Charitable Planning with Retirement Assets

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Nerd's Eye View

JANUARY 22, 2024

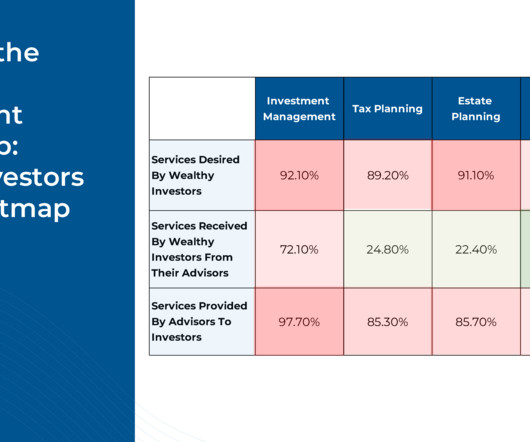

For example, an advisor may think of "risk management" in terms of life and property insurance coverage, whereas HNW clients may instead think of tax and estate-planning strategies as asset protection measures – particularly for the future wealth of their heirs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

NAIFA Advisor Today

MARCH 26, 2025

Charitable giving plays a vital role in many clients financial plans, yet discussions often focus heavily on tax mitigation rather than the true philanthropic intent behind the gift.

Advisor Perspectives

MARCH 29, 2023

Charitable planning is an important topic to discuss with your clients, especially if they’re facing extraordinary taxable events this year. You can add value to your clients by sharing these tax-smart giving strategies for 2023.

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. Discuss more advanced estate planning, charitable planning and special family issues.

MainStreet Financial Planning

DECEMBER 19, 2022

But what if you could do good for the charity and your taxes at the same time? Charitable donations can lock in tax deductions that will save you money. Having a simple plan and willingness to use alternatives to cash donations can help you lower your tax liability. Bunch donations. Donate directly from your IRA.

eMoney Advisor

NOVEMBER 29, 2022

Below I’ve answered common questions from financial advisors on coordinating a client’s RMD with a QCD to make the most of tax benefits, whether clients should first fund a donor-advised fund (DAF) before a QCD, as well as some general guidelines to follow. The QCD is generally more tax-advantaged if you are giving cash.

Let's personalize your content