CFP Board Splits To Better Tout Profession’s Benefits

Wealth Management

JANUARY 25, 2023

The CFP Board Center of Financial Planning will concentrate on pro bono and research work, while the CFP Board of Standards will focus on certifying advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 25, 2023

The CFP Board Center of Financial Planning will concentrate on pro bono and research work, while the CFP Board of Standards will focus on certifying advisors.

Wealth Management

AUGUST 3, 2022

Healy, who was laid off from TD Ameritrade during its integration with Schwab, has volunteered with the Center for Financial Planning for several years. Now she'll lead it.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

OCTOBER 18, 2023

Blake Pinyan, CFP and FPA National NextGen Co-Chair, shares his journey in the financial planning industry.

Abnormal Returns

JANUARY 30, 2023

Podcasts Daniel Crosby talks with Jamie Hopkins, Managing Partner of Wealth Solutions at Carson Group, about understanding our money stories. standarddeviationspod.com) Michael Kitces talks Jennifer Climo, the CEO and a Senior Advisor for Milestone Financial Planning, about the logistics of merging two practices in just 7 years.

Nerd's Eye View

MAY 22, 2023

Traditionally, financial planning internship programs have offered students who are aspiring financial planners a way to prepare for entering the workforce by gaining real-world experience in advisory firm settings (as well as a way to get their foot in the door with prospective employers).

Wealth Management

JULY 26, 2023

Dale Buckner, CFP, is not your average advisor.

Nerd's Eye View

DECEMBER 16, 2024

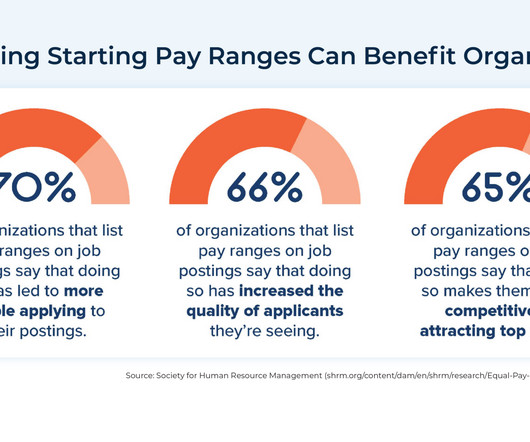

When a financial planning firm is hiring a new employee, it naturally wants to find the best candidate to fill the role. CFP Board Career Center, FPA Job Board), on general interest sites (e.g., When promoting an open position, firms can benefit from advertising beyond their personal networks and local geographic areas.

Wealth Management

AUGUST 12, 2022

The largest financial planning designation group announced several suspensions of advisors, including a Delaware-based planner who faces five counts of dealing child pornography, as well as a Maryland planner who was arrested and charged with manslaughter in an alleged drunk driving incident.

Abnormal Returns

OCTOBER 9, 2023

wiredplanning.com) Michael Kitces talks with Brett Danko who is the Founder of Brett Danko Educational Center, and the CEO and Managing Partner for Main Street Financial Solutions. advisorperspectives.com) What does comprehensive financial planning entail? advisorperspectives.com) How to choose a CFP exam study program.

Nerd's Eye View

OCTOBER 3, 2023

Brett is the Founder of Brett Danko Educational Center, a CFP Board Education and Exam Prep provider, and the CEO and Managing Partner for Main Street Financial Solutions, an independent RIA based in Newtown, Pennsylvania, that oversees almost $2 billion in assets under management for nearly 1,700 client households.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively.

