Adjusted for Risk: Client Communication Is Key to Investing Alternatives

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

Wealth Management

JANUARY 6, 2023

New research from WealthManagement.com's WMIQ suggests firms are inhibiting growth by minimizing, and in many cases mishandling, marketing and client communications.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

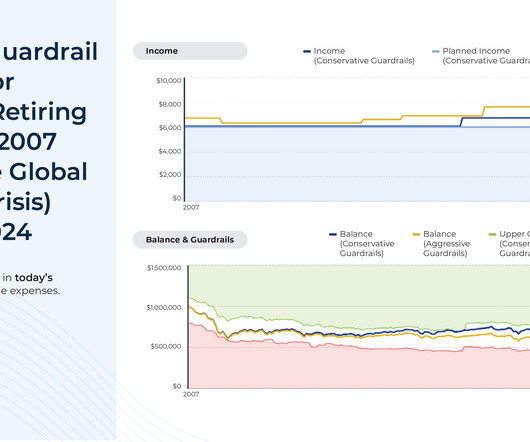

Nerd's Eye View

MARCH 20, 2024

Monte Carlo simulations have become a central method of conducting financial planning analyses for clients and are a feature of most comprehensive financial planning software programs. the Great Depression or the Global Financial Crisis), showing clients when and to what degree spending cuts would have been necessary.

Wealth Management

JANUARY 29, 2025

Clearly explaining the technical aspects of the planners proposals aids in the successful implementation of estate plans.

Nerd's Eye View

JUNE 19, 2023

The necessity of fee increases entails a certain amount of pain for monthly-fee advisors since each conversation around raising fees creates the possibility of pushback from clients that could put a strain on the client-advisor relationship. Read More.

Nerd's Eye View

APRIL 24, 2024

Over the past few decades, advicers have used Monte Carlo analysis tools to communicate to clients if their assets and planned level of spending were sufficient for them to realize their goals while (critically) not running out of money in retirement.

Wealth Management

APRIL 25, 2023

“Personalization with efficiency” is key to building strong client relationships.

Wealth Management

AUGUST 4, 2023

True personalization means taking the time to understand your clients' preferred learning styles and communication preferences to lay the foundation for fruitful dialogue, genuine comprehension of your advice, and ultimately, sound decision-making and action by the client.

Abnormal Returns

APRIL 29, 2024

barrons.com) Advisers Don't discount the power of the Fidelity, Vanguard and Schwab brands to potential clients. (downtownjoshbrown.com) Ritholtz Wealth Management continues to grow without acquisitions. riabiz.com) Advisory firm profitability and how affiliate fees play a role.

Wealth Management

SEPTEMBER 13, 2023

Thursday, October 05, 2023 | 2:00 PM ET

Nerd's Eye View

FEBRUARY 24, 2025

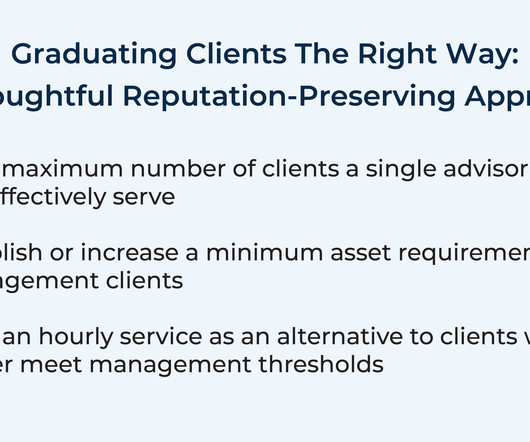

Early in a firm's life cycle, a founder might take on nearly any client (and their fees) just to generate enough revenue to 'keep the lights on'. However, as the firm grows, some of those early clients may no longer be profitable to serve – especially if they generate lower fees than newly onboarded clients.

Nerd's Eye View

JANUARY 15, 2024

For financial advisors, an ongoing client service model often means finding ways to keep clients engaged and progressing toward their goals outside of the 1 or 2 typical client review meetings each year.

Nerd's Eye View

JULY 29, 2024

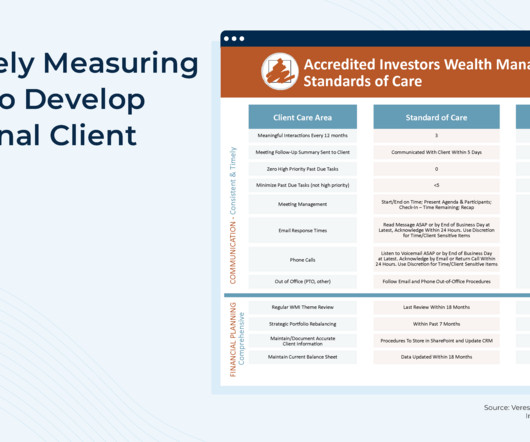

Most financial advisors strive to provide excellent client care and prioritize a systematic process to maintain regular communication with their clients both on a scheduled (e.g., Suddenly, the question of, "What does it mean to provide the best care for clients at this firm as a team?" becomes a crucial one to solve.

