The Myriad Benefits of Marriage in the United States

Wealth Management

JUNE 14, 2024

marriage benefits regulate virtually every aspect of how clients manage taxes, finances, inheritance, housing and healthcare.

Wealth Management

JUNE 14, 2024

marriage benefits regulate virtually every aspect of how clients manage taxes, finances, inheritance, housing and healthcare.

Harness Wealth

MARCH 14, 2025

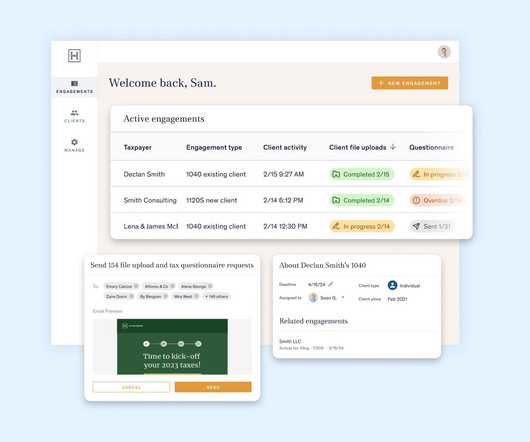

For many small tax firms, the process of collecting client tax documents can be a time-consuming and a prolonged process. The good news is that technology solutions, like Harness, can streamline document collection and transform the way tax professionals work.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

NOVEMBER 23, 2022

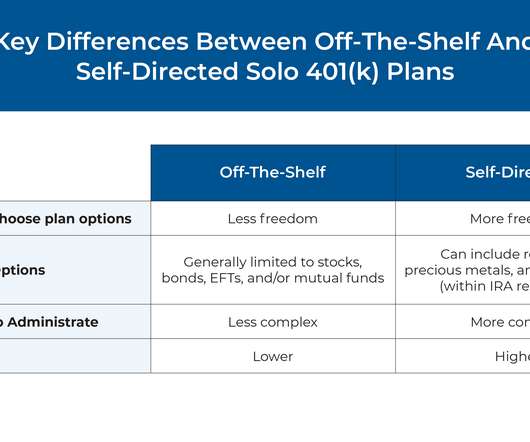

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings.

Harness Wealth

SEPTEMBER 23, 2024

Key Takeaways: CRM system centralizes all client and prospect information, helping tax firms manage client interactions and replacing manual systems like spreadsheets. Instead of emails and phone calls that go untracked, one of the key features of a CRM is providing your firm with a history of every client interaction.

Harness Wealth

SEPTEMBER 23, 2024

Key Takeaways: Too many tax practices are bogged down in commoditized administrative tasks and compliance work, making it challenging to cross-sell services to expand client relationships. The more a firm can either automate processes or outsource tasks, the more time it’ll have to build deeper client relationships.

Steve Sanduski

FEBRUARY 18, 2025

How advisors can help clients properly value, insure, and document their collections The tax implications of buying, selling, and trading collectibles. Tom Ruggie and I discuss: The confluence of factors driving the rise in collectibles as investments. Fractional collectible investments.

Nationwide Financial

AUGUST 14, 2022

Our paycheck impact tool can be utilized to help clients calculate how their income could impact their 401(k) and retirement savings plans. Budgeting is an important step in helping your clients manage their money, helping to ensure they are controlling their debts and have money available to invest.

Let's personalize your content