Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

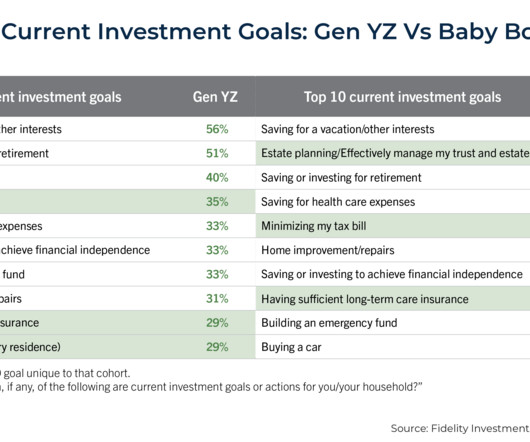

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Nerd's Eye View

NOVEMBER 25, 2024

To start, Taylor refined his ideal client profile to focus on those he could best serve: diligent savers over age 50 with a retirement nest egg between $2M and $10M. These clients, typically in or near retirement, face key challenges like reducing taxes, managing investment risk, and maximizing income.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JANUARY 22, 2025

Some prospects approach an advisor with an immediate 'problem to be solved', such as a fast-approaching retirement date. I help clients in retirement by doing X, Y, and Z."). These situations often narrow the focus of the prospecting conversation, giving the advisor a clear opportunity to affirm their value (e.g., "I

Nerd's Eye View

APRIL 9, 2025

For instance, rather than starting a conversation by asking, "How much do you need for retirement?" which focuses a client on numbers and the possibility that they might not have saved enough), an advisor might instead ask, "What does an ideal retirement look like for you?"

Nerd's Eye View

MAY 15, 2024

On April 25, 2024, the Department of Labor (DoL) issued the final version of its Retirement Security Rule (the "Final Rule"), which imposes an ERISA fiduciary standard "that applies uniformly to all investments that retirement investors may make with respect to their retirement accounts ".

Nerd's Eye View

JANUARY 4, 2023

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. And when it comes to retirement planning, one popular technique is the use of ‘guardrails’, which set an initial monthly withdrawal rate that can be later adjusted as the size of the client’s portfolio changes.

Nerd's Eye View

AUGUST 24, 2023

However, when these aspirations are delayed or blocked by senior advisory firm partners who choose to delay their retirement plans, it can leave younger advisors frustrated and in a place of uncertainty about their futures with their firm.

Nerd's Eye View

MARCH 10, 2025

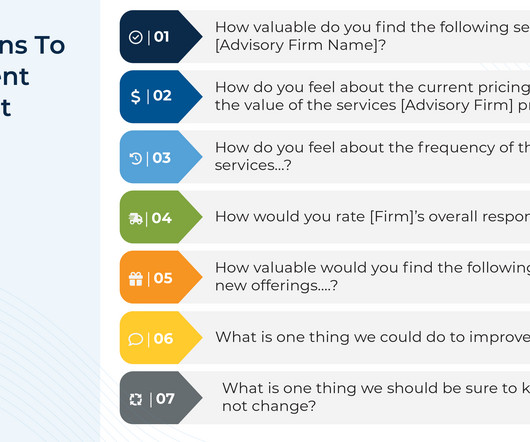

These services may range from 'standard' offerings like retirement planning to less traditional areas like credit card consulting. Financial advicers often market their comprehensive financial services as a way to differentiate themselves from other advisory firms and to stand out in the broader landscape of financial advice.

Nerd's Eye View

OCTOBER 29, 2024

We also talk about how Travis built the onboarding and compensation plans for his own (contracted) student loan consultants to scale the business while incentivizing them to take on a greater volume of meetings (and still ensuring that they could give high-quality student loan advice), how Travis decided to diversify his business's income streams when (..)

Nerd's Eye View

FEBRUARY 25, 2025

In this episode, we talk in-depth about why Jennifer’s firm has taken an approach to grant equity rather than require buy-ins (and intends for every employee to either have equity, or at least a path to equity if they’re still new), how Jennifer’s firm sets individual performance targets for its client-facing wealth advisors to earn (..)

Nerd's Eye View

APRIL 8, 2025

We also talk about Seth's journey to financial planning as a career changer (after finding that previous jobs in urban planning and real estate either took too much time away from his family or weren't compatible with his values), how Seth's connection with a family friend eventually led him to assume the books of business of three retiring advisors (..)

Nerd's Eye View

JANUARY 21, 2025

We also talk about how Daniel has used a subscription-based model for financial planning fees for 30 years (now setting the monthly subscription fee based on each client's unique needs, including the complexity of their tax situation), why Daniel finds that the vast majority of clients also decide to have his firm manage their assets (paying a separate (..)

