Weekend Reading For Financial Planners (March 25-26)

Nerd's Eye View

MARCH 24, 2023

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

OCTOBER 31, 2023

Read More.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

JULY 17, 2023

In the early days when financial advisors were first and foremost salespeople for insurance and investments products, the reality is that "advisor training and education" wasn't really about finance or advice… it was mostly just about learning how the company's products worked and how to effectively sell them to consumers.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. Individuals who earn this certification are thoroughly prepared to offer expert financial advice.

International College of Financial Planning

FEBRUARY 23, 2024

At the heart of this profession lies the financial planner certification, a credential that not only signifies expertise but also opens doors to significant career opportunities. This certification is recognized globally and is considered a benchmark for competence and professionalism in financial planning.

MazumaBusinessAccounting

MAY 31, 2022

Remember, the IRS recommends keeping tax-related documents for at least six years. Some documentation has no expiration date, such as birth certificates and social security cards. Keep vital personal documents, like birth certificates, passports, marriage certificates, etc., Why should you keep some items permanently?

International College of Financial Planning

OCTOBER 26, 2023

Crafting a Comprehensive Financial Plan: This includes a detailed net worth statement, defining SMART Goals including retirement, children education etc., Empowerment Through Education A quintessential trait of genuine CFP® professionals is their commitment to enlightening the clients. They are dynamic, evolving with the flow of life.

Carson Wealth

JULY 12, 2022

So much of our world is filled with abbreviations surrounding insurance and investment products, processes, education and accomplishments. . Before being appointed, that professional will have to pass one or more state insurance exams, agree to a code of ethics, and maintain their license annually through continuing education.

Nationwide Financial

OCTOBER 18, 2022

These accounts can help your clients’ beneficiaries save for college and the funds can be used for various expenses relating to K-12 and higher education. It’s important to remind your clients that beyond just paying for education, there are significant tax benefits to using 529 plans. 529 Education Savings Plan.

MainStreet Financial Planning

SEPTEMBER 16, 2022

The Department of Education made significant, but temporary changes to the PSLF program called the Limited Waiver. Once you complete this, your balance will be forgiven, tax free. You can always check your employer by their EIN (or tax ID) if you are unsure. I am referring to the Public Service Loan Forgiveness (PSLF) program.

International College of Financial Planning

OCTOBER 26, 2023

Their wisdom extends to suggesting tax-efficient avenues for pivotal life moments, be it education or the golden years of retirement. Achieving them typically involves: Completing a dedicated education program. They’re well-versed in recommending vital products like life insurance and are wizards at tax planning.

Zoe Financial

JUNE 6, 2023

However, the increasing costs of pursuing higher education have made financing a concern for many parents. Regardless of the timeline, it’s vital to develop a well-thought-out plan to finance education. In the quest for knowledge and personal growth, higher education has always stood as a pivotal milestone in one’s journey.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

Clever Girl Finance

JUNE 27, 2023

Online educator 12. Although you’d still crush it with certifications and experience on specific programs such as Microsoft or Oracle. Their duties also include managing payroll and working with an accountant or tax preparer to file the company’s tax return. Remote IT technician 3. Bookkeeper 4. Accountant 5. Paralegal 7.

Walkner Condon Financial Advisors

SEPTEMBER 2, 2022

And while ABLE accounts can be a bit more complex for Wisconsin residents, they offer significant tax benefits for individuals with disabilities and their families. The money in the account grows tax-deferred and income from the account is tax-free when used for qualified expenses. candidate for cfp® certification.

Harness Wealth

MARCH 5, 2024

Tax advisors, and other tax professionals , offer services from preparing and filing annual tax returns to comprehensive tax strategies that help minimize taxes and preserve wealth over time. In this guide, we’ll explore the average fees of tax advisors in the US for 2024.

International College of Financial Planning

SEPTEMBER 7, 2024

The CFP® Fast Track course offers a quick, efficient pathway to certification, allowing you to accelerate your career in the financial planning industry. Unlike the regular pathway that requires passing multiple exams over a year, the fast track allows eligible candidates to take just one exam and complete the certification in 3-4 months.

