Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Nerd's Eye View

MARCH 10, 2025

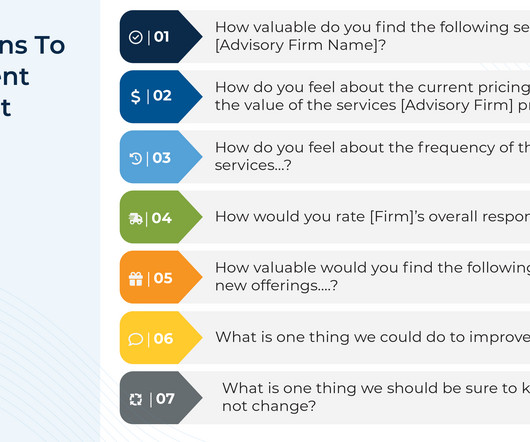

These services may range from 'standard' offerings like retirement planning to less traditional areas like credit card consulting. Financial advicers often market their comprehensive financial services as a way to differentiate themselves from other advisory firms and to stand out in the broader landscape of financial advice.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

AUGUST 24, 2023

However, when these aspirations are delayed or blocked by senior advisory firm partners who choose to delay their retirement plans, it can leave younger advisors frustrated and in a place of uncertainty about their futures with their firm.

Nerd's Eye View

JANUARY 4, 2023

Financial advisors have a wide range of strategies at their disposal to create financial plans for their clients. And when it comes to retirement planning, one popular technique is the use of ‘guardrails’, which set an initial monthly withdrawal rate that can be later adjusted as the size of the client’s portfolio changes.

Nerd's Eye View

APRIL 8, 2025

We also talk about Seth's journey to financial planning as a career changer (after finding that previous jobs in urban planning and real estate either took too much time away from his family or weren't compatible with his values), how Seth's connection with a family friend eventually led him to assume the books of business of three retiring advisors (..)

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

Nerd's Eye View

SEPTEMBER 2, 2022

We also have a number of articles on retirement planning: New research suggests that while the average senior will amass hundreds of thousands of dollars in health care expenses in retirement, the net cost they have to pay is not nearly as high.

Nerd's Eye View

JANUARY 1, 2024

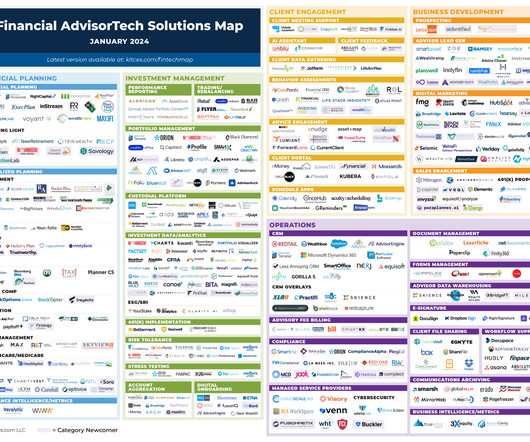

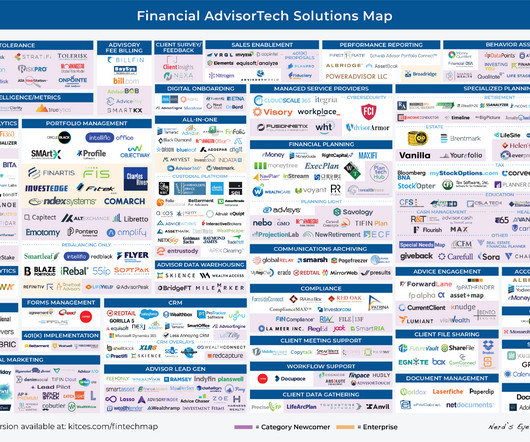

This month's edition kicks off with the news that held-away asset management platform Pontera has raised $60 million in venture capital funding as advisors increasingly seek to directly manage clients' 401(k) and other outside assets – although an ongoing investigation by Washington state regulators over whether advisors' use of Pontera violates (..)

Nerd's Eye View

DECEMBER 16, 2022

We also have a number of articles on retirement planning: While weak stock and bond market performance has challenged advisors and their clients this year, these trends have likely increased the ‘safe’ withdrawal rate for new retirees.

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. As more workers consider the growing appeal of semi-retirement, some ask — is working part-time in retirement a good idea?

Nerd's Eye View

NOVEMBER 11, 2022

We also have a number of articles on retirement planning: How the recent increase in interest rates has made TIPS a more viable option to increase a retired client’s safe withdrawal rate. The most effective question advisors can use to end initial prospect meetings.

