Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

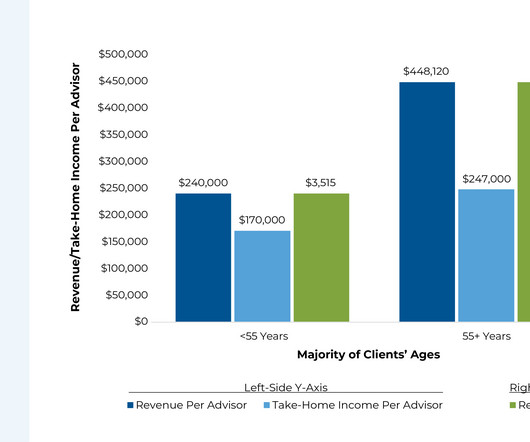

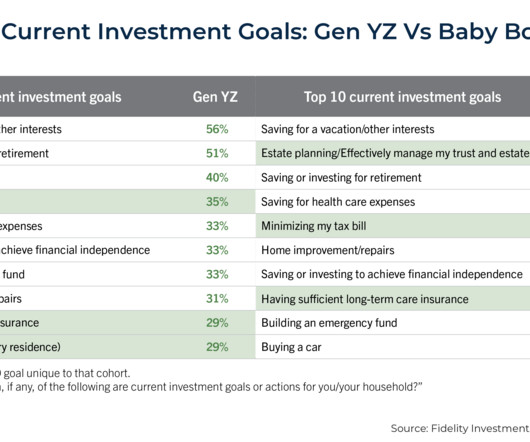

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Wealth Management

FEBRUARY 8, 2024

Myriad Advisor Solutions announces two initiatives to help clients navigate the digital landscape securely while optimizing their business legacies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

DECEMBER 18, 2024

While state and Federal regulations clearly outline recordkeeping requirements for areas like financials, advertisements, and trading records, there is a notable gap when it comes to documenting the delivery of services – especially financial planning services – necessary to justify the fees charged for those services.

Nerd's Eye View

NOVEMBER 25, 2024

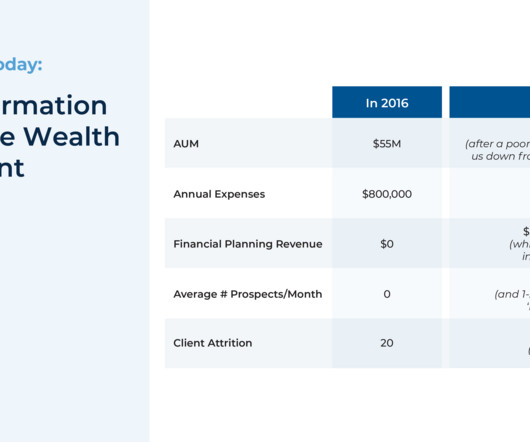

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

Nerd's Eye View

NOVEMBER 21, 2022

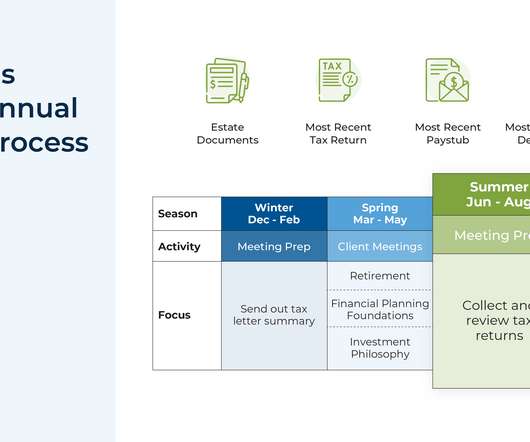

A common service model for many financial advisory firms is to schedule annual client meetings throughout the year where the advisor meets with each client in the month they started working with the firm, and conducts a comprehensive review of all planning topics for the client. Read More.

