Adjusted for Risk: Client Communication Is Key to Investing Alternatives

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

Nerd's Eye View

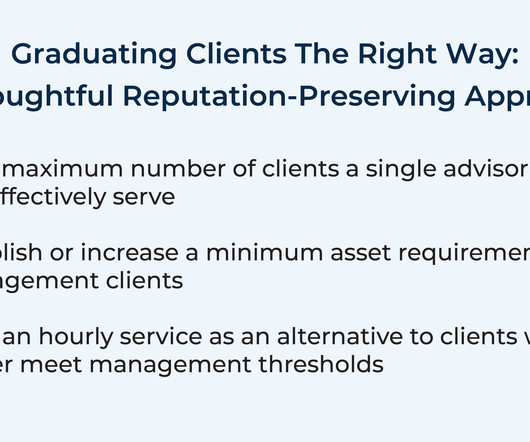

FEBRUARY 24, 2025

Early in a firm's life cycle, a founder might take on nearly any client (and their fees) just to generate enough revenue to 'keep the lights on'. However, as the firm grows, some of those early clients may no longer be profitable to serve – especially if they generate lower fees than newly onboarded clients.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

Wealth Management

NOVEMBER 5, 2024

UniFi by CAIA's Aaron Filbeck details the evolution of alternative investments and the importance of client communication.

Nerd's Eye View

APRIL 9, 2025

It's natural for advisors to begin discovery meetings by asking questions about a client's current financial situation – understanding cash flow, debt, investments, risk tolerance, or even the burning tax concern that brought them to the advisor's door in the first place is crucial for financial planning.

Nerd's Eye View

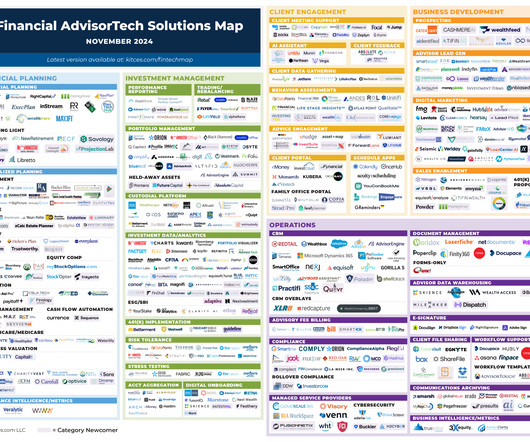

NOVEMBER 4, 2024

And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com !

Nerd's Eye View

MARCH 21, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a report from Cerulli Associates found that, amidst an industry-wide trend towards comprehensive financial planning and away from pure transaction-based investment management, asset-based fees currently represent 72.4%

Nerd's Eye View

JUNE 19, 2023

The necessity of fee increases entails a certain amount of pain for monthly-fee advisors since each conversation around raising fees creates the possibility of pushback from clients that could put a strain on the client-advisor relationship.

Abnormal Returns

APRIL 29, 2024

rationalreminder.libsyn.com) The biz Goldman Sachs ($GS) is getting out of the robo-business by selling its Marcus Invest to Betterment. barrons.com) Advisers Don't discount the power of the Fidelity, Vanguard and Schwab brands to potential clients. investmentnews.com) AssetMark was just sold to GTCR.

Nerd's Eye View

APRIL 11, 2025

In addition, Atkins' arrival could also mean the end of the pending RIA outsourcing and custody rules proposed under Gensler, a reduced focus on monitoring advisors' off-channel communications, and a new regulatory framework for digital assets.

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

Nerd's Eye View

JUNE 15, 2023

For many financial advisors, keeping an open line of communication with clients is a key component of building trust, understanding the client’s values, and developing a meaningful plan to help them reach their financial goals.

Indigo Marketing Agency

MARCH 20, 2025

Recession Concerns & Market Volatility: How Financial Advisors Should Communicate With Clients As financial advisors , youre well aware that so far the 2025 financial market has been more unpredictable than a toddler. Why Proactive Communication Matters If theres one thing more unpredictable than the markets, its human emotion.

Nerd's Eye View

JANUARY 6, 2025

FINNY AI, an AI-powered prospecting tool, has raised $4.2 FINNY AI, an AI-powered prospecting tool, has raised $4.2 FINNY AI, an AI-powered prospecting tool, has raised $4.2

Nerd's Eye View

MARCH 3, 2025

This month's edition kicks off with the news that Morningstar Office will be shutting down in early 2026 as a part of Morningstar's ongoing effort to refocus on its core investment data and analytics business – forcing advisors currently using the tool to switch (which might be a net positive for many of those advisors who have long complained (..)