Nerd's Eye View

JANUARY 6, 2023

How planning specializations can help firms and their advisors stand out from the pack. From there, we have several articles on retirement planning: Why an individual’s portfolio of relationships could be just as important as their investment portfolio when it comes to happiness in retirement.

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family.

Nerd's Eye View

DECEMBER 9, 2022

Also in industry news this week: A recent survey indicates that retirement plan sponsors currently using financial advisors to support their plan are overwhelmingly satisfied with the service they receive, which also leads to improved retirement savings for their employees.

Nerd's Eye View

JUNE 5, 2023

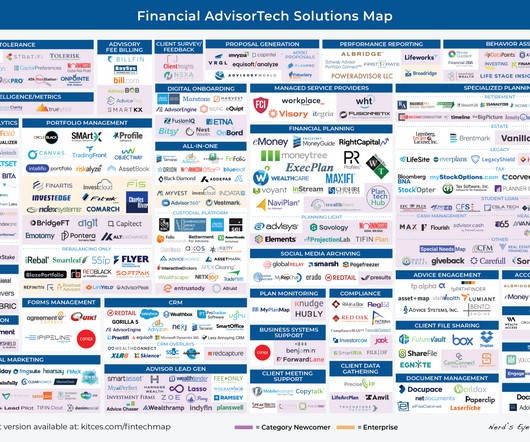

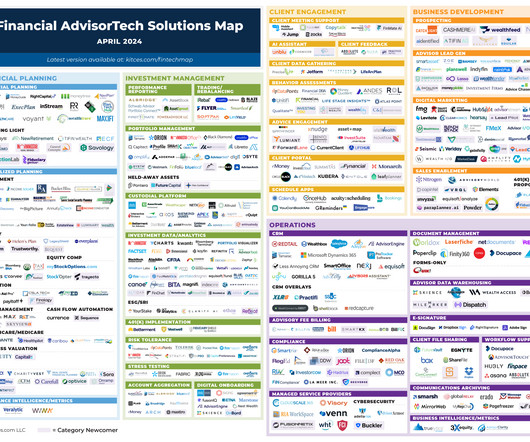

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: InvestCloud, a TAMP and all-in-one advisory technology platform which has undergone rapid growth in recent years through the acquisition of numerous disparate technology tools in order to compete with its more-established competitor (..)

Nerd's Eye View

DECEMBER 23, 2022

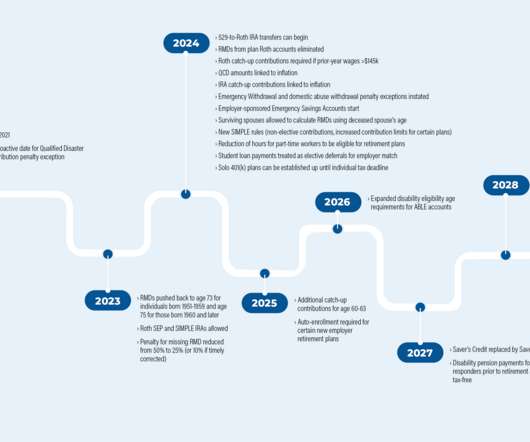

”, a series of measures that will have significant impacts on the world of retirement planning. Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”,

Nerd's Eye View

DECEMBER 30, 2022

” has brought a wide range of changes to the world of retirement planning. Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the passage of “SECURE Act 2.0”

Nerd's Eye View

SEPTEMBER 6, 2022

Andy is the owner of Tenon Financial, a virtual independent RIA that oversees $70 million in assets under management for 43 retired client households. Welcome back to the 297th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Andy Panko.

Nerd's Eye View

MAY 1, 2023

Rowe Price has acquired Retiree Income, the parent company of popular retirement income planning software SSAnalyzer and Income Solver, to put its resources behind developing and distributing the company’s planning tools (albeit perhaps more to its retail and employee retirement plan clients than to advisors?).

Nerd's Eye View

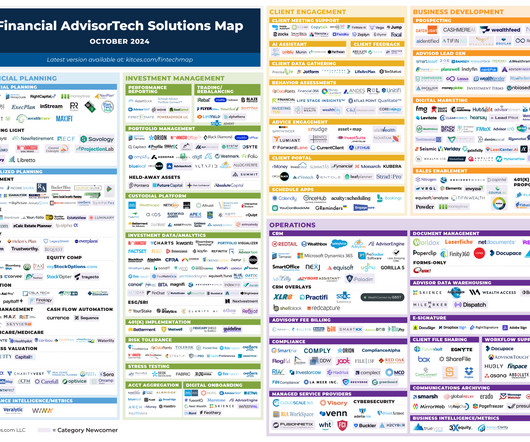

OCTOBER 7, 2024

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: VRGL has announced a new venture capital funding round to continue building out its capabilities to extract data from prospects' investment statements and automatically generate investment proposals – which while having proven (..)

