Weekend Reading For Financial Planners (March 22–23)

Nerd's Eye View

MARCH 21, 2025

of advisor compensation, while commission-based revenues have declined to 23% of an average advisor's revenue.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

MARCH 21, 2025

of advisor compensation, while commission-based revenues have declined to 23% of an average advisor's revenue.

Wealth Management

OCTOBER 26, 2023

The commission accused Julie Anne Darrah of a multi-year scheme targeting elderly female advisory clients spanning from before and after her firm joined Wealth Enhancement Group.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JANUARY 24, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that while overall financial advisor headcount remains relatively flat, the RIA channel continues to gain share in terms of both headcount (as brokers break away to start their own independent firms and aspiring advisors seek (..)

Wealth Management

FEBRUARY 7, 2023

The commission claims Joshua Coleman raised more than $200 million in loans, opening multiple lines of credit and using clients’ funds without permission.

Wealth Management

MARCH 2, 2023

The commission charged Kevin Kane and Sean Michael Kane for defrauding clients after they were fired from Waddell & Reed by telling them they left voluntarily.

Nerd's Eye View

MAY 9, 2023

Liz is the co-owner of Pleasant Wealth, a hybrid advisory firm based in Canton, Ohio that oversees $146 million in assets under management for 522 client households.

Wealth Management

NOVEMBER 4, 2024

The commission settled charges that Wahed Invest violated the ad rule when including a pro soccer player and MMA athletes in marketing without clarifying that they weren’t clients and were compensated.

Wealth Management

JUNE 29, 2023

Commissioned by the U.S. House Committee on Appropriations, the study confirms views that mandatory arbitration agreements imposed by fiduciary-bound RIAs can unfairly limit clients' ability to seek legal remedies from wrongful actors.

Wealth Management

JULY 31, 2023

According to the commission, Clarice Saw liquidated the securities of her 87-year old client without his knowledge when he was hospitalized.

Nerd's Eye View

APRIL 11, 2025

Senate has confirmed Paul Atkins to be the next Chair of the Securities and Exchange Commission (SEC). Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the U.S.

Wealth Management

OCTOBER 17, 2022

According to the commission, Keith Springer and his firm used “deceptive marketing” via ads and his radio show to attract investors, many of whom were retirees.

Nerd's Eye View

NOVEMBER 28, 2022

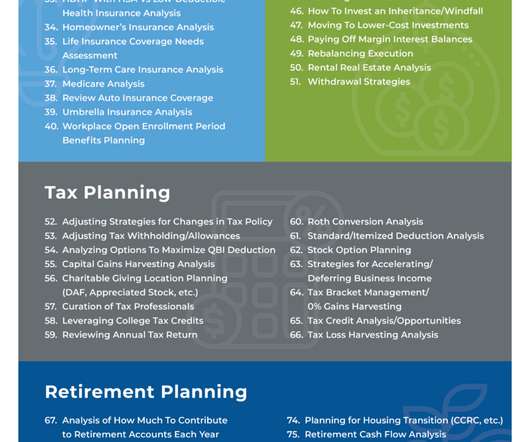

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. Combined with growing advisor (and consumer) interest in comprehensive financial planning services, the number of ways advisors can add value for their clients has expanded greatly.

Wealth Management

SEPTEMBER 11, 2024

According to the commission, Donald Anthony Wright made false statements when selling promissory notes to clients to fund the purchase of a Texas-based media marketing company.

Wealth Management

SEPTEMBER 30, 2024

The commission alleged two advisors defrauded clients by allocating unprofitable trades into their accounts, netting millions in "illicit" profits for themselves.

Wealth Management

DECEMBER 12, 2024

The commission charged South Carolina-based former rep Eric Cobb with defrauding clients while working for SeaCrest Wealth Management. The firm paid $375,000 to settle the charges.

Wealth Management

DECEMBER 11, 2023

In a recent report, the SEC Investor Advocate suggested the commission "temporarily" stop RIAs from including mandatory arbitration clauses in contracts, arguing they could "mislead retail clients into not exercising their legal rights."

Wealth Management

NOVEMBER 25, 2024

According to the commission, James David Burleson’s scheme caused over $3 million in losses for his clients and a 26.5% positive return for himself. The SEC argues the probability that divergence occurred by chance was “less than one in a million.”

Wealth Management

NOVEMBER 4, 2024

The commission settled charges that Wahed Invest violated the ad rule when including a pro soccer player and MMA athletes in marketing without clarifying that they weren’t clients and were compensated.

Nerd's Eye View

MARCH 14, 2025

Which, if implemented under the new administration, could provide relief for investment advisers, particularly smaller firms that already have to balance compliance with client service, marketing, and the other duties that go into running a firm.

Wealth Management

NOVEMBER 4, 2024

The commission settled charges that Wahed Invest violated the ad rule when including a pro soccer player and MMA athletes in marketing without clarifying that they weren’t clients and were compensated.

Wealth Management

APRIL 18, 2023

The robo advisor failed to tell some clients its tax-loss harvesting service only checked accounts on alternating days and not daily, as some materials claimed, according to the commission.

Wealth Management

JULY 25, 2023

A commission report from last month highlights the problem of forced arbitration clauses in contracts between RIAs and clients.

Wealth Management

JULY 22, 2022

The firm recommended investments in share class options for clients in its wrap account programs when more affordable options were available, according to the commission.

Nerd's Eye View

APRIL 26, 2024

Also in industry news this week: The Federal Trade Commission released a final rule that would ban most non-compete agreements, which could lead to an increasing number of non-solicit agreements (and, potentially, lawsuits regarding their enforcement) between financial planning firms and their advisors The Securities and Exchange Commission issued (..)