Nerd's Eye View

JANUARY 12, 2023

As comprehensive financial planning has become more widely adopted, many financial advisors have felt pressure to find new ways to differentiate themselves by demonstrating their unique value to clients. Others use frequent emails to stay in regular contact, sending reminders or helpful information relevant to their clients.

Nerd's Eye View

DECEMBER 12, 2024

There's an old joke in the financial planning industry that the ideal client is "anyone with a pulse". However, as their firms mature, advisors often notice a divide manifesting between newer clients paying higher fees and 'legacy clients' from the early days paying discounted rates. take a physical and emotional toll.

Nerd's Eye View

JULY 25, 2024

About a decade or so ago, one of the most pressing issues facing the financial advice industry was the threat of an imminent deluge of advisor retirements coupled with a paucity of succession plans to transition clients to the next generation. or "Is there anything that's top of mind right now that maybe we haven't addressed yet?"

Nerd's Eye View

FEBRUARY 6, 2025

In the 157th episode of Kitces & Carl , Michael Kitces and client communication expert Carl Richards discuss how advisors can alleviate a prospect's anxiety by setting clear expectations for the introductory meeting – both in terms of logistics and emotional preparedness. Read More.

Nerd's Eye View

NOVEMBER 28, 2024

This fee confidence gap has large ramifications in the long term, as firms with higher revenues can reinvest in growth – with hiring, marketing, and process improvements – that enhance their value proposition and attracts more prospective clients. Have clients described the advice as "life-changing"? Read More.

Nerd's Eye View

JUNE 15, 2023

For many financial advisors, keeping an open line of communication with clients is a key component of building trust, understanding the client’s values, and developing a meaningful plan to help them reach their financial goals.

Nerd's Eye View

OCTOBER 5, 2023

For many financial advisors, financial planning advice traditionally focuses on optimization: tax-efficient, continually rebalanced portfolios are often designed to maximize a client's wealth throughout retirement. Which can help clients narrow down what really matters to them most.

Nerd's Eye View

JULY 22, 2024

The obvious answer to growing beyond the capacity of a single owner/advisor is to build a team of employees (either in advisory and/or other roles like client service or operations) that can accommodate additional room for growth.

Wealth Management

NOVEMBER 20, 2024

New tools automate the process of personalizing service and communications to improve the advisor-client relationship.

Nerd's Eye View

JULY 27, 2022

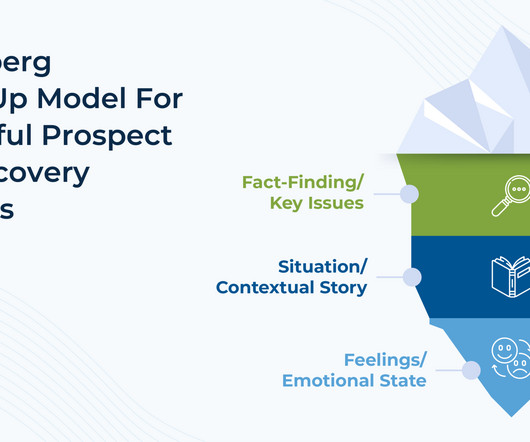

While an advisor needs technical financial planning knowledge to create and implement plans for clients, soft skills that involve effective communication and relationship building are also crucial to both relate to prospects and clients and to understand their needs. Notably, the goal-development process is not a quick one.

Nerd's Eye View

JULY 27, 2022

While an advisor needs technical financial planning knowledge to create and implement plans for clients, soft skills that involve effective communication and relationship building are also crucial to both relate to prospects and clients and to understand their needs. Notably, the goal-development process is not a quick one.

Nerd's Eye View

OCTOBER 20, 2022

In recent years, politically charged topics have become the forefront of news and media, and with the rise of access to digitally distributed media, it has become commonplace for clients to have concerns about the possible impact of political events on their portfolios.

Nerd's Eye View

AUGUST 12, 2024

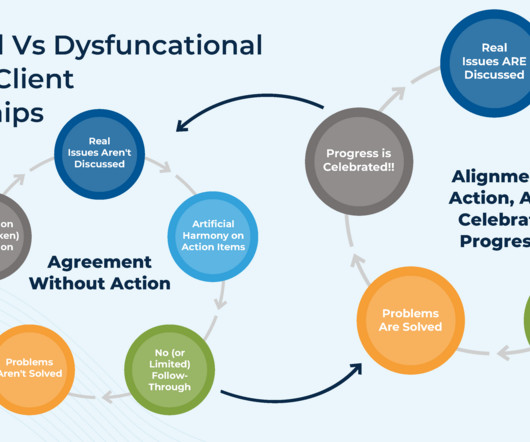

In the modern era of financial advice, the advicer/client relationship is tightly centered on trust. Then, because the client isn't "bought in" to the recommendations, they simply don't act on what the advisor recommends.