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. As more workers consider the growing appeal of semi-retirement, some ask — is working part-time in retirement a good idea?

Nerd's Eye View

OCTOBER 15, 2024

What's unique about Mark, though, is how he uses a liability-driven-investing approach to build retirement portfolios and manage sequence of return risk, with a particular focus on using closed end bond funds to generate income needed to cover his client's expenses during the early (and most financially dangerous) years of retirement.

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family.

Nerd's Eye View

SEPTEMBER 2, 2022

We also have a number of articles on retirement planning: New research suggests that while the average senior will amass hundreds of thousands of dollars in health care expenses in retirement, the net cost they have to pay is not nearly as high.

Nerd's Eye View

DECEMBER 16, 2022

We also have a number of articles on retirement planning: While weak stock and bond market performance has challenged advisors and their clients this year, these trends have likely increased the ‘safe’ withdrawal rate for new retirees.

Nerd's Eye View

OCTOBER 23, 2024

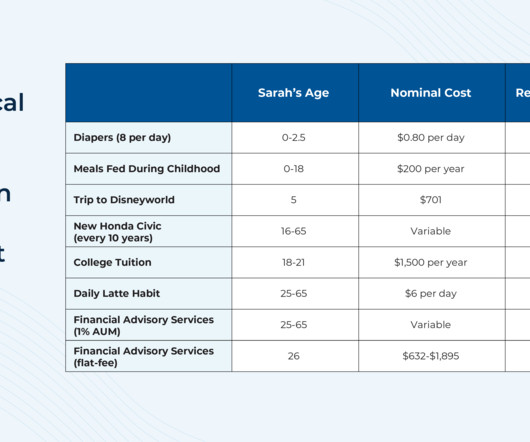

AUM detractors like Sethi often present a calculation that compares the performance of 2 identical portfolios – one managed by an advisor who charges a 1% AUM fee for 20+ years, and one without an advisor – illustrating how the fee can significantly erode the cumulative value of their portfolio by the time they reach retirement.