Abnormal Returns

AUGUST 28, 2023

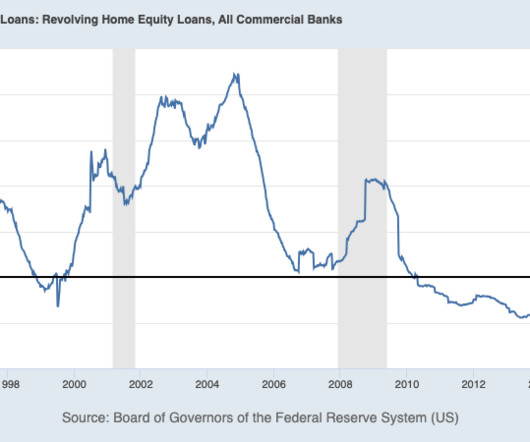

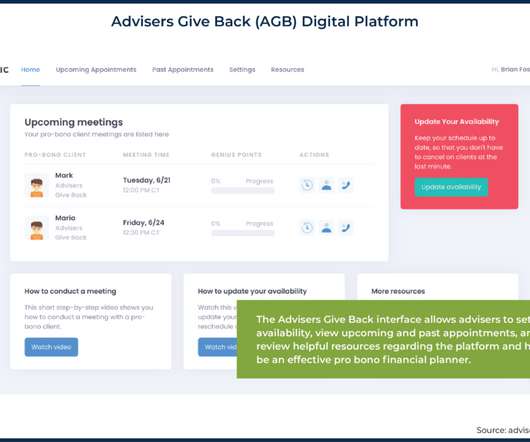

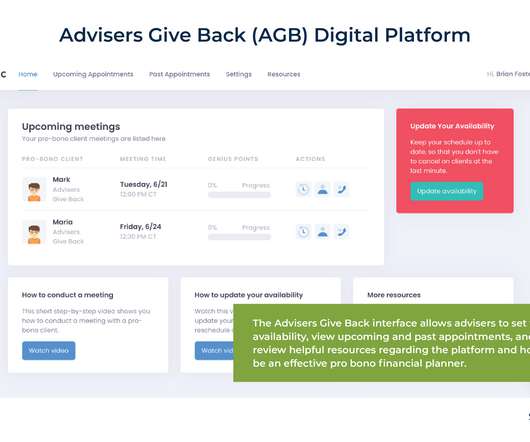

(riabiz.com) Charles Schwab ($SCHW) is planning more job cuts due to the TDA integration. investmentnews.com) Pro bono planning Does financial planning have a pro bono problem? mywealthplanners.com) The CFP Board wants to encourage pro bono planning. kitces.com) The SEC is focusing on RIA marketing.

Nerd's Eye View

SEPTEMBER 9, 2024

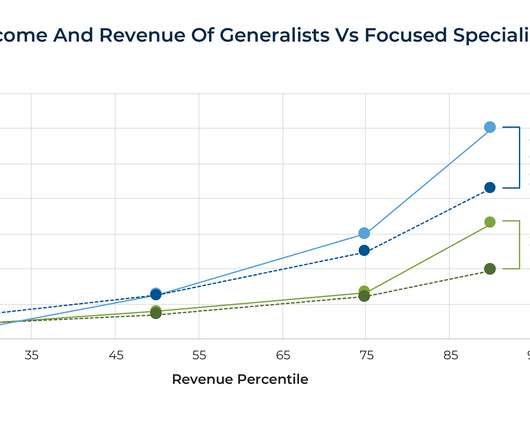

While the share of advisors with the CFP marks has risen steadily over time, today, about 2/3 of financial advisors are not CFP professionals. The typical service advisor without CFP certification earns $48.83 The typical service advisor without CFP certification earns $48.83 hour, compared to $120.00

Nerd's Eye View

DECEMBER 16, 2022

Also in industry news this week: While the FPA is going full steam ahead on its federal and state lobbying efforts to regulate the title “financial planner”, CFP Board is more focused on increasing recognition of the CFP marks.

International College of Financial Planning

MARCH 12, 2025

Many influencers dont have professional financial expertise; theyre just good at marketing. What to Do Instead: Stick to fundamentals: Learn about asset allocation, risk management, and diversification before investing. A strong financial foundation is built on conscious spending, strategic saving, and disciplined investing.

Nerd's Eye View

OCTOBER 11, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a CFP Board ad campaign promoting a career in financial planning to high school and college students sparked an uproar in the planning community, as some advisors questioned whether the messages being sent in the ads – (..)

The Big Picture

JANUARY 29, 2024

When the opportunity to partner with Adam Day, CFP in Naples came along, we jumped on it. This is the perfect opportunity to learn more about how we manage assets and develop financial plans for our clients, or to just swing by and say “hello.” We will be meeting with both clients and potential clients.

Abnormal Returns

SEPTEMBER 9, 2024

Podcasts Michael Kitces talks financial wellness with Zack Hubbard. Zack is the Director of Financial Planning and Participant Engagement of Greenspring Advisors. youtube.com) Brendan Frazier talks with Michael Kitces about mastering the human side of financial advice.