Nerd's Eye View

MAY 9, 2023

In this episode, we talk in-depth about how, to realize their vision for the future of a commission-based firm their father originally built, Liz and her brother have gone through the messy multi-year process of refocusing to a niche and rightsizing their client loads, how Liz and her brother realized in the process of buying into the firm that they (..)

Nerd's Eye View

MAY 6, 2024

This month's edition kicks off with the news that self-directed retirement planning software provider NewRetirement has raised a $20M Series A round as the company demonstrates that its DIY tools really do turn a subset of consumers into bona fide prospects for financial advisors.

Nerd's Eye View

DECEMBER 6, 2023

Notably, while many financial coaches satisfy the majority of these requirements – they are in the business of offering advice to clients and are compensated as such – they often steer clear of making specific securities recommendations, focusing instead on areas like budgeting, debt management, savings, and retirement planning.

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g.,

Nerd's Eye View

AUGUST 24, 2022

a single person, a couple, a business, or a retirement plan) and the date on which the agreement will become effective. To start, the agreement should contain basic information about the adviser-client relationship, including who the client is (e.g.,

Nerd's Eye View

OCTOBER 17, 2023

What's unique about Brad, though, is how he built a multi-billion-dollar advisory firm not by moving 'upmarket' to gather multi-millionaire clients, but instead leveraged his 401(k) retirement plan advisory firm to begin offering comprehensive financial planning to the employees of large companies as an added employee benefit, and in the process scaled (..)

Nerd's Eye View

SEPTEMBER 3, 2024

Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors, an RIA based in Towson, Maryland, that manages $2 billion of private wealth assets under management for 1,300 client households and advises on an additional $5 billion in retirement plan assets.

Ballast Advisors

APRIL 13, 2023

Making the transition from taking care of your business to having the business take care of you in retirement is the purpose of succession planning. A good plan helps ensure the orderly transfer of a business to the next generation while providing you with retirement income or a nest egg to secure your future.

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. As more workers consider the growing appeal of semi-retirement, some ask — is working part-time in retirement a good idea?

oXYGen Financial

AUGUST 18, 2023

You're responsible for every decision, from selecting printer paper to creating a budget and business plan, as well as securing funding. Due to all of the tasks needed to keep a business profitable, long-term planning may become neglected.

Fortune Financial

MARCH 5, 2024

Small business owners are always on the lookout for strategies to not just survive but thrive in Kansas City. One powerful tool that might not be on every entrepreneur’s radar — but definitely should be — is a 401k plan. Employers can provide incentives to contribute to this type of retirement plan via an employer match.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

Clever Girl Finance

NOVEMBER 1, 2023

There are other things that matter just as much, like saving, investing, and retirement planning. Save for retirement Just like with having an emergency fund, over the long term, saving for retirement reduces and hopefully eliminates any reliance you have on debt. The post How Does Credit Work?

Midstream Marketing

NOVEMBER 5, 2024

Think about which parts of financial planning you like best. Is it retirement planning, investment management, or estate planning? This could be young professionals starting their careers, families thinking about education, or people who are close to retirement. You could think about offering specific services.

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0

Good Financial Cents

APRIL 19, 2023

The idea of passive income is to supplement, augment or get you out of your job so you can retire, travel, or spend more time with loved ones. You can earn passive income whether you’re an entrepreneur with a brilliant business plan, a talented artist, or just happen to have extra cash to invest. This is active income.

Steve Sanduski

APRIL 8, 2023

What’s your retirement number? Back in 2008, ING ran a “Your Number” marketing campaign with print, web, and TV ads showing different people busy with their daily routines carrying a large orange six- or seven-figure number in dollars. – – The number supposedly represented how much they needed to save for retirement.

Nationwide Financial

MARCH 6, 2023

While clients are thinking about 2022’s taxes, it’s a good time to discuss income, estate, and business planning opportunities for 2023. For example, they could make most of their charitable contributions and medical expenditures in a year they plan to itemize.

Nerd's Eye View

DECEMBER 10, 2024

Erika is the Director of Wealth Management of VisionPoint Advisory Group, a hybrid advisory firm based in Dallas, Texas, that oversees approximately $3 billion in assets under advisement for both 780 client households and for retirement plans.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content