Nerd's Eye View

JUNE 5, 2023

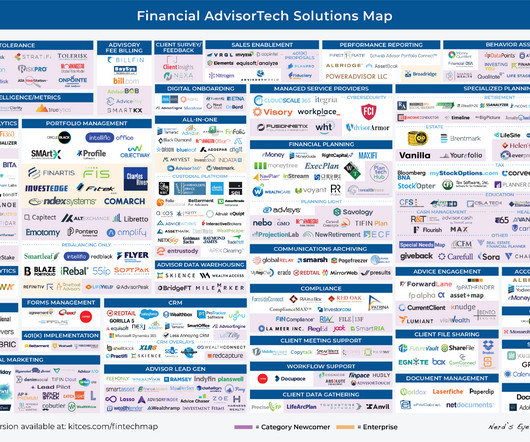

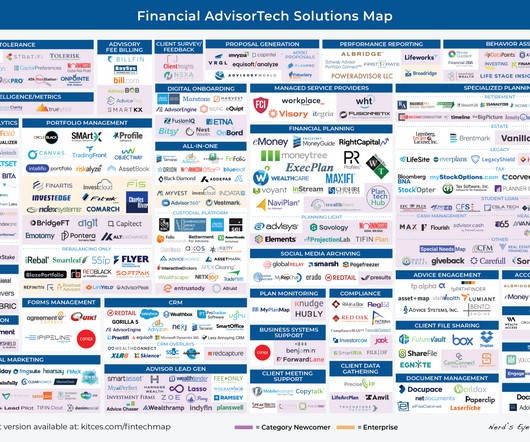

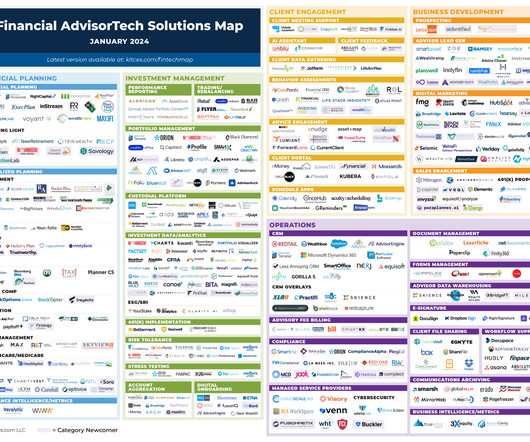

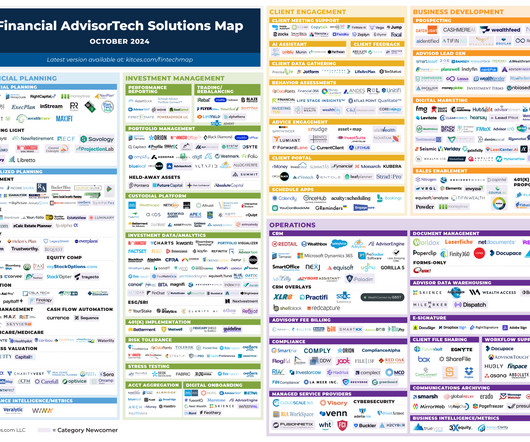

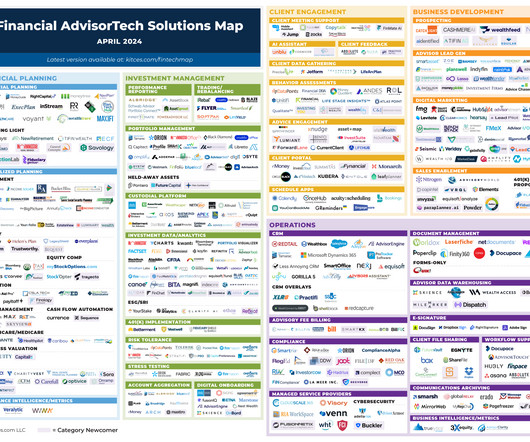

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: InvestCloud, a TAMP and all-in-one advisory technology platform which has undergone rapid growth in recent years through the acquisition of numerous disparate technology tools in order to compete with its more-established competitor (..)

Nerd's Eye View

SEPTEMBER 6, 2022

Andy is the owner of Tenon Financial, a virtual independent RIA that oversees $70 million in assets under management for 43 retired client households. Welcome back to the 297th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Andy Panko.

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

Nerd's Eye View

FEBRUARY 11, 2025

In this episode, we talk in-depth about the best practices David recommends to firms to start preparing in advance for an internal succession (including creating defined career tracks and compensation structures as well as getting the firm’s business metrics in order and receiving a third-party valuation), how David advocates for breaking up (..)

Nerd's Eye View

NOVEMBER 11, 2022

We also have a number of articles on retirement planning: How the recent increase in interest rates has made TIPS a more viable option to increase a retired client’s safe withdrawal rate. The most effective question advisors can use to end initial prospect meetings.

Nerd's Eye View

JANUARY 6, 2023

How planning specializations can help firms and their advisors stand out from the pack. From there, we have several articles on retirement planning: Why an individual’s portfolio of relationships could be just as important as their investment portfolio when it comes to happiness in retirement.

Nerd's Eye View

APRIL 30, 2024

We also talk about how Troy's firm has hired a number of marketing professionals to improve the performance of its marketing campaigns, how Troy has also grown his advisor staff to meet the needs of the rapidly expanding client base, and adopted a 3-advisor pods approach to ensure clients have touchpoints with multiple advisors (and that advisors can (..)

Nerd's Eye View

DECEMBER 9, 2022

Also in industry news this week: A recent survey indicates that retirement plan sponsors currently using financial advisors to support their plan are overwhelmingly satisfied with the service they receive, which also leads to improved retirement savings for their employees.

Nerd's Eye View

MAY 1, 2023

Rowe Price has acquired Retiree Income, the parent company of popular retirement income planning software SSAnalyzer and Income Solver, to put its resources behind developing and distributing the company’s planning tools (albeit perhaps more to its retail and employee retirement plan clients than to advisors?).

Nerd's Eye View

JANUARY 1, 2024

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Nerd's Eye View

AUGUST 6, 2024

What's unique about Jaime, though, is how his firm has grown to more than $1 billion in AUM over the past 20 years in part by making a series of 6 acquisitions, typically buying mixed fee-and-commission practices from retiring advisors in his local area and converting them into ongoing recurring revenue financial planning clientele.

Nerd's Eye View

OCTOBER 7, 2024

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: VRGL has announced a new venture capital funding round to continue building out its capabilities to extract data from prospects' investment statements and automatically generate investment proposals – which while having proven (..)

