FPA Unveils Cybersecurity Certification Program

Wealth Management

APRIL 2, 2025

The organization has completely rebuilt its cybersecurity certification program, originally introduced in 2020, given regulatory changes in the past five years.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 2, 2025

The organization has completely rebuilt its cybersecurity certification program, originally introduced in 2020, given regulatory changes in the past five years.

Wealth Management

MAY 1, 2024

Certified advisors differentiate themselves by being equipped to offer comprehensive services that address complex client needs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

OCTOBER 21, 2024

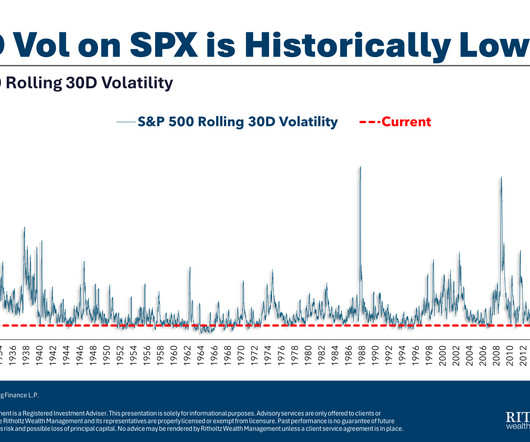

Key considerations for investors.

Wealth Management

JANUARY 11, 2024

A redesigned CAIA certification program for alternative investments highlights the need for advisors to approach the sector as a long-term, strategic play.

Wealth Management

APRIL 10, 2024

The Investments & Wealth Institute has updated its CIMA certification curriculum and exam for the first time since 2019.

Abnormal Returns

FEBRUARY 10, 2025

crr.bc.edu) Advisers Certifications are important, but connecting with clients is paramount. (morningstar.com) Robinhood's ($HOOD) proposed robo-advisor offering seems plain vanilla. riabiz.com) Health The case against HSAs. kitces.com) People seem to underestimate the chances of needing long term care.

Nerd's Eye View

APRIL 25, 2023

Ari is Managing Partner of Values Added Financial, an independent RIA based in Washington, D.C., that oversees $143 million in assets under management (AUM) for nearly 75 client households. Welcome back to the 330th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Ari Weisbard.

Wealth Management

AUGUST 2, 2022

Empty certifications that require no experience and limited interaction only adds to plan sponsors’ mistrust of the industry.

Nerd's Eye View

MARCH 25, 2025

AJ is the co-founder of Brooklyn Fi, an RIA based in Brooklyn, New York but operating as a fully remote business, that oversees $370 million in assets under management for more than 400 client households. My guest on today's podcast is AJ Ayers.

Nerd's Eye View

MARCH 11, 2025

Lorie is the wealth manager of Fearless Financial Advisors, a dba of hybrid advisory firm Fidelis Wealth Advisors based in Castle Rock, Colorado, where Lorie personally oversees $30 million in assets under management for 88 client households. Welcome to the 428th episode of the Financial Advisor Success Podcast !

Wealth Management

MARCH 1, 2023

Big financial institutions don’t feel the need to offer competitive rates on certificates of deposit, which are universally below the world’s safest asset: Treasury bills.

Nerd's Eye View

SEPTEMBER 13, 2024

Which means that while many fee-only RIAs use the reduced conflicts that come with the fee-only model (as opposed to firms that receive compensation from commissions and other sources) as a key marketing talking point, the fact remains that being truly 'conflict free' is nearly impossible and such claims (which are hard to substantiate) appear to be (..)

Nerd's Eye View

FEBRUARY 10, 2023

Among others, one notable item that could be reviewed is the current certification requirement that a candidate must have attained at least a bachelor’s degree, which some observers have suggested limits the pool of potential CFP professionals at a time of high demand for advisor talent.

Nerd's Eye View

FEBRUARY 23, 2024

Which suggests that instead of trying to go head-to-head with these larger firms (and their heftier marketing budgets) in attracting clients, smaller firms might instead demonstrate how they are 'different' by offering a unique service offering tailored to their ideal target clients.

Nerd's Eye View

MAY 7, 2024

Hannah is a partner and financial advisor at Lomanto Provost Financial Advisors, a hybrid advisory firm based in Plattsburgh, New York, that oversees approximately $150 million in assets under management for about 380 client households.

