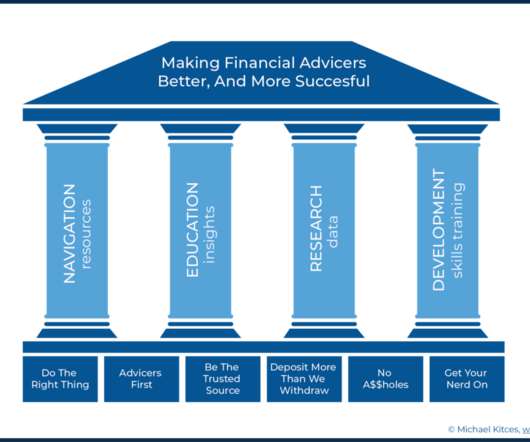

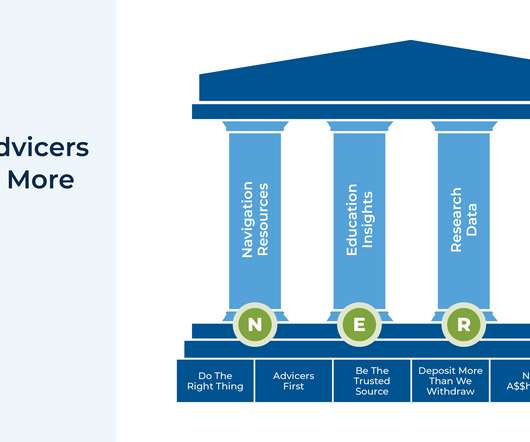

Announcing More Webinars And IAR CE In 2024 And The State Of The (Nerd’s Eye View) Blog

Nerd's Eye View

DECEMBER 11, 2023

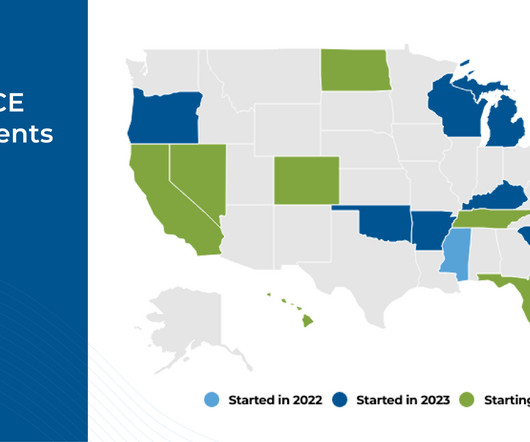

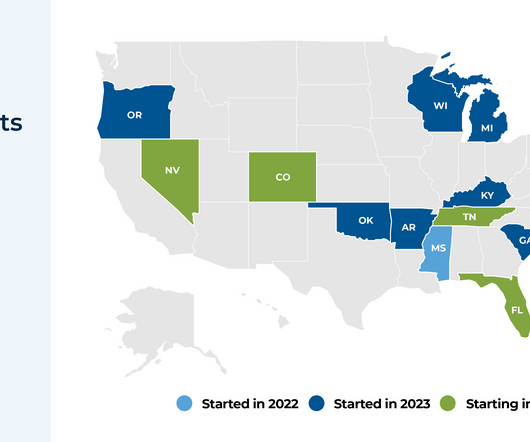

And in the coming year, we're going to make sure that even more of that Kitces content is eligible for not only the full range of CE credit for CFP, CPA, and the other various professional designations, but also the ever-expanding IAR CE obligation. In 2024 we'll again feature our Marketing Summit (save the date for April 25th!)

Let's personalize your content