Wealth Management

FEBRUARY 28, 2023

Mercer CEO Dave Welling says the new brokerage will help it better serve prospective clients and M&A prospects with long-standing commission-based assets at outside broker/dealers.

Wealth Management

SEPTEMBER 13, 2022

Scott Adam Brander allegedly made more than $800,000 when allocating certain trades to benefit his own accounts, while placing less successful trades into clients’ accounts, according to the commission.

Nerd's Eye View

JUNE 30, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that NAPFA has announced that it will no longer exclude advisors who receive up to $2,500 in annual trailing commissions from previous product sales, if they agree to donate that money to a non-profit organization (..)

The Big Picture

APRIL 28, 2023

He was the founding Trustee of the Robin Hood Foundation in 1988He was also Chairman and CEO of Computer Trading Corporation, an investment and advisory firm whose largest consulting client is the Canadian Imperial Bank of Commerce (CIBC). Presidential Task Force on Market Mechanisms (Brady Commission) for the U.S.

Nerd's Eye View

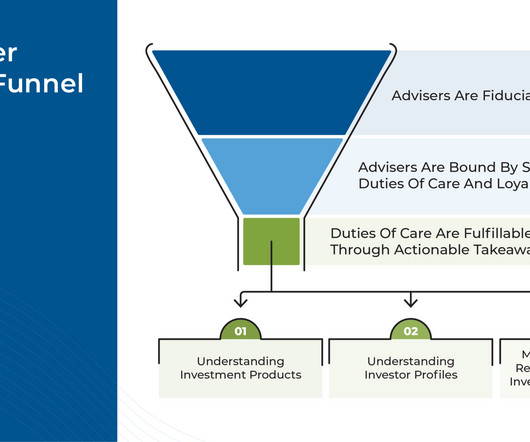

OCTOBER 25, 2023

There is a general understanding that investment advisers have a fiduciary relationship with their clients – in other words, that they are required to act in the client's best interests. These 3 components in practice make up a core part of the adviser's fiduciary duty to their clients.

Abnormal Returns

MARCH 18, 2024

xyplanningnetwork.com) Clients are increasingly willing to meet remotely. investmentnews.com) How home buying is going to change with the upheaval of realtor commissions. (riabiz.com) When do you need to register as an investment adviser? obliviousinvestor.com) How to pick an encrypted file system.

Abnormal Returns

DECEMBER 25, 2023

riabiz.com) DPL Financial Partners is seeing growth in commission-free annuity sales. advisorperspectives.com) Do financial advisers recommend annuities to their clients? (morningstar.com) A list of the most popular podcasts for financial advisers. linkedin.com) The biz Vestwell just raised a new $125 billion Series D. kitces.com)

NAIFA Advisor Today

JANUARY 6, 2025

Over the decades, he has built enduring relationships with clients, many of whom have been with him for over 30 years. Despite the initial shock and challenges of working on straight commission, Tom leaned into his natural work ethic, his extensive network, and his determination to succeed.

Nerd's Eye View

JUNE 12, 2024

Financial advisors, as professionals whose clients rely on their advice to make financial decisions, are legally and financially responsible for the advice that they give. Because ultimately, it's better to be surrounded by others who take care in advising their clients than to be the only one doing so! Read More.

Nerd's Eye View

SEPTEMBER 23, 2022

While the new rule allows financial advisors to proactively use testimonials (from clients), endorsements (from non-clients), and highlight their own ratings on various third-party websites, the SEC’s warning suggests that advisory firms will want to take care to abide by the compliance requirements linked to the new rule.

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice.

Nerd's Eye View

MAY 10, 2024

billion (thanks to expected reductions in commissions and the embedded costs in these annuities). could save retirement plan participants $55 billion over the next 10 years (due to an expectation of more low-cost fees being offered in plans) and those rolling over workplace plans into IRAs to purchase annuities another $32.5

Nerd's Eye View

OCTOBER 3, 2022

While the growth of DPL’s marketplace may itself usher in a greater level of annuity competitiveness, as companies are forced to compete for RIA attention not by offering the biggest commissions but by offering the best features and benefits to get through the RIA-as-gatekeeper.

Nerd's Eye View

AUGUST 5, 2022

How the proposed “Inflation Reduction Act” will impact financial advisors and their clients. Why state long-term care insurance programs are driving demand for private policies, and the implications of these programs for advisors and their clients. How advisors can support clients in choosing a Medigap policy.

Nerd's Eye View

DECEMBER 16, 2022

From there, we have several articles on practice management: Why it is important for advisors charging on a fee-for-service basis to regularly reassess their pricing, and best practices for letting current clients know about a fee increase. How firms can best leverage their internal data to improve the number of client referrals they receive.

Nerd's Eye View

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. Combined with growing advisor (and consumer) interest in comprehensive financial planning services, the number of ways advisors can add value for their clients has expanded greatly.

Nerd's Eye View

FEBRUARY 9, 2024

Also in industry news this week: A recent study finds that having a defined marketing strategy is a linchpin of marketing success, as advisors with a defined strategy were more likely to have seen an increase in inbound leads during the past 12 months and have more confidence in meeting their practice goals during the coming year than those without (..)

Nerd's Eye View

AUGUST 25, 2022

Historically, the career path for newer financial advisors has followed a commission-based model that was focused on sales and business development first and learning the technical aspects of financial planning along the way. Read More.

Nerd's Eye View

AUGUST 25, 2022

Historically, the career path for newer financial advisors has followed a commission-based model that was focused on sales and business development first and learning the technical aspects of financial planning along the way. Read More.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content