#FA Success Ep 290: Serving Neurodivergent Clients As A Financial Advisor With Autism, With Andrew Komarow

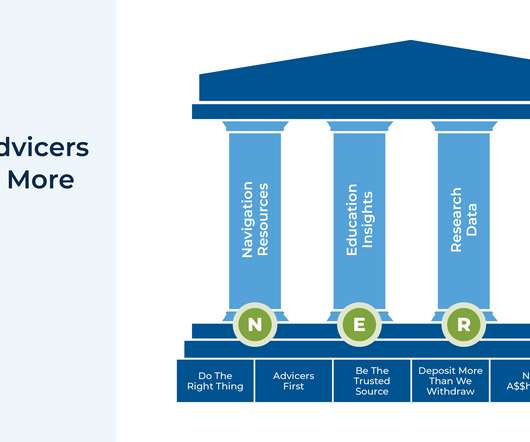

Nerd's Eye View

JULY 19, 2022

Welcome back to the 290th episode of the Financial Advisor Success Podcast ! Andrew is the founder of Tenpath Financial Group and Planning Across the Spectrum, a hybrid firm based in Farmington, Connecticut that oversees $100 million in assets under management for 100 client households. Read More.

Let's personalize your content