Nerd's Eye View

NOVEMBER 4, 2024

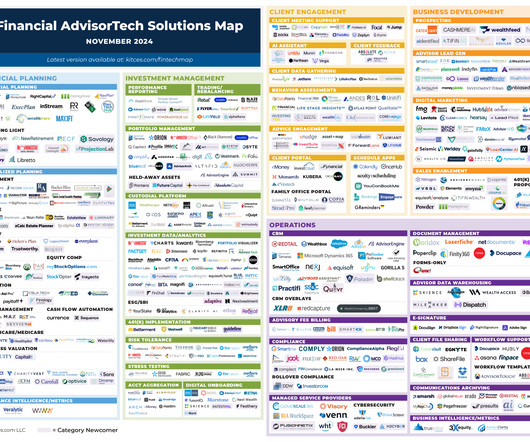

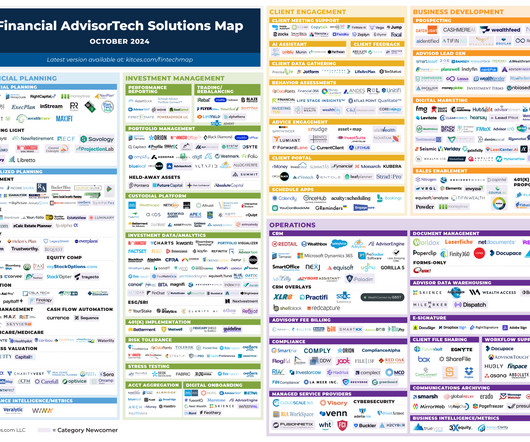

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Nerd's Eye View

OCTOBER 23, 2023

Though, at some point, covering a large number of financial planning topics can eat into an advisor's time, which is problematic if clients won't pay substantially more to receive that more comprehensive advice.

Nerd's Eye View

SEPTEMBER 11, 2023

annual plan reviews) to their current clients, they will continue to prospect and onboard new clients as well. a client service associate to handle various administrative and client communication tasks, or a paraplanner or associate advisor to work on more planning-centric issues such as building out drafts of financial plans).

Nerd's Eye View

DECEMBER 28, 2022

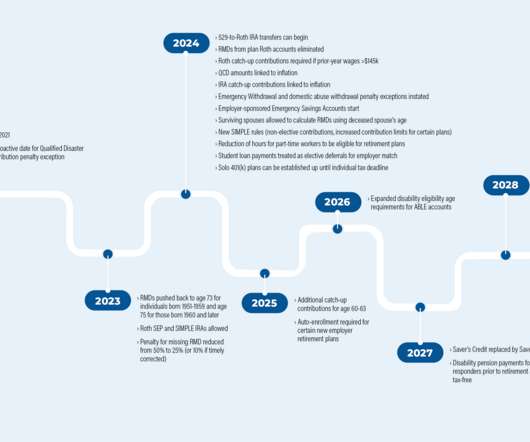

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 backdoor Roth conversions).

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 backdoor Roth conversions).

Nerd's Eye View

AUGUST 24, 2023

However, when these aspirations are delayed or blocked by senior advisory firm partners who choose to delay their retirement plans, it can leave younger advisors frustrated and in a place of uncertainty about their futures with their firm.

Nerd's Eye View

FEBRUARY 23, 2023

The increasing popularity of financial planning has led to a growing awareness of how important managing finances and planning for the future can be. For most financial advisors today, a website is a critical tool that allows them to market their services and communicate their fees to potential clients.

Nerd's Eye View

JUNE 11, 2024

In this episode, we talk in-depth about how Mark created a structured process to serve clients under the hourly model, including segmenting client engagements into 5 "levels" based on the complexity of their needs to match them with the right advisor, how Mark's firm uses those levels to provide accurate quotes for how many hours it will take to meet (..)

Nerd's Eye View

AUGUST 23, 2022

What's unique about Shari, though, is how after a life-changing experience she went through in trying to get clear in articulating her own most important values, she created a 5-step “Maximize the Return on Life” framework to use with her clients, and then created what she calls her “CFO Family Checklist” as a form of living (..)

Nerd's Eye View

MAY 9, 2023

What's unique about Liz, though, is how she and her brother have taken ownership of what was originally their father’s broad commission-based practice with more than 1,500 clients, and have managed the balance of transitioning the business into a fee-based financial planning practice while still doing right by the smaller or more transactional (..)

Nerd's Eye View

NOVEMBER 14, 2023

What's unique about Eric, though, is how he leverages a custom-built financial planning assessment he calls their Financial Prosperity Index, which he gives to both prospective and ongoing current clients so that they can better understand their financial health, target the financial planning domains where clients need the most help, and even more (..)

Nerd's Eye View

DECEMBER 5, 2023

So, whether you're interested in learning about how to build associate advisor compensation plans and career tracks, how to leverage a multi-faceted marketing approach to generate client leads, or what it looks like to roll up into a larger RIA, then we hope you enjoy this episode of the Financial Advisor Success podcast, with Jeff Brown.