Nerd's Eye View

MAY 29, 2024

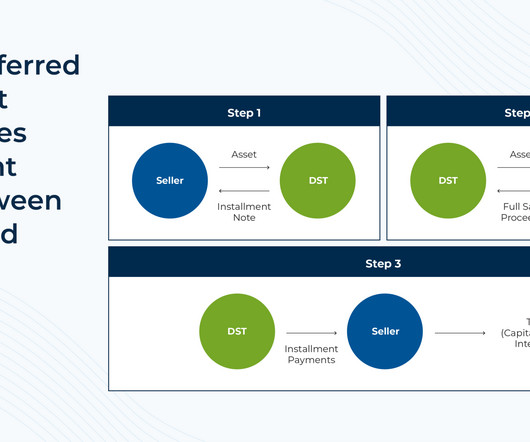

Small business owners often treat their businesses not only as their source of income during their working years, but also as an asset that can be sold to fund their retirement. One way to reduce the tax impact of selling a small business is by using an installment sale. Under IRC Sec.

Nerd's Eye View

MAY 9, 2023

In this episode, we talk in-depth about how, to realize their vision for the future of a commission-based firm their father originally built, Liz and her brother have gone through the messy multi-year process of refocusing to a niche and rightsizing their client loads, how Liz and her brother realized in the process of buying into the firm that they (..)

Nerd's Eye View

JANUARY 24, 2023

In this episode, we talk in-depth about how, after the sudden passing of a successor for a close friend and solo advisor that she met through a local study group of NAPFA advisors, Jennifer decided to merge their practices so that she could not only help her advisor friend and the clients she served, but create a positive opportunity for Jennifer’s (..)

Nerd's Eye View

OCTOBER 4, 2022

What's unique about Ramit, though, is how he literally wrote the book (and subsequently launched an online educational platform and brand) on how consumers can not just learn more about their finances but change their financial behaviors, without focusing on a budget or setting retirement savings goals, and instead helping them focus their money more (..)

Nerd's Eye View

DECEMBER 23, 2022

”, a series of measures that will have significant impacts on the world of retirement planning. Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”,

Nerd's Eye View

DECEMBER 30, 2022

” has brought a wide range of changes to the world of retirement planning. Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the passage of “SECURE Act 2.0”

Nerd's Eye View

NOVEMBER 18, 2022

From there, we have several articles on tax planning: How advisors can add value for their clients by managing their exposure to mutual fund capital gains distributions. A new research study suggests that delaying taxes in retirement is often not the optimal course of action.

MazumaBusinessAccounting

JULY 15, 2021

Plan for Current Business Needs. First, let’s talk about the importance of a business plan. How does an idea develop into a fully functioning business? It takes vision, work, and a good plan. For entrepreneurs, we call this map a business plan. Creating a marketing plan.

Nerd's Eye View

JUNE 25, 2024

In this episode, we talk in-depth about Chris's efficient planning process, including how he works through clients' financial plans collaboratively during their annual meetings and sends them a final copy afterward (instead of conducting a lot of time-intensive plan preparation in advance), how Chris used to do in-depth cash flow analyses with his (..)

Nerd's Eye View

SEPTEMBER 16, 2024

At a high level, the challenge of serving next-generation clients is that, although they may not be able to afford higher fees, their financial needs are just as complex – if not more so – than those of retired clients. robo-managed portfolios) at a lower fee.

Nerd's Eye View

MAY 6, 2024

This month's edition kicks off with the news that self-directed retirement planning software provider NewRetirement has raised a $20M Series A round as the company demonstrates that its DIY tools really do turn a subset of consumers into bona fide prospects for financial advisors.

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. As more workers consider the growing appeal of semi-retirement, some ask — is working part-time in retirement a good idea?

Nerd's Eye View

DECEMBER 6, 2023

Notably, while many financial coaches satisfy the majority of these requirements – they are in the business of offering advice to clients and are compensated as such – they often steer clear of making specific securities recommendations, focusing instead on areas like budgeting, debt management, savings, and retirement planning.

Nerd's Eye View

NOVEMBER 21, 2022

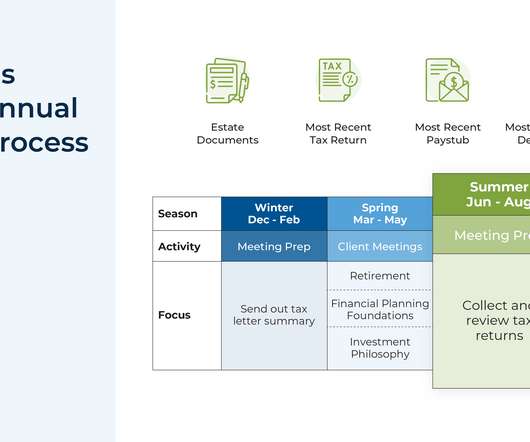

This approach allows advisors to focus more deeply on each topic they discuss with clients and, because of the systematic nature of the schedule, can also save time while improving both efficiency and efficacy.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content