Abnormal Returns

SEPTEMBER 18, 2023

(citywire.com) Creative Planning is getting creative to retain former United Capital advisers. riabiz.com) RWM A lot of changes have happened in ten years at Ritholtz Wealth Management. theirrelevantinvestor.com) Taxes Why clients need to start planning now for the coming dip in the estate tax exemption. alphaarchitect.com)

Nerd's Eye View

JANUARY 3, 2023

Sue is the owner of Delegated Planning, which offers virtual outsourced financial planning support to 55 advisory firms, and the co-founder of Planning Zoo, an outsourced financial planning data entry business that helps current and recently graduated students from college CFP educational programs connect with advisory firms that need paraplanner support (..)

Nerd's Eye View

JULY 12, 2022

Kamila is the CEO and Founder of Collective Wealth Partners, an independent RIA based in Atlanta, Georgia, that oversees nearly $25 million in assets under management for almost 175 client households.

Nerd's Eye View

JANUARY 13, 2025

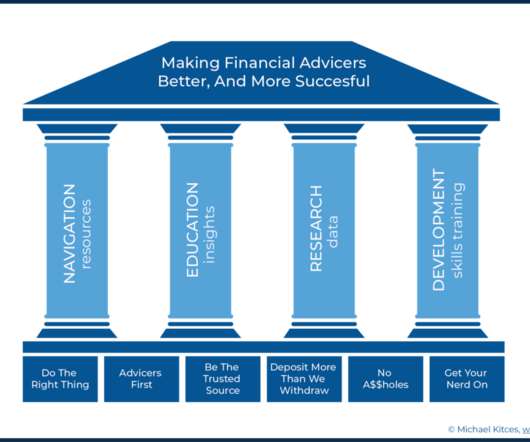

We've also rolled out a new private community specifically for Directors of Financial Planning (DFPs), who are increasingly becoming the lynchpins that drive planning excellence in advisory firms… which is so in alignment with our own Kitces mission that we wanted to start hosting a community for DFPs to further foster their success!

eMoney Advisor

MAY 1, 2023

.” Only 4 percent of Certified Financial Planner™ professionals identify as Asian American or Pacific Islander (AAPI), though they make up 6.2 1,2 Despite the small numbers, AAPI professionals remain the largest ethnic minority within the financial planning profession. percent of the American population.

Nerd's Eye View

AUGUST 18, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study has found that consumers are increasingly likely to spread their portfolios across a range of asset managers, and that this trend is particularly pronounced amongst more affluent clients (e.g.,

Nerd's Eye View

APRIL 14, 2023

The company said the bulk of the funds will go toward research and platform development as it attempts the challenging task of getting more mid-sized RIAs to move over to Altruist from their current custodian.

Nerd's Eye View

OCTOBER 17, 2023

Brad is the Co-Founder & CEO of Intellicents, an independent RIA with 12 offices across the country and headquartered in Albert Lea, Minnesota, that oversees $6 billion in assets under management for more than 3,000 client households.

eMoney Advisor

MARCH 1, 2023

In fact, statistics show that eight out of every ten women are going to end up responsible for managing either their own wealth or someone else’s. As women in financial planning, we can work to build that environment by connecting with, elevating, and inspiring each other.

Nerd's Eye View

JUNE 6, 2023

Welcome back to the 336th episode of the Financial Advisor Success Podcast ! Adam is a principal with RubinGoldman and Associates, and the Founder and CEO of Asset-Map, a financial planning tool that helps financial advisors create a visual representation of their clients’ financial situation, reaching over 1.25

Nerd's Eye View

AUGUST 15, 2022

Working as a financial advisor can be both financially rewarding and emotionally satisfying. By helping clients develop financial goals, creating a financial plan, and supporting the implementation and monitoring of the plan, advisors help clients live their best lives. Read More.

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

eMoney Advisor

JANUARY 12, 2023

We’ve gathered seven unique volunteer opportunities for financial professionals, including pro bono financial planning. It turns out that helping people manage their money might literally be a lifeline. A 2021 study measured the impact pro bono financial planning can have on cancer patients.