Nerd's Eye View

JULY 17, 2024

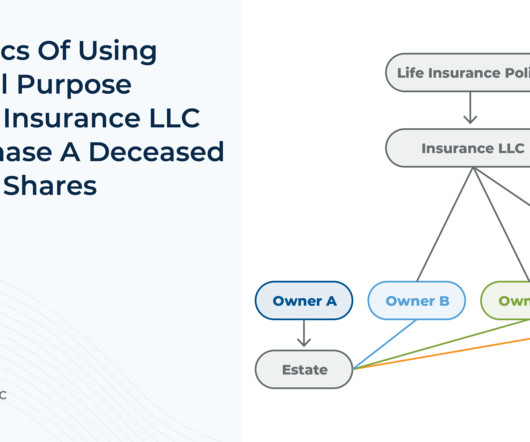

Buy-sell agreements are a common succession planning tool for business owners where, upon a triggering event like the death of one owner, the surviving owners have either the option or the contractual obligation to purchase the deceased owner's shares of the business.

Nerd's Eye View

AUGUST 23, 2022

What's unique about Shari, though, is how after a life-changing experience she went through in trying to get clear in articulating her own most important values, she created a 5-step “Maximize the Return on Life” framework to use with her clients, and then created what she calls her “CFO Family Checklist” as a form of living (..)

Nerd's Eye View

JULY 26, 2022

Amy is the owner of Rooted Planning Group, an independent RIA based in Corning, New York that oversees $67 million in assets under management for 175 client households. Welcome back to the 291st episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Amy Irvine.

Nerd's Eye View

FEBRUARY 25, 2025

Jennifer is the CEO of The Mather Group, an RIA based in Chicago, Illinois, that oversees $15 billion in combined assets under management and advisement for approximately 4,400 client households.

Nerd's Eye View

OCTOBER 29, 2024

Travis is the founder of Student Loan Planner, an RIA and student loan consulting company based in Chapel Hill, North Carolina that serves nearly 1,400 households with ongoing financial planning (as well as consulting with over 15,000 clients on student loan debt).

Nerd's Eye View

FEBRUARY 11, 2025

Read More.

Nerd's Eye View

MAY 14, 2024

What's unique about Danielle, though, is how she has created a process she calls "Financial Fingerprints To Footprints ", where she helps clients who are struggling to implement their financial planning recommendations by working with them to unlock their money memories and help them understand how the financial lessons of their past may be creating (..)

Nerd's Eye View

FEBRUARY 18, 2025

Sebastian is the President of Guerra Wealth Advisors, a hybrid advisory firm based in Miami, Florida, with nearly $15M of revenue and almost 60 team members, supporting over 1,700 client households.

Nerd's Eye View

AUGUST 19, 2024

Which means that longer-term projects, such as creating a succession plan to have in place for the firm when the owner retires, may tend to get put on the back burner.

Nerd's Eye View

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

SEPTEMBER 16, 2024

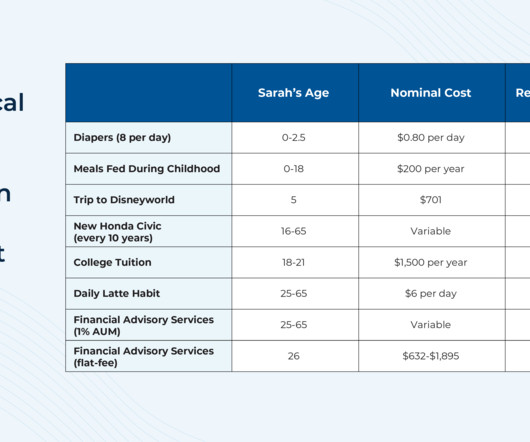

For example, most Millennial and Gen Z clients can open their own investing account and buy index funds online with only minimal guidance from their advisor, so full-service investing might not offer enough value to a next-generation client to justify an ongoing planning fee.

Nerd's Eye View

OCTOBER 21, 2024

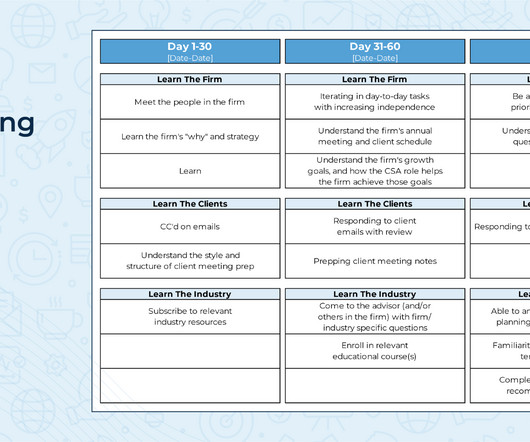

Much of this frustration can be avoided with a clear onboarding plan. A good onboarding plan can bring clarity to the advisor (or hiring manager) on how much time will need to be spent with the new hire, what order to present information in, and when an advisor can plan to 'let go' of and finally delegate different tasks to the CSA.