Nerd's Eye View

JULY 25, 2024

About a decade or so ago, one of the most pressing issues facing the financial advice industry was the threat of an imminent deluge of advisor retirements coupled with a paucity of succession plans to transition clients to the next generation. or "Is there anything that's top of mind right now that maybe we haven't addressed yet?"

Nerd's Eye View

NOVEMBER 6, 2024

In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning.

Nerd's Eye View

OCTOBER 20, 2022

In recent years, politically charged topics have become the forefront of news and media, and with the rise of access to digitally distributed media, it has become commonplace for clients to have concerns about the possible impact of political events on their portfolios.

Nerd's Eye View

NOVEMBER 14, 2024

With revenue rooted in more predictable, recurring income, many advisors were able to step off the relentless 'treadmill' of constant sales, allowing them to invest in growth by hiring staff and delegating tasks. Yet, even for advisors who understand the value of delegation, actually letting go is often easier said than done.

Don Connelly & Associates

DECEMBER 16, 2024

Whether planning for retirement, investing in volatile markets, or managing tax implications, clients are often presented with intricate information that can leave them overwhelmed, confused, and anxious, undermining their ability to make informed decisions.

Nerd's Eye View

NOVEMBER 13, 2023

Traditionally, financial planning meetings have been held face-to-face in an advisor's office, and over the years, a body of research has emerged showing that how the advisor's office is laid out can have a significant impact on how clients perceive the advisor, their mood during the meeting, and even their resulting financial planning decisions.

Wealth Management

JANUARY 23, 2024

Morningstar research finds trust, communication and behavioral guidance may be more important to client retention than returns on investment.

Nerd's Eye View

JULY 13, 2023

Establishing successful client relationships as a financial advisor relies on good communication skills not just to present information persuasively and with confidence, but also to establish client rapport that allows meaningful and engaging relationships to be built.

Nerd's Eye View

NOVEMBER 14, 2023

Eric is the Chief Financial Advisor and Co-Owner of Econologics Financial Advisors, an independent RIA based in Largo, Florida, that generates more than $4M of revenue while working with nearly 300 client households.

Nerd's Eye View

AUGUST 28, 2024

Historically, advisors haven't had many avenues to manage clients' 401(k) plan accounts, since unlike traditional custodial investment accounts, advisors generally lack discretionary trading authority in employer-sponsored retirement plans.

Nerd's Eye View

MAY 8, 2024

Measuring a client's tolerance for risk is an essential (and required!) step when onboarding a new client, as making any sort of recommendation is impossible without first understanding how comfortable clients may be when their portfolios inevitably experience volatility. Would you agree to this investment?").

Nerd's Eye View

AUGUST 10, 2023

When a firm becomes large enough, though, the firm owner may be compelled to consider stepping away from their long-standing work as a client-facing financial advisor into a more pronounced business leadership role to manage the growing business.

Nerd's Eye View

JULY 6, 2022

Advisors occasionally encounter situations where their recommendations conflict with a prospect’s or a client’s opinions or beliefs. In some cases, it is clear to advisors that it would be inappropriate to try to persuade a client to go against their values.

Nerd's Eye View

AUGUST 11, 2022

Many clients seek financial advisors for their expertise and their abilities to guide them through financial decisions. However, for some clients, the ambiguity that inevitably arises from uncertain outcomes can be very distressing, especially when it comes to investments during volatile times.

Nerd's Eye View

APRIL 26, 2024

Also in industry news this week: The Federal Trade Commission released a final rule that would ban most non-compete agreements, which could lead to an increasing number of non-solicit agreements (and, potentially, lawsuits regarding their enforcement) between financial planning firms and their advisors The Securities and Exchange Commission issued (..)

The Big Picture

APRIL 15, 2025

I discussed much of this in my Q2 2025 RWM client quarterly call on April 5. Whatever the final tariff situation, the White House can clearly learn from the communication strategies the Federal Reserve has perfected. ~~~ We are not privy to the discussions inside the Oval Office. The backlash includes boycotts of the US and its goods.

Investment Writing

APRIL 15, 2025

Investment commentary authors often know the markets well, but lack writing and editing expertise. Ive learned some lessons about how to edit investment commentary that I share below with you. The lessons are based on my years of experience editing and writing commentary for a diverse group of clients.