Nerd's Eye View

OCTOBER 3, 2023

Brett is the Founder of Brett Danko Educational Center, a CFP Board Education and Exam Prep provider, and the CEO and Managing Partner for Main Street Financial Solutions, an independent RIA based in Newtown, Pennsylvania, that oversees almost $2 billion in assets under management for nearly 1,700 client households.

Nerd's Eye View

OCTOBER 31, 2023

Jon is the Founder and CIO for Echo45 Advisors, an independent RIA based in Walnut Creek, California, that oversees $163 million in assets under management for more than 180 client households. My guest on today's podcast is Jon Henderson.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. Individuals who earn this certification are thoroughly prepared to offer expert financial advice.

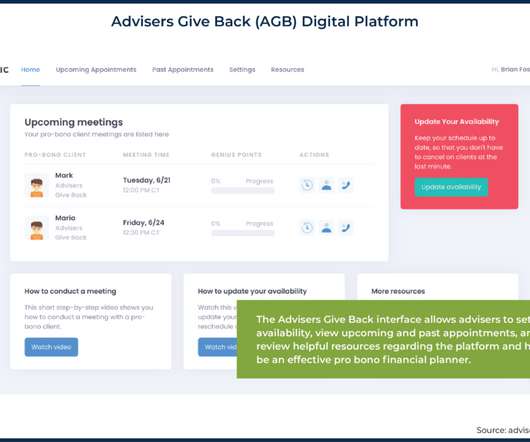

Nerd's Eye View

AUGUST 15, 2022

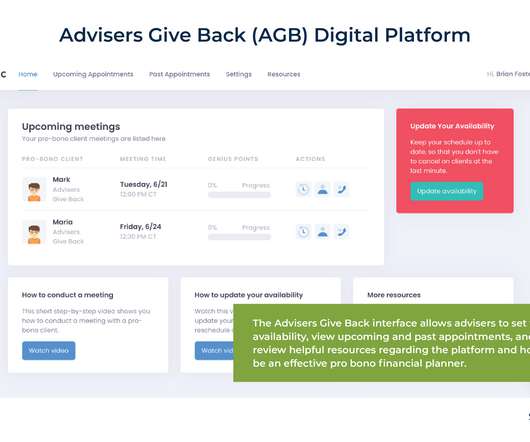

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

The Big Picture

AUGUST 1, 2022

I’ve been an Amazon customer since my college roommate gave me a gift certificate in 1998. The reasons for this are simple: If you already have a repair and warranty division to manage ordinary warranties, it costs you next to nothing to repair or replace the stuff off warranty. This leaves lots of room for profit.

Nerd's Eye View

MAY 22, 2023

And there are even advantages for the firm’s existing employees who mentor the interns: the opportunity to train, teach, and manage interns can provide valuable leadership experience to benefit their own career development.

International College of Financial Planning

FEBRUARY 23, 2024

At the heart of this profession lies the financial planner certification, a credential that not only signifies expertise but also opens doors to significant career opportunities. This certification is recognized globally and is considered a benchmark for competence and professionalism in financial planning.

Nerd's Eye View

AUGUST 15, 2022

Most advisors are already familiar with many of the issues these individuals face, from setting goals to debt management, although the specifics might be slightly different given the typically lower incomes and wealth of pro bono clients. law) with established pro bono programs.

International College of Financial Planning

JULY 20, 2022

Here are some of the key things you learn in risk analysis under CFP certification. One of the most important aspects of any risk management strategy is communication. This understanding allows people to make informed decisions regarding managing those risks. The CFP certification is a globally recognized designation.

A Wealth of Common Sense

JULY 12, 2024

Messengers with huge black boxes on wheels, filled with stock and bond certificates, scurried from broker to broker tr. One of my favorite parts of the book is where Ellis looks at how Wall Street has changed in the past 50 years: MBAs were uncommon. PhDs were never seen. Commissions still averaged 40 cents a share.

Nerd's Eye View

SEPTEMBER 9, 2024

The typical service advisor without CFP certification earns $48.83 The knowledge obtained through CFP certification can forge a more planning-centric practice, offering financial plans that are more comprehensive and updated more frequently – which are clear value-adds for high-net-worth households who often have complex planning needs.

International College of Financial Planning

OCTOBER 26, 2023

Their primary objective is to ensure that the assets are managed & distributed according to the wishes of the client. Estate planning is a significant aspect of financial management that ensures the seamless transfer of assets to the next generation and the fulfilment of an individual’s wishes after their demise.