International College of Financial Planning

APRIL 20, 2022

You can make your mark in this field with the proper education and a little effort. This article will discuss the basics of financial planning , the education and certifications required to become a financial planner, and how to develop your financial planning skills and network.

Clever Girl Finance

MARCH 14, 2023

We’ll also go over the benefits of growing the income for your portfolio and how to deal with taxes from investments! Savings Savings accounts and products like certificates of deposit (CDs) often earn interest, which is usually considered portfolio income. Some of these rules could potentially help you save money on your taxes.

Trade Brains

DECEMBER 7, 2023

Personal Finance for Beginners by FinGrad FinGrad Academy is an educational platform that offers various courses on financial products for better investment opportunities. Also, you will learn how to plan your taxes, credit score importance and how to budget your income to create a portfolio. You can enroll in the course here.

International College of Financial Planning

SEPTEMBER 23, 2024

This program offers a streamlined route to earning the prestigious Certified Financial Planner (CFP®) certification, especially for experienced professionals or those with advanced qualifications in finance. b) Increased Earning Potential Obtaining a CFP® certification significantly enhances your earning potential.

International College of Financial Planning

OCTOBER 10, 2024

The CFP® Fast Track offers a time-efficient and cost-effective solution for becoming a Certified Financial Planner, especially for those in India where the cost and time associated with traditional certification methods can be daunting. Why is CFP® Certification Important for Financial Planners?

International College of Financial Planning

JUNE 10, 2022

CFP, also known as Certified Financial Planner , is a certification given by the Financial Planning Standards Board (FPSB) to professionals who wish to take up financial planning. This certification is recognized internationally and considered the best for financial planning training, education, and ethical practice. .

Clever Girl Finance

NOVEMBER 8, 2022

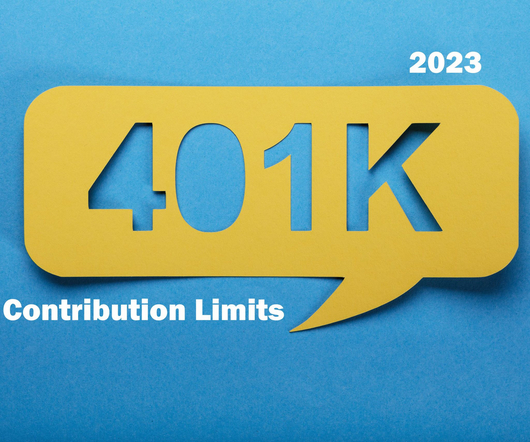

When you decide to start investing, the most important part of the process is educating yourself. In general, these accounts are aimed at saving for your retirement in a tax-advantaged way. Consider certificates of deposits. Leverage tax-advantaged retirement savings accounts from your employer first.

International College of Financial Planning

JANUARY 15, 2024

Embracing Financial Planning Courses Online versus On-Campus Learning The advent of online financial planning courses marks a pivotal shift in educational methodologies. On-Campus Learning: A Rich Educational Tapestry Contrasting to the online experience, on-campus learning offers a more immersive educational journey.

International College of Financial Planning

AUGUST 2, 2021

The simplest definition of the role of a financial advisor would of that of a person who helps individuals, families, and organizations make decisions related to their investments, taxes, insurance planning, retirement planning, estate planning, and money management. Accounting & Tax Planning Firms. Banks & NBFCs.

Trade Brains

NOVEMBER 30, 2023

Mutual Fund Investing for Beginners by FinGrad FinGrad Academy is an educational platform that offers various courses on investing and trading. The course covers what are mutual funds, types & terminologies of mutual funds, SIP, advantages, risks involved, regular vs direct funds and taxes in mutual funds.

Walkner Condon Financial Advisors

FEBRUARY 28, 2023

Going beyond your emergency fund, you might have some cash set aside for other short term expenses like property taxes or an upcoming home remodeling project or maybe a wedding. Certificates of Deposit (CDs) You can get CDs through your local bank or credit union or from a broker. They have maturity dates ranging from months to years.