Nerd's Eye View

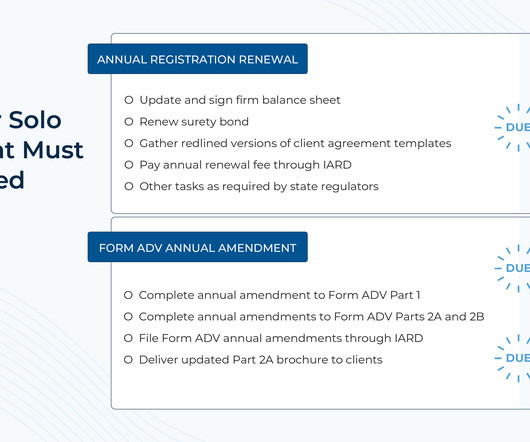

APRIL 26, 2023

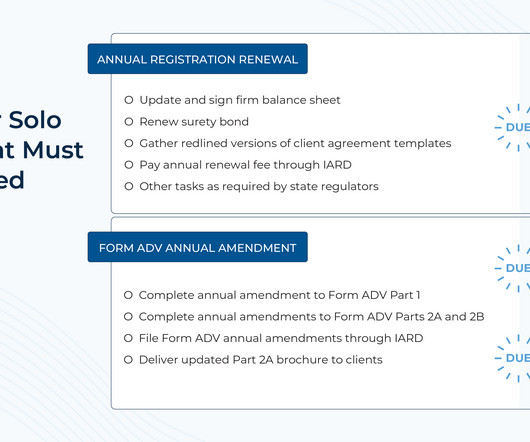

accounting reports, client contract templates, and a surety bond) and filing an annual renewal fee near the end of the year. After year-end, firms typically have until March 31 to submit an annual amendment to their Form ADV Part 1 and Part 2A/2B, and until April 30 to offer a copy of their updated Form ADV to their clients.

Nerd's Eye View

OCTOBER 10, 2022

Communicating ongoing value to clients and prospects can be a challenge for financial advisors. Although there are many ways to articulate how an advisor can create value for a client, there is no guarantee that any one particular method will resonate with every potential client.

Nerd's Eye View

NOVEMBER 24, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that FINRA has issued a proposal to allow broker-dealers to advertise hypothetical performance data to institutional and high-net-worth investors, which would bring the rules for broker-dealers largely in line with (..)

Indigo Marketing Agency

MARCH 14, 2023

In the case of the Silicon Valley Bank failure, it can be particularly alarming for those invested in the technology sector. As a financial advisor, it’s crucial to effectively communicate this event to your clients to help them understand the potential impact it may have on their investments and overall financial well-being.

Nerd's Eye View

DECEMBER 28, 2023

Throughout history, there has been an age-old question of the difference between an investment and an expense. What if there was a way to shift our financial mindset about expenses from one of endless sunk costs to one of intentional investment? But what if there was an alternative path? activities.

Nerd's Eye View

APRIL 26, 2023

accounting reports, client contract templates, and a surety bond) and filing an annual renewal fee near the end of the year. After year-end, firms typically have until March 31 to submit an annual amendment to their Form ADV Part 1 and Part 2A/2B, and until April 30 to offer a copy of their updated Form ADV to their clients.

Nerd's Eye View

AUGUST 16, 2024

Notably, this announcement included the first off-channel communication case brought by the SEC as a result of a referral from an RIA exam, which could lead examiners to focus on off-channel communications during regular RIA examinations.

Abnormal Returns

OCTOBER 21, 2024

(frazerrice.com) Brendan Frazier talks with Ben Haas about how to conduct client 're-discovery' meetings. riabiz.com) XYPN Planning Network has launched a new registered investment advisor corporate affiliation model, Sapphire. ft.com) Communication is key when it comes to families.

Nerd's Eye View

AUGUST 30, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent benchmarking study suggests that a number of RIAs are looking to move 'upmarket' and work with wealthier clients by expanding their service menu to include family office services, investment banking, and/or trust (..)

Steve Sanduski

DECEMBER 11, 2024

01 What Triggers the Need to Transition Clients to a New Advisor? Transitioning clients between advisors within a financial firm can be a challenging and emotionally charged process. Eventually, Erin realized that in order to grow further and ensure the highest quality of service, he needed to transition his clients to other advisors.

Abnormal Returns

FEBRUARY 12, 2024

Podcasts Brendan Frazier talks with Sten Morgan, the founder of Legacy Investment Planning, about better communicating with clients. investmentnews.com) Advisers Why private equity hasn't tired of investing in wealth management firms yet. msn.com) Why follow-up questions are crucial in financial planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content