Heather Zack on the Power of Charitable Planning

Wealth Management

DECEMBER 9, 2022

Heather Zack, manager of advanced planning at Commonwealth Financial Network, offers tips on how to use charitable planning to expand an advisor’s client base.

Wealth Management

DECEMBER 9, 2022

Heather Zack, manager of advanced planning at Commonwealth Financial Network, offers tips on how to use charitable planning to expand an advisor’s client base.

Wealth Management

SEPTEMBER 17, 2024

Traps to avoid when donors make significant gifts.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 13, 2023

Legacy IRAs and charitable remainder trusts are powerful tools to help defer or avoid certain taxes.

Wealth Management

MARCH 13, 2024

And the four client types that stand to benefit most from a conversation regarding donation to charity and philathropy.

Wealth Management

NOVEMBER 1, 2022

Failed charitable planning technique results in a malpractice claim.

Wealth Management

SEPTEMBER 15, 2023

Financial advisors play a crucial role in helping high-net-worth clients achieve their philanthropic goals through effective charitable planning. Two versatile and effective means of charitable giving are through donor-advised funds (DAFs) and privat

Nerd's Eye View

JANUARY 22, 2024

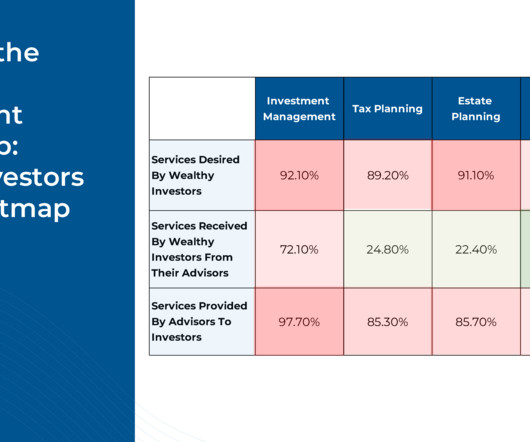

In the early days of wealth management, a financial advisor's value proposition was relatively explicit, typically focusing on a limited range of portfolio management activities (e.g., selling and trading) or on sales-oriented advice that centered on implementing insurance products.

Let's personalize your content