Nerd's Eye View

FEBRUARY 7, 2024

The need for financial professionals to ask prospects and clients questions has a long history in the industry. One of the best ways to accomplish that goal is not to ask better questions, but to also ask engaging follow-up questions that build trust and rapport with clients. as judgmental.

Nerd's Eye View

APRIL 6, 2023

But some advisors who choose to take more time off from their schedules might be concerned that prospects and clients will consider them to be less committed to serving their planning needs than other advisors. Notably, the choice of work schedule can affect the type of client with whom an advisor might want to work.

Nerd's Eye View

MARCH 21, 2024

For many financial advicers, helping long-time clients identify and progress toward their goals eventually transitions into conversations around the best ways to enjoy the fruits of their labor once they reach them. And by ensuring that their clients are equipped with (and know how to follow!) Read More.

Nerd's Eye View

JULY 13, 2023

Establishing successful client relationships as a financial advisor relies on good communication skills not just to present information persuasively and with confidence, but also to establish client rapport that allows meaningful and engaging relationships to be built.

Nerd's Eye View

NOVEMBER 14, 2023

Eric is the Chief Financial Advisor and Co-Owner of Econologics Financial Advisors, an independent RIA based in Largo, Florida, that generates more than $4M of revenue while working with nearly 300 client households.

Nerd's Eye View

NOVEMBER 13, 2023

Traditionally, financial planning meetings have been held face-to-face in an advisor's office, and over the years, a body of research has emerged showing that how the advisor's office is laid out can have a significant impact on how clients perceive the advisor, their mood during the meeting, and even their resulting financial planning decisions.

Wealth Management

NOVEMBER 14, 2023

The co-founder discusses the why of Bento through to the predictive client-communications platform's just announced partnership with marketing firm FMG Suite.

Wealth Management

JUNE 10, 2024

The AI assistant records meeting notes and turns them into automated actions from generating client communications to plan changes.

Wealth Management

DECEMBER 1, 2023

As the first AI-powered GPT assistant for financial advisors, SIFA is on a mission to automate ongoing communications between advisors and their clients.

Nerd's Eye View

OCTOBER 6, 2022

When it comes to politically charged discussions, financial advisors generally try to stay neutral and focus on providing clients with objective financial advice. While many advisors want to remain neutral, the recurring conversations about politics can be stressful, especially when the client and advisor have opposing political viewpoints.

Nerd's Eye View

JUNE 29, 2023

And while there are many factors that help owners determine whether their firm is making enough money to profitably sustain itself, one common variable that can help them adjust their net revenue is the fee they charge to clients for financial planning services. Read More.

Nerd's Eye View

JULY 11, 2024

Meaningful communication is crucial to building strong, durable relationships, and asking effective questions is an essential part of facilitating impactful conversations. More often, initial outreach from a prospect occurs because there's some urgent issue they need help with.

Nerd's Eye View

APRIL 17, 2024

After advisors do all of the work of bringing on a new client (Marketing! And while all may appear well on the surface – the client rarely contacts the advisor with problems but they show up for every annual meeting – they may actually be feeling quite disengaged with the financial planning services being provided.

Nerd's Eye View

APRIL 20, 2023

In any business profession, establishing credibility and trust are important to attracting clients and building a reputation amongst colleagues. Traditionally, business attire for financial advisors meant wearing the typical suit and tie in all instances of client-facing activities. Read More.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

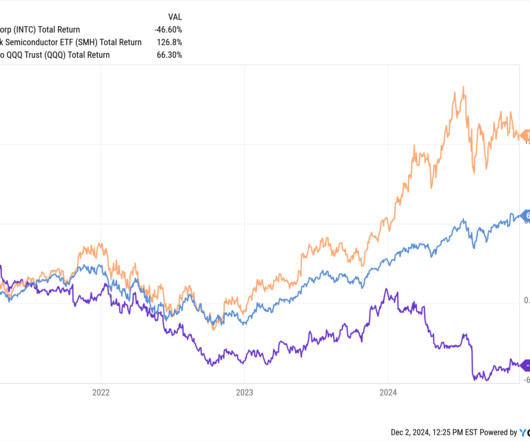

Abnormal Returns

DECEMBER 2, 2024

bonddad.blogspot.com) Earlier on Abnormal Returns Adviser links: loving clients' problems. (sherwood.news) Economy Bubbles often leaving interesting stuff behind. awealthofcommonsense.com) The November ISM manufacturing index remains weak-ish. abnormalreturns.com) What you missed in our Sunday linkfest.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content