Nerd's Eye View

JULY 17, 2023

In the 2nd half of the year and into 2024, we'll also be hiring a new Manager of People & Culture, a Curriculum DesigNerd and Instruction DesigNerd for our Education team, and a full-time Director of Advisor Research.

Tobias Financial

AUGUST 28, 2023

In the midst of interest rate hikes, the world of certificates of deposit (CDs) is buzzing. Learn more here: [link] The post Navigating High-Yield Certificates of Deposit in a Changing Interest Rate Landscape appeared first on www.tobiasfinancial.com.

Nationwide Financial

DECEMBER 1, 2022

When clients avoid investing and instead hold a large portion of assets in cash or other low-risk investments (such as money markets, certificates of deposit and bonds) during periods of high inflation, it could ultimately work against their long-term goals. 4 And the nearly $4.46 trillion 5 currently parked in U.S. Cash on the sidelines.

International College of Financial Planning

OCTOBER 26, 2023

If the thought of enlightening others on sound financial choices resonates with you, if you’re intrigued by the world of investment management, and if building lasting relationships is your forte, then financial advisor as a career choice is the chosen one. Various profiles as a Financial Advisor?

International College of Financial Planning

MAY 20, 2024

Opting for a job oriented course after graduation in wealth management can be particularly advantageous, offering a direct route into a vibrant and lucrative financial sector. Course Curriculum: The curriculum should be comprehensive, covering essential topics in demand in wealth management.

Trade Brains

DECEMBER 5, 2023

It covers the basics of options, option Greeks, technical analysis, option chain, selecting strike prices, trading strategies, Psychology and money management in options trading. By enrolling in this course, you will learn the options trading concept with risk management techniques. You can enroll in the course here.

Darrow Wealth Management

FEBRUARY 13, 2025

If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products. Although some firms use these compensation methods, the majority base fees on a percentage of assets under management (AUM) for their services. Independent firm.

Clever Girl Finance

AUGUST 10, 2023

Educational requirements: High school diploma or your GED and a patient care technician certificate. Educational requirements: High school diploma or get a GED, and, typically, a certificate program or get an associate’s degree. You might also be required to conduct healths coaching sessions and pass a certification exam.

Good Financial Cents

JUNE 11, 2023

You see, financial advisors that focus primarily on wealth management can be costly to keep around. They charge either a percentage of assets managed or a flat hourly rate that can run as high as several hundred dollars per hour, plus trading commissions and administrative fees. Personal Capital to the rescue.

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Carson Wealth

JANUARY 22, 2025

It was a heartwarming day, and even our Associate Wealth Advisor, Zach Vande Weerd, managed to get a photo with his wife, Hannah, and their adorable dog, Chief. Professional Milestones Congratulations are in order for Zach, who obtained his CFP certification on November 7th!

Million Dollar Round Table (MDRT)

AUGUST 18, 2022

By Bryson Milley, CFP, CIM One of the questions I’m most asked by retiring clients is, “How do I manage my investments once I’m retired?” Managing the building. In our case, we carefully select a handful of property managers to look after the building and collect the rent.

Clever Girl Finance

MAY 15, 2024

Requirements: Strong communication skills Some employers may require sales associate certifications 4. Requirements: Physical fitness skills Relevant certifications 6. Requirements: Fluency in language(s) other than English May require a certification 7.

Carson Wealth

DECEMBER 13, 2022

RIAs commonly use two titles for their IARs: Financial Advisor and Wealth Manager. Financial Advisors and Wealth Managers have a common knowledge and skill sets. What Do Wealth Managers Do? Wealth management is also a phrase used to describe the process of choosing a client’s investment portfolio. The Similarities.

Carson Wealth

JULY 12, 2022

Professional Certifications for Financial Advisors. Professional certifications and degrees, or the letters that come after a name, represent additional steps an advisor has taken on their professional journey. . The CRPC is managed by The College for Financial Planning. CFP ® – CERTIFIED FINANCIAL PLANNER.

Harness Wealth

APRIL 5, 2023

In this article, we’ll explore the challenges of balancing liquidity, returns, and risk management when optimizing idle cash in personal financial planning. We’ll dive into various cash management strategies, their benefits and drawbacks, and how to align them with your financial goals.

Midstream Marketing

DECEMBER 26, 2024

These features include customizable advertising templates, automated email campaigns, tools for social media management, and access to approved, compliant content libraries. Staying Ahead with Google Certifications: Forefield’s digital marketing experts have Google certifications.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content