement Organizational Change

Nerd's Eye View

AUGUST 26, 2024

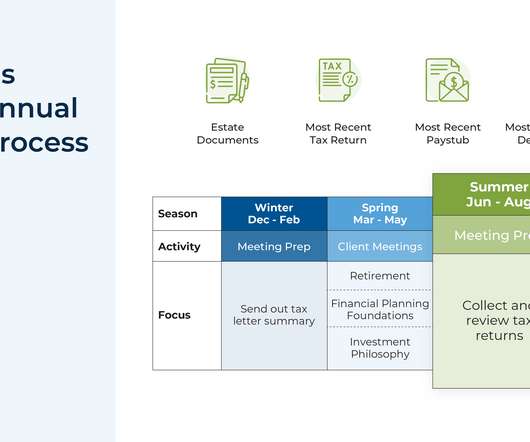

Additionally, those promoting change can be very clear about what the process will entail and how it will be implemented (with the caveat that the plan needs to be flexible to allow for change as conditions evolve). In this model, the groundwork for change is first established by assessing the situation (e.g.,

Let's personalize your content