Nerd's Eye View

OCTOBER 25, 2024

Also in industry news this week: The SEC this week released its list of priorities for 2025 examinations, which include advisers' use of Artificial Intelligence tools, adviser recommendations of complex investment products, and broker-dealers' compliance with Regulation Best Interest CFP Board has introduced a refreshed ad campaign encouraging students (..)

Nerd's Eye View

JULY 9, 2024

Alex is the owner of Blackbridge Financial, a hybrid advisory firm based in Irmo, South Carolina, that oversees approximately $330 million in assets under management for 415 client households. My guest on today's podcast is Alex Lewis.

Nerd's Eye View

JULY 25, 2022

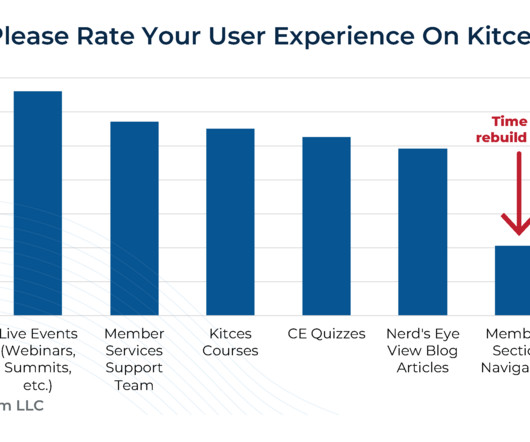

Yet despite this – and perhaps even because of it – advisory firms are putting an ever-greater focus on financial planning in 2022, as a way to both show value to clients in the midst of difficult market returns, and, more broadly, to help clients navigate the current environment. A gap our Kitces Courses aim to fill!

Nerd's Eye View

AUGUST 15, 2022

Working as a financial advisor can be both financially rewarding and emotionally satisfying. By helping clients develop financial goals, creating a financial plan, and supporting the implementation and monitoring of the plan, advisors help clients live their best lives. Read More.

Steve Sanduski

FEBRUARY 18, 2025

Advisors who learn how to incorporate these and other emerging asset classes into Life-Centered Financial Plans will be offering a valuable service that sets them apart — especially in the eyes of high-net-worth individuals. Tom Ruggie on LinkedIn Significance of Wealth Subscribe to Tom’s podcast.

Walkner Condon Financial Advisors

JUNE 2, 2023

The importance of getting women into financial planning feels like it should go without saying. Unfortunately, we’re not quite there yet as a society, since as of 2022, the Bureau of Labor Statistics reports only a third of financial advisors are women. In 2022, nearly 42% of the externships participants were women.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

Tobias Financial

DECEMBER 15, 2024

When it comes to financial planning, working with an advisor who understands both tax law and financial strategy can offer significant benefits. Financial planning is not just about setting one goal – its a continual process of making decisions that shape your financial future.

Million Dollar Round Table (MDRT)

JANUARY 28, 2025

By Alain Quennec, CFP, CIM Fifteen years ago, a client and I were cycling when he introduced me to one of his friends. My heart fell right away because this client didnt understand the breadth of the work and complex financial planning we had done for him in the previous five or 10 years. He said, Hi, this is Al Quennec.

Nerd's Eye View

AUGUST 19, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the FPA is planning to leave the Financial Planning Coalition (which also includes the CFP Board and NAPFA) at the end of the year.

International College of Financial Planning

APRIL 25, 2024

Achieving the status of Certified Financial Planner® (CFP®) represents a significant professional milestone in financial services. Recognized in over 27 countries globally, the CFP® designation is one of the most respected and widely acknowledged credentials in financial planning.

Million Dollar Round Table (MDRT)

JANUARY 14, 2025

By Jamie McIntyre, CFP It was pretty clear from the regulator that they didn’t want product to be the focus of what a financial planner or financial advisor led with. So with that, the message was clear: Don’t lead with a financial product as the tool that is going to help someone.

Nerd's Eye View

NOVEMBER 21, 2023

Welcome back to the 360th episode of the Financial Advisor Success Podcast ! Suzanne is a Senior Financial Advisor at Meridian Wealth Management, an RIA based in Lexington, Kentucky, where she oversees approximately $110 million in assets under management for nearly 150 client households.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content