Personal finance links: ignoring the lottery

Abnormal Returns

JANUARY 4, 2023

abnormalreturns.com) This startup site is designed to provide people with information about divorce. bestinterest.blog) The return on certificates of deposit are once again worth a look. (bestinterest.blog) Giving up How to de-prioritize activities that don't serve you. msn.com) New year Ten words for 2023 including 'Simplify.'

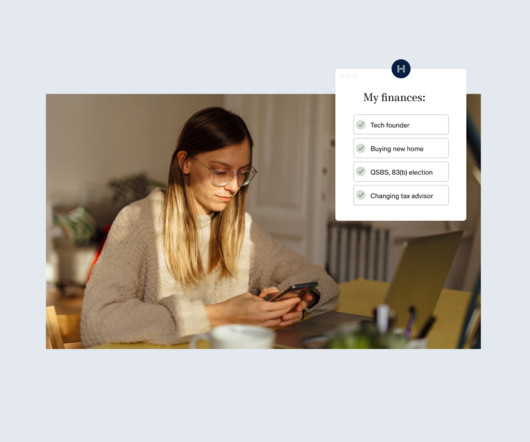

Let's personalize your content