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

Nerd's Eye View

OCTOBER 24, 2023

Sarah-Catherine is the founder of Aptus Financial, a fee-only financial planning firm based in Little Rock, Arkansas, that is approaching $2M in revenue and works with over 480 client households. Welcome to the 356th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Sarah-Catherine Gutierrez.

Nerd's Eye View

APRIL 17, 2024

And while all may appear well on the surface – the client rarely contacts the advisor with problems but they show up for every annual meeting – they may actually be feeling quite disengaged with the financial planning services being provided. – important goals. Questions such as "What is different from the last time we met?"

Nerd's Eye View

NOVEMBER 17, 2022

At the same time, though, over-analyzing strategies prior to implementing them can create a substantial gap between ideating a plan and actually putting it into motion. business goals! And sometimes, the fear of committing to an idea that might end in failure can be the real reason for the hesitation to implement in the first place.

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family.

Nerd's Eye View

JANUARY 16, 2024

Thomas is the co-founder of AllStreet Wealth, a financial planning firm for millennial business owners and those with equity comp based in Indianapolis, IN, that has quickly grown to more than $500,000 of run-rate revenue generated from serving 70 ongoing client households. My guest on today's podcast is Thomas Kopelman.

Nerd's Eye View

JANUARY 22, 2025

Instead, acknowledging their ambivalence as a natural part of the decision-making process can help create space for them to discover the value of financial planning on their own. One effective way to facilitate this self-discovery is through self-persuasion questions.

Nerd's Eye View

APRIL 10, 2023

Additionally, MoneyGuide rolled out a new "Plan Pulse" dashboard allowing advisory firms to look across all of their clients’ plans and identify those who have fallen behind. The resources that advisory firms invest in new technology can be wasted if employees don’t know how (or why) to use it. Read More.

Nerd's Eye View

MARCH 25, 2024

In this article, Kitces Managing Editor Sydney Squires shares how the fully virtual Kitces team constructs its biannual team retreats – and how other leaders of virtual teams can also plan and execute a retreat of their own. While a great deal of work is involved in the logistical planning of organizing a retreat (e.g.,

Nerd's Eye View

MARCH 6, 2023

Which at best will still be a substantial uphill battle, given the hassle of switching from one financial planning platform to another (and the fact that most advisors are generally satisfied with their current financial planning software in the first place!).

Nerd's Eye View

SEPTEMBER 3, 2024

Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors, an RIA based in Towson, Maryland, that manages $2 billion of private wealth assets under management for 1,300 client households and advises on an additional $5 billion in retirement plan assets. My guest on today's podcast is Zack Hubbard.

Nerd's Eye View

JUNE 25, 2024

What's unique about Chris, though, is how he has built a highly efficient solo practice that allows him to work fewer than 25 hours/ week to have more time for his family and managed to cut his hours down by relentlessly focusing on only the financial planning tasks that really truly matter most to his clients… and either outsourcing, or just (..)

Nerd's Eye View

SEPTEMBER 30, 2024

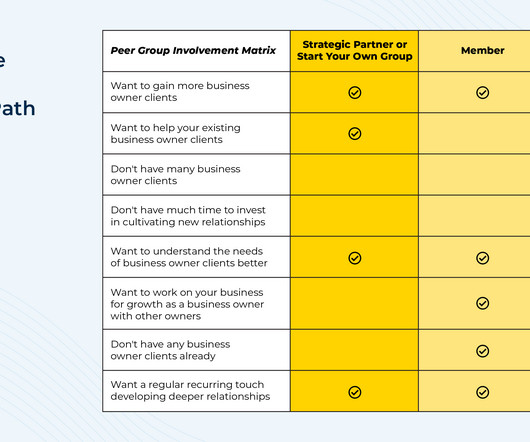

When it comes to focusing on a niche for financial advisors, business owner clients can be an appealing target as they can have complex financial planning problems ranging from cash flow management to tax planning to acquisition strategies. Ultimately, the key point is that for advisors who work with (or would like to work with!)

Nerd's Eye View

OCTOBER 23, 2024

Though in practice, while a 1% AUM fee is a common 'starting point' in the industry, the actual fee structure can vary based on the firm's approach; for example, some firms may reduce the fee for high-net-worth clients, or charge an additional fee for separate and additional services (from deeper financial planning to add-ons like tax preparation).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content