International College of Financial Planning

MARCH 9, 2024

This blog is designed to illuminate the path to becoming a CFP® professional, focusing on the critical steps involved in the admission process, exploring the myriad of career prospects, delving into the eligibility criteria, and the future of the CFP® certification.

eMoney Advisor

DECEMBER 12, 2022

Across both small and large firms, 57 percent of employers are reimbursing financial advisors for some form of training or education—something to consider as you attempt to roll out planning across your organization. It is not meant to be, and should not be taken as financial, legal, tax or other professional advice.

Good Financial Cents

DECEMBER 26, 2022

I’m a big fan of the Roth IRA and investors that understand it’s massive tax-free benefits are also. A Roth IRA is a type of individual retirement account (IRA) that allows you to contribute after-tax money and withdraw it tax-free in retirement. Roth IRA Conversion Taxes. What is a Roth IRA?

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Similarly, if you’re saving for your child’s education, you must understand the projected cost and timeline.

eMoney Advisor

FEBRUARY 8, 2023

Include ways you and your firm have built the practice around this niche noting special expertise, education, and certifications. DISCLAIMER: The eMoney Advisor Blog is meant as an educational and informative resource for financial professionals and individuals alike.

Ballast Advisors

SEPTEMBER 22, 2023

The IRS has announced guidance for the home energy audit tax credit. Fortunately, there is a federal income tax credit available equal to 30% of the amount paid for home energy audits, up to $150 per tax year. If you claim the credit, the home energy audit should be kept as part of your tax records.

Good Financial Cents

JANUARY 26, 2023

That means understanding the stock market, planning for debt and savings, and investing in yourself through education or entrepreneurial ventures. Step 3: Invest and Invest Aggressively I probably don’t have to tell you that you’re not going to be able to retire at 50 by investing in interest-bearing assets, like certificates of deposit.

Trade Brains

OCTOBER 1, 2024

Additionally, they foster technological advancements, improving efficiency in healthcare, education, and transportation. Kaynes boasts impressive statistics: 34 years in manufacturing, over 1500 permanent employees, and 10 global certifications. They also provide prototyping and regulatory certification assistance.

Walkner Condon Financial Advisors

FEBRUARY 21, 2023

You also may be able to make after-tax contributions into your 401k as well to get up to the limit. While they are not tax deductible, the gains in the account will be tax deferred. You should always consult a financial, tax, or legal professional familiar about your unique circumstances before making any financial decisions.

International College of Financial Planning

JULY 10, 2023

Investment advisors can also specialize in specific areas such as retirement planning, tax planning, or portfolio management. Qualifying Certification Exams for Investment Advisors Individuals must clear the necessary qualifying exams to become certified investment advisors in India. Excellent communication and interpersonal skills.

Good Financial Cents

SEPTEMBER 29, 2022

Share insights in a community and access a wealth of educational content. Real Estate: Best for Predictable Gains + Tax Benefits. Real estate also has valuable tax benefits, like depreciation expense. Please note that they are not ranked in any certain order. Ad Build a portfolio through a unique investing experience.

Clever Girl Finance

MARCH 30, 2023

A money market fund is a sort of mutual fund that invests in short-term and low-risk securities like government bonds , certificates of deposit, and commercial paper. It's a good strategy for things like saving for a child's education or starting a business. If so, paying off debt or investing in education may be your route.

Clever Girl Finance

NOVEMBER 25, 2023

When you decide to start investing, the most important part of the process is educating yourself. In general, these accounts are aimed at helping you save for your retirement in a tax-advantaged way. You might choose to invest in your financial education , which could save you thousands of dollars over the course of your life.

International College of Financial Planning

JULY 31, 2023

Investing is essential to achieving our financial goals, whether saving for retirement, funding our children’s education, or building wealth for the future. They are financial experts with extensive education and training in finance and investments.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Similarly, if you’re saving for your child’s education, you must understand the projected cost and timeline.

Harness Wealth

MAY 25, 2023

The right advisor can help manage your wealth, plan for retirement, navigate tax implications, and more. The average hourly fee charged is typically between $120 per hour and $300 per hour, highly dependent on the metro area, educational background, and level of experience the advisor has attained.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content